Two resources companies flag earnings warnings

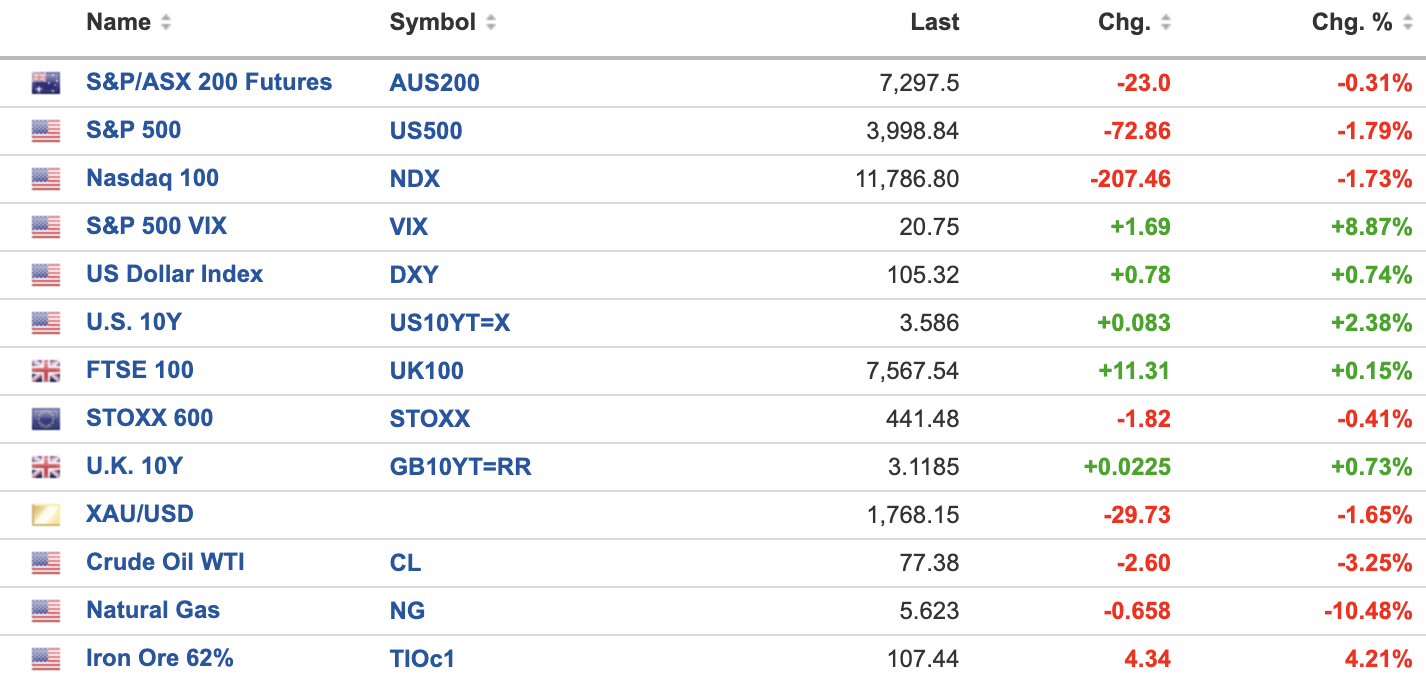

MARKETS WRAP

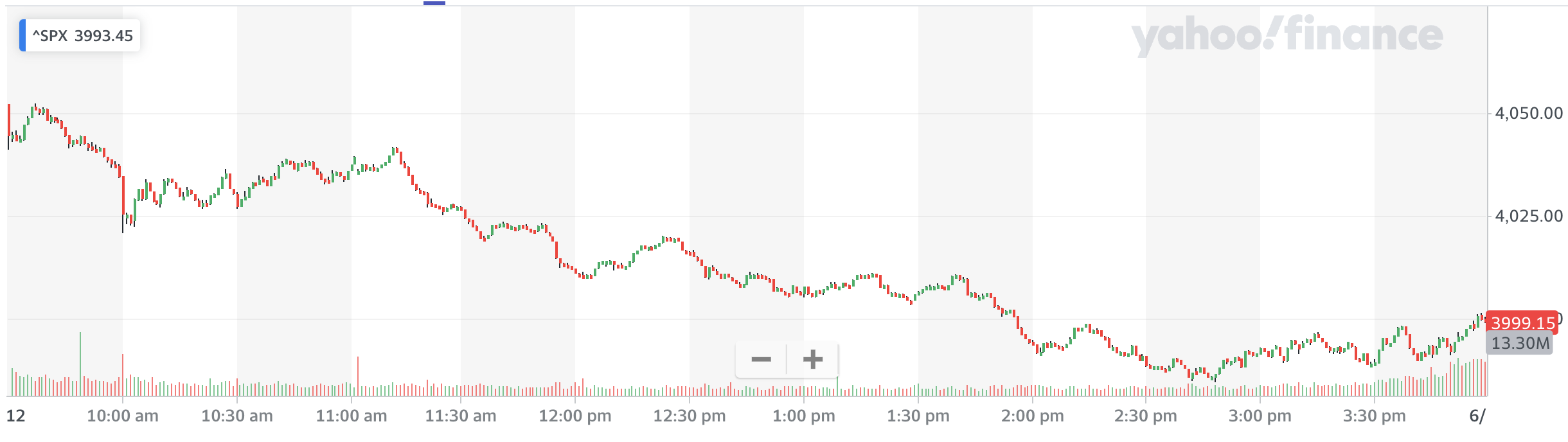

S&P 500 TECHNICALS

RBA PREVIEW

Here is your cheat sheet ahead of 2:30pm this afternoon. Thank me later.

- Goldman Sachs: +25bps

- TD Securities: +25bps, but look for a pause early next year

- BofA: +25bps

- NAB, CBA, ANZ, Westpac: +25bps

- AMP: +25bps, but look for language that suggests they debated either a 25bps hike or a complete pause.

In fact, all 30 economists polled by Reuters believe the RBA will hike by 25 basis points this afternoon at 2:30 pm AEDT. Is anybody sensing a theme here? But as Shane Oliver quipped in his Friday note last week, maybe this is the time that the RBA finally makes all the OCD-gripped economists happy!

"...a slowdown in the economy adds to our confidence that we are getting near the peak in the cash rate and the debate on Tuesday at the RBA Board meeting is likely to be between a pause or a 0.25% hike and not between a 0.25% hike or a 0.5% hike. Maybe the RBA should just hike by 0.15% taking the cash rate to a neat 3%!"

THE CHARTS

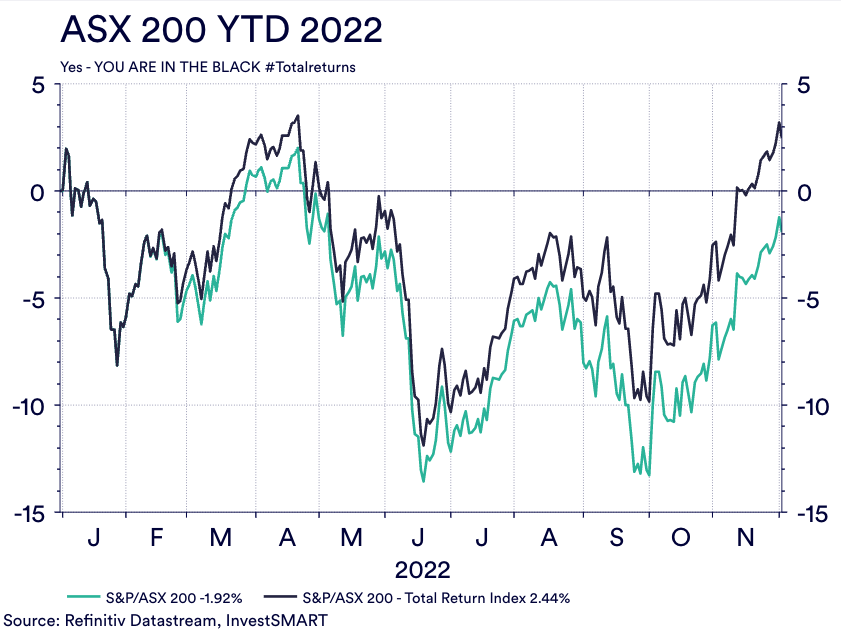

As Chris Conway alluded to on Friday, we are actually not that far off record highs for the ASX 200. And to prove it, here is the chart from InvestSMART's Evan Lucas.

Of course, on a nominal basis, the ASX 200 is still down but given it's only a marginal loss, it's very possible the Santa Rally will get us over the line by year's end.

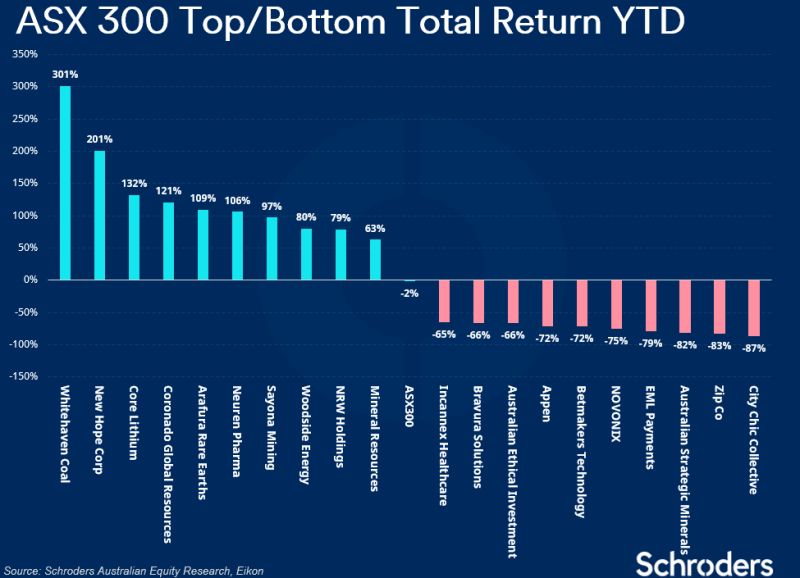

As for the stocks that have done the best and worst this year - well, you know what they are. Unsurprisingly, the runaway winner was Whitehaven Coal (ASX: WHC). In contrast, the biggest loser were growth names Zip Co (ASX: ZIP) and City Chic Collective (ASX: CCX).

STOCKS TO WATCH

In our stocks to watch today, I thought I'd look at two resources companies that are making headlines for all the wrong reasons.

First, Coronado Global Resources (ASX: CRN), alarmed the market after it a) lowered its production guidance and then b) warned that it may not meet its unit cost guidance.

Credit Suisse feels near-term weather risks and operational disappointments this year may result in more conservative 2023 guidance and lead to a lower consensus forecast for production volume. It (as well as Macquarie) lowered its price target marginally on the news.

And IGO (ASX: IGO) is also in the headlines after a fire caused the company's Nova mine to sideline production until next year. Ord Minnett has also cut its price target by 40 cents on the company as a result.

TODAY'S TOP READ

My colleague David Thornton wrote a piece not too long ago on the perils of investing in anticipation of a central bank pivot. But what if the puzzle was not that simple? What if equities are priced for a pivot when it's actually the bond market that should be priced for a pivot? Those themes are tackled in this piece by Steven Anastasiou of Economics Uncovered:

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

5 stocks mentioned

5 contributors mentioned