Unlocking a $74 billion boom: Australia's thriving private commercial real estate debt market

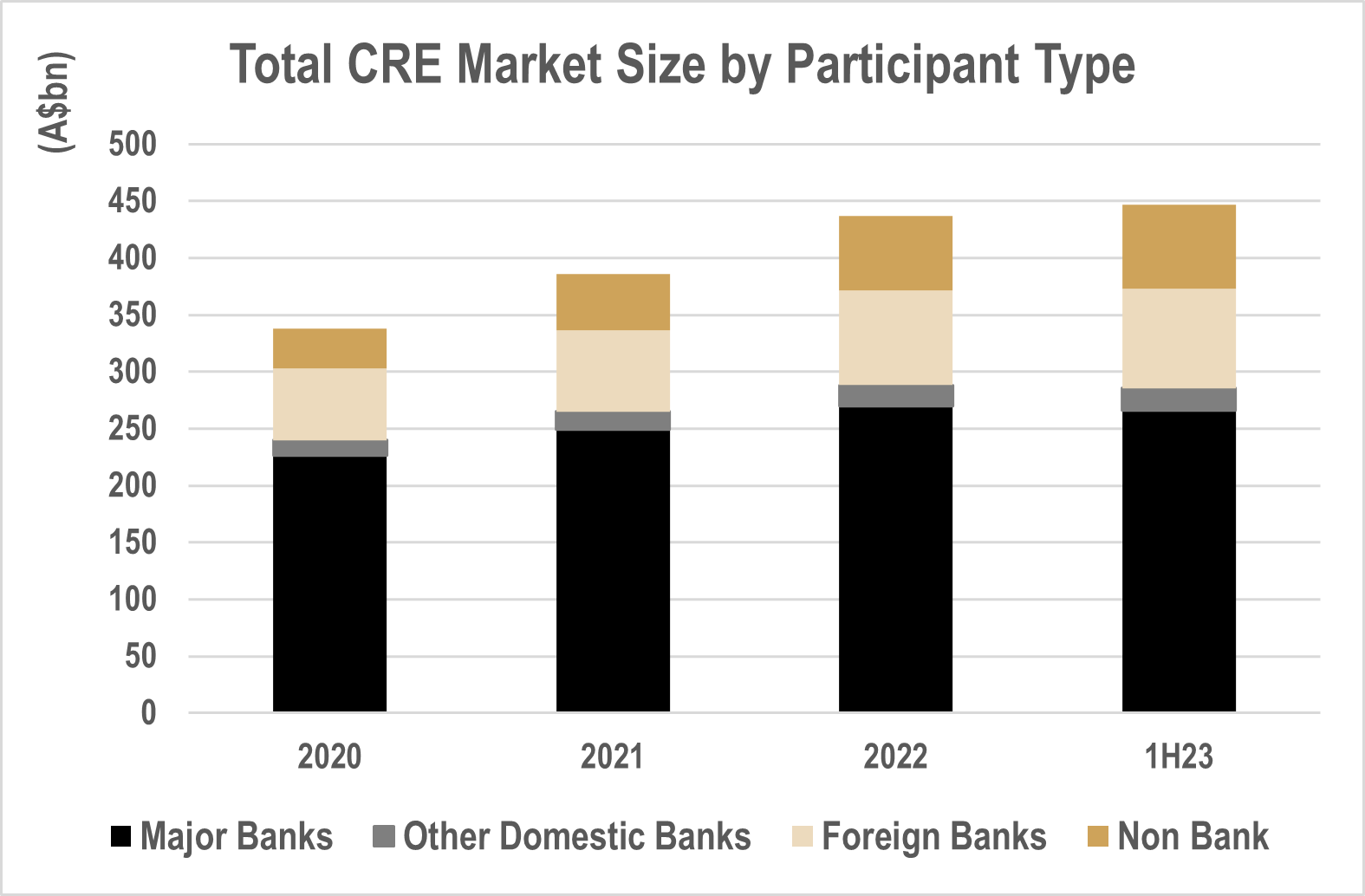

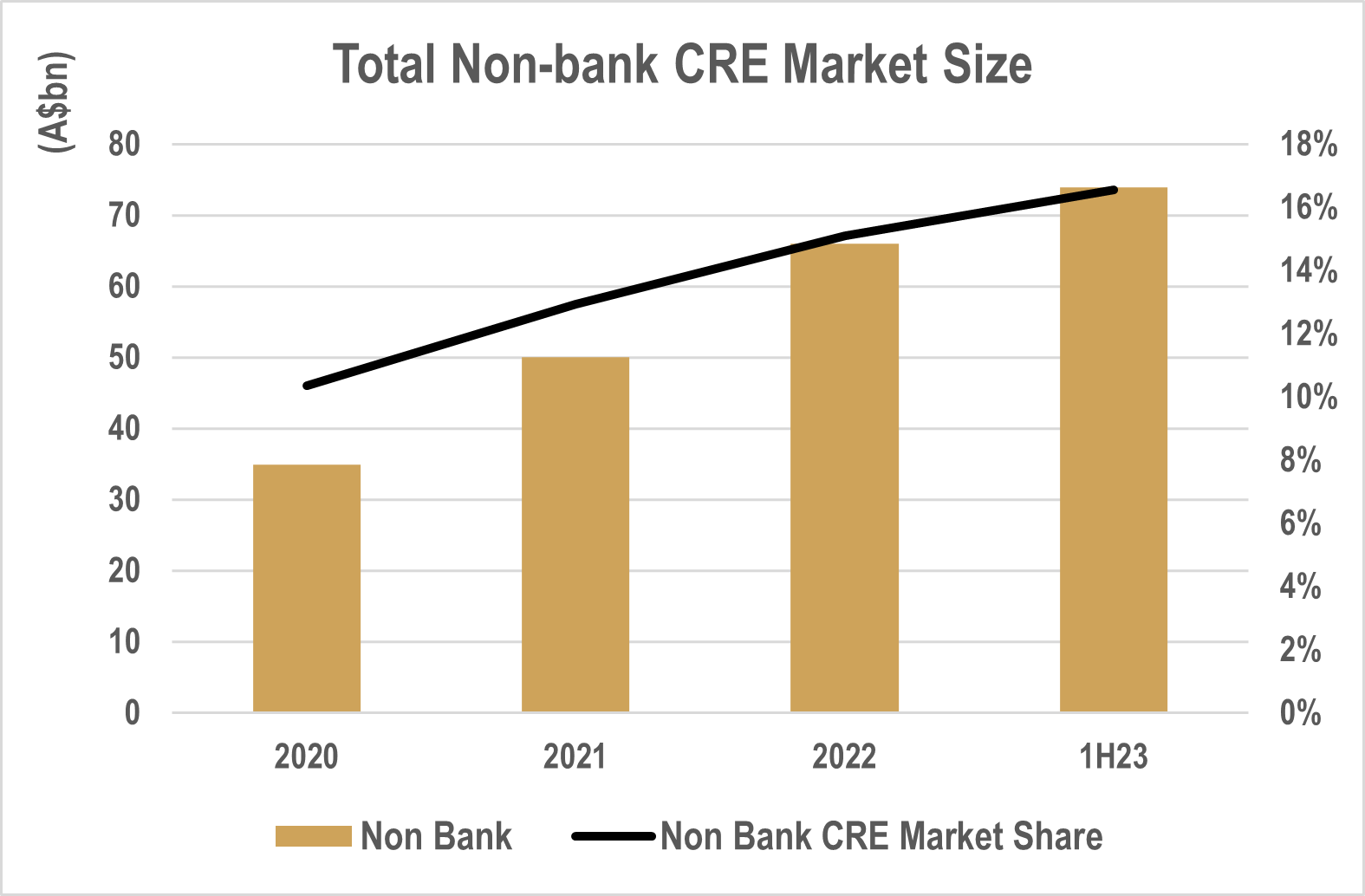

The Australian Commercial Real Estate Debt (ACRED) sector has undergone a remarkable transformation in recent years, witnessing a robust 7.9% Compound Annual Growth Rate (CAGR) since 2013. As of June 2023, the market has burgeoned to an impressive $447 billion, with $373 billion attributed to traditional lenders (Bank’s) and a substantial $74 billion to non-bank lenders. This surge in non-bank lending has reshaped the landscape, marking a notable shift away from the historical dominance of major banks towards the growing non-bank ACRED segment, which now commands a 16% market share, up from 10.4% in 2020.

.png)

Source: Foresight Analytics, APRA

Over the last decade, major banks have seen their market share erode from 86% in 2013 to 73% in March 2023, emphasising a significant change in the financing dynamics of the sector with foreign banks and other domestic banks taking market share. The retreat of traditional financiers, driven in part by Basel III reforms and heightened risk aversion partly imposed by APRA, has paved the way for alternative lenders to fill the void. The non-bank ACRED lenders, primarily funded by high-net-worth, family office and institutional investors, have demonstrated a remarkable 35% CAGR since 2020, positioning them as key players in the ACRED space.

.png)

Source: Foresight Analytics. ARES

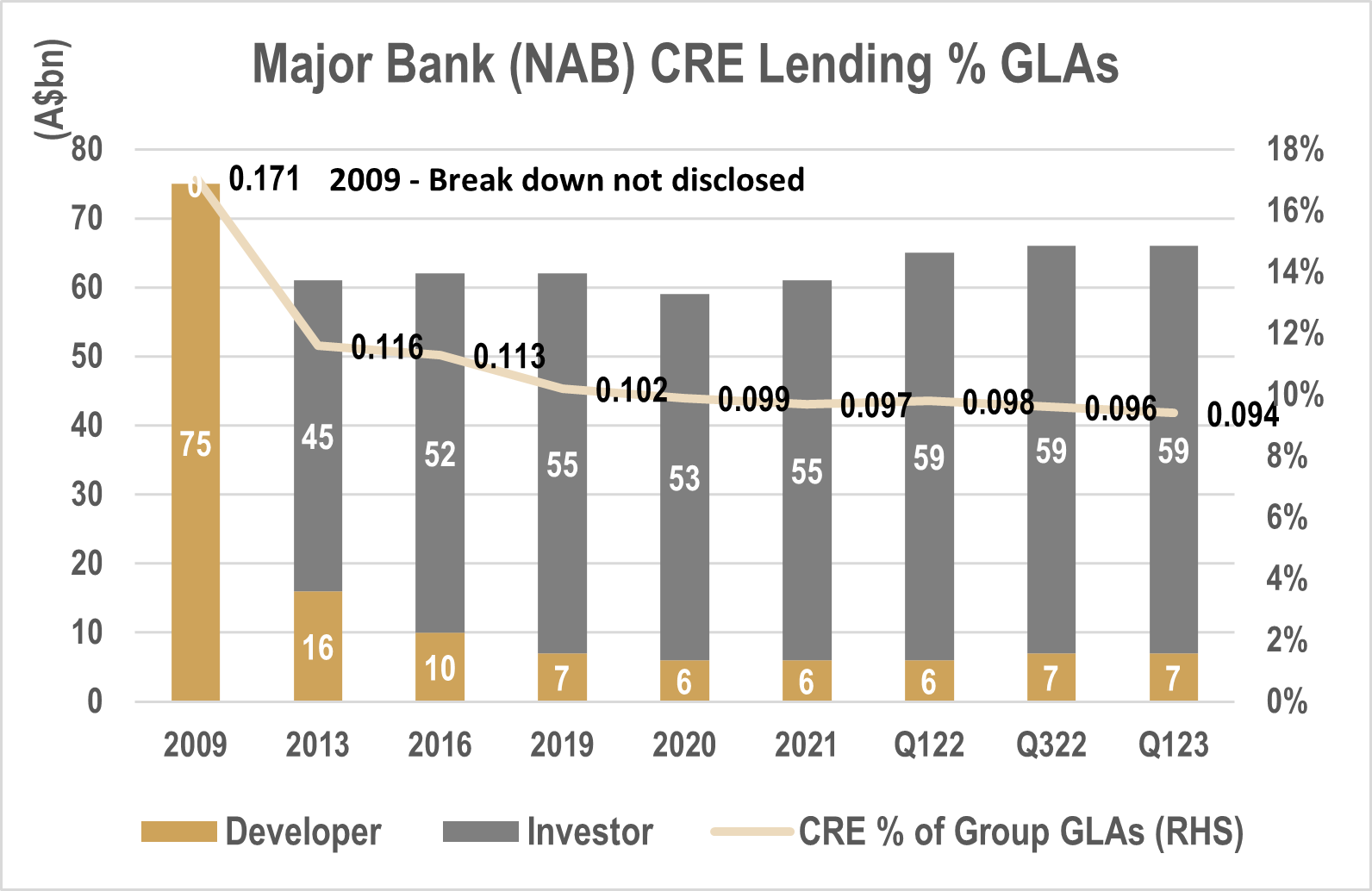

The ACRED markets have experienced significant opportunities due to the Major Banks' decreased involvement in development funding. As shown the below chart, NAB's developer financing in their CRE book declined from 16% in 2013 to a 7% in 2023. Additionally, the proportion of Commercial Real Estate (CRE) lending relative to Gross Loans and Advances (GLA) has dropped from 17.1% to 9.4% in 2023. This shift underscores the Major Banks', in this case NAB’s, emphasis on residential home lending.

Source: Foresight Analytics Research Insights on ACRED, November 2023

Decoding the growth of the non-bank ACRED market

The remarkable growth in the non-bank ACRED space can be attributed to a number of key factors.

One significant driver is the growing awareness of and its appeal to High Net Worth (HNW) investors, particularly the baby boomer demographic. Australia’s aging population is more and more in search of higher income with less risk. We see that ACRED's track record in downside protection via its mortgage backed collateral, positions it as an ideal asset class for investors at or near retirement age. Offering monthly or quarterly income with limited downside risk, ACRED mitigates sequencing risk for retirees who may need periodic capital drawdowns. With the 65+ age cohort in Australia projected to grow by 42% between 2023 and 2040, ACRED aligns well with the evolving investor demographics. HNW investors have only recently been able to access non-bank ACRED as this has largely been the domain of large family offices.

While the 'search for yield' dynamic continues, non-bank ACRED lending yields remain highly attractive, outperforming other asset classes on a risk adjusted basis. We believe that non-bank ACRED has emerged as a true portfolio diversifier, lowering overall portfolio risk while enhancing returns. Non-bank ACRED, demonstrates a low or negative correlation with major asset classes, making it a stabilising force during crises and economic uncertainty. The resilience exhibited during the COVID-19 environment positions ACRED as a strategic allocation for investors focusing on capital preservation with stable, defensive, and asset-backed income.

The liquidity profile of non-bank ACRED managed funds, with redemptions offered typically quarterly, half yearly or yearly for pooled funds and longer for single asset direct offers, contrasts with the limited liquidity/exit options in U.S. or European direct lending markets largely held by institutional investors. Non-bank ACRED's relatively short weighted average loan expiry (WALE) adds to its appeal. The funding landscape for ACRED managers has expanded beyond traditional sources, with superannuation funds, institutional investors, including major foreign banks and overseas institutions, contributing to the sector's growth. With the emergence of the asset class in recent years, the influx of institutional investors, offering warehouse facilities and acquiring equity stakes in local businesses, reflects the global recognition of the scarcity premium present in the Australian non-bank ACRED space.

The ACRED segment's increasing popularity can also be attributed to its proven track record. Foresight Analytics, in a recently commissioned report on the ACRED market, reports a notable absence of material arrears, defaults, or loss-given-defaults (LGDs) in private debt strategies, highlighting the sector's robust risk management.

Additionally, the scarcity premium in the Australian ACRED market offers a premium over other developed markets like Europe and North America which further contributes to its allure. The lower competition for ACRED investment managers sustains this scarcity premium, indicating its persistence in the foreseeable future.

Forward growth projections for Australian commercial real estate private debt

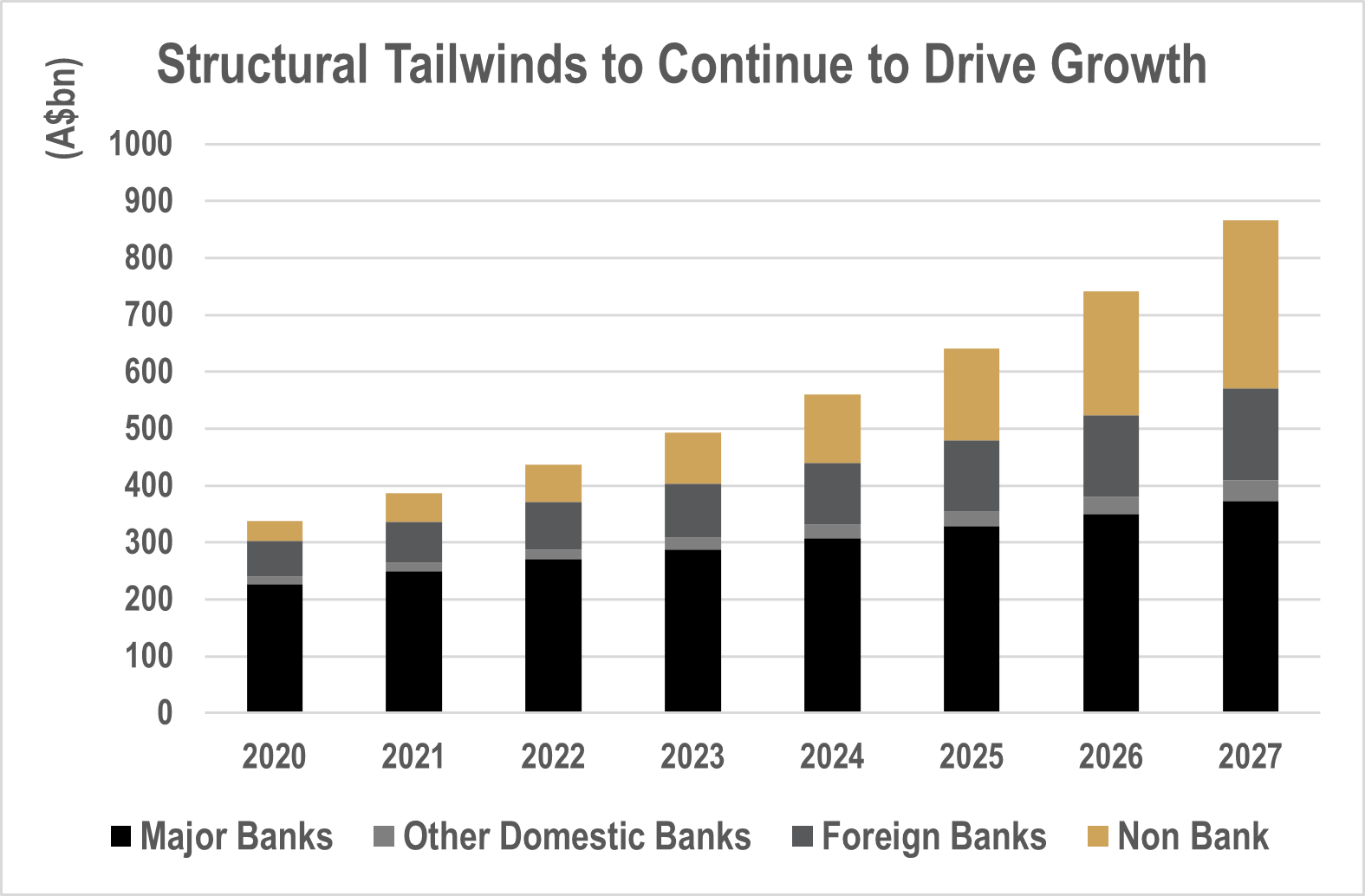

Forecasting the trajectory of non-bank ACRED involves navigating uncertainties, prompting the adoption of a scenario-based approach for future growth guidance. This method relies on two key pillars: the total growth of the ACRED market and the market share changes within the non-bank private lender segment.

The base case scenario for ACRED market trajectory envisions a 7.0-8.0% CAGR for the total sector over the medium term (five years). This conservative estimate contrasts with the system level CAGR of 12% over the last three years, emphasising a cautious outlook. Additionally, the assumption includes an annual total market share growth rate of 1.0-1.25% for the non-bank lender segment, again conservative, compared to the 5% plus market share gain recorded over the previous three years.

The below ACRED forecast scenario analysis combines the CAGR for total market growth and the annual market share gain non-bank ACRED lenders. The matrix illustrates various total ACRED market annual growth rates (6% to 9%) and the corresponding total market size in five years. Simultaneously, it outlines different annual market share gain assumptions for non-bank ACRED lenders and the resulting total market share by March 2028.

This base case scenario envisions a market size ranging from $138.3 billion (1.9X) to $146.3 billion (2X) in 2028, presenting a substantial $70 billion plus opportunity for non-bank lenders. This base case aligns with an estimated total ACRED market of $642 billion by 2028.

In their analysis, Foresight Analytics highlights a significant opportunity for growth-oriented non-bank lenders with the scale and capacity to capitalise on the unfolding market dynamics. As anticipated, growth will not be uniform across the sector, with mid-sized lenders, managing sub $2 billion lending books, standing out as the prime candidates to double their growth over the next five years.

The below charts illustrate the sizing of the market and sub-segment lender exposures, assuming the most recent historical CAGRs persist over the next 5-year period. The optimistic projections hint at a potential fourfold growth in the non-bank ACRED market size, reaching $295 billion This scenario is compared with the conservative view of $70 billion in the base case scenario. This emphasises the transformative potential for non-bank lenders, positioning them as key players in the evolving landscape of ACRED.

Source: Foresight Analytics Research Insights on ACRED, November 2023

The Australian Commercial Real Estate Private Debt sector is undergoing a transformative journey, driven by shifting market dynamics, regulatory reforms, and the rise of non-bank lenders. The growth trends, trajectory, and future projections indicate a fundamental reshaping of the industry, with private lenders poised to play a more significant role. As the sector continues to navigate constant economic uncertainties, maintaining a focus on downside protection, transparency, and asset quality will be instrumental in securing continued trust and therefore investment from investors. The ACRED sector's evolution is a testament to its adaptability and resilience, offering a promising landscape for investors and lenders alike in the years to come.