US Federal Reserve held rates at 5.5%, Canadian median CPI y/y rose 4.1%

What a choppy week for global financial markets. Our focus continued to be on intraday ASX cash market performance, reach out if you'd like to hear about more of the specifics.

Let’s hop straight into five of the biggest developments this week.

1. China maintained 1y loan prime rate at 3.45%

The PBC left its short-term lending rates unchanged at 3.45%, in line with market expectations. The decision was intended to both stimulate internal demand as well as prop up the lackluster Yuan as the central bank strives for a soft landing in a weakening global environment. A fine balance is needed to ensure stimulus doesn’t devalue the yuan and drive inflation higher while boosting domestic demand.

2. Canadian median CPI y/y rose 4.1%

Inflation in Canada rose much faster than anticipated with annual inflation rising 4.1% in the year to August. This marked a significant jump from the previous upwardly revised report of 3.9%, which caught market participants who expected a minor easing of 3.7%. Petroleum price and mortgage interest stood out as main driving factors to this increase.

3. Bank of England left interest rates unchanged at 5.25%

The BOE sat on its hands to maintain interest rates at 5.25% in a move that saw the central bank hold for the first time after 14 consecutive hikes. Markets had bet on a 25-basis point raise with price elevation still a major concern. This was widely seen as damage control as weak data began to emerge in recent months, a sign that relentless tightening is beginning to filter through to growth.

4. US Federal Reserve held rates at 5.5%

The FED left interest rates unchanged for the second consecutive meeting. It held its lending rate at 5.5%, which was in line with market forecasts. With inflation targets a long way off, the FED is mulling leaving rates high for longer or tightening further. Market participants now expect one further rate rise in 2023, while one rate cut is forecasted for 2024.

5. Swiss National Bank held interest rates steady at 1.75%

The SNB left interest rates unchanged for the first time since June 2022, as rates were held at 1.75%. The stay caught markets by surprise, as expectations were for a further 25bps increase to 2%. The SNB is taking its time to monitor the short-term effect of its current policy rate, as markets expect further rate increases in the short term.

Below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Mean reversion in the commodities market was the overall theme this week as prices fell across board. Conditions have been wildly choppy around key short and long-term moving averages recently. The VIX rebounded as US equities sold off, the Nasdaq, S&P500 and Russell 2000 were down -3.35%, -3.01% and -3.85% for the week. The risk-off scenario provided a boost to silver, the US Dollar Index finished up while Gold ended the week flat. All in all a very ugly choppy week across the board.

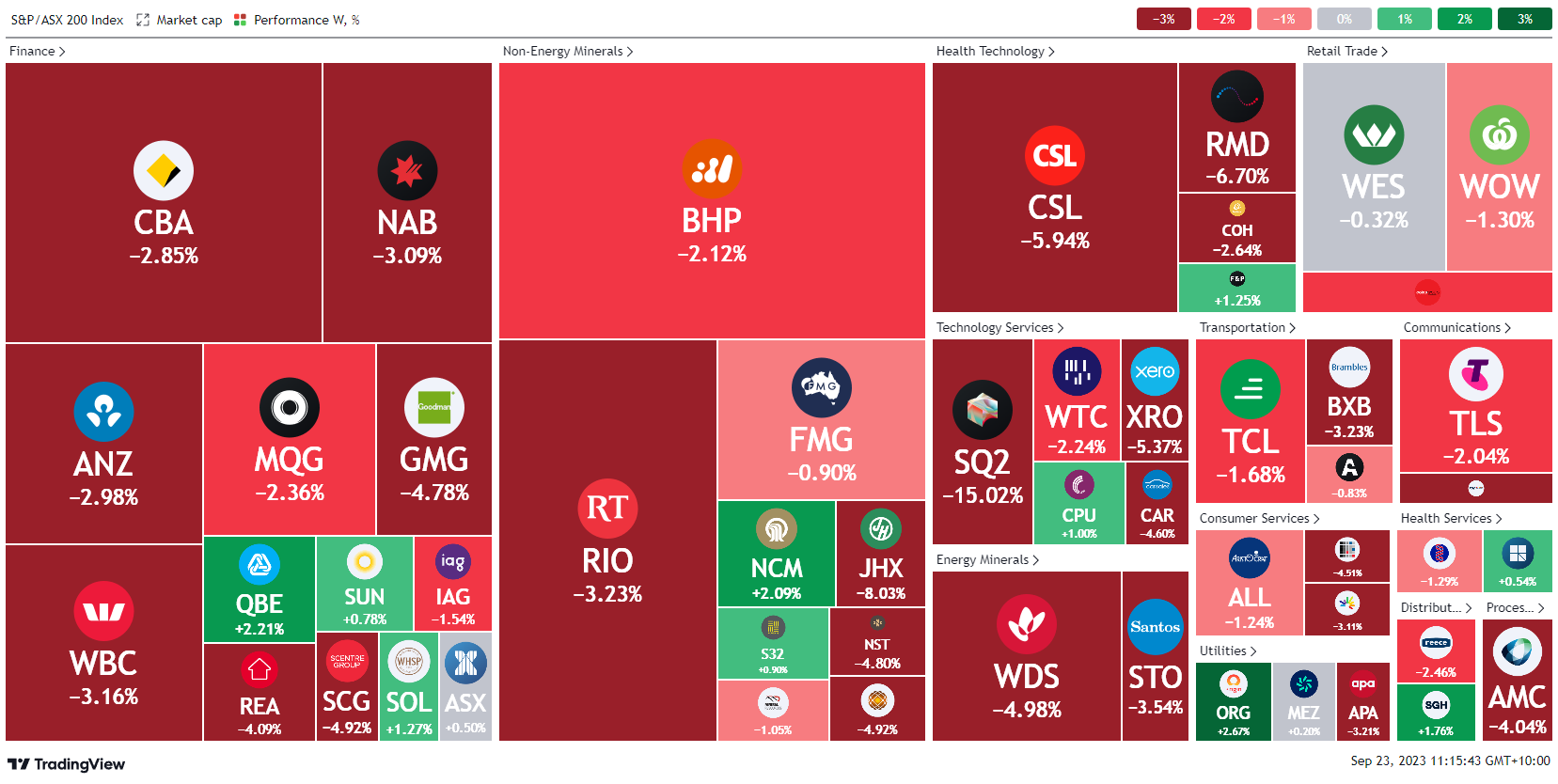

Here is the week's heatmap for the largest companies in the ASX.

A sea of red. A very ugly week for Australian shares, as the financial sector declined by around -3%. Miners also struggled with BHP and RIO down over -2%. The general risk off theme caused broad selling pressure with the only bright spots being the insurers, Newcrest Mining and Origin Energy. September seems to be following usual seasonality as the Australian market is down around -3.5% MTD. Fortunately Friday saw the index rally strongly off lows which may provide some respite coming into next week.

Below shows our proprietary trend following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

3 topics