Value investors hold on! December dip just a blip, says Maple-Brown Abbott

A pullback in the “eye-watering” share prices of some of Australia’s technology juggernauts is a matter of when, not if, says Dougal Maple-Brown of value-centric fund manager Maple-Brown Abbott.

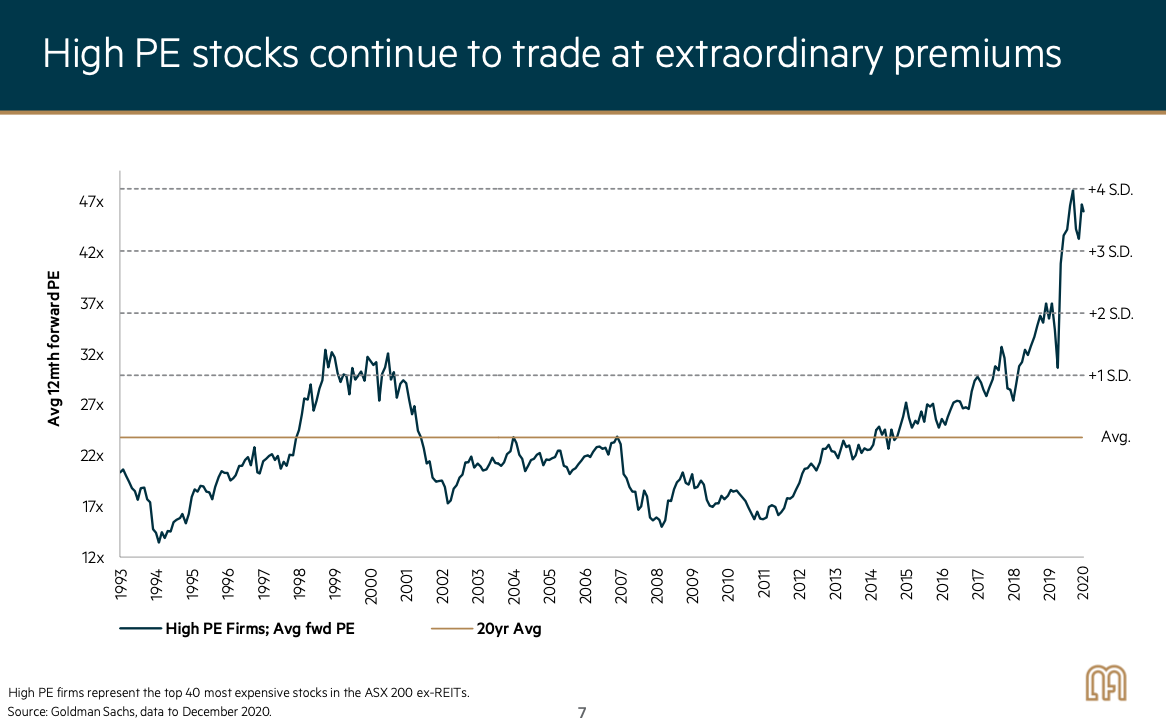

After a year in which the likes of market darling buy-now-pay-later company Afterpay (ASX: APT) and a cohort of other locally-listed tech firms saw their PE ratios spiral upwards – as shown in figure 1 – the party’s end is nearing, says Maple-Brown, the manager’s head of Australian equities.

Some of the other stocks Maple-Brown and his team believe could be set to disappoint in the near future are:

- Software firms Altium (ASX: ALU), WiseTech Global (ASX: WTC) and Xero (ASX: XRO)

- automotive sales and jobs portals Carsales.com (ASX: CAR) and Seek (ASX: SEK),

- property websites Domain (ASX: DHG) and REA Group (ASX: REA)

- data centre operator NextDC (ASX: NXT).

“In 2020, their PEs went from roughly 50-times forward-earnings to almost 100-times…a global phenomenon,” Maple-Brown says.

Figure 1

“Why the stocks did this, who knows, but when they de-rate – and they will – then value will do well.”

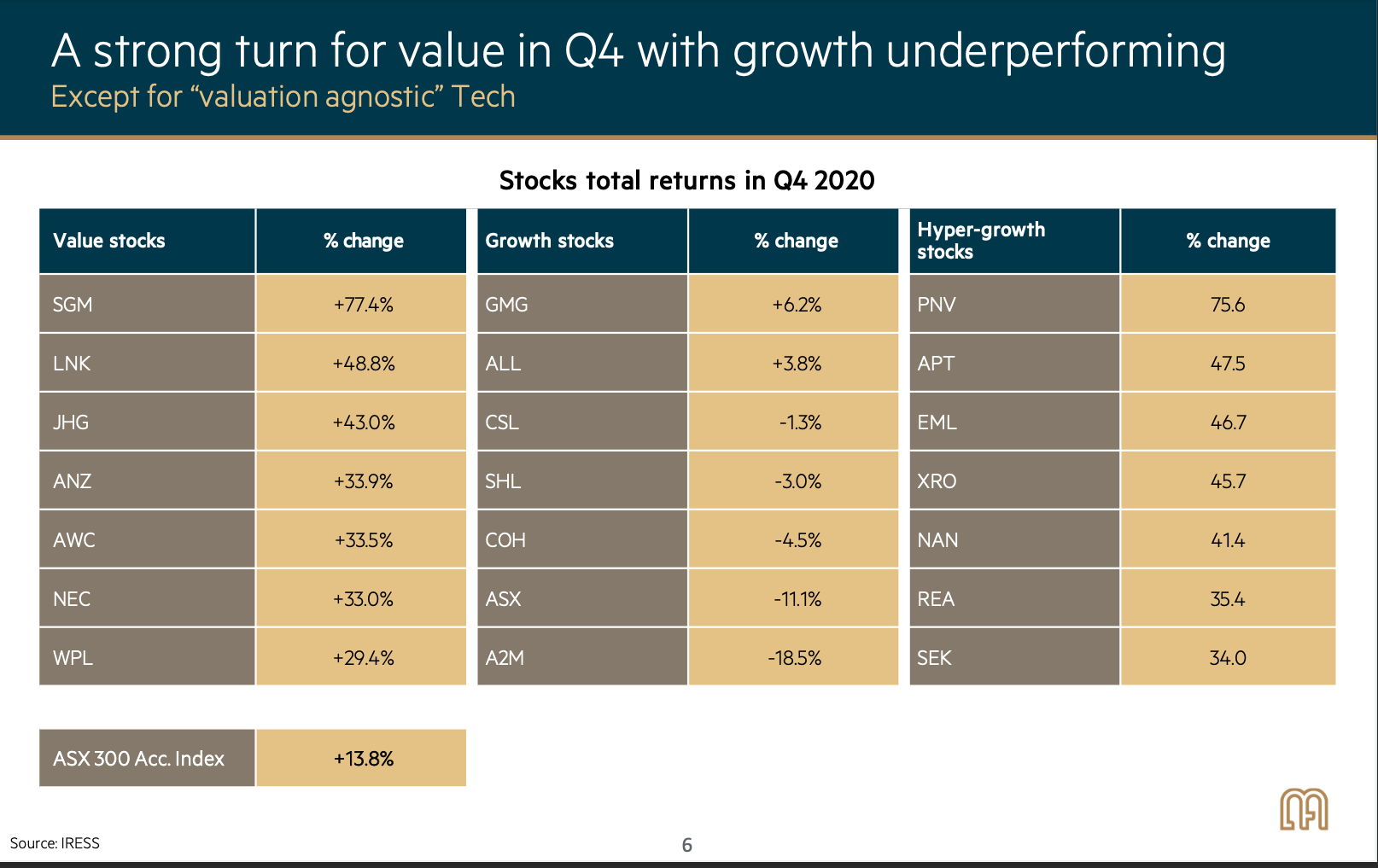

Long-suffering Value investors got a rare flicker of hope at the end of last year, the category outperforming Growth for two of the last three months of 2020. This was also reflected in the performance of Maple-Brown Abbott’s Australian Share Fund, which beat the benchmark ASX 200 by 6% in Q4 2020. This contrasts with some less-than-stellar figures over recent history, the fund undercutting benchmark returns by 4.6%, 6.2% and 3.8% in calendar 2020 overall, 1-year and 3-years, respectively.

But after what Maple-Brown concedes has been “a pretty miserable decade” for value stocks, Maple-Brown believes the outperformance of companies like Janus Henderson Group (ASX: JHG), Link Administration Holdings (ASX: LNK) and Nine Entertainment (ASX: NEC) in two out of the last three months of 2020 is just the tip of the iceberg.

Some of the other names held in the manager's Australian equities strategy as of 28 January are listed in the table below, including metals and electronics recycler Sims Metal Group (ASX: SGM), big-four Aussie financial firm ANZ Bank (ASX: ANZ) and aluminium producer Alumina (ASX: AWC).

Figure 2

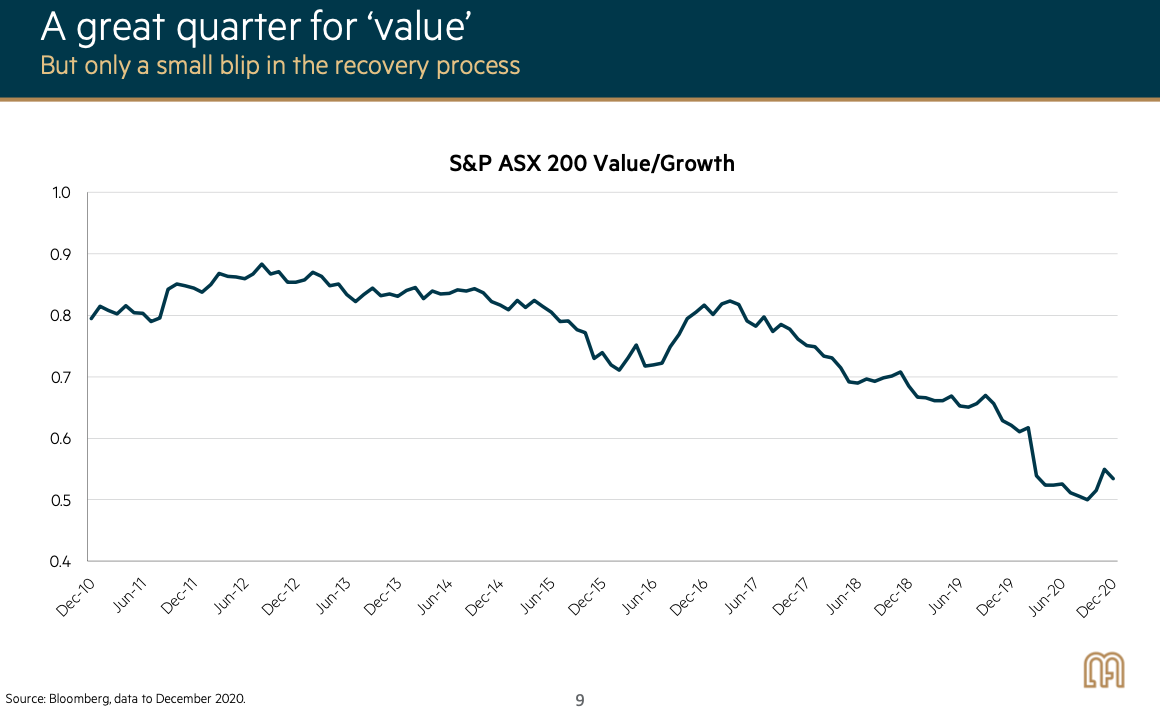

As shown in Figure 3, only October and November saw an uptick in value’s performance, dipping back down again in the month of December. This period of outperformance is little more than a blip in the recovery process of value stocks, Maple-Brown argues.

“In the context of 50% underperformance over a decade, the last quarter, while pleasing – and it’s continued into January as well – does not make a summer,” he says.

“We think there’s plenty more to go for value, both on the valuations themselves and the underperformance that the category has suffered to date.”

Figure 3

Asian tigers set to roar?

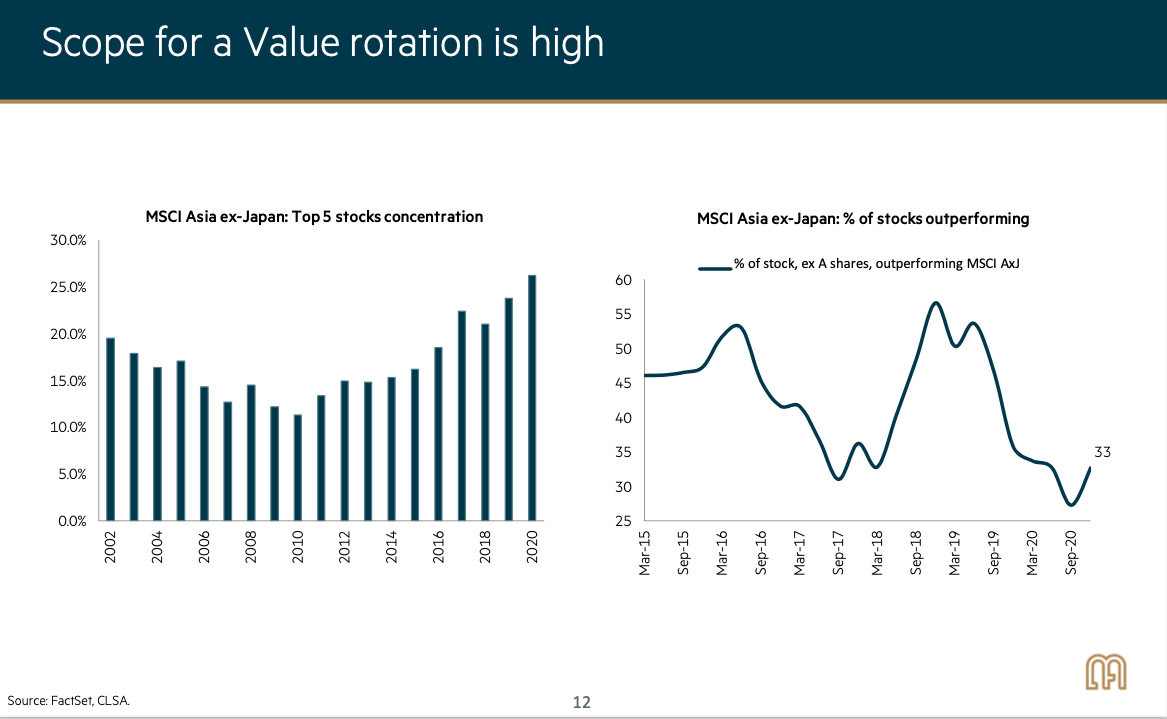

The fund manager’s chief stock-picker of Asian equities, Geoffrey Bazzan, is also bullish on the outlook for value stocks in the region. He believes many investors have been “buying the hype over the reality” during much of the last decade – and expects this trend to continue unwinding, having started in Q4 2020.

Just as his colleague argues for Australian stocks, Bazzan also believes the rotation into Asian Value stocks is only in its infancy.

The over-representation of the five largest stocks within Asia’s largest index – the MSCI Asia ex-Japan – currently sits at its highest level in almost two decades.

“Although we’ve seen some rotation over the last quarter…it was still the worst year for Value in the last 20, which highlights just how far markets have herded into such a narrow cohort,” Bazzan says.

This concentration is similar to several other markets around the world, including Australia.

“Ultimately, we think that is unsustainable…and that there are many companies that offer significantly more upside without the attendant risk attached to these five in light of their valuation premium,” Bazzan says.

“2020 was a very good year for Asian markets, the benchmark returning around 20%, which made it the second-best return over the last decade, which is quite staggering when you think of the issues that markets confronted.”

An early-stage earnings recovery in Asian companies, combined with the benefit of a weaker US dollar, underpin his belief that more stocks from the region will “re-rate” in favour of investors in the coming months and years.

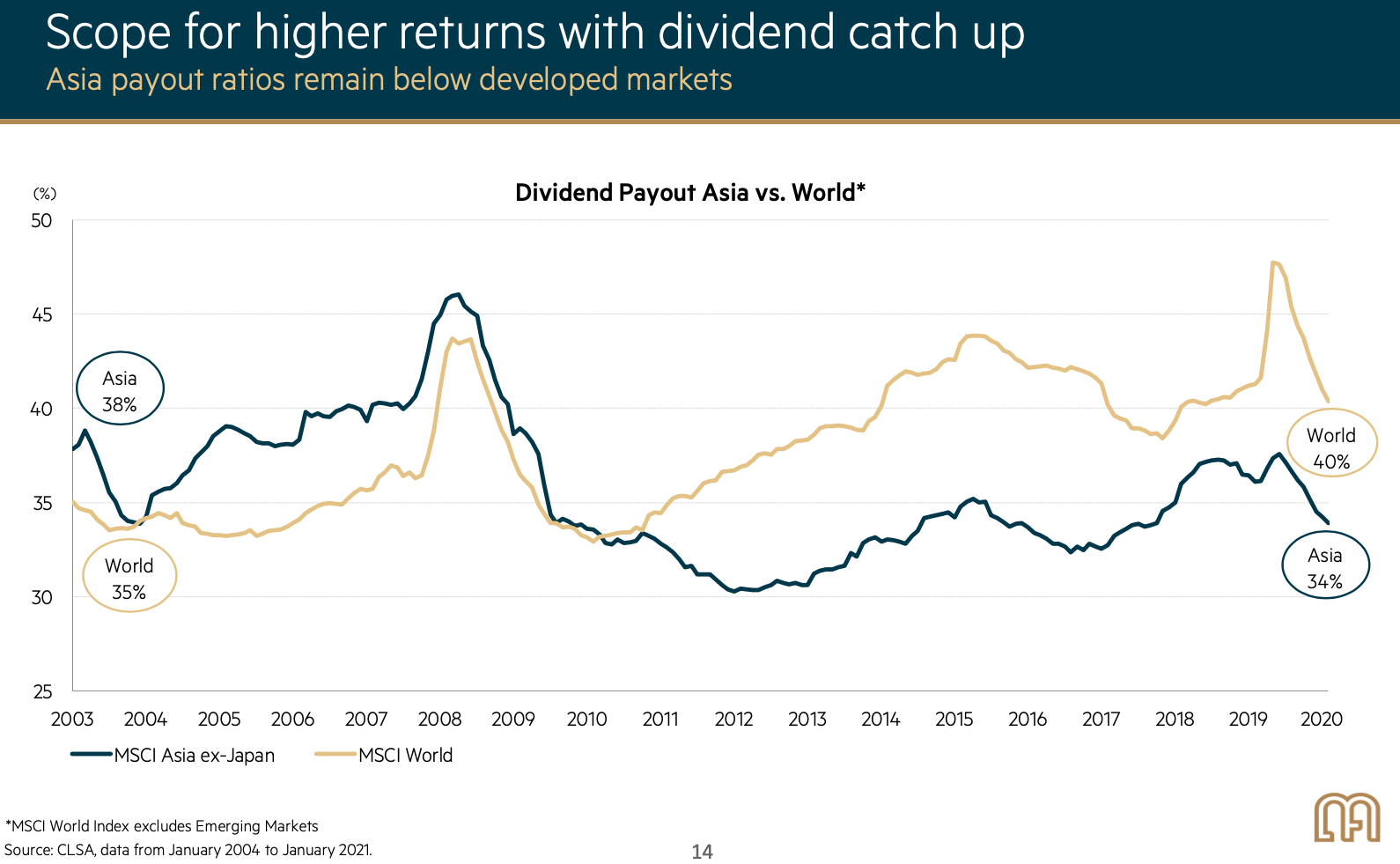

Another reason for his optimism is Asian companies’ relatively low utilisation of "capital management" initiatives – such as share buybacks and dividend distributions.

Asian companies have traditionally been more reluctant to pay dividends than their western counterparts, as shown in the graph above. Many of the stocks Bazzan and his colleagues are examining also have strong balance sheets, high levels of cash-on-hand and attractive valuations.

“We think the earnings recovery story here is underway…with good scope for a retracement of some of that underperformance that we’ve seen essentially since the GFC,” he says.

“We’re certainly seeing that in the companies we’re examining, which should be able to grow far more resiliently than they have in the past.”

Stay up to date

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

15 stocks mentioned