Two charts every equities investor needs to see

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,899 (-0.08%)

- NASDAQ - 12,126 (+0.14%)

- CBOE VIX - 26.09

- US 10 YR - 3.08%

- USD INDEX - 106.89

It was another very strong labour report out of the US on Friday. In June, 372,000 jobs were added - far above expectations. The unemployment rate has also stabilised at 3.6%.

It was same-same but different in Canada, where job creation actually went backwards last month (-43,200 jobs in June). However, the decline didn't offset a larger decline in available workers. That meant the unemployment rate remained stuck at mid-1970s lows.

- FTSE 100 - 7,196 (+0.1%)

- GERMAN DAX - 13,015 (+1.34%)

- GOLD - US$1,741/oz

- WTI CRUDE - US$104.80/bbl

- NATURAL GAS - US$6.07/mmBTU

THE CALENDAR

Welcome to the craziest week for macro since we started Charts and Caffeine. Buckle up while I give you the fast version.

It all starts with the Reserve Bank of New Zealand interest rate decision on Wednesday lunchtime. Much like most other central banks, the hike is definite. The size is up for debate. The consensus there is for a 50 basis point hike.

Later that night, we get UK GDP before the main course of the week - US inflation. Remember, core CPI was tipped to peak last month. It actually increased again. That sent markets south and the Federal Reserve head first into a 75 basis point hike scenario. What will this month's read bring?

Not 90 minutes after that, we'll hear from the Bank of Canada and its interest rate decision. Economists expect another 50 basis point rate hike there too.

And not 11 hours after that, we will get the Australian jobs report for June. Wages will be the key. Its effect on the unemployment rate will be absolutely vital. Last month, the economy created 60,000+ jobs but the headline rate didn't move because more people came back into looking for work.

11 hours after that report, we get the contrast to US CPI (consumer inflation) with the US PPI (producer inflation) print. Remember - inflation is like a supply chain. If producers are paying more, they will have to find some way to pass it on to you or they go out of business.

Both reads are absolutely vital.

Finally, just to spice things up, we get Chinese GDP and retail sales figures on Friday. Here, we will get to witness the impact of zero COVID on the country's economic growth.

Yesterday, Chinese CPI came in dead flat for the month while PPI increased 6.5% in just 30 days.

THE CHARTS

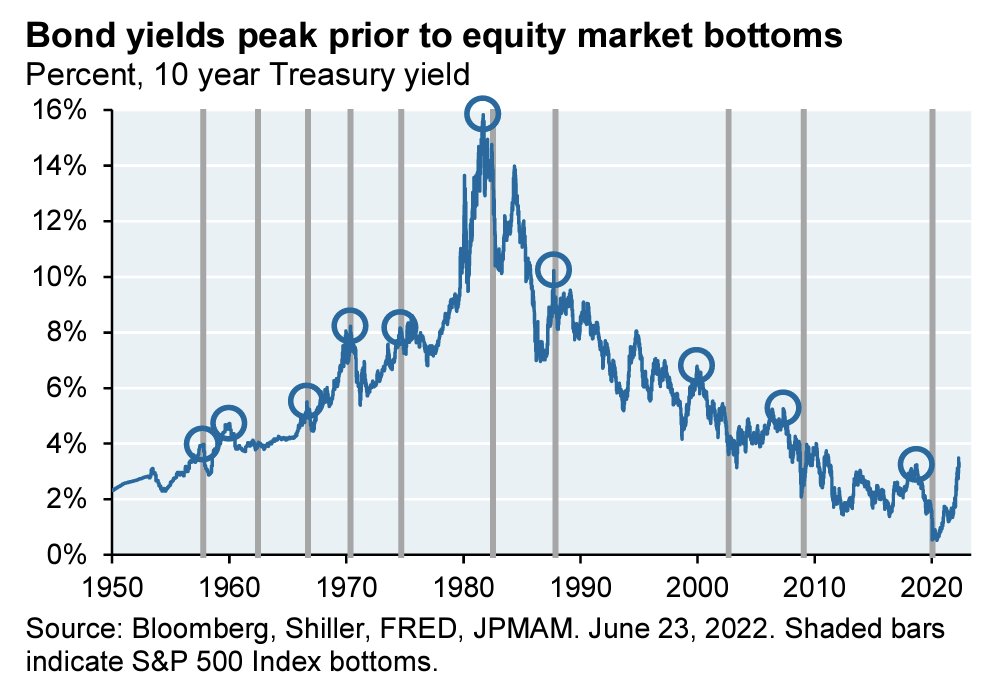

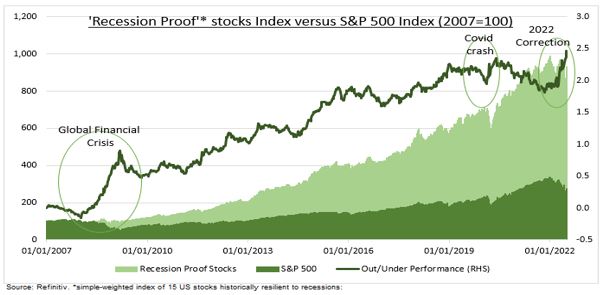

Today, I thought I'd bring you two charts telling the same storyline. With recession being the buzzword on everyone's minds, there are two things we hear a lot of:

- Don't try to pick the bottom

- Now is the time to pick stocks, not be broad and passive

This section of the wrap will examine those two maxims in some detail.

STOCKS TO WATCH

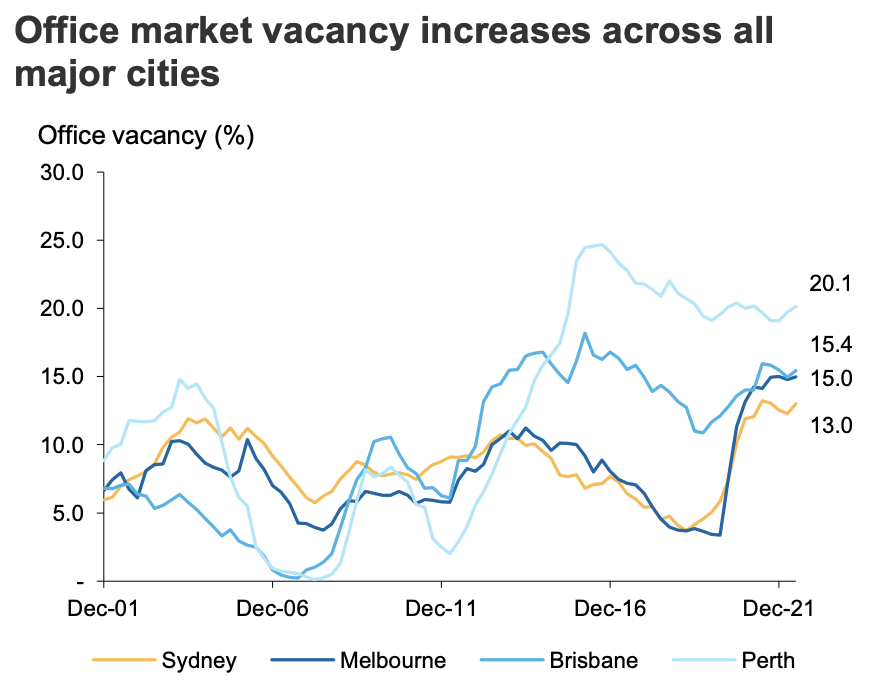

Speaking of stocks, let's bring it back home. Today, we're taking a look at the property space through the eyes of rents and vacancies in the commercial space.

Real estate research house JLL compiled its latest office data for the second quarter. It found that rent growth for the industrial space hit 20% in all of the major cities. Rents are also holding firm in the retail space despite the decline in demand for consumer discretionary products.

But the biggest issue is still in the office. Vacancies are still quite high - and in Perth, it's over 20% (!)

With this in mind, Macquarie had this to say about the office market, and corporate-related REITs:

While we had been cautiously optimistic on a recovery in office demand given a strong labour market and a relaxation of restrictions through 2Q22, we are becoming more wary as several leading indicators begin to moderate and the macroeconomic cycle slows.

In spite of this caution, analysts have outperform ratings on three office-related REITs: Dexus (ASX:DXS), Growthpoint (ASX:GOZ), and Mirvac (ASX:MGR).

In fact, Macquarie's coverage of the entire REITs space features no underperform ratings. That's remarkable given the impact rising bond yields would and have had on yields and rents. Maybe the downgrades are just on the way?

THE STAT

4.8%: The new year-on-year estimate for core inflation in Australia, per ANZ Research

A reminder that "core" or "trimmed mean" inflation is price rises without food and energy costs. The Q2 data will hit the wires on July 27th - and it'll all be covered here in the wrap and the Livewire website.

And for the record, NAB is predicting something similar so there's no reprieve.

THE QUOTE

But the country deserves a Government that is not only stable, but acts with integrity.

Not two days after he was appointed to the job, UK Chancellor of the Exchequer (aka Treasurer) Nadhim Zahawi put out a searing letter calling for his boss' head.

Not long after that letter, Boris Johnson finally caved in and resigned his post.

But I'm sure his decision had absolutely nothing at all to do with the other 54 resignations from the UK Cabinet that he received in three days.

GET THE WRAP

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

3 stocks mentioned