US ISM Manufacturing PMI records 50.3, Crude oil inventories rise to 3.2M barrels

Let’s hop straight into five of the biggest developments this week.

1. US ISM Manufacturing PMI records 50.3

The survey of about 300 purchasing managers had reported its first expansionary reading since October 2022, ahead of expectations of 48.5. This implies that the US manufacturing sector is back on track and expanding.

2. German Prelim CPI m/m rises by 0.4%

German CPI missed expectations for the second month in a row. Expectations were for a reading of 0.5%, an increase of 0.4% from the prior month. Inflation continues to stabilise and in Germany with annualised CPI running at 2.2%, demonstrating that inflation seems to be under control in Europe’s largest economy.

3. US Job openings in line with expectations at 8.76M

Job openings in the US continue to be stubbornly high with a reading of 8.76M. This is down from the highs seen last year, however, continues to hover around 9M. The Fed has continued to say that the market needs to cool, and businesses need to stop hiring, however the level of openings continues to much higher than the Fed wants.

4. Crude oil inventories rise to 3.2M barrels

U.S. crude oil refinery inputs averaged 15.9 million barrels per day during the week ending March 29, 2024, which was 35 thousand barrels per day less than the previous week’s average. The take-away here is that crude inventories are building at a much faster rate than the current demand in the US.

5. Swiss CPI m/m shows stagflation

In Switzerland CPI has continued to slow at an aggressive rate with the most recent reading of 0.0% m/m showing stagflation. Expectations were for an increase of 0.3% m/m, a slowdown from the prior months reading. This contraction aligns with the view that rate cuts later this year may be necessary due to an economy that is rolling over.

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

The VIX was the best performer over the course of the week rising as equity markets sold off as market participants repositioned their expectations for rate cuts this year. Jerome Powell continued to state that expectations for rate cut this year were going to be data dependent and may only be one this year. Precious metals continued to climb as trader positioned into a possible inflation hedge with cuts/QE later this year. The energy complex had a solid week on geopolitical issues. Cocoa took a breather after extreme price action over the last few weeks. Equities declined broadly, with the Nasdaq, S&P500 and the DAX all down over -2%.

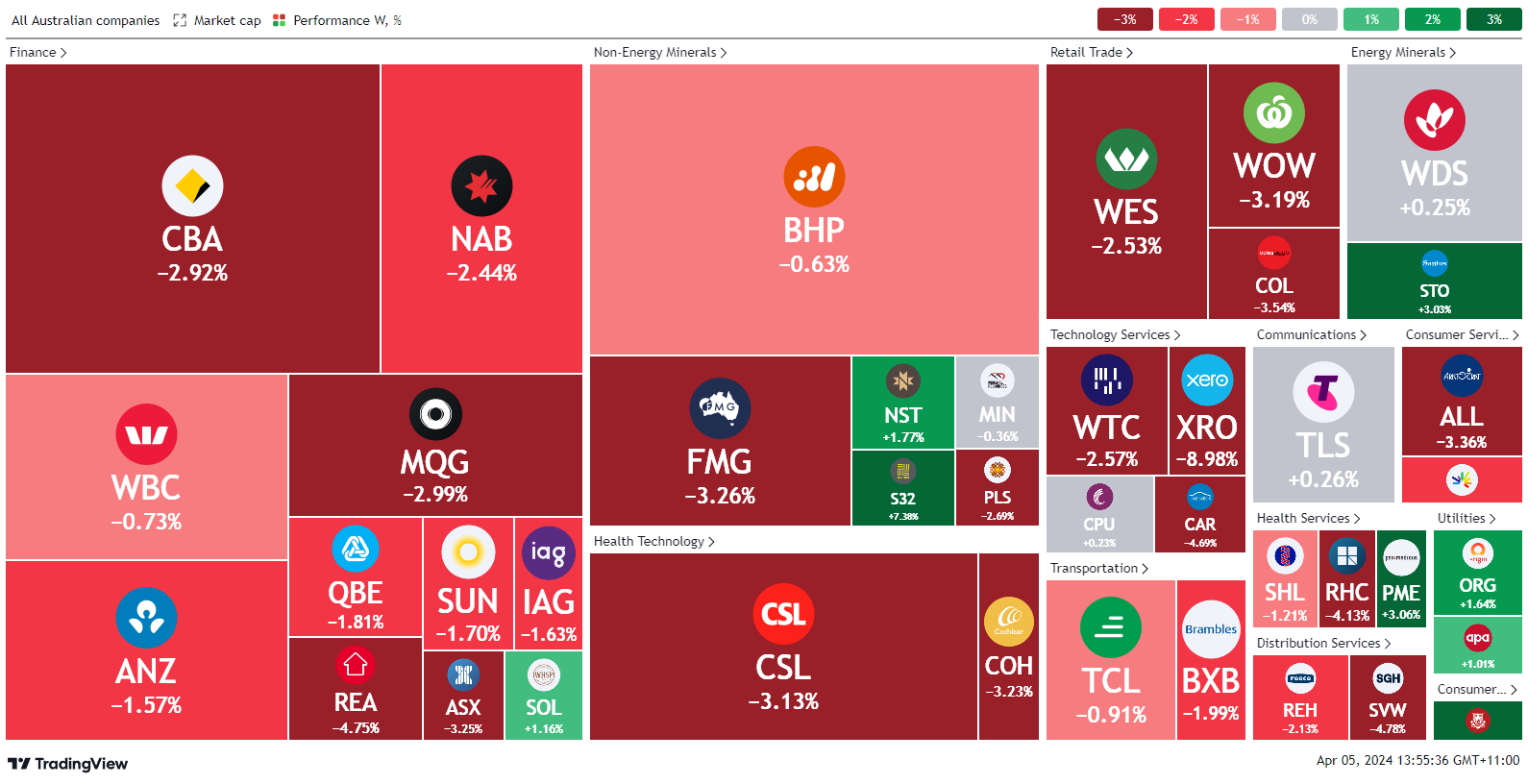

Here is the week's heatmap for the largest companies in the ASX.

Over the last week, we have seen some very choppy price action on the ASX with only a few pockets of green. On the surface, the moves on a week-to-week basis seem modest, however under the hood there have been large swings. Financials were led lower with CBA, MQG, and NAB all down by over -2%. CSL and COH both declined by over -3%. Defensive names were relatively strong with TLS, ORG, and APA flat to higher. Tech experienced the majority of the selling with XRO, WTC, and CAR all down between -2.5% and -8.98%.

Below shows our proprietary trend-following barometer which captures the number of futures contracts within our universe hitting new short and long-term trends.

5 topics

5 stocks mentioned