This is the tell-tale indicator of when central banks start to cut interest rates

Economists, strategists, and fund managers alike will look at decelerating inflation, excess savings among consumers, and a tight labour market to tell them when interest rate cuts are coming. But there is one indicator that precedes rate cuts more accurately and efficiently than all the rest.

It also explains why emerging economies like Peru, Brazil, and Poland raised interest rates far faster (and are cutting them earlier) than central banks here in the West.

In this wire, I'll introduce you to the concept of the real rate with the help of a research note from TD Securities. We'll discuss what it is, how it informs interest rate decisions, and most importantly, why it can influence what kinds of assets you include in your portfolio.

What is the real interest rate?

Put simply, it's the nominal interest rate that takes into account the impact of inflation:

Real interest rates = Nominal interest rate - headline inflation rate

Although central banks and your financial institution will quote you a nominal interest rate, it is the real rate that informs where that nominal interest rate may go.

How does it affect my money?

For your purposes, real rates measure the true percentage return from an investment. For instance, it might sound good that an investment is returning 5.5% but given that inflation is running at 5.4%, your real return is essentially flat. This also explains why many investors simply put their cash away in a term deposit yielding 5% last year. If you can't find assets to grow, you might as well put your hard-earned cash somewhere essentially risk-free.

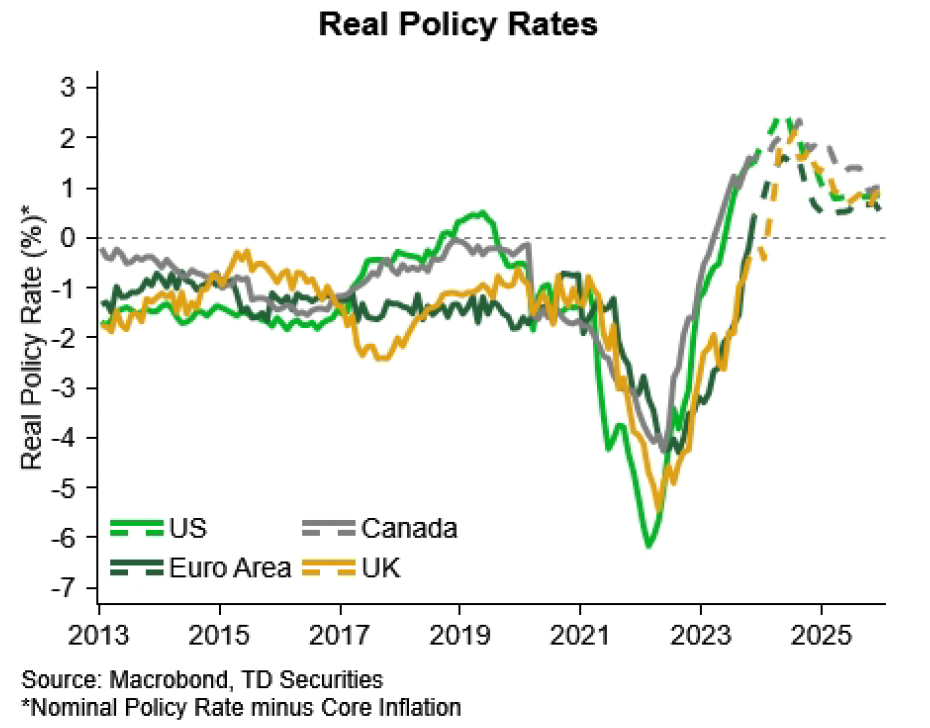

Real interest rates are also a useful guide to whether monetary policy is easy or tight. For example, low (or negative) real interest rates suggest that monetary policy is accommodative or stimulatory while high real interest rates suggest that monetary policy is tight.

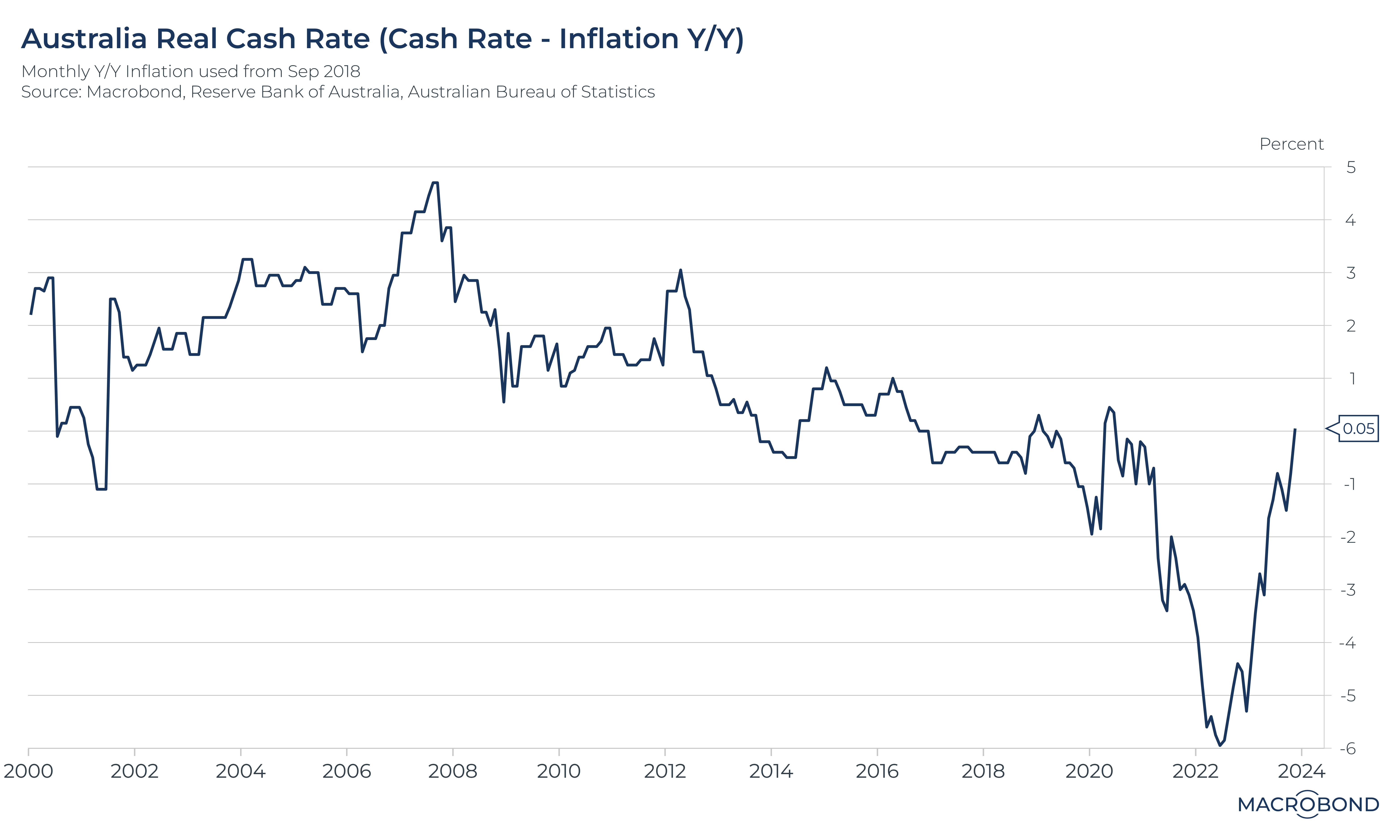

Since 2000, the Australian real interest rate has not climbed above 5% which helps explain why Australian interest rates have remained generally lower than in other jurisdictions.

How does the real rate affect central banks?

The real rate has become crucial to central bank decision-making since the inflation surge of 2022, as James Rossiter, Head of Global Macro Strategy at TD Securities explains.

"But in the last few years, with inflation well outside its typical range, it's much more important that central banks focus on real policy rates rather than nominal."

Rossiter goes on to explain that super-loose real rates helped the global economy avoid a recession in 2022 and most of 2023. But the effects of all this sharp policy tightening have since changed that game.

The good news, at least in Rossiter's view, is that the huge rise in real rates has allowed the market to do part of the central bank's work for itself. Indeed, when you hear about economists and strategists saying that central bank policy is "highly restrictive", this is what that means.

So the next move, naturally, will be lower.

"By year-end [2024] and into 2025, we expect a regime shift from the decade before the pandemic, with real rates settling in a higher (and positive) range, in part due to higher nominal neutral rates," Rossiter wrote.

What will trigger the first rate cut?

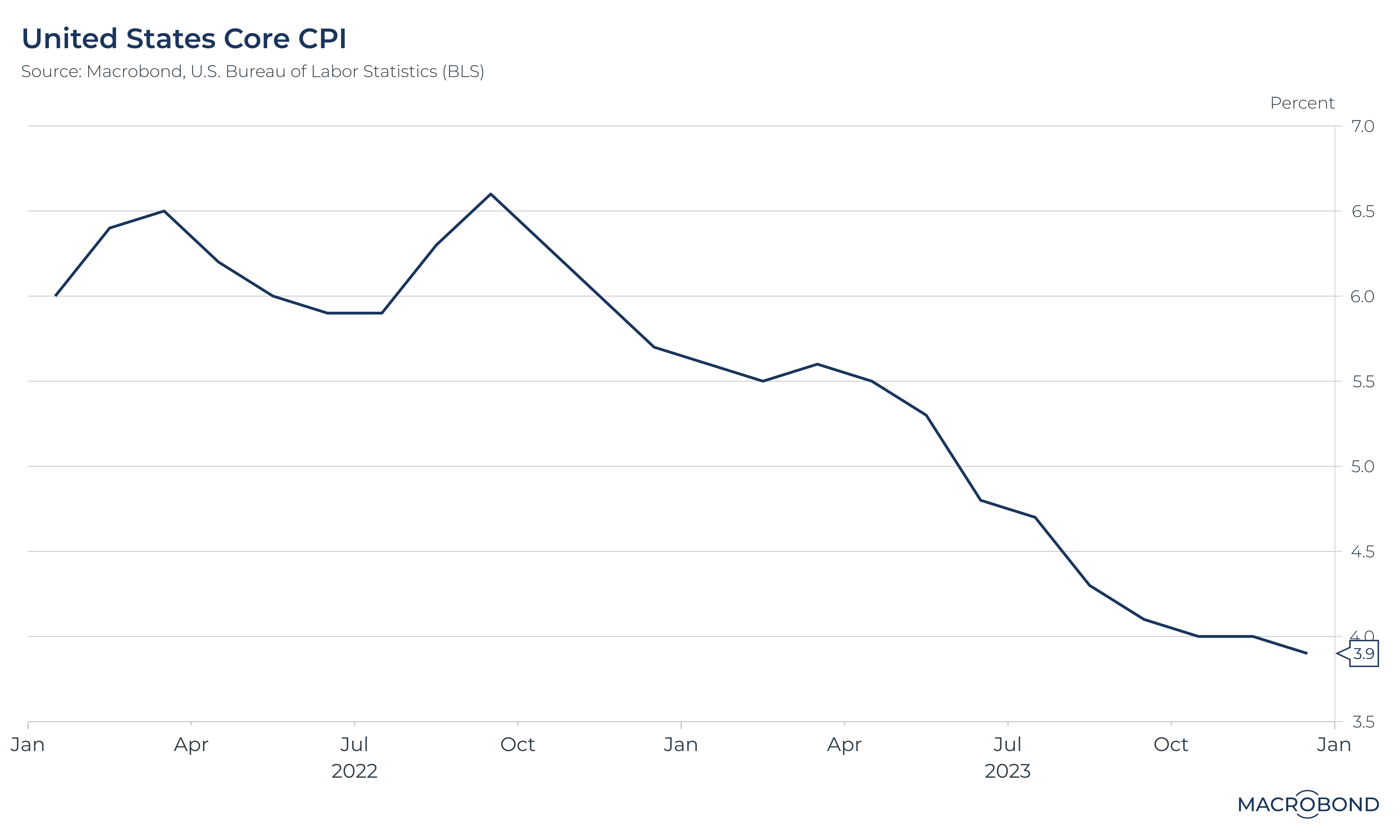

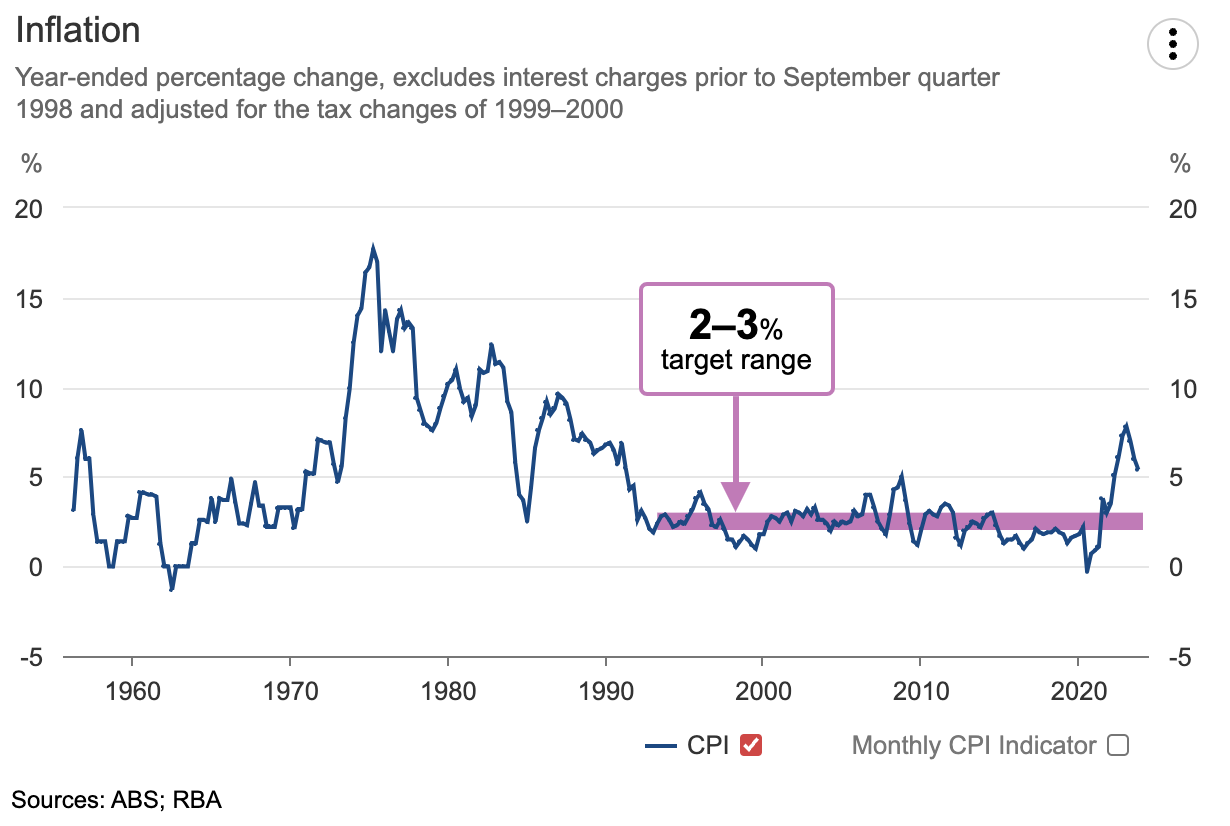

Recall that the real interest rate formula is 50% inflation - so naturally, getting inflation back down to the 2-3% target range will be crucial. But as any good economist can also tell you, the last mile when fighting inflation is usually the hardest.

Consider this: The American headline inflation rate took 11 months to come back down from the 9.1% peak (June 2022) to 4% (May 2023). But since May 2023, the inflation rate has hovered up and down between 3% and 3.7%. We haven't seen a 2-handle since March 2021.

Here in Australia, the Monthly Inflation Indicator (just to compare apples to apples) has never seen a 2-3% print since it was launched in August 2022. In past periods when inflation has been well above target in Australia, it has also taken a long time for inflation to come back down to target (see December quarter 1990 at 6.9% to December quarter 1991 when it finally registered 2.6%).

Currently, market pricing has the US Federal Reserve cutting in March. That might be too early for some (including TD, who believe they will cut in May) but there is a trade-off in that TD expects the Fed will cut more times than markets expect.

"We think the FOMC's dot plot implies too tight a real policy path in 2024, one of the key reasons we look for more cuts than they do," Rossiter wrote.

As for Australia, Rossiter's colleague Prashant Newnaha has this to say:

"With inflation still relatively high, coupled with the upside risks from strong population growth on rent inflation, it may be biased toward holding rates high for longer. But a sharp deceleration in inflation (the downside surprise on November's monthly inflation figure helps) could nudge the RBA to a cut sooner than August," Newnaha wrote.

Which assets and stock market sectors benefit from lower real rates?

If lower real rates inform lower nominal rates, the asset classes that most benefit from the decline in real rates are dependent on the cost of servicing debt. This naturally makes sense - wouldn't you want a lower interest repayment rate on your mortgage?

Assets exposed to this theme include real estate and private equity.

Government bonds also benefit from the cutting of interest rates as the two have an inverse relationship.

Lower real interest rates create a dynamic where increased demand and an inverse relationship between price and yield all contribute to an appreciation in government bond prices. And if central banks cut interest rates too many times and markets get the sense they are cutting into a recession, the fixed income trade is the classic risk-off trade.

Within the stock market, several sectors may benefit. The first - and probably the one you thought of most quickly - is the tech sector. The rise in real rates increases the cost of capital, meaning tech stock share prices tend to fall. But now that the market is looking through all these rate rises, the tech sector has made some big moves to the upside.

Another sector that benefits is the healthcare sector. If you're a small biotech without a product on the market yet and in need of cash, the huge rise in real rates was not your friend. Equally, if you're a healthcare REIT or a healthcare company that owns a lot of properties, that balance sheet felt a big pinch last year from the huge rise in real borrowing costs.

The other theme that benefits from the lower real and nominal rate is the profitable, dividend-paying stock trade. If you can get a better dividend yield than inflation and the presiding nominal interest rate, then you would naturally take a punt on that particular asset.

3 topics