US manufacturing PMI contracts to 48.5, European Core CPI Flash estimate rises steady at 2.9%

Let’s hop straight into five of the biggest developments this week.

1. German CPI m/m declines to 0.1% m/m

German inflation slowed after two months of accelerating as the country’s economic recovery showed signs of stalling. Consumer prices rose 2.5% from a year earlier in June — down from 2.8% in May and in line with a Bloomberg survey of analysts. Energy costs continued to decline, while goods eased.

2. US manufacturing PMI contracts to 48.5

Economic activity in the manufacturing sector contracted in June for the third consecutive month and the 19th time in the last 20 months. This was down 0.2 from the reading in May. Demand was weak again, output declined, and inputs stayed accommodative. This number continues to demonstrate that higher rates are still working their way into the economy.

3. US job openings little changed at 8.14m

The number of job openings changed very little at 8.1 million on the last business day of May. Over the month, both the number of hires and total separations were little changed at 5.8 million and 5.4 million, respectively. Recent JOLT data is demonstrating that the economy is slowing in the US, however, it seems to be at a very gradual rate, which is in line with the US Fed’s expectation for a soft landing.

4. French Parliamentary Elections give a surprise result

In the first round of elections which were held on the weekend, 76 MPs were elected including 39 for the National Rally (RN) and its allies (which is deemed a far-right party). The second important round happens this weekend, with an impact expected on the EUR. It also further sets the precedent for further far-right parties being elected across the Eurozone.

5. European Core CPI Flash estimate rises steady at 2.9%

June core inflation remained unchanged at 2.9% y/y in June. Flash inflation was in line with expectations of a small drop to 2.5% y/y, while core inflation surprised a tad to the upside remaining unchanged. Today's release doesn't change the ECB outlook. The main drivers were food and energy prices which have been consistent across most CPI measures recently.

As per usual, below shows the performance of a range of futures markets we track. Some of these are included within the universe of our multi-strategy hedge fund.

Over the last week, we have seen very solid performance come in from a basket of commodities, which in the future may be a hindrance to most central banks. Soybean oil, cocoa, copper, canola, lumber, and crude oil, were all up in excess of 2.5%, with Soybean oil and Palladium the best up in excess of 10%. The majority of these moves have been caused by expanding demand levels across the board. The worst performer over the week was Natural Gas, it declined by 12.03% as warmer weather conditions hit North America. Most equity markets were flat to higher over the week with only the Russell 2000 being the weakest. Interestingly, earnings of the ‘Mag 7’ are expected to grow by over 30%, while everyone else is expected to be around 5%.

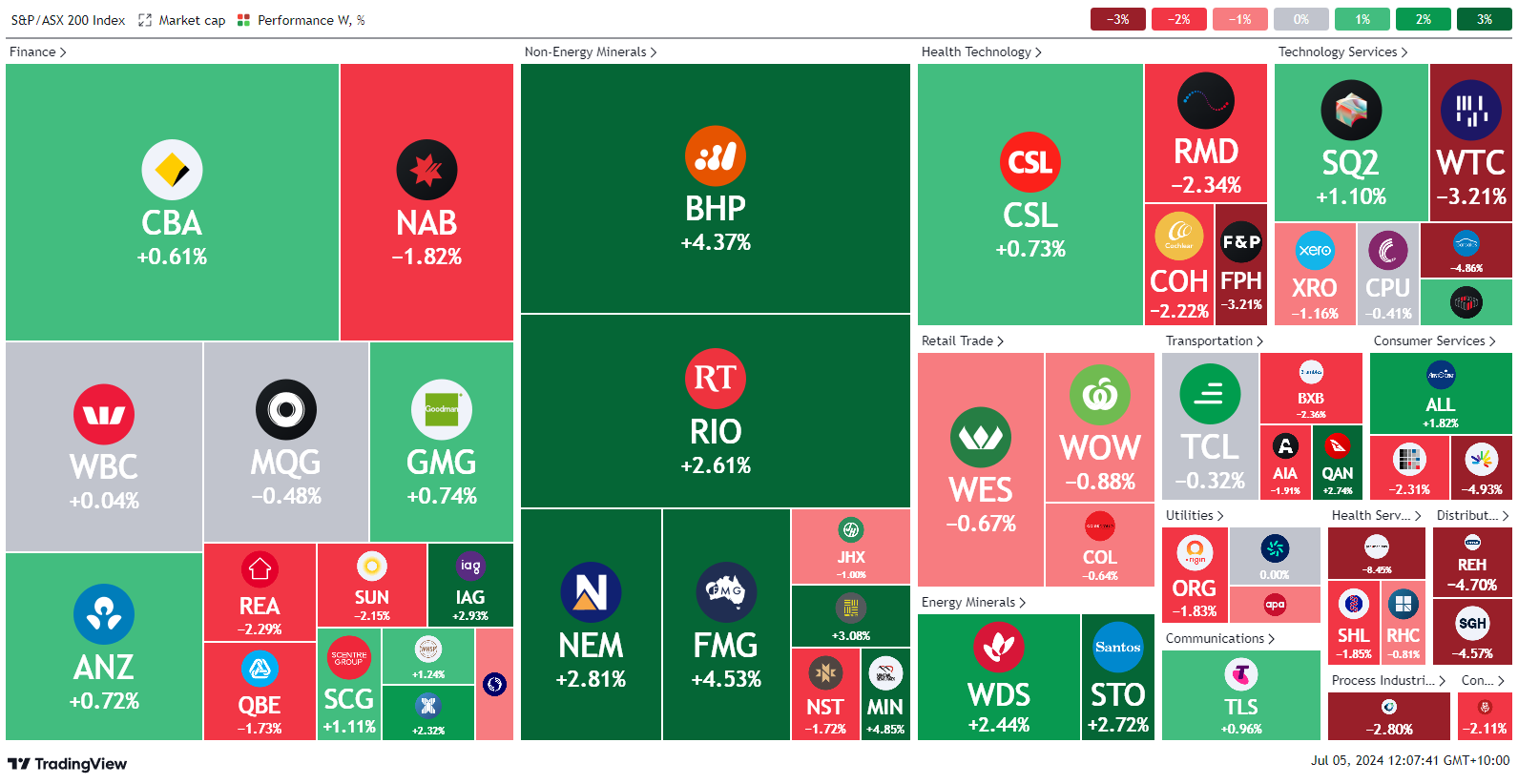

Here is the week's heatmap for the largest companies in the ASX.

This week, a different basket of companies led the S&P ASX 200 higher. The materials, after a period of terrible performance over the last month, have bounced back with a vengeance, as underlying commodity prices have rebounded. BHP, RIO, and FMG all had stellar weeks, rising >2.5%. We saw profit taking of NAB, RMS, COH, BXB, and MQG, which have recently been some of the strongest performers. Energy names, which have been poor recently, had a solid week, rising ~2.5% each. Tech names such as CAR and WTC, experienced profit-taking after a period of solid performance.

Please reach out if you’d like to find out more about how our quantitative approach captures the price action covered above, or if you would like to receive these updates directly to your inbox, please email admin@framefunds.com.au.

5 topics

5 stocks mentioned