Trending On Livewire: Weekend Edition - Saturday 10th August

We hope you enjoy the updated Weekend Edition of Livewire's daily newsletter (feedback here).

To quote Kylie, this week has me “spinning around”. The S&P 500's 3% fall on Monday, the worst since 2022, was quickly met with a 2% rise on Thursday evening. The Japanese stock market index entered a technical bear market on Monday then rose 13% in the two sessions that followed. Here at home, the ASX 200 had a savage 3% fall on Monday but when all was said and done, the five-day performance was just a TK% fall.

And that's before we talk about reporting season!

Whether you were licking your wounds in Audinate (down 50% then up 30%), jumping up and down over the Life360 result (up 20%), or taking profits on your bond investments, I hope you will be using this weekend to recharge and to reflect on what has been a remarkable and unforgettable week in markets.

Hans Lee, Senior Editor, Livewire Markets

Buy Hold Sell: 5 of the fastest-growing stocks on the ASX for FY25

In this episode, Marcus Today's Henry Jennings and Market Matters' James Gerrish analyse some of the market's hottest growth stocks.

Ally Selby, Livewire Markets ∙ 9 min episode

Also on Buy Hold Sell

- 50% of the ASX is banks and miners. Should you bet against the market?

- 5 stocks likely to surprise to the upside this reporting season

Signal or Noise: Why everything has to go right this ASX reporting season (and 4 must-watch stocks)

The most important month of the investing year is here - and the stakes are very high. Lazard Asset Management's Aaron Binsted, Wilsons Advisory's David Cassidy and AMP's Shane Oliver are here to help you through August and beyond.

Hans Lee, Livewire Markets∙ 22 min episode

READ THE MACRO GUIDE TO AUGUST

More from Signal or Noise

- The one question these investors want answered this ASX reporting season

- 6 opportunities for Australian income investors

Why trying to time small caps is a "big waste of time" (and 2 long-term stock ideas)

In this Rules of Investing podcast, Langdon Equity Partners Founder and Lead Investor, Greg Dean, explains why - and shares how he does it.

James Marlay, Livewire Markets ∙ 42 min podcast

More from The Rules of Investing

- How to dominate small caps like Roger Federer dominates tennis

- 30-year property veteran: Australia has its head in the sand on housing

Top 3 Wires this Week

- What caused stocks to crash, what’s next for markets, and how to defend your portfolio • 9 min read

- Why dividend payouts from ASX companies won't crash (and 16 stocks fundies are backing) • 5min read

-

Forager's 5 ASX stocks for long-term investors • 5 min read

From our Experts

-

The case for value in today's market (and 8 undervalued stocks)

Reece Birtles, Martin Currie • 4 min read -

What do recession fears and share market falls mean for the RBA and investors?

Shane Oliver, AMP • 6min read -

Why Australia's sharemarket is a sure bet over the long term

Paul Taylor, Fidelity International • 3 min read

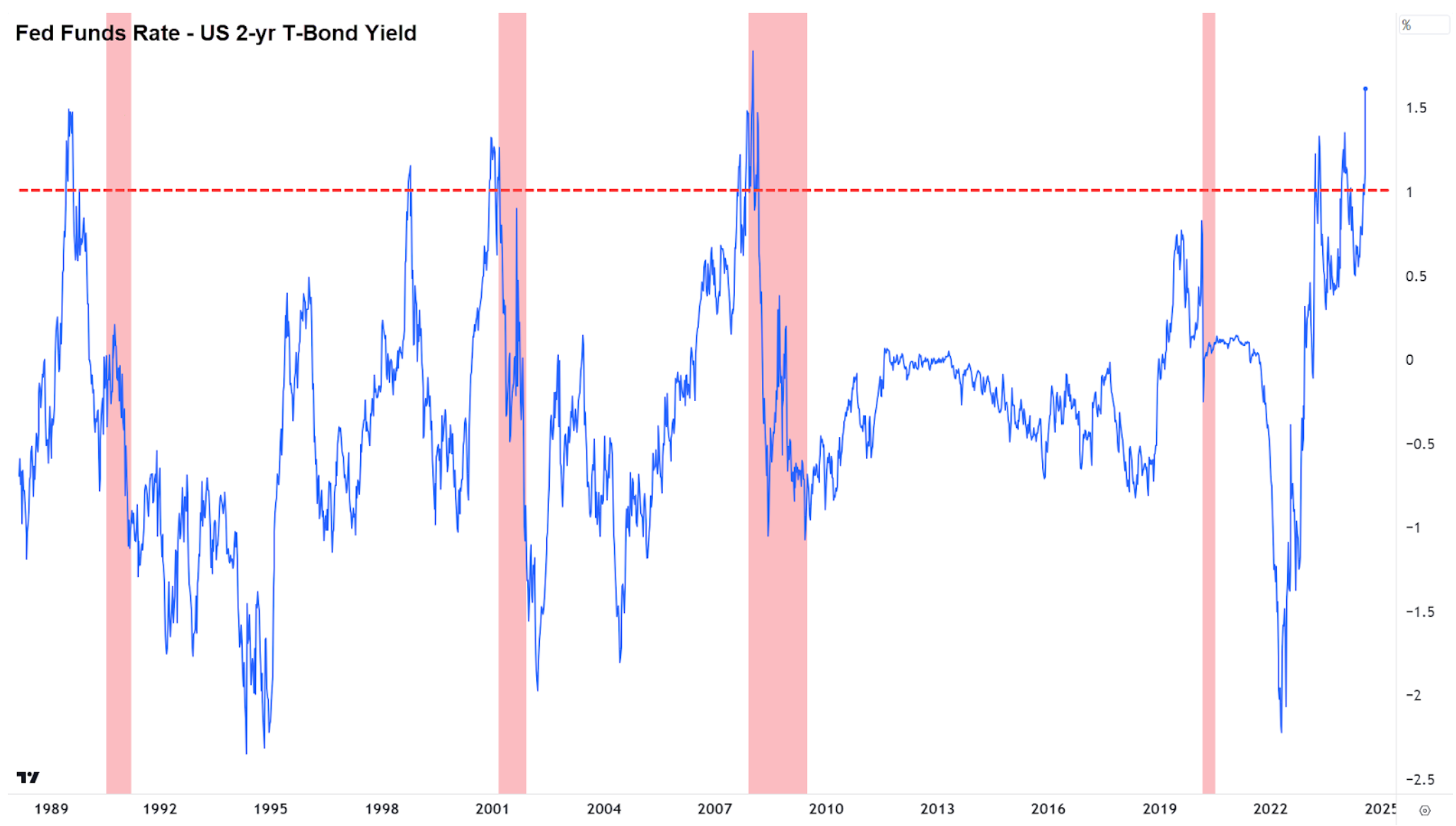

Carl’s Chart of the Week: This indicator predicted every US recession for 35 years and it’s flashing a major warning for stocks!

The above chart shows the difference between the cash rate and the 2-year T-Bond yield with each of the recessions since 1989 shaded in red. For ease, I will refer to it as the “blue squiggly line”.

For the most part, there isn’t a great deal going on in the US economy to warrant a big disconnect between the cash rate and market expectations for the cash rate.

But, note how immediately prior to each of the red zones, the blue squiggly line trended towards a 1-1.5% difference. This is the market betting the Fed is about to cut rates – and cut them big. Why would the Fed want to all of a sudden slash the cash rate? Yep, the economy’s in the toilet – the Big “R”.

Right now, the blue squiggly line is rising deep into what has been dangerous territory in the past. It’s at a level only rivalled by what occurred at the beginning of the GFC. Sound the warning bells!? Hey…the future is unknown, and anything can happen. I am just pointing out a tool that’s been historically very accurate. Draw your own conclusions!

Carl Capolingua, Livewire Markets • 9 min read

Weekly Poll

As an investor, how did you respond to the volatile price action on Monday?

A. Bought the dip

B. Sold some of my positions

C. A combination of the above (i.e. Bought and sold)

D. I made no changes to my portfolio

Last Weeks Poll results

We asked "Which companies reporting this week have the biggest potential to surprise?"

Results showed our readers are eyeing Life360 (ASX: 360) as the standout potential surprise in this week's earnings reports, with over a third of respondents picking the tech company. REA Group (ASX: REA) and Nick Scali (ASX: NCK) are also on the radar, collectively accounting for another 36% of expectations.

Curious about the full breakdown and what it might mean for the market?

The Meme Market

.png)

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

-

Weekly Wrap: A summary of market highlights from the week, sent each weekend

3 stocks mentioned

7 contributors mentioned