"Unbelievable!" KKR says M&A momentum is not just a stock market story

In a year where more than US$3.6 trillion of M&A deals were inked, equity markets have remained robust on the back of low rates and ample liquidity. But it’s not only stock investors who have benefited.

The strength of the private equity space underpins much of this activity. One of the world’s largest and most recognisable names in private equity, KKR, recently hosted a webinar discussing the sector, which has seen demand hit historic highs over the last 18 months. This demand has been a key “equalising” force in keeping spreads high while also helping sustain corporate bond issuance.

"Private Equity firms now have over $1 trillion of dry powder and we expect demand for sub-investment grade credit to continue to be strong as these firms look to deploy this capital over the next five years or so," said Jeremiah Lane, a partner of the KKR credit investing team.

“M&A volume has driven these unbelievable amounts of loans and high-yield bond issuance."

This has allowed the team to continue finding opportunities in their strike zone, to maintain the yield and continue delivering returns of around 7%.

The KKR Credit Income Fund (ASX: KKC) is a fixed income-focused listed investment trust that launched in 2019.

KKC’s strategy is to invest around 55% in traded credit through the global credit opportunities strategy (roughly 50% in the US, 5% in Europe), and 45% into European direct lending to provide diversification across geography and asset class.

European direct lending closed in September 2020 and deployment is estimated to take around three years as KKC invests in privately originated loans.

The fund is currently 19% invested in European direct lending, which is around 42% of the target allocation and Lane expects deployment will speed up as COVID uncertainty in the market continues to dissipate. The fund is already ahead of the target for its deployment into this area.

“Early in the pandemic, we were pivoting into investment grade. It was very low-risk but offered high return and was a great place to find attractive risk-return when the world was very uncertain,” Lane said.

“Fast-forward to later in 2020 and the opportunity set changed. Higher-quality assets recovered very quickly while triple-C assets recovered very slowly. We were big participants in the lower-quality end of the spectrum as we were harvesting some of the opportunities the market was giving us.”

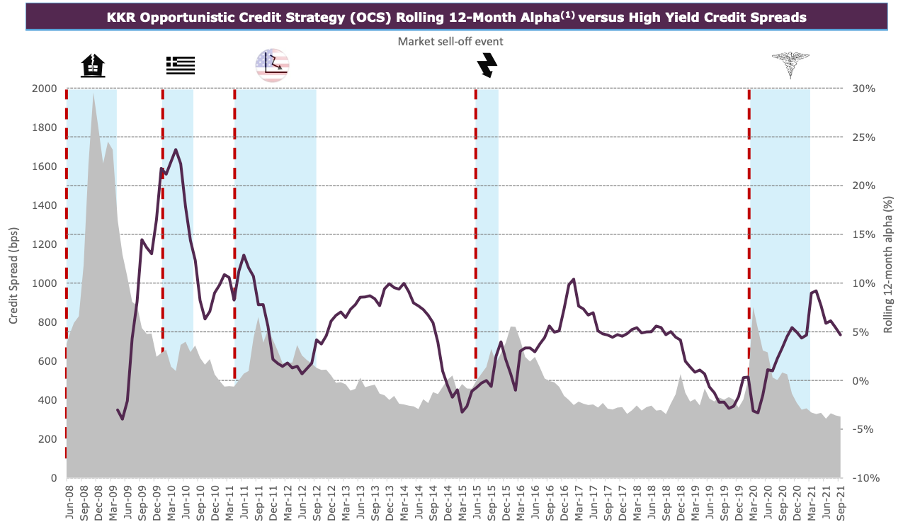

The above characteristics are core to the “opportunistic credit strategy” pursued by KKR, which rotates among asset classes as the goalposts shift over time.

Source: KKR

Opportunistic credit has historically outperformed after periods of volatility

As Lane explained, there’s a common view in the market that the “easy money has been made” – that the returns possible in the midst of peak pandemic disruption are now gone.

“But in these calmer markets, we’ve had tremendous success outperforming our benchmark as we focus on the durability of cash flow, downside protection and looking across a huge universe of opportunities and distilling them down to those where the risk-reward is skewed in our favour,” he said.

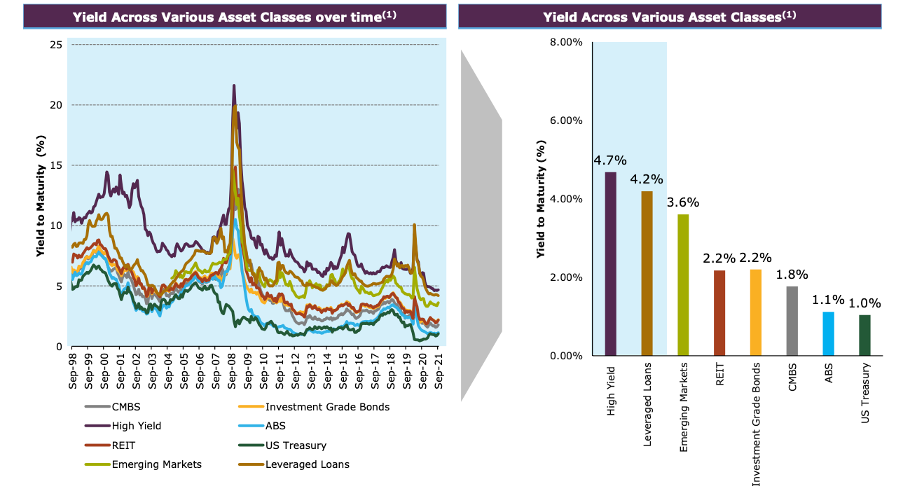

Credit still looks attractive versus other asset classes

Source: Bloomberg, S&P and ICE Indices as of 30 September 2021.

Lane and his team are currently re-targeting the portfolio toward European direct lending, where all KKR’s loans are floating rate. This will serve to reduce its duration – in other words, reducing the portfolio’s sensitivity to official interest rates.

“This positions us that much better for when the day finally arrives and the Fed starts raising rates. We’ll be participating in that increase in income, instead of seeing asset price degradation as a result of sensitivity to the rate cycle,” he said.

What is KKC?

An Australian managed investment scheme, the KKR Credit Income Fund (ASX: KKC) is a listed investment trust on the ASX. It is managed by KKR Australia Investment management – an affiliate of global alternative asset manager and private equity firm, Kohlberg Kravis Roberts & Co (KKR).

KKC’s “opportunistic credit” approach gives the LIT exposure to an opportunity set of between 700 and 800 debt securities globally. With more than 160 investment professionals in the KKR Credit Investment Team, these opportunities are refined to what Lane described as a “concentrated sub-portfolio of our highest conviction names in which we can aggressively invest.”

“Typically, only 10 names out of those are going to comprise between 20% and 35% of our KKC portfolio. And around 20 names make up about 45% of the traded credit side,” he said.

Lane believes this highly concentrated approach underpins its ability to deliver higher total yields than would be available from a more index-oriented portfolio.

“Our sourcing network, relationships with sponsors, and our knowledge of the companies means we can find new opportunities to deploy money at these yields, even with the overall market having re-rated to lower yields,” he said.

“Often, this means financing a new transaction for a PE sponsor, where we can bring our diligence capability to validate the credit quality and provide more leverage than a competitor.”

This depth of experience enables it to partner with companies that others in the space might have difficulty understanding. “That’s what we’ve been doing since we started this strategy in 2008 and we’ve had success doing this across all different market environments,” said Lane.

KKC currently has a duration of 1.5 years and 64% of the portfolio is floating rate. Because the vast majority of European non-bank loans are floating rate, Lane and his team expect that as deployment increases, so will its overall exposure to floating-rate assets.

"For the traded credit portion of the portfolio, we can dynamically move between loans and bonds - both floating and fixed. As long as inflation numbers remain high in our target markets, we expect that a larger proportion of the portfolio will be floating rate," said Lane.

Learn more about investing in private credit

For further insights from one of the world's most recognisable names in private equity and alternative investments, visit the KKC Australia website. And if you would like to find out how to invest in the KKC listed investment trust (ASX:KKC), contact the local KKR team at this link or call them on 1300 737 760.

1 topic

1 stock mentioned