Trump, Taiwan, and the $10 trillion semiconductor threat

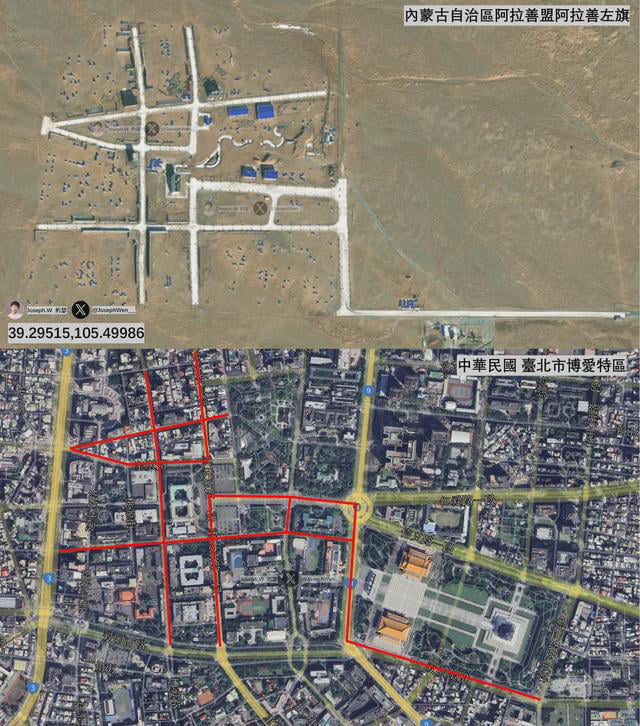

In March, a Taiwanese analyst posted a satellite image revealing an unusual Chinese military base deep in Inner Mongolia’s remote deserts.

These isolated, seemingly purposeless roads bear a striking resemblance to those surrounding Taipei's presidential palace.

In fact, the layout includes buildings at the exact locations of the presidential palace, the foreign affairs ministry, the national museum, and the national concert hall.

If you're sceptical, search for it yourself. The coordinates are below, although the area is scrubbed on Google Maps (it's still on Bing). If you zoom in you'll see the fake buildings.

The revelation is a stark reminder of Beijing’s intentions in Taiwan, and the risks to our peace and stability.

While the world mulls all the unknowns of a Trump presidency, China and Taiwan have moved to the centre of global money managers’ risk radars.

To be clear, a war between Taiwan and China is a low-probability scenario, yet it warrants consideration.

At Fat Tail Investment Research, we like to investigate potential ‘black swan’ events. By understanding the unlikely, you can help protect yourself from its full force.

Here, I’ll explore why this risk is worth considering today, a possible scenario, and what it could mean for your portfolio.

The Current Climate

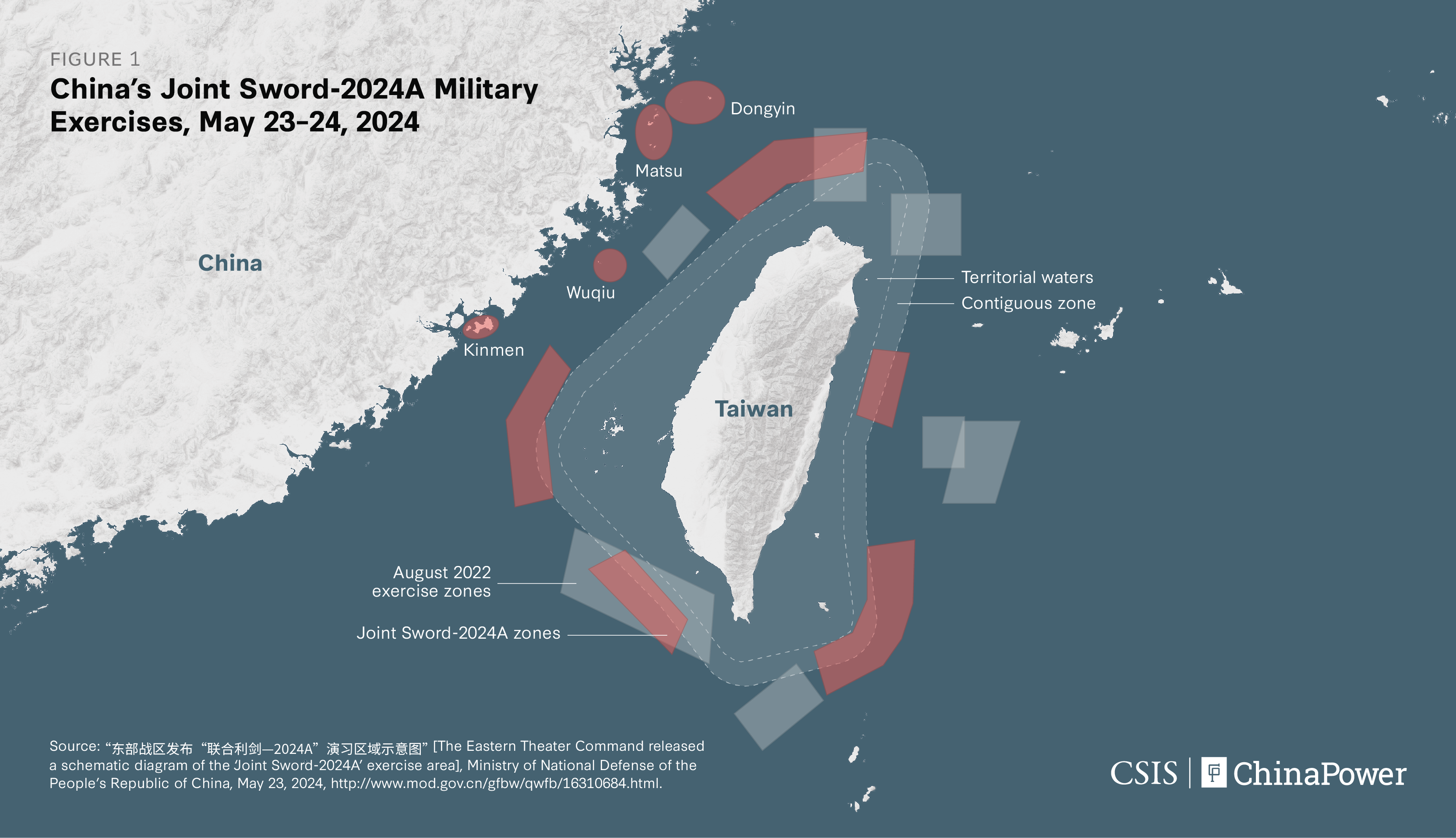

In early October, China flew a record 153 aircraft near Taiwan in 24 hours. China called the incursions a ‘stern warning to independence forces’.

Similar displays of force were seen in May after the Taiwan elections and in 2022 after US Speaker of the House Nancy Pelosi visited the island.

These full-scale military drills aim to intimidate and corral Taiwan. Each slightly escalates without justifying retaliation. A Chinese strategy that translates to ‘nibbling like a silkworm’.

The most recent drills also included invasion simulations across China’s mainland, flexing its growing amphibious forces.

These drills followed statements from Taiwan’s President Lai Ching-te, who has softened his pro-independence stance to avoid escalating tensions.

But for China, who labelled him as a ‘separatist agitator,’ any mention of a Taiwan free of China’s control has met threats and condemnation.

For Beijing, there is only one way this will go: with Taiwan firmly back into the fold of the People’s Republic.

But why haven’t they done this already? And why is this small island nation so important to us?

The Silicon Shield — Taiwan’s Importance

If China is the heart of global manufacturing, Taiwan is the brain.

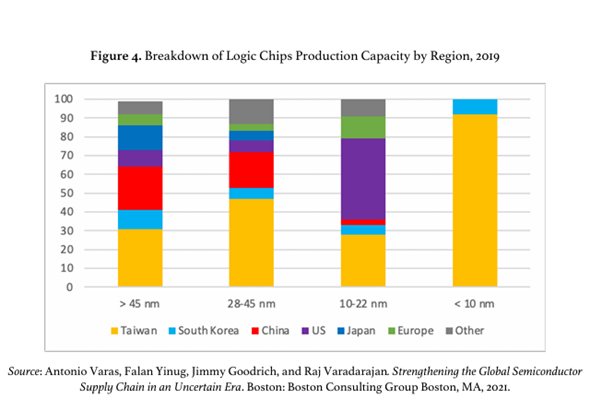

Taiwan controls 90% of advanced chip production worldwide through one company, Taiwan Semiconductor Manufacturing Company (TSMC).

It's not just advanced chips (those below 10 nanometres). Around 60% of global chip production comes from Taiwan.

These nanometre (nm) sizes refer to the chip's smallest feature. Anything over 45nm is now considered ‘legacy chips’ — older-technology semiconductors that still form the foundation of many industrial applications.

Below, you can see just how vital Taiwan has become for advanced GPU makers like Nvidia.

Semiconductors have steadily crept into our lives and become the gears of our technological world. The average new car, for example, has 1,500 chips. EVs can have closer to 3,000.

These chips are in almost every modern device, from our AI ambitions to your fridge and phone.

Nearly every essential service—water, energy, internet, waste management — relies on the steady performance of these chips

They control every sensor and machine in modern industrial production and are the alpha and omega of advanced military equipment.

But Taiwan's significance extends beyond semiconductors. Taiwan’s strait is one of the world's critical trade routes, handling over 50% of global shipping containers and neighbours other essential shipping lanes.

Any disruption or blockade would cripple many nations’ (including China’s) ability to access markets and those critical chips.

Nor can China simply seize these factories. TSMC and chip toolmaker ASML have pointedly told China that its machines will self-destruct in the event of invasion.

So this ‘Silicon Shield,’ along with support from the US, has been enough to hold China’s ambitions at bay.

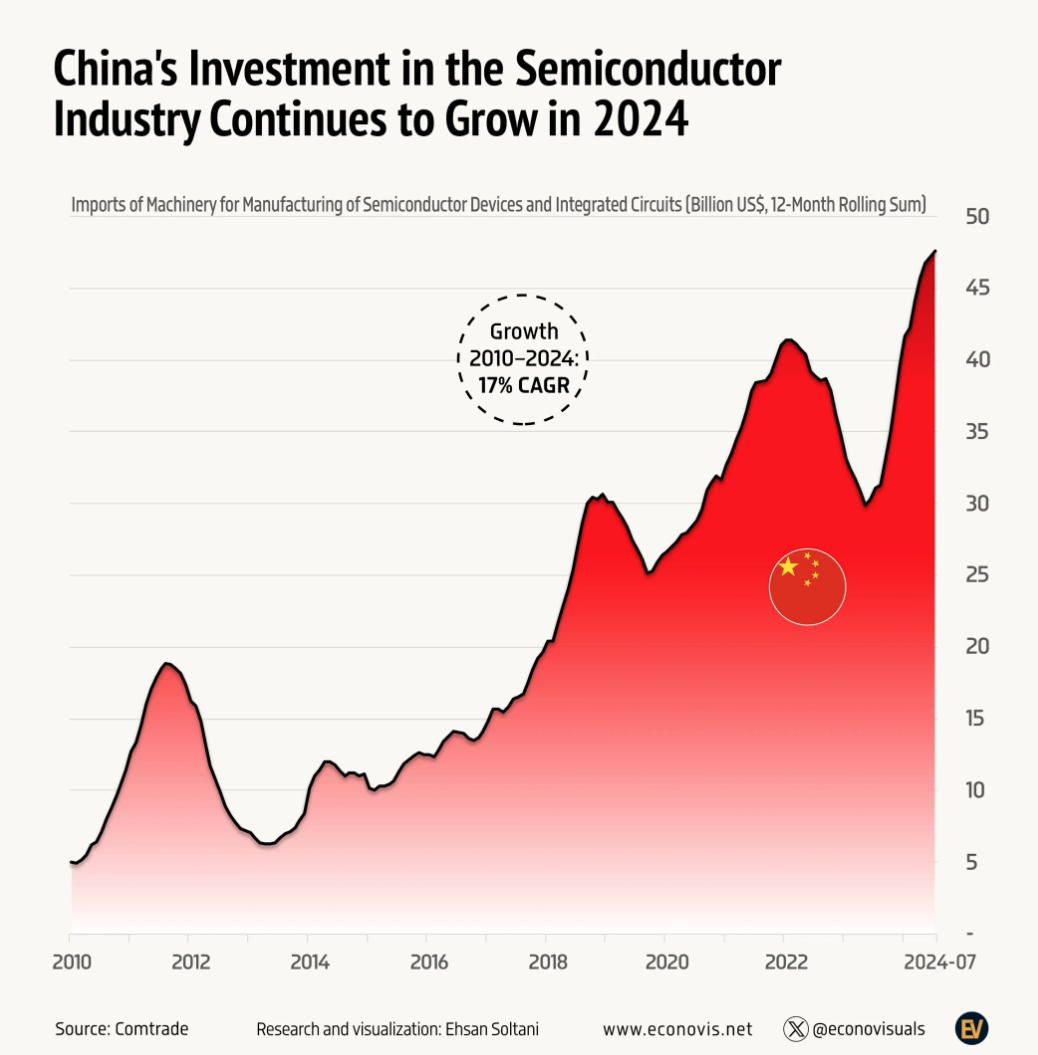

But with a change in the White House, China’s strategy could change. This comes at a time when China is furiously spending to rid itself of its dependence on Taiwan.

Sanctions and Resilience

In October 2022, the Biden administration introduced export controls to limit China’s access to advanced US chips and technologies.

The aim was to maintain US technological superiority and address ‘security concerns’ around AI and advanced weapon systems.

There are around 1,000 stages to chip-making. US sanctions have primarily targeted lithography, a crucial step in chip production.

Here’s a short video of the chipmaking process with that shown in step five.

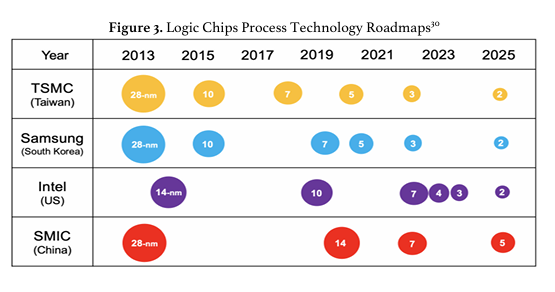

Today, the most advanced lithography machines come from the Dutch company ASML.

Their latest tools can support chip production down to 1.4nm. In comparison, China’s homegrown machines were reportedly down to 28nm at the start of 2024.

In the eyes of the US, they had hit China’s Achilles heel and slowed its development for decades. However, the sanctions failed to understand that the legacy tools could be adapted.

Before the sanctions hit, China had already been stockpiling many of ASML’s DUV (Deep Ultraviolet) machines, which could be retooled to go smaller.

While its chips are much more expensive and have lower yields, China is still producing 7nm chips with these old ASML machines and aims to reach 5nm by the end of this year.

At the same time, China gave US$47.5 billion in subsidies to domestic producers to boost ‘legacy’ chip production.

This has seen its domestic chip production explode and the Silicon Shield begin to crumble.

For example, China has gone from accounting for 8% of ASML’s revenue in 2023 to now half.

This is the kickstart China will rely on until its domestic tooling can catch up. Soon, markets will be flooded with cheaper chips from China, something that manufacturing could begin to rely on.

In fact, we’re now reliant on China in many regards. Around 38% of all outsourced semiconductor assembly and testing (OSAT) is based in China and is set to grow.

That is, unless Trump puts a cleaver to US-China trade and markets split.

ASML’s CEO Christophe Fouquet recently acknowledged that global markets ‘need China's legacy chips.’

But what happens to Taiwan when China doesn’t need our chips?

The Window of Vulnerability

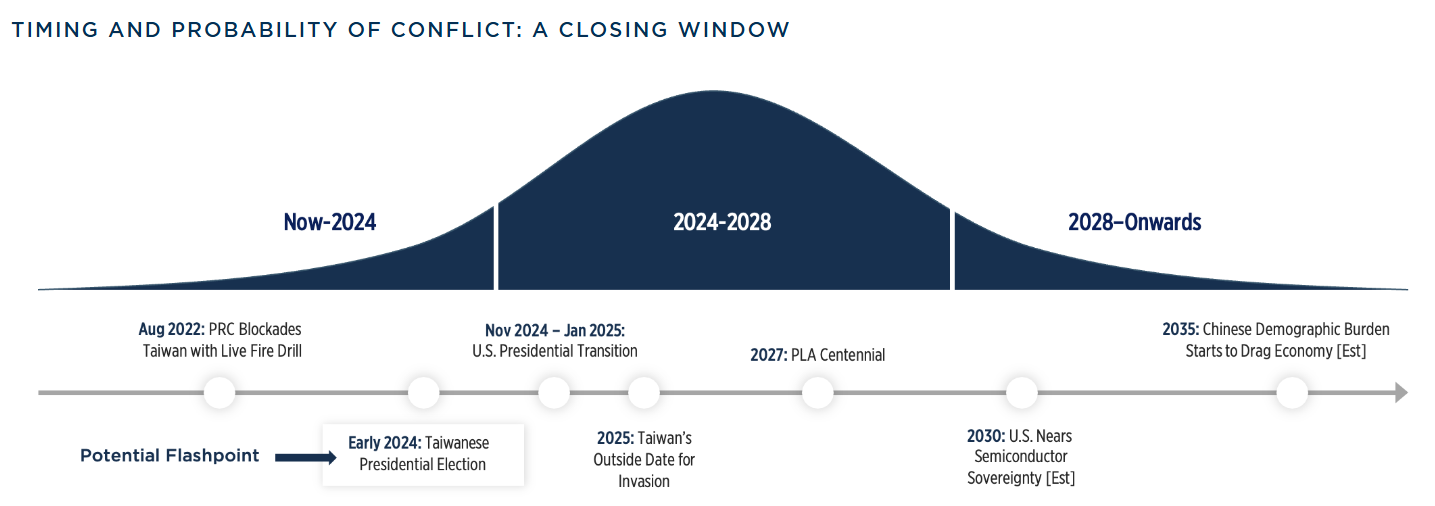

US defence experts warn that China’s timeline to act on Taiwan has accelerated, with CIA and Pentagon officials projecting a possible invasion this decade.

CIA Director Willam Burns was one of the first to raise the issue publicly, stating that the US knew, ‘as a matter of intelligence’ that ‘President Xi has instructed the PLA [People’s Liberation Army], the Chinese military leadership to be ready by 2027 to invade Taiwan.’

While a leaked memo from General Mike Minihan, head of Air Mobility Command, titled ‘I hope, I am wrong,’ put the date far sooner, in 2025.

China’s defence spending increased by 7% this year, the most in the last five years, as it modernises its military.

Satellite images reveal serious military build-up near Taiwan. For example, the Longtian military airbase has expanded and improved many of its fighting capabilities.

Here are the changes in white in the past two years alone:

It is just one of a dozen airbases in southern China that have seen significant upgrades since 2020.

‘The amount of military equipment they’re producing is eye-watering,’ noted Former head of Pentagon’s China Policy, Chad Sbragia.

But as China spends to catch up with the vast US arsenal, its ambitions have a ceiling.

Thanks to its one-child policy, China faces a fast-ageing population. We’ve also seen pressure from Xi Jinping, who’s now 71. He has promised to ‘solve’ the Taiwan issue during his tenure

These create a closing window for China that puts Taiwan and the West squarely at risk.

A Trump presidency could also open the window further. During the campaign, Trump repeatedly questioned the US-Taiwan relationship and expressed frustration that Taipei was not paying the US to fund its defence.

Whether this is bluster or a negotiation tactic remains to be seen. For Taiwan, the risk of attack during his presidency is all too real.

Scenario of Attack

Reviewing Chinese military doctrine and war simulations is not for the faint-hearted. The threat of nuclear escalation, massive loss of life, and market collapse are all on the cards.

Looking at the first satellite image and lessons from Ukraine, China could favour targeted strikes on leadership rather than a full invasion.

However it starts, there is a high chance of Western involvement (including Australia).

While you’ve likely heard of a possible invasion, the reality is far more nuanced. Rather than a full-scale war, China’s plans could instead target our economies.

Subtle changes to China’s maritime and coastguard laws in 2021 have allowed China to legally justify a so-called ‘quarantine’ of Taiwan. These moves would challenge Western resolve to respond — for fear of escalation.

Experts predict a blockade could effectively weaken Taiwan and the West without sparking open conflict.

So what would the economic impacts be, and what should you do now?

Economic Impacts and Hedges

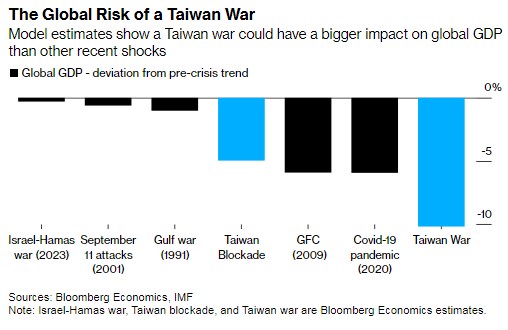

In an ‘out of the blue’ Taiwan crisis, global markets would experience an immediate and severe shock.

You’re not going to be the first to find out, but if you’re prepared, at least you can know how to act.

Fast-moving hedge funds would be the first to react, rapidly selling their regional exposures before the broader market response.

This would trigger a massive ‘flight to safety’ across all markets. Gold prices could surge to record one-day gains. Dwarfing the 11.6% one-day gain seen during the 2008 financial crisis.

Technology stocks, especially the Magnificent 7, would face intense selling pressure as semiconductor supply fears grip the market.

Simulations have the NASDAQ dropping around 10%, and the S&P 500 down fall 7% within the first days.

Safe-haven assets, including gold, silver, and US Treasuries, would continue to rise as investors seek shelter. At the same time, the US dollar would strengthen against most currencies.

The extended impact would be far more severe than the initial shock.

US Intelligence Director Avril Haines put it bluntly: a Chinese invasion stopping TSMC's production could cost the global economy up to $1 trillion annually in the first year alone.

Given our reliance on these chips, severe supply crunches and rising inflation would likely follow. If it then escalates to a broader war, the global economic impact could reach $10 trillion.

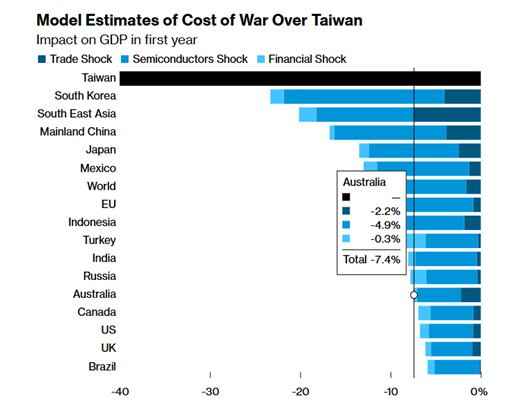

For Australian miners reliant on Chinese trade the reality is dire. ASX giants BHP, Rio Tino, and Fortescue would all fall sharply, as would most ASX 200 stocks.

But beyond the initial shock, the true damage to our economy would come from the lack of semiconductors.

For Australia, that’s an estimated loss of 7.4% of our annual GDP in the first year.

For investors in the here and now, I’m not suggesting positioning your entire portfolio for this today. But like a bushfire plan, even a little planning can go a long way. Understand what’s exposed and what could benefit.

Your immediate portfolio adjustments should focus on exiting ASX companies that trade with China. Iron ore and coal are the obvious two, but tech stocks will also face selling pressure without chips. If trade breaks down with China, our entire economy could be threatened.

On the buy side, focusing on companies with robust supply chains and rigid demand would be the key to your portfolio's survival in such a crisis.

Remember toilet paper during the pandemic? That’s the kind of reality we could see for electronics.

Look towards precious metals, quality blue-chip stocks, and defensive sectors like healthcare and consumer staples. These usually do well in times of war or strife.

Energy sector investments, including oil and gas, and strategic metals like titanium and palladium could also provide some protection.

A chip shortage leads to a supply crunch. In this scenario, expect inflation to hit hard and fast again.

Anticipating that inflation could mean buying that fridge or car you’ve been putting off wouldn’t be the worst idea if the unthinkable comes.

For business owners, hardware or machinery that’s already in Australia should be a priority.

Similarly, real estate would be a solid option before inflation and potential migrant inflows skyrocket prices.

While this may seem unlikely, the outsized risks make a diversified portfolio strategy a wise approach here.

Small moves or a little planning can protect your wealth against what could be the most significant geopolitical and economic disruption of our generation.

If you want to read more articles like this that break down the unexpected and the overlooked, sign up at Fat Tail Investment Research to see more market-leading topics on gold, commodities, and macro trends.

1 topic

%20cropped.png)

%20cropped.png)