Trending On Livewire: Weekend Edition - Saturday 22nd March

A relative sense of calm returned to markets this week, with the ASX200 climbing over 2.5% - a welcome rebound after the sharp falls we’ve seen since mid-February. Looking at US market data going back to 1945, there have been 37 instances where markets fell by 10%, or about once every two years. Corrections are, in many ways, just part of the investing cycle. The silver lining? Fewer than 30% of these corrections have deepened into bear markets (defined as a 20%+ decline). Better yet, history suggests the S&P 500 has typically delivered strong rebounds, with average gains of 19% one year post-correction and 37% after two years.

Closer to home, Coles (ASX:COL) and Woolworths (ASX:WOW) shares rallied on Friday following the ACCC’s long-awaited Supermarkets Inquiry Final Report (a hefty 441 pages!). The report outlined recommendations to boost transparency around promotional practices, but clearly the market feared worse. A sigh of relief for shareholders - although grocery shoppers might not be celebrating just yet.

Meanwhile, gold continues to shine in 2025, extending its strong run from last year. Some point to rising geopolitical tensions as a key driver behind gold’s ascent as a defensive asset. The largest gold ETF on the ASX has surged 14.8% year to date, outperforming the ASX200 by an impressive 42% over the past 12 months. Not bad for a so-called "safe haven" asset.

James Marlay, Co-Founder, Livewire Markets

Trump is making waves: 3 high-growth ASX stocks to ride them

Emanuel Datt’s small cap fund has returned 25.7% p.a. after fees since its inception in October 2023. In this wire the stock picker tips three businesses he expects to make money for investors over the year ahead. Two of the picks have exposure to the ‘Trump trade’ of owning strategically important commodities as the US scrambles to secure supplies of tin and niobium to reduce its reliance on China. Datt also tips a junior gold miner he says is very cheap and gushing cash. As a bonus he’s confident it may soon snare a takeover bid.

There have been 37 corrections since 1945, what are the chances shares fall more?

Equity market corrections and bear markets are as inevitable as death, and taxes yet they can feel like financial earthquakes. Small Industrials just had a -10.2% correction and are down -5.8% for the month at the time of writing after being down -2.8% in February. Recently my younger, smarter and more hard-working colleague Josh Clark and I were discussing the current market correction. While I blathered, Josh did a deep dive into the numbers around corrections to understand their frequency, depth, recovery, and what investors can learn from history.

Top 3 Wires this Week

Here are the weeks top viewed or liked wires by our subscribers:

Our Experts

Some of the best wires from our Contributors this week

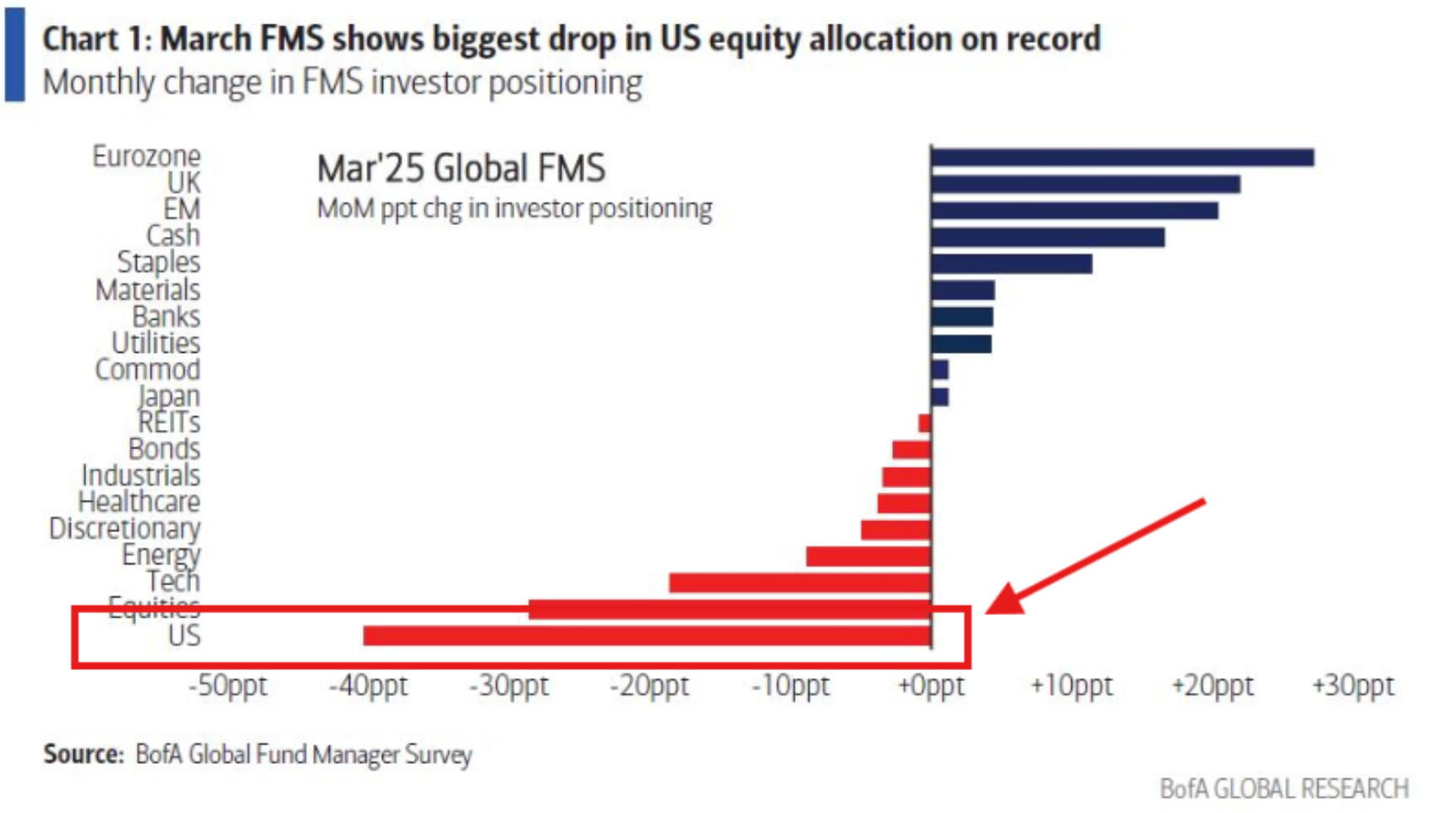

Chart of the Week: The biggest drop in US equity allocation on record

Records have been broken in the latest Bank of America Fund Manager Survey revealing how professional investors are behaving. The survey for February revealed the biggest drop in US equity allocation on record. It provides some context to the heavy falls experienced on Wall St as investors came to the abrupt realisation that they were all crowded to one side of the boat.

James Marlay, Co-Founder, Livewire Markets

Weekly Poll

As of March 2025, gold has demonstrated a long-term average annual return of approximately 10.7% in U.S. dollar terms since 1971, when the gold standard was abandoned. Gold doesn't feature heavily in many portfolios and returns can be volatile given it doesn't generate any income or pay dividends.

Do you invest in gold?

e) No, but I am considering adding gold to my portfolio

LAST WEEKS POLL RESULTS

We asked "AI-related stocks have taken a hit recently, with the ASX 200 Information Technology sector down 14% year to date. Companies like NextDC, Wisetech and Technology One are down significantly this year. Do you see this as:"

The poll shows 44% saw it as a buying opportunity, 39% viewed it as a warning sign, and 16% expected a short-term rebound.

How do you rate this Weekend's Trending On Livewire?

After selecting, you'll have the option to provide more detailed feedback in our quick survey.

Get the Weekend Edition straight to your inbox

Popular and exclusive content from the week sent every Saturday morning

SUBSCRIBE TO TRENDING ON LIVEWIRE - IT'S FREE

Other Newsletters across our network

- Trending on Livewire Daily: Get the best of Livewire by signing up to our popular daily newsletter

- Market Wraps: Concise market recaps of the ASX's most critical events 2x daily

- Weekly Wrap: A summary of market highlights from the week, sent each weekend

1 contributor mentioned