US equities are broadening and grinding higher

The narrowness of the equity rally to date remains a concern for investors. While the Magnificent 7 may not enjoy the same outperformance as earlier this year, solid earnings growth should assure continued equity gains. With the strong economic backdrop promoting a broadening of returns in the second half of 2024, investors can look to companies, sectors, and markets with meaningfully less stretched valuations to continue to fuel the equity market rally.

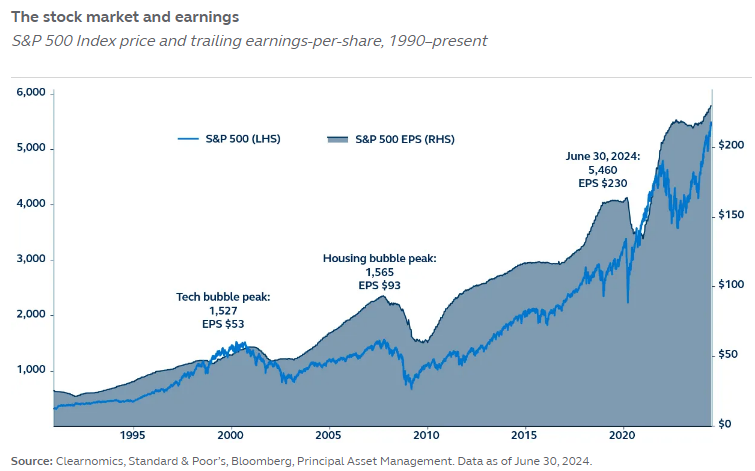

Prospects for significant interest rate cuts were an important driver of the market rally in the first half of 2024. Yet that same economic strength that has delayed Fed cuts should support a positive backdrop for corporate earnings, ensuring that the setup for equities remains constructive, even if gains are not as strong as earlier in the year.

Historically, long Fed pauses have been positive for stocks. In fact, the 1995–1996 Fed pause was against a similar backdrop to the present day, with strong economic growth giving the Fed little reason to lower rates. During that period, the Fed kept policy rates on hold, the S&P 500 rose 19.2%.

The narrowness of market gains remains a concern, with the equity rally seemingly hostage to the performance of Magnificent 7 technology stocks. Yet, the AI craze and delivery of strong earnings means that investors are still willing to pay higher multiples for those companies. Stretched valuations and very concentrated positioning may imply the Magnificent 7 only grind higher from here, but the secular trend upwards should persist over the long run. Furthermore, solid economic growth should support a broadening out of risk appetite and earnings growth across a variety of other companies, sectors, and markets which are meaningfully less stretched and, therefore, offer the potential for strong returns.