Two sectors set to light it up in FY23

All sectors have their time in the sun, that glorious moment when it's their turn to outperform the rest of the market.

First it was healthcare, led by market darling CSL. Then technology, typified by Afterpay's meteoric rise. And most recently it was commodities, as the likes of lithium stocks Core Lithium and Pilbara Minerals rode the commodities bull market.

So what will be the next 'hot' sector in FY23?

In this wire, Jun Bei Liu from Tribeca Investment Partners and Jack Collopy from Perpetual offer up two sectors they think are sitting pretty as we move into FY23.

As you'll see, the two sectors are looking good for very different reasons. One is primed for structural growth, while the other has been oversold and is due for some reversion to the mean.

Healthcare to return with a bang

Jun Bei Liu: We believe the healthcare sector will regain its position as the top performing sector in FY23. Our thesis is based on three factors, stabilising interest rate expectation, the opportunity for outsized near term growth and its structural growth prospects.

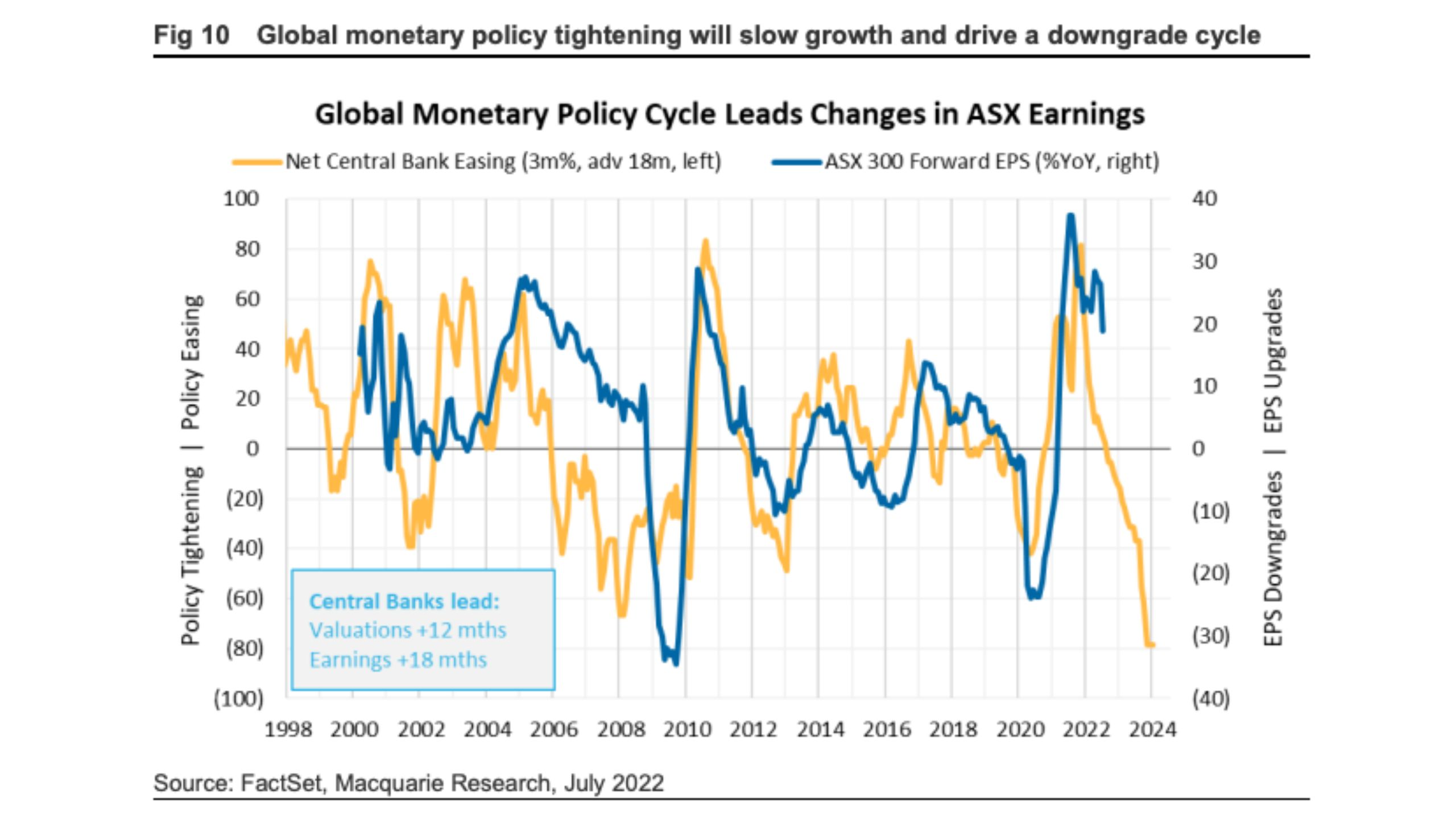

In the past six months, market participants have aggressively priced in rapid interest rate increases around the world as a result of elevated inflation.

Higher future interest rate expectations lower the near term valuation for growth companies such as healthcare and technology businesses.

This is why we saw sharp sell off of these two sectors - with some names down as much as 70 per cent. With falling commodity prices more recently and the debottleneck of global supply chains easing, we believe the inflation reading has now peaked which should see stabilisation of interest rate expectations. This certainly makes health care businesses look cheap relative to historical multiples.

Despite the fact that some areas of healthcare have benefited from the global pandemic, much of the healthcare sector has been the COVID losers as pandemic restrictions locked down hospitals and collection centres.

Many healthcare companies will see a significant return to growth from the next half, but it could take as long as 18 months to two years to clear the enormous backlog that has been built up over the past two years.

Finally and most importantly, we have entered into a period of economic consolidation with slowing consumer spending and a slower housing market. Many sectors will face slowing revenue lines and rising costs. Against this backdrop, many of our healthcare companies have long track record of growing their market share globally throughout many economic cycles. They have been, and are expected to continue, to deliver double digit growth regardless of the economic cycle as their services are often life critical and non discretionary. In a world where earnings becomes uncertain for many, healthcare businesses generate defensive growth and help future proof portfolios.

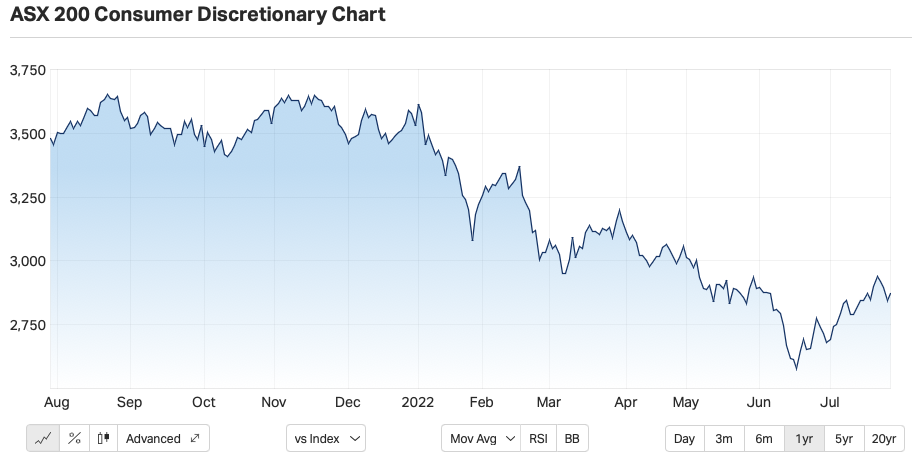

Consumer discretionary fears make way for bargains

Jack Collopy: One sector where we see pockets of good value currently is Consumer Discretionary. Many of the small and mid-cap listed retailers have been sold off aggressively in recent months on concerns that central banks are going to push economies into recession in their attempts to get the inflation genie back in the bottle.

Whilst we don’t have a crystal ball, in our view the market is pricing in a very negative scenario for many of the Retail stocks.

In general, they are coming into this tougher environment with very strong balance sheets and there are some valid reasons why the Australian consumer may be more resilient than expected.

One position we have added to recently is Nick Scali (ASX: NCK). NCK is extremely well run, has an excellent balance sheet and we think the recent Plush acquisition will prove to be a great use of capital.

Whilst there’s a chance that trading is volatile and challenging over the near term, we think a lot of this is already reflected in the share price and that NCK will continue to become a better business and reward shareholders over time.

.jpg)

NEVER MISS AN INSIGHT

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

1 stock mentioned

1 contributor mentioned