US Midterms: Why gridlock in Washington is good news for Wall Street

The US Midterm elections are underway and markets have a preferred horse in the race - the GOP. If that horse gets up in one house of Congress, expect stocks to rally.

According to Gallup, 46% of Americans mention some aspect of the economy as the most important problem facing the country, with the top two specific issues being inflation (20%) and the economy in general (18%).

"Americans' concern about the economy is a reflection of its perceived health -- 14% describe its current condition as excellent or good, 37% as only fair, and 49% as poor," Jeffrey Jones and Lydia Saad from Gallup say.

"The 35-point gap between positive and negative evaluations of the economy is the worst Gallup has measured at the time of a midterm election (with trends going back to 1994), surpassing the -31 gap in 2010."

In this wire, I draw on expert opinion and historical data to show why gridlock in Washington means gains on Wall Street.

Midterm elections are good for stocks, as are split governments

Here's a fun fact - the S&P 500 has not experienced a loss in the 12 months post-election since the 1940s.

Most forecasts also suggest a split government, with Republicans primed to take the House of Representatives and maybe the Senate. A split government will make it hard to impossible for either party to pass bills through congress - and that's just fine by markets.

“This typically results in gridlock as lawmakers are unable or unwilling to agree on major legislation, meaning that substantial laws are either not approved or significantly reduced in scope and impact," says deVere Group CEO Nigel Green.

“This stalemate, while often infuriating for voters, is often good news for stock markets."

Markets love certainty and political gridlock provides that. It also reduces the likelihood of tax hikes.

“The status quo usually means that corporations can push on with their plans and investments without the risk of everything being upended by new laws and requirements.”

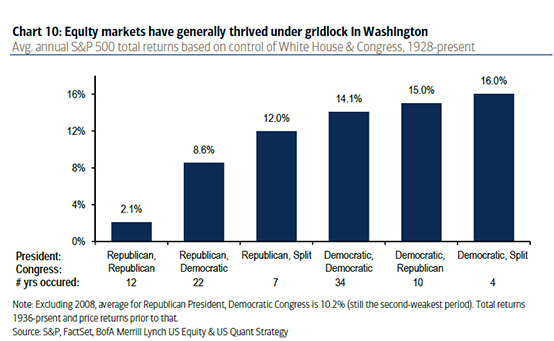

As the below graph from BofA Merrill Lynch shows, markets typically do better during split governments although any two-year period following a midterm election has been good regardless of the composition of Washington.

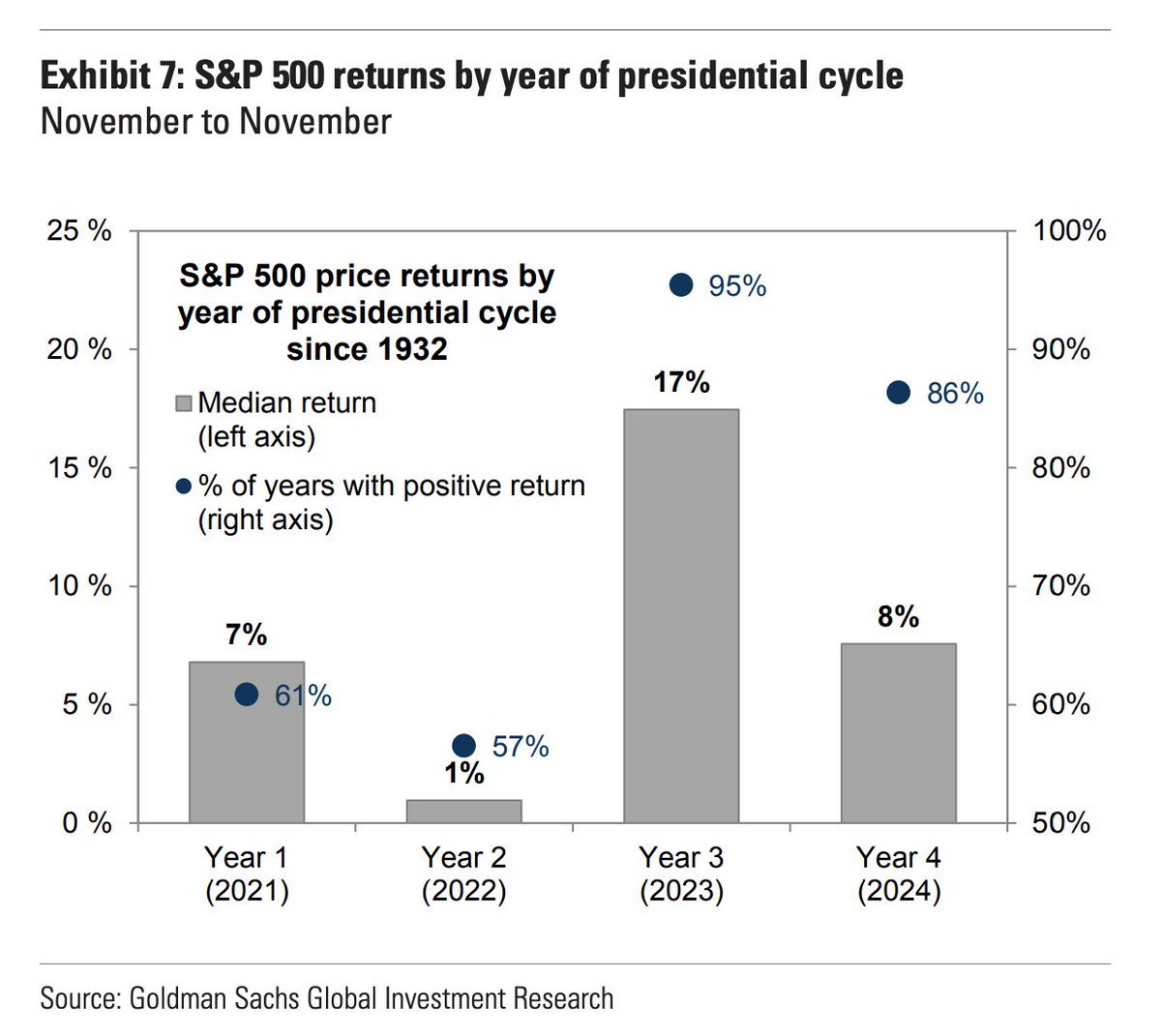

Similarly, as this next graph shows, markets tend to do their best work in the third year of a presidency.

Still, a stock market rally is far from guaranteed.

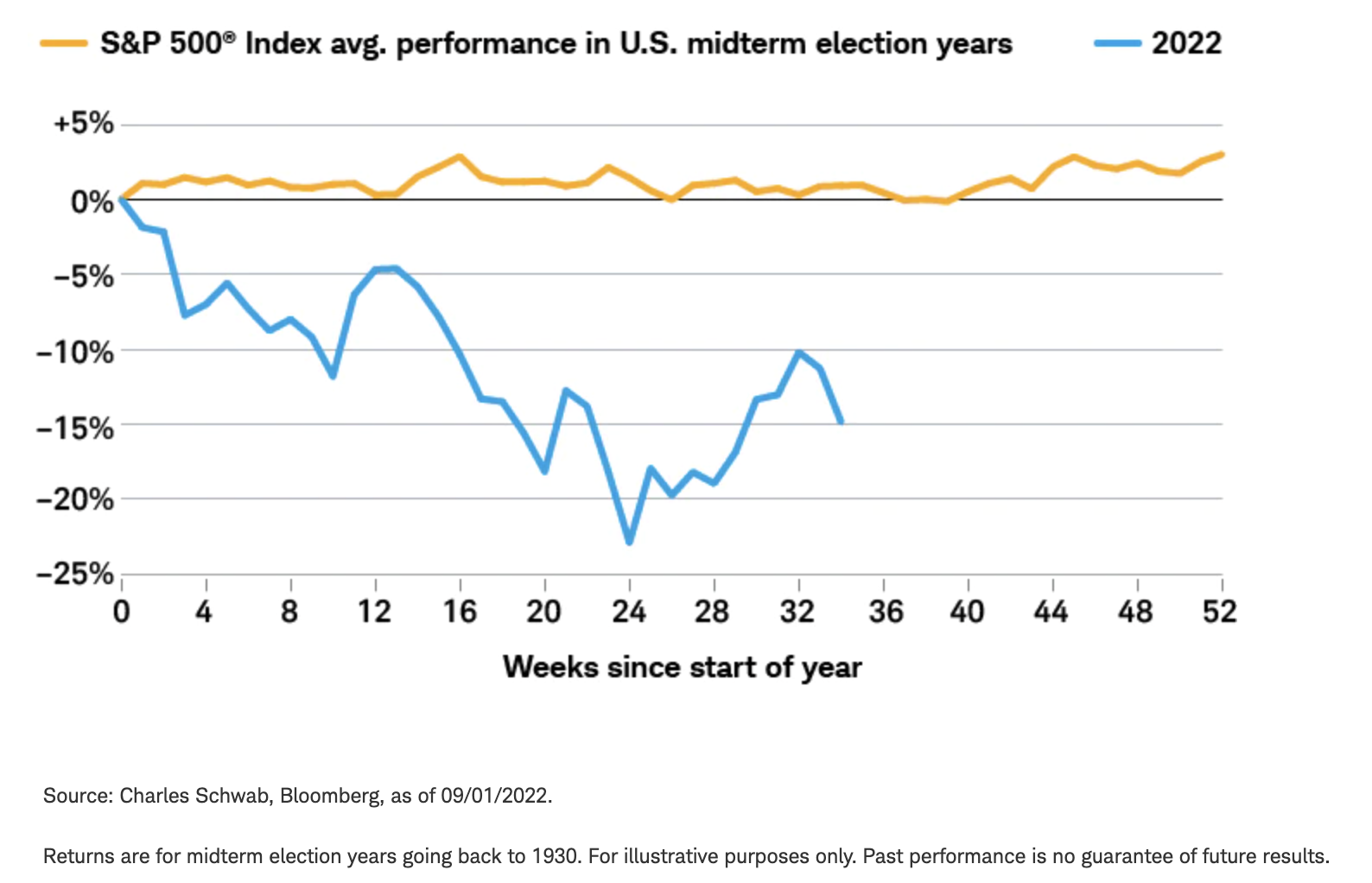

"The combination of high inflation, the war in Ukraine, and a lingering pandemic has already made this cycle unlike prior midterm years," says Liz Ann Sonders, Schwab's chief investment strategist.

"With so many other forces at play in the market, I wouldn't put much weight in historical midterm-year performance."

Sectors to benefit

Firstly, "You’re unlikely to see any meaningful pickup in government spending," and that means even the most immoral of public companies may attract the buyers.

"So-called “sin” sectors, i.e., prisons, tobacco, for-profit education, student lending … these sectors are likely to catch a bid on the prospects of reduced negative legislation against them.

Sectors involved in the military, national security, are likely to benefit from increased government spending," says Ashwin Alankar , Head of Global Asset Allocation at Janus Henderson Investors.

"Fossil fuel industries are also likely to benefit."

dVere adds tech, pharma, and biotech, and energy to the list of beneficiaries from a Republican comeback.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic

1 contributor mentioned