Uranium supply approaches a tipping point

Uranium has gone through a bout of volatility over the past few months, notably selling off from the decade highs it had hit earlier this year on bullish supply and demand narratives. Supply disruptions and slower-than-expected production resumptions played a large role in the initial rally. As such, with Kazatomprom (‘KAP’) announcing a surprise production upgrade in 2024 and reducing near-term projected deficits, spot uranium markets promptly experienced a correction. However, this price consolidation may not be a reflection of shifting sentiment, but rather a healthy breather amid constantly improving market fundamentals.

Key takeaways

- Uranium markets have historically relied on secondary supply stockpiled from the Cold War era of excessive uranium production.

- Utility firms have shown decade high commitment to long-term contracts, indicating increasing demand and concerns about supply shortage.

- Kazakhstan’s surprise mineral extraction tax change is an overall positive development which could delay uranium asset development and incentivise price over volume.

Uranium Supply: The Current Landscape

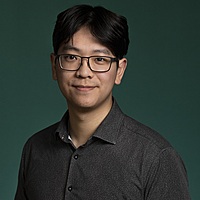

Uranium primary production (mining) has been consistently below global nuclear reactor demand since 1991. In 2024, production is expected to match only 89% of global reactor needs – once again missing market demand. This disparity between mined supply and fuel demand has been allowed to exist thanks to an overwhelming amount of secondary supply carried on from a production boom during the Cold War, as well as a short period of excess production post-Fukushima. Global dependence on secondary supply was most obvious throughout 1991 to 2013, where decommissioned weapons and tactical stockpiles supported as much as 50% of global demand.(1) Over the past decade, utilities have continued to rely on secondary supply, albeit mostly in the form of commercial inventories as ex-weapons resources have slowly run dry. However, this plentiful supply environment may be changing.

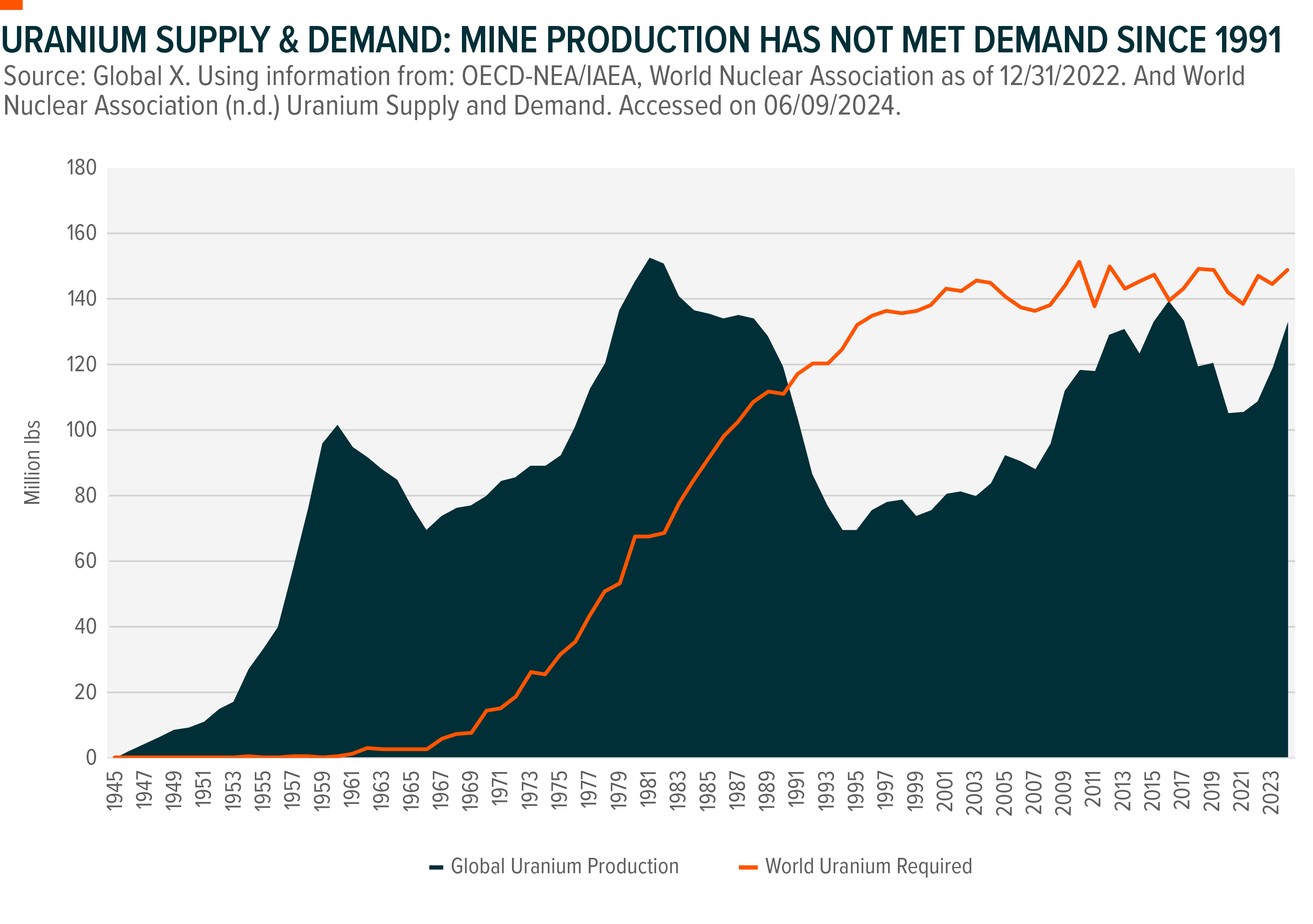

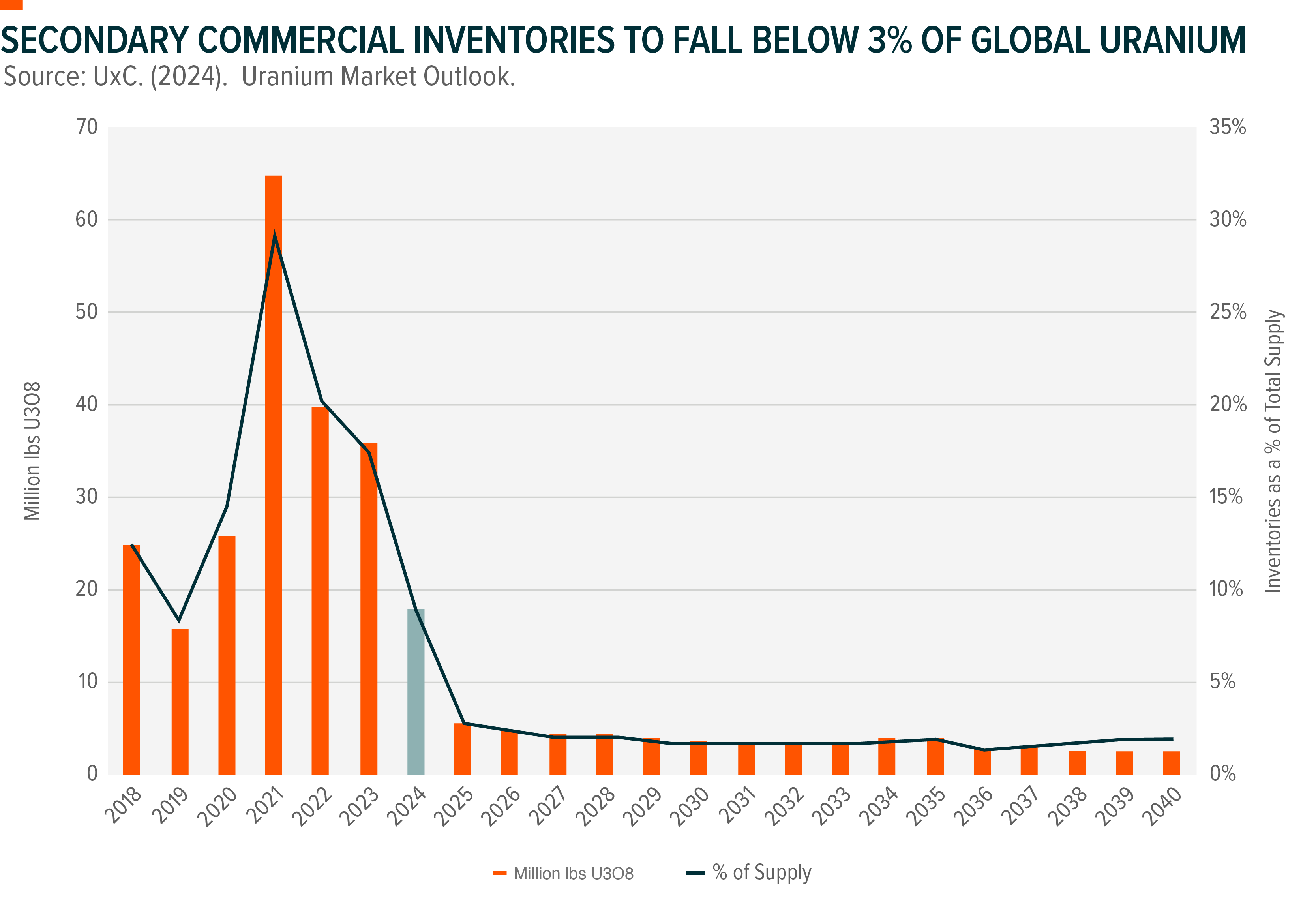

According to analysis by UxC, a leading uranium research firm, commercial supplies of uranium fuel peaked in 2021 (on underutilisation during global lockdowns) at 65 million pounds (~30% of global supply) and has since declined to just 17.5 million pounds in 2024 (~9% of global supply). Forecasts also suggests 2024 will be the last year in which nuclear operators will have access to meaningful reserves. Commercial inventories are set to fall below 7 million pounds or 3% of global supply and stay that low for the foreseeable future. With production slated to stay below global reactor requirements from now to 2030 and beyond, uranium markets may soon be entering a new era of scarcity.

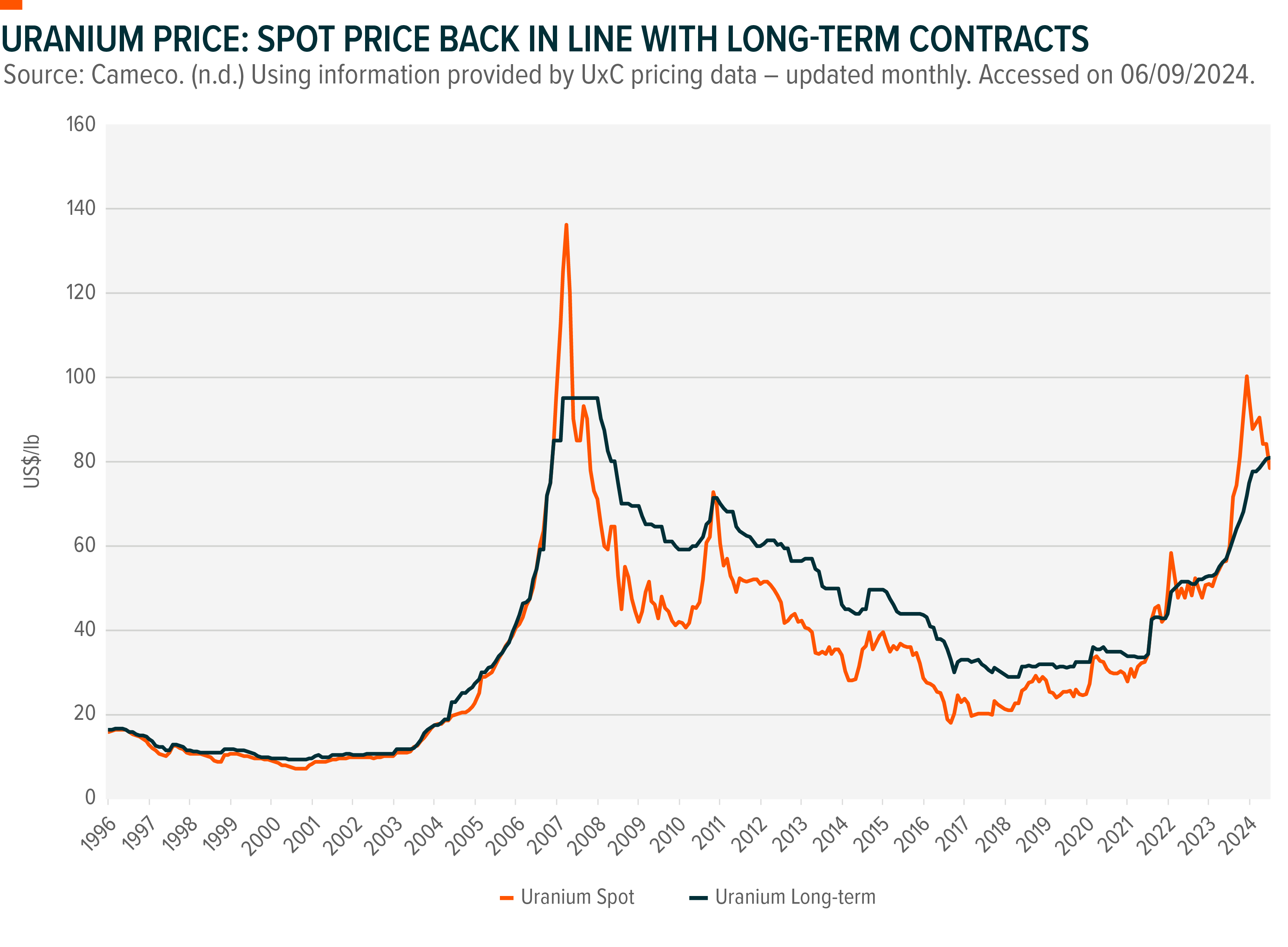

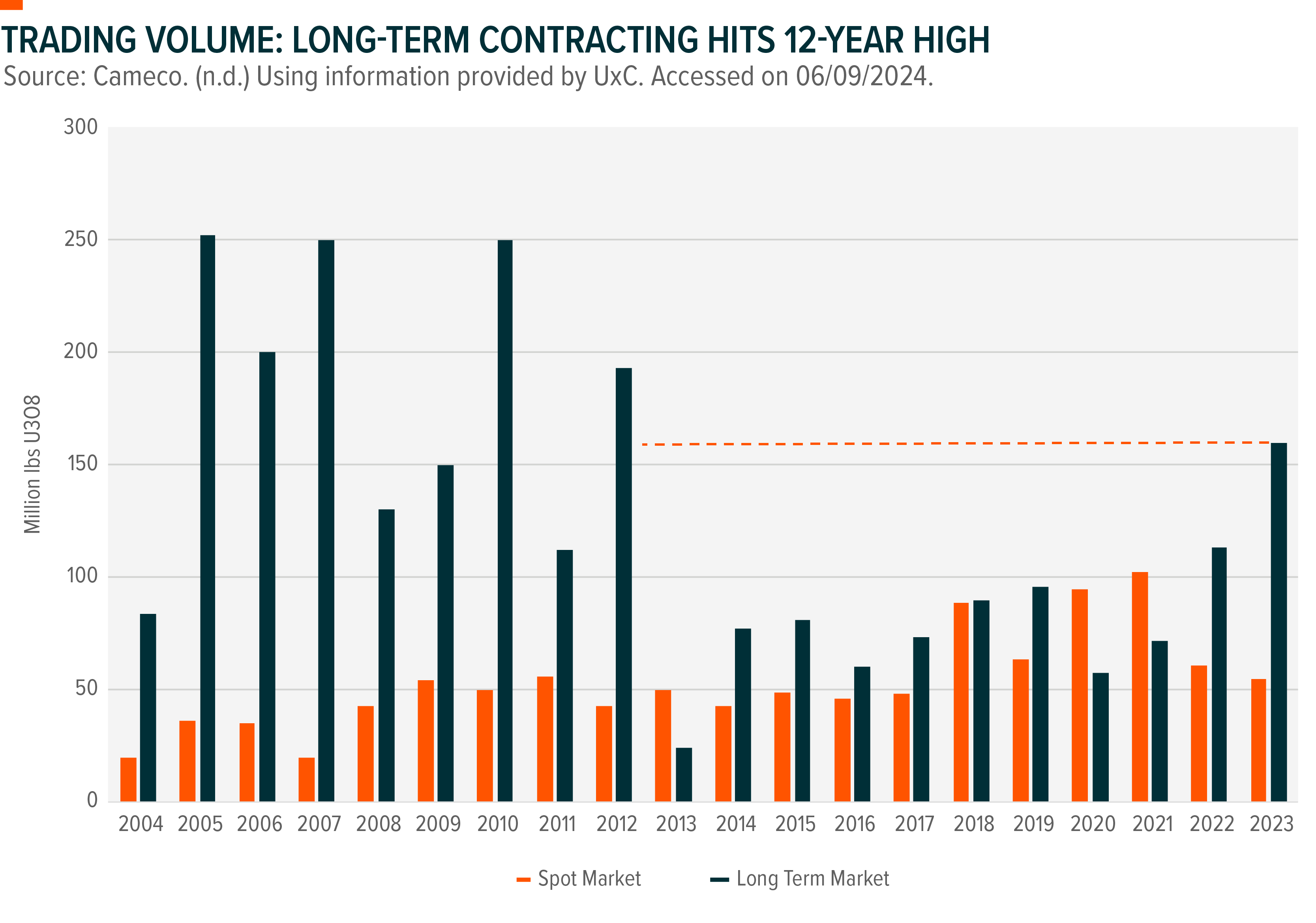

Long-term uranium contracts are agreements between uranium producers (mining companies) and buyers (typically utilities companies) to supply uranium in a certain price range over an extended period, usually ranging from 3-10 years. They are by far the most common way uranium is traded today (75-80% of uranium volume is traded in long-term contracts). And analysing these current long-term uranium contracts suggests that utility firms are aware that a supply crunch may be on the horizon.

As of August, long-term prices hit US$81/lb, the highest mark in 16-years. Furthermore, market participants are locking in contracts with ceilings of as high as US$130/lb and price floors of US$70/lb – rates which Cameco, the world’s most valuable uranium miner, says are the best they’ve seen in a decade.(2) Uranium contracting volume also approached 160 million pounds in 2023, once again, the highest in a decade. Evidently, uranium users are showing increased commitment to securing consistent supply despite elevated prices, likely as protection against an impending shortage.

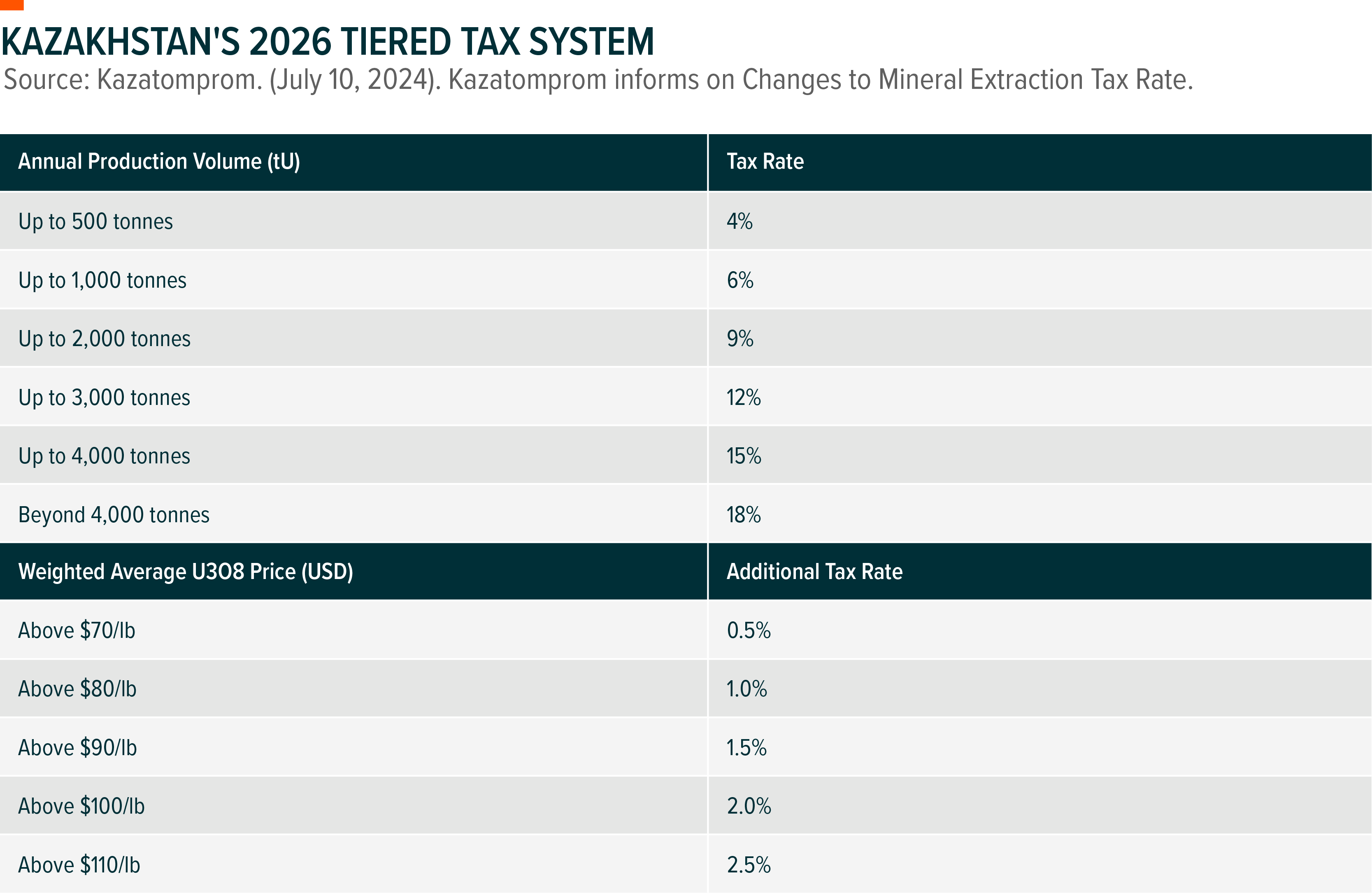

Kazakhstan’s surprise tax change

Kazakhstan, the world’s most prolific producer of uranium, announced sweeping changes to the Mineral Extraction Tax (MET) for uranium miners in July. METs differ from traditional tax regimes – miners are taxed based on the volume of minerals extracted and taxed regardless of sale. As such the new changes to the MET, which have a significant impact on producers, were a shock to the market. The current flat MET rate of 6% had only been introduced for a year, yet as of 2025, a new, higher MET of 9% will be enforced. Furthermore, starting 2026 the government will look to introduce a tiered tax system based on both production volume and the price of uranium fuel. Under the new tiered regime, miners producing more than 4,000 tonnes or 8.8 million pounds of uranium will face tax rates of up to 20.5%.

The importance of these changes should not be overlooked. Kazakhstani production accounted for roughly 37% of global supply in 2023, and an impactful increase in cost could disrupt the global uranium ecosystem.(3) As of August, Kazakhstan’s KAP is projected to produce 22.5-23.5 tonnes of uranium in 2024 and 25-26.5 tonnes in 2025, far above the highest tax threshold laid out in the new tax system. An increased ongoing mining cost will meaningfully increase the uranium price required to incentivise development of uranium assets and increase production. Instead, KAP may look to adopt an OPEC-style “quality-over-quantity” strategy which seeks to prioritise price instead of volume of production.

KAP’s new approach could yield positive effects for the market such as the setting of a price floor and reduced market volatility. However, in the context of an ongoing primary supply deficit and increasing global adoption, Kazakhstan’s new tax changes represent yet another challenge for a necessary ramp up in supply. On the 23rd of August, KAP cut its output guidance for 2025 by more than 20% citing shortage of sulfuric acid – an important element in uranium extraction. The announcement alone was enough to send rival miner Cameco’s stock up 6.8% on the day, a sign that markets are highly sensitive to short-term supply changes. However, investors may still be under-pricing the long-term supply picture, and the possibility that KAP, the world’s largest uranium miner, does not look to resume full-capacity production post the implementation of new tax rates.

Conclusion: Uranium still has room to run

Global uranium mine supply in 2024 is forecasted to reach 156 million pounds, well short of the 176 million pounds required by nuclear reactors. That gap, for now, will be resolved through use of secondary supplies. Looking forward, the World Nuclear Association expects increasing energy consumption and decarbonisation could drive uranium demand to almost 300 million pounds in 2040.(4) This would require a near doubling of current mine supply, but investment and supply response has thus far been lacking. With spot uranium back in-line with long-term contract pricing, we view the current market pricing as reasonable and a potentially attractive entry-point for investors with conviction in the proliferation nuclear power.

The Global X Uranium ETF (ASX: ATOM) invests in a broad range of companies involved in uranium mining and the production of nuclear components, including those in extraction, refining, exploration, or manufacturing of equipment for the uranium and nuclear industries.

1 stock mentioned

1 fund mentioned