Two small caps powering the green revolution

Investors with patient capital play a crucial role in financing innovative companies and bringing their long-term vision to life. But projects need to line up multiple stakeholders to succeed, and it can take years for the stars to align between regulators, governments, investors and market sentiment. Once they do, however, the outcomes can be truly stellar.

Our investment philosophy is to identify small, growing businesses in which we co-invest, helping them achieve their goals, while aiming to deliver long-term returns to investors.

Two companies we have invested in illustrate the importance of long-term partnerships with emerging companies, and the impact that investors can have when they allocate capital to innovative ‘green’ projects.

Genex Power (ASX: GNX)

Genex is focused on renewable energy generation and storage. Its flagship project, the Kidston Clean Energy Hub, combines an operating 50 megawatts (MW) solar project, a 250MW pumped storage hydro project (in construction), and a 150MW wind project (in development). (1)

Using a decommissioned gold mine, Kidston is the first pumped hydro project in Australia for 40 years and unlocks the renewable generation potential of North Queensland. Genex has been on an important journey in recent years, securing funding from equity investors, the Northern Australia Infrastructure Facility, the Australian Renewable Energy Agency, the Clean Energy Finance Corporation, and green (sustainability-focused) bonds from major banks.(2)

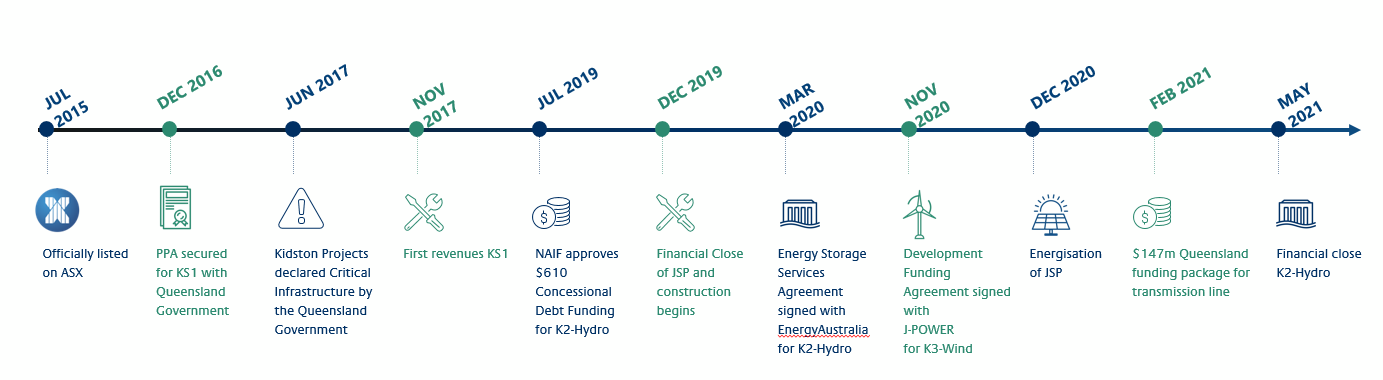

The process to secure these funding sources has not been a linear one. As a long-term investor, we’ve had to ‘keep the faith’ at various points in the Kidston project’s development. While this has been testing for both management and investors, the project reached final close in May 2021 and construction has commenced in April 2021 – rewarding our patience over the last few years.

Chart 1: Timeline of Genex milestones

.png)

Source: company presentation May 2021

With this greater certainty, the share price has become more stable and we believe the company has significant upside thanks to its diverse revenue streams, innovative technology and strong investor backing.

Ecograf (ASX: EGR)

EcoGraf is building a vertically integrated ‘HF-free’ battery anode material business, supporting the global transition to clean energy and e-mobility. The problem with the current lithium-ion battery production supply chain is that it’s 100% reliant on China, and the natural graphite required is energy-intensive to produce, and uses a toxic hydrofluoric (HF) acid to process it.

This is a concern for the Electric Vehicles (EV) industry, as there is a disconnect between the ‘clean, green’ goals of EV customers, and the processes required to power their vehicles. With analysts predicting growth of over 700% in demand for natural graphite by 2025 (source: BloombergNEF, June 2021), improving the environmental footprint of the industry is an urgent challenge.

EcoGraf has responded by creating a state-of-the-art processing facility in Western Australia to manufacture graphite products for export. It uses a superior, environmentally responsible, HF-free technology to produce high performance battery anode material. Not only does this remove the supply chain risks associated with processing graphite in China, it removes a toxic manufacturing process for an industry (EV production) that is seeking to improve environmental outcomes.

We have been invested in Ecograf since 2016, as we recognised the potential of this technology to disrupt the battery production market and solve a growing problem of relying on China for battery anode materials. As the largest shareholder, we were early believers in this technology - but it now sits at the intersection of major global trends, including:

- US President Biden’s plan to electrify the US Federal Government’s vehicle fleet and roll out 500,000 EV charging stations nationally.

- The EU Commission’s new regulations on batteries which mandate more environmentally responsible carbon footprints, sourcing, traceability and recycling.

- Unprecedented investment in new European battery capacity to meet the needs of up to 10 million electric vehicles being produced per year.

- Deteriorating trade relations between China, US and Australia, making both investment research and supply chain tracing difficult in that country. (3)

Ecograf is now in advanced planning stages for its processing plant in Kwinana, WA, after more than four years of intensive test work and process design. It has secured both Federal and State Government support for the construction of the plant.

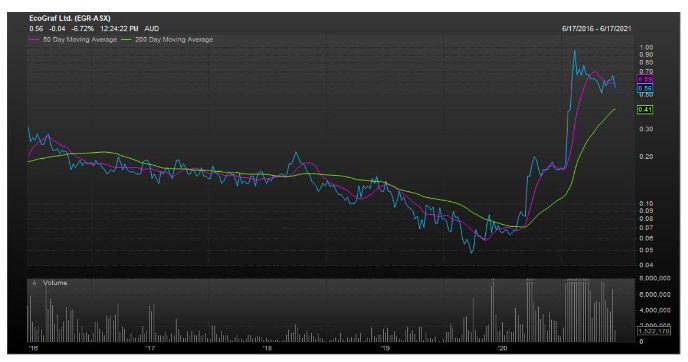

In the time we’ve been invested in Ecograf, the share price has been trading below our assessment of fair value. However, with market dynamics converging towards a boom in EVs and other battery-powered devices, investors have recognised the company’s significant potential. The share price has risen more than ten-fold since the beginning of 2020.

Chart 2: Ecograf share price

Source: Bloomberg June 2021

Being a small-cap investor sometimes means believing in a thesis while waiting for the market to catch up. In the case of Ecograf, we were always convinced of the importance of this technology and its role in the global battery industry. Now that the Kwinana project has been significantly de-risked, we are pleased to see positive market sentiment building around Ecograf and its investment performance reflecting this bright future.

Any stock mentioned does not constitute any offer or inducement to enter into any investment activity.

Never miss an update

In volatile times, diversification is more important than ever. Be the first to read our latest insights by clicking the follow button below.

3 topics

2 stocks mentioned