Three buys for the looming copper shortage

Copper is used in just about everything and is the best conductor of energy available. The world has been mining it for thousands of years. But in recent times, exploration and mine development expenditure has been low. This leads to historically low inventories and forward supply concerns.

Over the last year, unexpected price squeezes in coal, nickel and lithium hindered the broader energy transition trade. The EV transition drove the squeeze in lithium, rare earths and nickel - all of which are key components of battery making. The coal squeeze came for different reasons with governments bowing to unrealistic public pressure in policy shifts and the absence of factoring in the steel needed to build the “green transition”. While the battery materials shortage will largely be solved by oncoming global production over the next few years, copper is the forgotten commodity that is required to conduct all this energy, both fossil and green.

Copper has all the hallmarks of being the next big price squeeze in the commodity sector:

- large reliance on one region for supply,

- environmentalist pressure slowing the opening of new mines,

- record low inventory levels at an exchange level

- geopolitical issues potentially causing supply issues.

In this wire, I’ll expand on the “next squeeze” thesis and share three companies which will stand to benefit most from this squeeze.

Regional supply reliance and Geopolitics

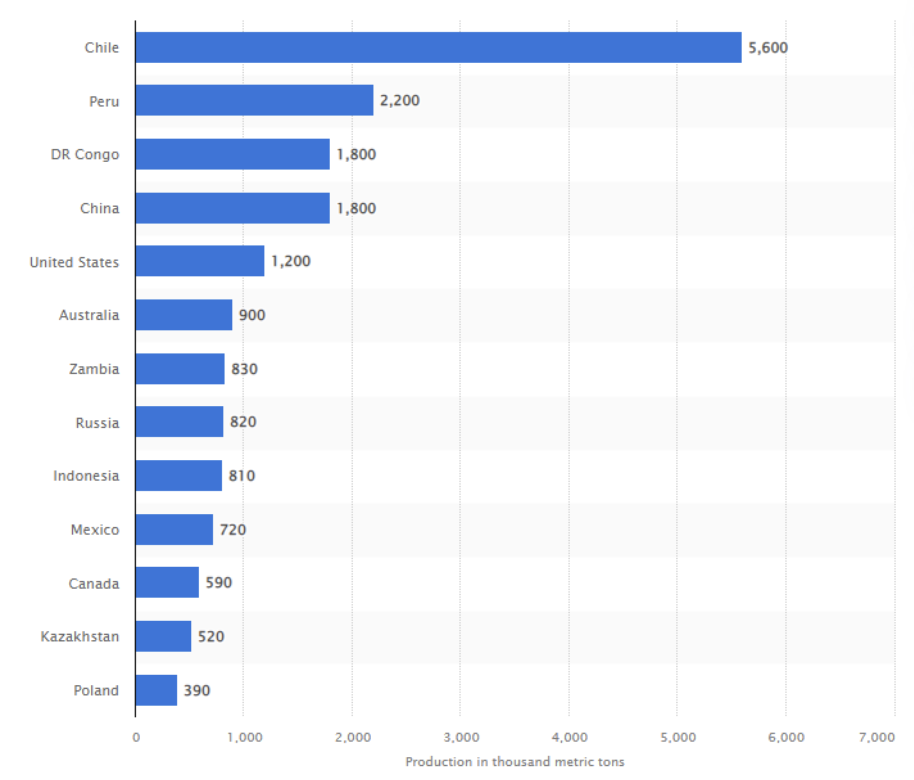

Arguments one and four are dangerously related. The two biggest global producers of copper are Chile and Peru. Together, the South American powerhouses make up 43% of the world supply. They also happen to be in political disarray. In Peru, there was recently a failed coup which nearly created a seventh president in six years. The protests already threatened 30% of Peru’s copper supply with some Chinese miners having already closed down some mines.

This is the equivalent to 75% of Australian production shutting down tomorrow. If political unrest continues, 13% of the world supply may come under threat.

Chile, traditionally one of the more stable countries in the region, has had spiralling inflation and unemployment. This has seen the crime rate jump by a staggering 50% and protests from the left gaining momentum which will spell disaster for the foreign-owned copper mines as their 17 political parties re-write the constitution from the Pinochet-era which skewed heavily in favour of foreign-owned exporters, introducing new taxes on miners.

Environmental restrictions

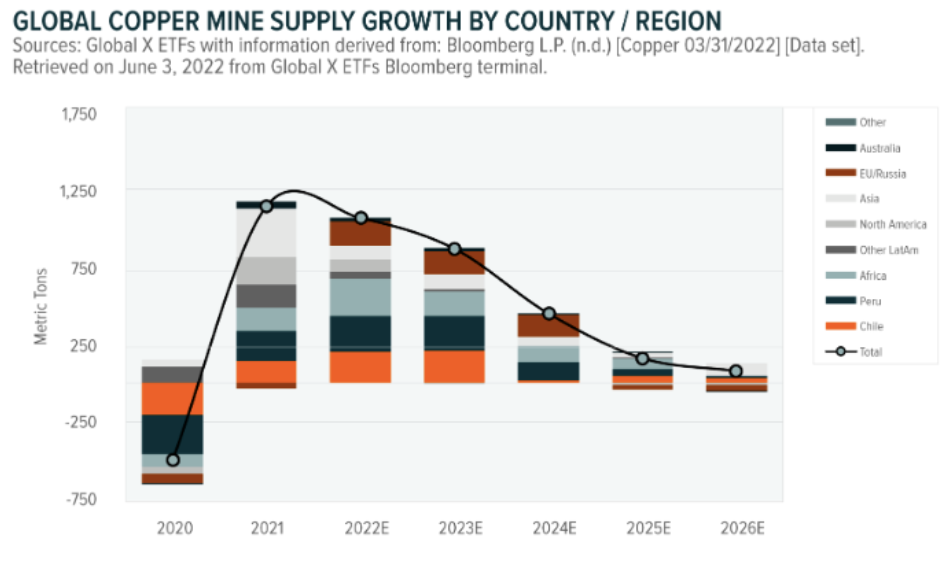

Copper mining isn’t particularly friendly to the planet and methods to extract copper ore vary by country and therefore price, due to regulation, meaning there are few incentives to start a mine. This has led to the industry’s pipeline of committed projects running dry, which brings me to my next point.

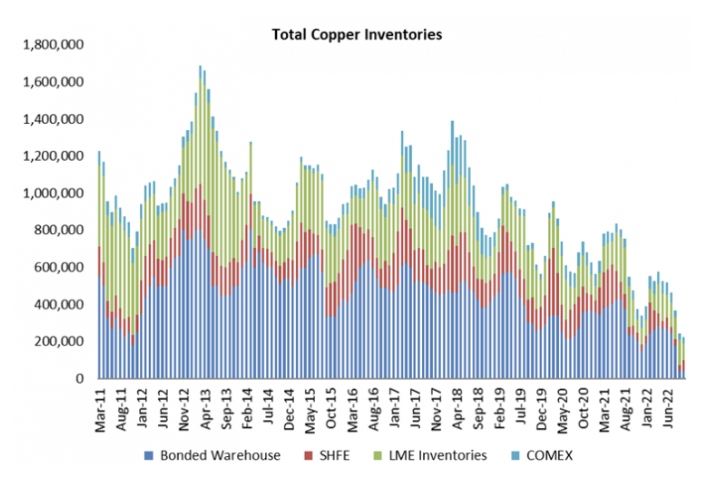

Near Record Low Inventories

Instead of starting new mines, we have used what we had warehoused or recycled. Prices have been so low that recycling has ground to a halt so we have used inventories. London Metal Exchange warehouse inventories are at record lows while countries have maintained inventories. But the recent global infrastructure stimulus coupled with the demand from the EV sector will quickly draw down inventories with the lack of supply to re-stock.

At mature mines, ore quality is deteriorating, meaning output either slips or more rock has to be processed to produce the same amount. Meanwhile, new deposits are getting trickier and pricier to both find and develop. Supplies are already so tight that producers are trying to squeeze tiny nuggets out of junky waste rocks.

And yet, in spite of all this, prices are down 25% from their highs last March, largely on the “common truth” that copper is the canary in the mineshaft (excuse the pun) for slowing economic growth and the collapse of the Chinese property market. But with the consensus predicting a shallow recession next year, this reasoning seems flawed. As infrastructure projects break ground, the China re-opening, and the pace of the EV revolution speeds up, the concern should be over impending shortage and not a macroeconomic theory that has passed its use-by date.

Our three top ideas

WIRE (ASX: WIRE) – Given the lack of options on the ASX, this new ETF from GlobalX ETFs has some of the best copper producers from around the globe. Canada, Australia, Mexico and China make up over 60% of the ETF, which largely avoids the perils of the South American unrest with only a 5.8% exposure to Chile.

While many of these companies have exposure in South America, they will still benefit from supply disruptions via higher prices. Based on the COPX ETF listed on the NYSE, it also provides plenty of liquidity.

Sandfire Resources (ASX: SFR) – As per the wire from our research team on the 2nd of February, SFR is one of the last large cap copper plays left on the ASX. The December quarter was slightly disappointing from a copper production point of view, but we see a reduction of C1 unit costs (C1 refers to the direct production costs of iron are) as a positive. And given the strong copper price dynamics, we see strong potential for the company to exceed revenue expectations.

With the Chinese construction season due to start in early March, our expectation is that the company will guide for a stronger second half, acting as a catalyst for the company. As the world increasingly moves to copper-intensive clean energy projects, we like Sandfire’s profile especially with the company’s operations maturing.

Aeris Resources (ASX: AIS) - a junior copper miner sits 3rd behind OZL and SFR. Unfortunately, Oz Minerals is under a takeover offer at a premium from BHP so AIS looks to have the best risk/reward and upside of the 3. Aeris has 5 tenements with 4 in production in 2023. The combined mine life of the 5 projects is 18 years with 57-71kt of production expected from the group next year and 780kt in reserves.

Never miss an insight

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors. And while I ask the questions of some of Australia’s best strategists, economists and portfolio managers, if you’ve questions of your own, flick me an email on content@livewiremarkets.com.

3 topics

2 stocks mentioned