This contrarian signal is flashing bright red

Options markets are exhibiting two unusual dynamics at the moment that can provide some insight on investor positioning and sentiment. For contrarians, the signals suggest the market is underprepared for disappointment on politics, virus, unemployment or anything else for that matter.

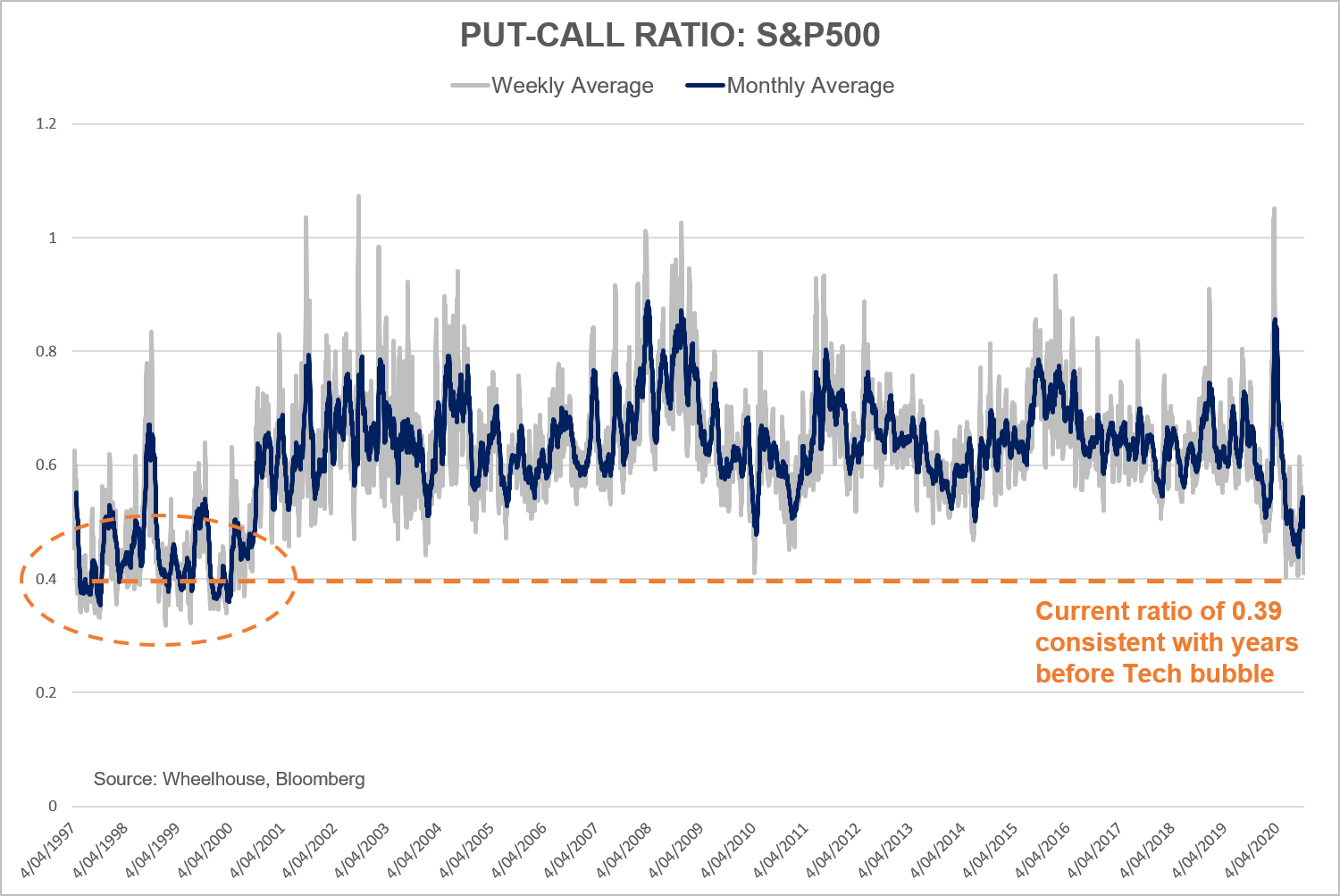

Firstly the Put-Call ratio is tracking at close to 20-year lows. This ratio references the number of put options held by investors versus call options. Investors will typically buy put options for protection and call options to express a bullish view, so when the balance changes it can reflect a change in investor sentiment and positioning.

In the chart above, when the line trends down it means more call options are being bought than put options which reflects a bullish outlook. However, during periods of market crisis such as March this year, the demand for protective puts outstrips demand for calls and thus the ratio spikes to its peak.

When the ratio reaches extreme levels, it can be a signal that the market is getting ahead of itself and a reversal is in the offing. For example, there were few better times to buy the market than during the two recent market corrections of December 2018 and March 2020 when demand for puts was peaking. Equally, the last time the ratio was consistently this low was during the build up to the Tech bubble in 2000, which ultimately unwound much of the good returns that were delivered beforehand. It's important to recognise there are no failsafe indicators (and potentially the ratio is better for gauging maximum fear versus maximum optimism), but we do take note when more extreme levels are reached.

There are a number of reasons for the declining ratio:

- Demand for single stock call options, particularly over the large tech stocks, remains particularly elevated. For Apple and Facebook in particular, the ratio of calls to puts is nearly 2:1, which is the opposite of typical positioning which is usually weighted towards puts.

- Protective put buying has decreased, in part we believe due to higher absolute volatility levels and hedging costs caused by the increased market turbulence in September. This period would typically be a time when investors would be looking to get hedges set for the US election risk around November 3rd.

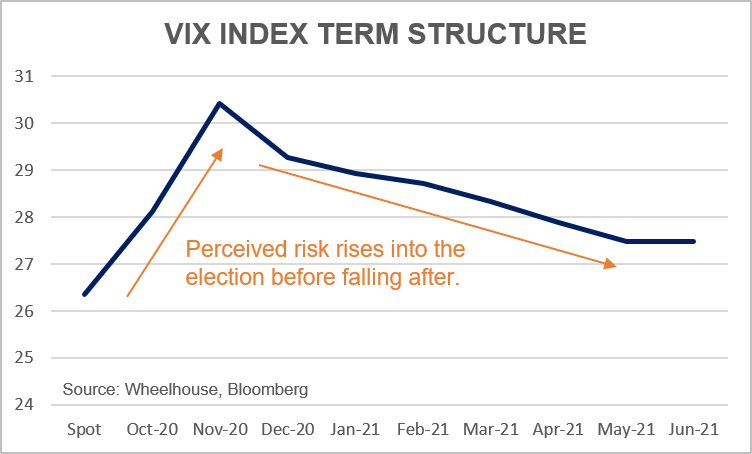

The election itself is also highlighting an unusual characteristic in the options market. Forward expected volatility, a reflection of future perceived market risk, is currently displaying a very kinked profile over the election date.

Usually term structure trends towards the longer-term mean (so can be upward sloping or downward sloping), so the kinked profile is unusual and reflects the event risk around the election. This peaked volatility can make hedging very expensive over these periods.

A cheaper way to hedge

One strategy that can be used to reduce hedging costs but maintain protection over the US election is calendar spreads. A protective calendar spread involves simultaneously selling a short-dated put option versus buying a longer-dated put option. During the week of the election, the put options we have sold will expire before the event, and as a result we will be left owning protective put options for the election and the aftermath. While this strategy needs to be actively managed in the lead up (there are no arbitrages here), the approach can more than halve the cost of buying protection over the specific US election period.

In an environment where the market appears clearly skewed to the upside, with fewer protective hedges in place, we believe maintaining lower-cost protection is essential in preserving capital should the market be on the wrong side of this event.

3 topics