US CPI y/y spikes to 3.7%, ECB raises rates to the highest level since 2001

Let’s hop straight into five of the biggest developments this week.

1. US CPI y/y spikes to 3.7%

The annual inflation in the twelve months leading to August rose faster than expected in the US. From the previous 3.2% reading, inflation rose by 3.7% to beat the market consensus of 3.6%. The concern that price elevation has picked up pace again, had shifted focus to next week’s interest rate decision with increased odds of hawkish communication.

2. UK GDP contracted by -0.5% in July

Economic activity in the UK receded faster than expected in July, contracting by -0.5% from a -0.5% growth rate in June. This was a far sharper contraction than the -0.2% anticipated by markets. With one of the highest inflation rates in the world, despite high-interest rates, fears of recession are becoming widespread with little room for maneuver.

3. Australia’s unemployment rate held steady at 3.7%

The Australian labour market demonstrated relative dynamism in the face of relentless monetary policy tightening as they maintained a 3.7% unemployment rate in August, in line with market forecasts. The implication is that the economy has so far resiliently absorbed the shocks from the RBA’s rate hikes. This gives greater leverage for central bank to tighten further in addressing the current price elevation or take a sustained wait and see approach.

4. ECB hikes interest rates to the highest level since 2001

The ECB escalated its counter-inflation measures with yet another interest rate hike which brought the main refinancing rate to 4.5%. The decision caught markets by surprise, having anticipated the first pause since June 2022. Rates are now at the highest level since 2001. The rationale was that despite deflationary trends in recent months, inflation would stay higher for longer, forcing the action now rather than later.

5. US retail sales rose 0.6% in August

US consumers remained unrestrained as autumn spending picked up steam for the month of August. Retail sales rose 0.6% from the previous downwardly revised figure of 0.5%, decisively beating markets that expected a mild rise of 0.1%. This implies that the US economy is stronger than expected and the consumer remains undaunted, which raises the prospect of interest rates staying higher for longer in the US.

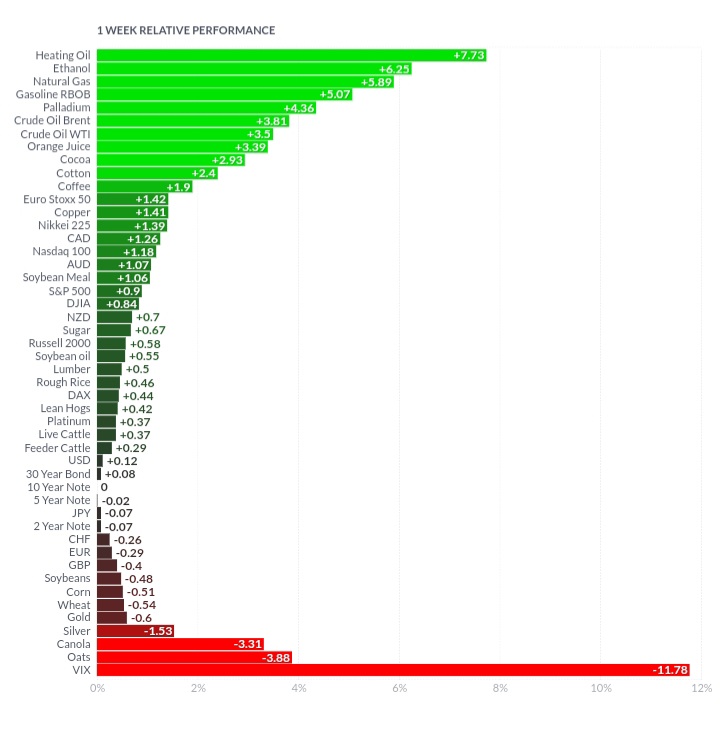

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Heating oil, ethanol, natural gas, brent, crude, cotton, coffee and cocoa were up on seasonality as the autumn cold takes hold. Orange juice rallied on supply shortfalls on off season weather conditions. The VIX tumbled as investors take on risk, in anticipation that the monetary tightening is peaking just when Chinese demand is rebounding. The risk on environment depressed treasuries, gold and silver as investors seek riskier investments.

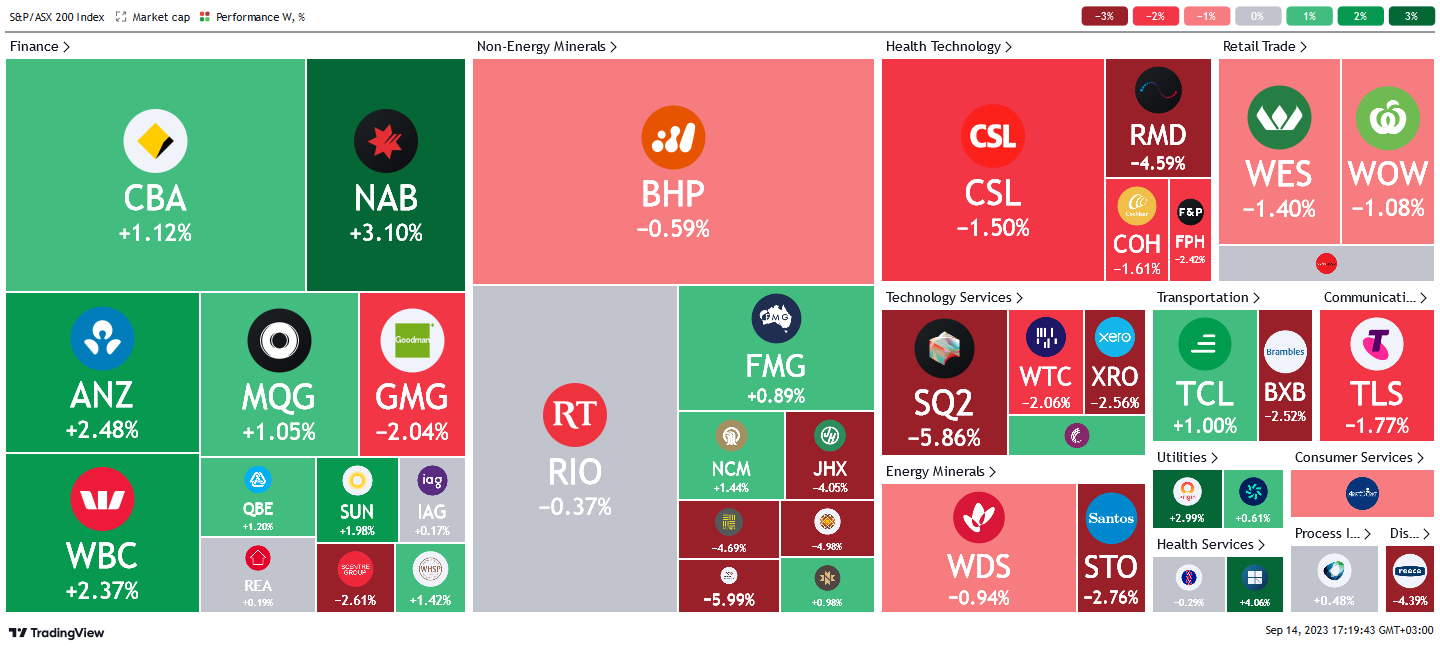

Here is the week's heatmap for the largest companies in the ASX.

The ASX is once again a mixed bag, after last week’s sell off. Financials did most of the weightlifting to prop the index, after the RBA sat on its hands yet again. NAB and ANZ were the biggest gainers, Scentre Group and GMG being the two largest underperformers in the financial sector. Miners were mixed as BHP & RIO chopped sideways. FMG rebounded after a few horrendous weeks. Healthcare and tech were poor, tech struggled on valuations.

Below shows our proprietary trend following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics