Trending On Livewire: Weekend Edition - Saturday 17th August

The ASX 200 went five for five this week but the real stories were under the hood. Four major companies raised their dividend this week - CBA (ASX: CBA), JB Hi-Fi (ASX: JBH), Telstra (ASX: TLS), and Cochlear (ASX: COH). But raising a dividend is by no means a foolproof strategy, as Cochlear found out the hard way. Speaking of healthcare, Pro Medicus (ASX: PME) had another remarkable day-of-earnings performance while CSL (NYSE: CSL) shares slumped due to investor concerns over the profitability of its Vifor business.

And speaking of slumps, Beach Energy (ASX: BPT) and Origin Energy (ASX: ORG) shares both fell by double digits. It's been a crazy week - and it only gets crazier next week!

Hans Lee, Senior Editor, Livewire Markets

Buy Hold Sell: 5 oversold ASX stocks

Like most things in life, stock sell-offs come down to simple supply and demand. If there are more sellers than buyers, a company's share price will fall. But in today's market, nearly 30 companies now trade at 52-week lows and many others have suffered double-digit losses over the last 12 months. So, are these oversold companies value traps or investable opportunities? To find out, Livewire's Ally Selby was joined by Perpetual's Nathan Hughes and Hayborough Investment Partners' Ben Rundle. They analyse three oversold companies and also name two beaten-down stocks that they believe are a buy today.

Ally Selby, Livewire Markets

Why AI will have a bigger impact on the world than the invention of electricity

Despite the stellar run in tech companies over the last year or so, and mounting concerns that investors may have gotten ahead of themselves on the momentum behind artificial intelligence, T. Rowe Price's Dom Rizzo believes investors are underestimating the true impact of AI. In fact, he argues it will likely be the biggest productivity-enhancing technology for the global economy since the invention of electricity. So how do you pick the real AI winners from the imposters? In this episode, Rizzo explains his process for picking winning tech stocks, as well as some of the companies that have passed through these filters.

Ally Selby, Livewire Markets

Top 3 Wires this Week

Here are the week’s top viewed or liked wires by our subscribers

- 5 ASX dividend stocks to weather what might be coming next

- CSL bleeds $7 billion on FY24 result. Have investors overreacted?

-

Fundies are selling stocks in droves. Here's where they are allocating instead

From our Experts

-

5 pharma and biotech stocks on the move in July

Claire Aitchison, Independent Investment Research

-

7 key charts for investors to keep an eye on - Where are they now?

Shane Oliver, AMP -

2 undervalued small and microcaps with structural growth opportunities

James Nguyen, Tyndall AM

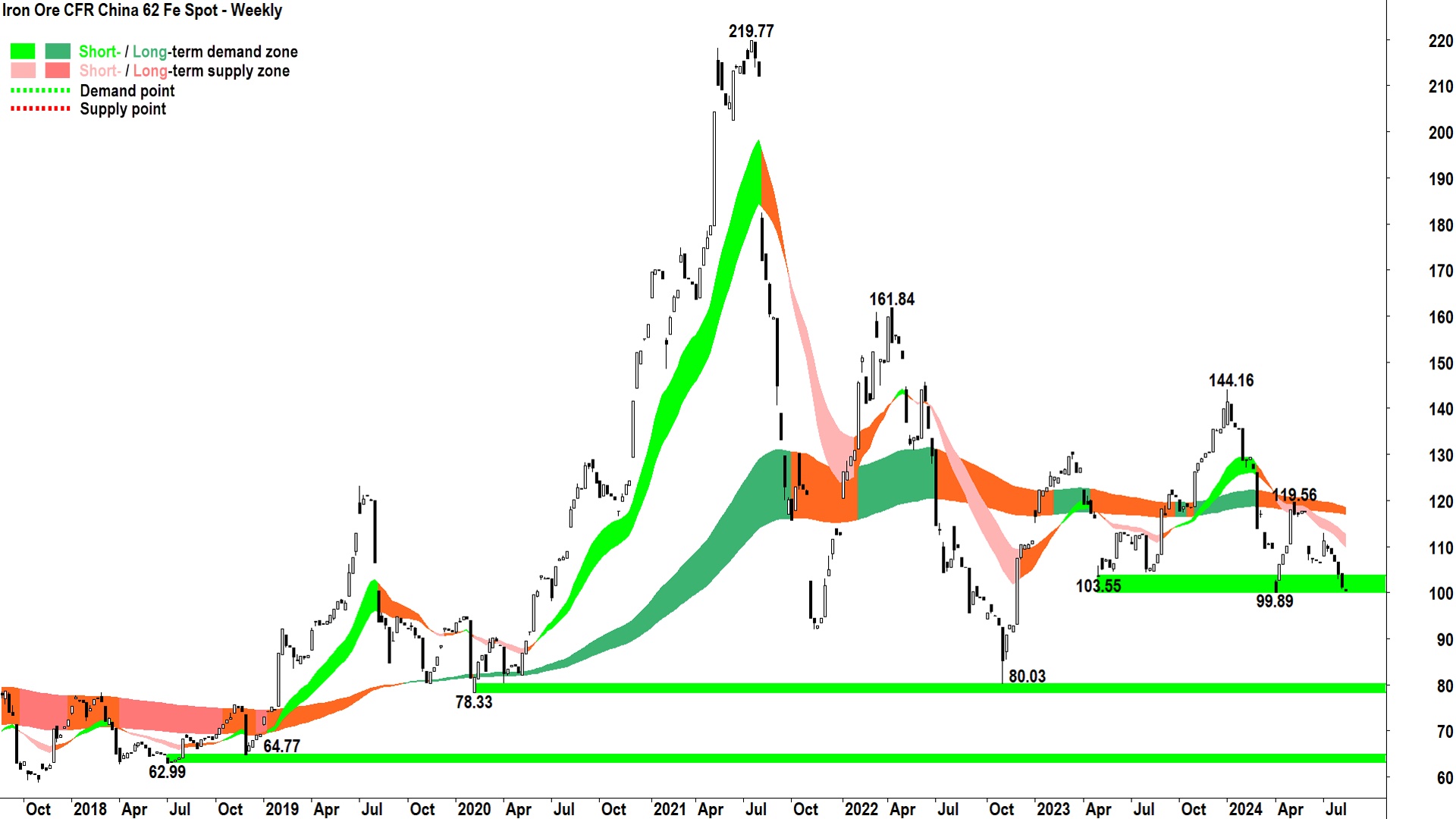

Carl’s Chart of the Week: Will the iron ore price crack $100 and trigger more pain for BHP, RIO, MinRes, and Fortescue?

From a purely technical analysis perspective, I propose that we’re now at a critical support point for the iron ore price. There is a zone of historical demand between $99.89 and $103.55. The price has rallied at least twice from this level.

The growing black weekly candles suggest the supply-side is increasing its control of the iron ore price in the very short term, and the broader trend of falling peaks and troughs and the falling short term downtrend ribbon confirms a broader picture of excess supply.

Should the iron ore price close below $99.89 demand support, the next zone of historical demand is not until $78.33 and $80.03. There’s little in the way of price action between $99.89 and $80.03, and in my experience, this tends to lend itself to a rapid price decline between the two points.

Carl Capolingua, Livewire Markets • 9 min read

FIND OUT WHAT THE BROKERS THINK

Weekly Poll

The following companies experienced earnings day share price slumps this week. Which one of these would you buy if you had the chance

- Cochlear

- CSL

- Beach Energy

- Simply Energy

- Seek

- I wouldn't buy any of them!

Last Weeks Poll results

We asked "As an investor, how did you respond to the volatile price action on Monday?"

Investor resilience shines through Monday's market turbulence. A commanding 62.79% of respondents held steady, making no portfolio changes. Opportunistic investors emerged, with 11.63% buying the dip. Only 6.98% opted to sell positions. Notably, 18.6% demonstrated tactical flexibility, both buying and selling. These results suggest a largely composed investor base amid volatility.

Curious about the full breakdown and what it might mean for the market?

The Meme Market

We'd love your feedback

Tell us how you would rate this Weekend's Edition of Trending On Livewire:

😡 😞 😐 🙂 😀

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

9 stocks mentioned

8 contributors mentioned