Three unloved sectors (and 5 stocks) that could become tomorrow’s winners

The herd mentality of investors is well-documented, but the most successful are often those who avoid the trends. This is perhaps best described by Warren Buffett in his famous epithet: “Be greedy when others are fearful and be fearful when others are greedy.” Of course, it’s easier said than done, especially during periods of market volatility.

In the following wire, I ask a couple of fund managers how their investment process helps them overcome behavioural biases. They also discuss some overlooked parts of the market they believe present appealing opportunities currently and how they’re investing in them.

Which parts of the ASX are overcrowded currently?

Quality companies – loosely defined as those with solid balance sheets, good cash flow and high return on equity – were particularly crowded trades as recently as six months ago, says Steve Johnson, founder and CIO at Forager Funds Management.

“But with companies like CSL (ASX: CSL), ResMed (ASX: RMD) and Macquarie (ASX: MQG) selling off heavily, there are more attractive opportunities in that part of the market today,” he says.

Though Johnson believes there is still a dominant view among retail investors that such companies are “safe” based purely on their performance over the past decade: “People have drawn the lesson that you can’t go wrong owning good quality businesses.”

And on a global basis, he also cites Artificial Intelligence as an investment theme that’s experiencing “a bout of wild euphoria. Most beneficiaries will not live up to the hype.”

“An over-crowded long”

Merlon Capital Partners portfolio manager Andrew Fraser singles out industrial property as a sector that appears to be an “over-crowded long” currently.

“While demand for industrial property and rental growth in the short term is strong, the market is not factoring in the impact of higher interest rates on property values or increased interest payments,” Fraser says.

“Multiples for industrial real estate investment trusts and asset managers are trading above their long-term history and analyst recommendations are a consensus “buy”.

.jpg)

How do you spot an overheated investment theme?

Johnson says there are several signals his team watches for. On an individual company level, this includes tracking whether share price growth is overtaking earnings growth.

Or at a sector level, they watch how its market cap weighting compares to a broader index over time. “For example, I remember financials reached 20% of the value of the S&P 500 just prior to the financial crisis,” he says.

“A compelling narrative can be made at absolutely any price level. Like “you can fit all of the gold that has ever been mined in four Olympic swimming pools,” says Johnson.

“That is true, but does it make it worth $1,000, $10,000 or $100,000 an ounce? People love to buy a great story (and fund managers love to sell them) and that’s why it is a key ingredient for an overheated asset.”

How does your investment process help navigate around sentiment?

Johnson emphasises his team’s “relentless focus” on the underlying value of a company’s cash flows. They do this by constantly asking themselves the following questions:

- How much is a company going to make?

- When am I going to see the cash?

- What is that cash worth to me in today’s dollars?

“That framework allows us to buy growing businesses with a good story but, by staying focused on the value rather than the story, it usually involves us buying those better businesses at times when others are less optimistic,” he says.

Companies are cheap for a reason

Over at Merlon Capital, Fraser emphasises his belief that people are “motivated by short-term outcomes, overemphasise recent information, and are uncomfortable having unpopular views”.

Acknowledging that professional investors are subject to the same behavioural biases, his team seeks to mitigate the effects by focusing on a range of potential valuation scenarios instead of any single “base case” valuation.

“Companies that appear “cheap” are typically cheap for good reason. To be a good investment we like to see that the share price is factoring in these issues and is trading at, or below, our mid-cycle bear case valuation,” Fraser says.

Overt biases in analyst recommendations are one of the red flags they watch for. Too many “BUY” recommendations can be an indicator the market is overly optimistic, while a “SELL” might suggest too much pessimism.

What are some of the most unloved sectors currently?

On a global basis, Johnson cites European banks as a sector where investors have suffered for more than a decade: “I think there are some really interesting changes taking place that aren’t getting any attention.”

“It’s been endless pain for European bank shareholders for the past 16 years, and the market is largely valuing them via the rear-vision mirror. That’s a mistake,” Johnson says.

“They’re cleaned up, they’re distributing lots of cash flow to shareholders, and they’re determined (and forced by regulators) not to repeat the mistakes of the past.”

He notes they’re currently trading on low price-to-earnings multiples of between 5-7 times earnings.

“Many distribute all of that cash to shareholders, with dividends and share buybacks adding up to cash returns for today’s investor north of 15%,” Johnson says.

Good growth prospects in mining services

“Mining services here in Australia is a sector that can’t catch a bid. The sector is profitable, growing, generating cash, and the share prices just keep going down,” Forager’s Johnson says.

He notes Australian mining services are trading at even lower multiples, of between 4-6 times earnings.

“It might be hard to believe at that valuation, but we think they have growth prospects. The world needs more commodities and Australia is likely to be the source of many new projects,” Johnson says.

“It has been a similarly difficult sector over the past two decades but, once again, precisely because of that difficult past, today’s mining services sector is a rational, profitable and cash-generative place to be invested.”

Financials look oversold

Merlon Capital’s Fraser believes too much pessimism is priced into some companies within Australia’s financial sector.

“The challenges following the Financial Services Royal Commission are well documented and have seen the industry structure and economics change demonstrably,” he says.

“Remediation costs, increased compliance costs and significant falls in platform margins have seen the four major banks exit the industry, and the likes of AMP and Insignia underperform the market considerably.”

Five stock picks

Both Merlon Capital’s Fraser and Forager Funds’ Johnson name companies from the financial sector among their current “unloved” picks.

Insignia Financial (ASX: IFL)

Fraser believes the market has become overly pessimistic on diversified wealth management and financial services business Insignia, while conceding that negative sentiment towards the industry is largely justified.

Insignia, formerly known as IOOF, acquired the National Australia Bank and ANZ Bank wealth businesses in 2021 and 2022, making it the largest provider of financial platforms.

Fraser acknowledges market concerns about investor capital outflows in recent years, combined with the impending departure of CEO Renato Mota. But he believes these are already factored into the share price and regards the company as reasonably priced at current levels.

ING Group (AMS:INGA)

Within global financials, Johnson calls out the Dutch bank as one of his team’s bank favourites.

“It’s nicely diversified, has excess capital, is paying out all of the cash generation to shareholders and does have a few growth prospects,” he says.

ING Group NV

Virgin UK (ASX: VUK) (LSE:VMUK)

“This looks like a bargain to me,” says Johnson in reference to the dual-listed financial company behind UK brands Clydesdale Bank, Yorkshire Bank and Virgin Money.

“It is predominantly focused on the UK, though, so comes with more exposure to one (troubled) economy.”

Macmahon Holdings (ASX: MAH)

In the mining services space, Johnson says: “You get what you pay for - the more liquid, larger companies trade at higher multiples. But I think you can buy the whole sector and do just fine,” Johnson says.

A Perth, WA-based company, Macmahon provides mining services to projects across Western Australia, Queensland and Indonesia.

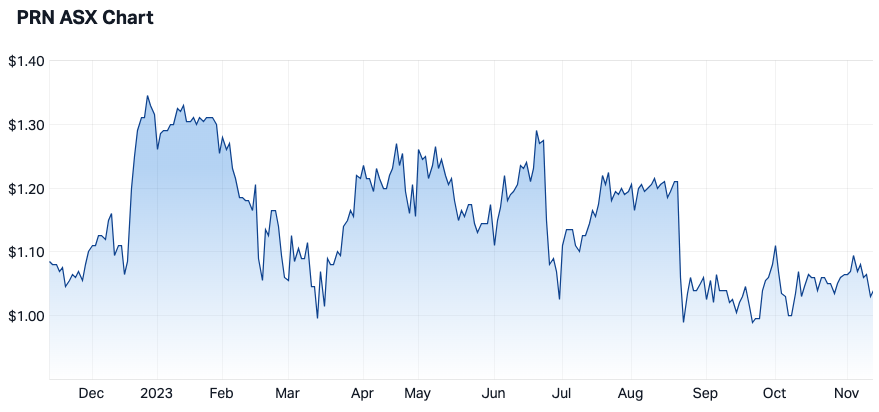

Perenti (ASX: PRN)

With interests in surface mining, underground mining and mining support services, the Australian-based company has operations and offices in multiple continents, including Australia, Africa and North America.

What's your contrarian stock pick?

Is there a part of the market you believe has been overlooked, or a company that's being unjustly written off as a dog? Please let us know in the comments.

2 topics

7 stocks mentioned

2 contributors mentioned