Valuation: Highlighting the importance of Return on Equity and Payout Ratios

In this wire, I will look to tease out the importance of a business’s return on equity (ROE) and look to shine a light on how this measure of a company’s profitably along with dividend payout ratios can considerably influence the long-term outcomes investors can expect from their investments.

Return on equity, or ROE, is a key measure of profitability revealing how much profit the company is making on each dollar of equity invested by shareholders. Ostensibly if a company is generating a greater return on each dollar invested by shareholders then that’s a good thing.

ROE is not only an indication of business profitability but capital efficiency. Definitions suggest that a company cannot grow earnings faster than ROE, without raising additional debt or capital. Therefore, a lower or falling ROE constrains earnings growth, arguably placing downward pressures on share prices, market sentiment and valuation re-ratings aside.

Before we proceed in scrutinising an example highlighting the impacts ROE can have on a business's valuation, it is worth noting that higher leverage and debt has the effect of inflating the ROE figure. For that reason, Return on Assets could be a superior measure for more highly indebted companies.

Company Valuation: Return on Equity

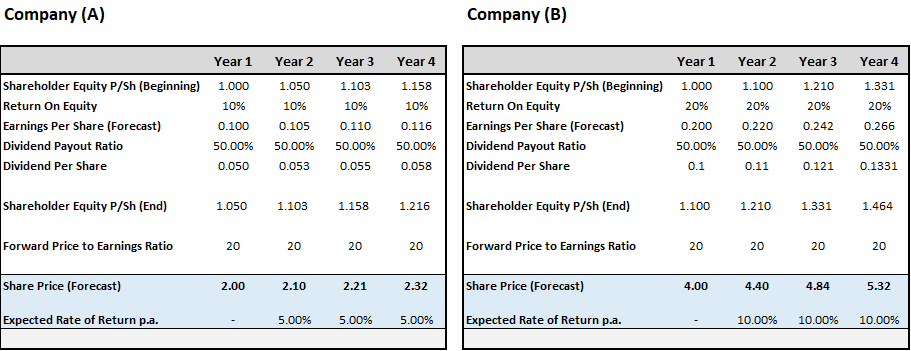

Consider for a moment two companies with no debt for simplicity purposes. One, Company (A) with an ROE of 10% and the other, Company (B) with an ROE 20%. To start with let’s assume a dividend payout ratio of 50% for both companies and the multiple or Price to earnings ratio of the companies remain constant over time at 20x earnings.

Do keep in mind this example is meant to be educational only and designed to highlight the influence ROE and dividend payout ratios have on company intrinsic value and doesn’t take into account the numerous other variables that will overtime influence the performance of share prices such as multiple re-ratings and the impacts of leverage etc.

Looking at the table above you can see the way a subtle difference in the ROE number can have a large impact long term earnings per share and in turn share price of a business. Assuming all else is equal except the ROE, the difference in the long term expected annual rate of return for a business is considerably higher for the company with the higher the ROE, in the above example that is Company (B), the business with a 20% ROE. You will find a similar iteration plays out for a business whose ROE steadily grows over time.

Company Valuation: Dividend Payout Ratios

Turning our focus to Dividends, it is worth turning our mind to the impact dividend payout ratios have on company valuation. As we know many Australian investors idolize their dividends, but the question is at what long term cost?

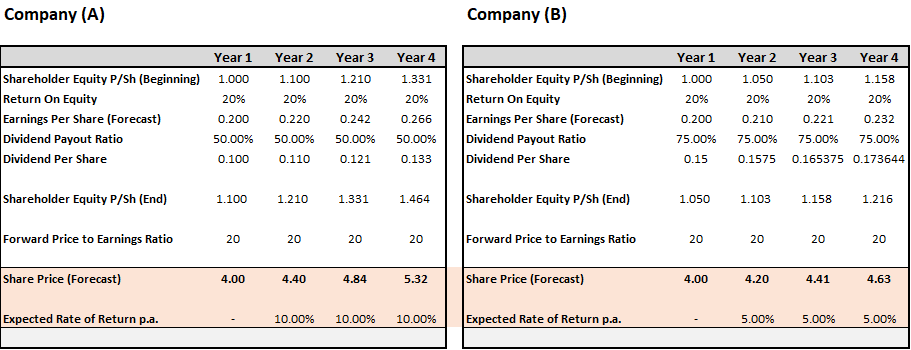

Again, consider for a moment two companies with no debt for simplicity purposes. One, Company (A) with a dividend payout ratio of 50%, and the other, Company (B) with a payout ratio of 75%. Let’s assume in this instance a ROE of 20% for both companies, and again the multiple or Price to earnings ratio of both companies remains constant over time at 20x earnings.

Looking at the table below you can see how the difference in the Dividend payout ratio of a company can have a large impact long term earnings per share and in turn share price of a business. Assuming all else is equal except the Dividend payout ratio, the difference in the long term expected annual rate of return for a business is considerably higher for the company with the lower dividend payout ratio, in the below case that is Company (A), the business with a 50% payout ratio.

In short, the willingness to have a return now in the form a of dividend can be significantly detrimental to long term value creation. In essence, why pull money out of a company that is able to use that cash, or equity, and achieve a compounded return on that equity of 20% plus? Living expenses, tax implications aside and company growth opportunities aside, investors need to ask themselves what use is the cash now without a superior investment alternative?

Pulling cash out of a company generating a return on equity of 20%, to put the cash into a bank account generating a return on equity of 0.50% is a nonsense.

It is important however to understand that not all companies are the same. That is larger more mature businesses may well have a dearth of growth opportunities in which case it makes complete sense for these businesses to return cash to shareholders in the form of dividends. On the same token for emerging businesses with a plethora of growth opportunities, it makes sense for these businesses to retain as much cash as they need, sacrifice dividends now, in order to reinvest back into the business, and deliver a return on that equity in order to drive future growth which can potentially not only deliver even bigger dividends, but better capital gains into the future.

The Interrelationship: Dividends and Return on Equity

Keeping our focus on Dividends, but this time rather than focusing on the relationship with valuation, let’s turn our attention to the relationship with ROE. In short dividend growth rates and ROE are linked. In simplistic terms dividend growth can be estimated as follows:

DivG = ROE x Payout Ratio

As you can see from the first example above, the growth rate in dividends for the business with the higher ROE, Company (B) is greater than the rate of growth in dividends for Company (A).

Looking at a real-world example in recent years some of the banks have been maintaining dividends essentially by increasing payout ratios to offset the falls in ROE. Naturally, management can’t keep raising payout ratios indefinitely and at some stage will need ROE to stabilise or rise to support dividends p/sh.

3 topics