Veteran bonds investor Bill Gross on equities, bonds and arbitrage via M&A

You know about the rise in interest rates. And courtesy of some of my colleagues - Hans Lee and Sara Allen - as well as commentary from our speakers at Livewire Live 2023 - you know the bond markets are also experiencing higher yields while stock markets appear less appealing.

But if you don't understand the link between interest rates, bonds and share prices, you've come to the right place. Bill Gross, the founder of global fixed income investment behemoth PIMCO starts off his latest newsletter thus:

"Professional stock investors know little about bonds and vice versa, I suppose. Yours truly has to be included in that mix but that doesn’t stop me from trying" he said.

He begins by acknowledging that most analysts will cite the rise in yields as a precursor to slower economic growth and lower earnings per share (EPS) estimates over the near term. He thinks this is only part of the story and not so significant on stock prices compared to changes in interest rates which influence longer-term values.

"The fact is that over the last 2 years, nominal and real yields have risen by 400 and 350 basis points respectively in the 10-year Treasury space and such an increase over such a short time period might even cause an equity analyst to wonder why stocks aren’t in a bear as opposed to a bull market. I have an explanation," he said.

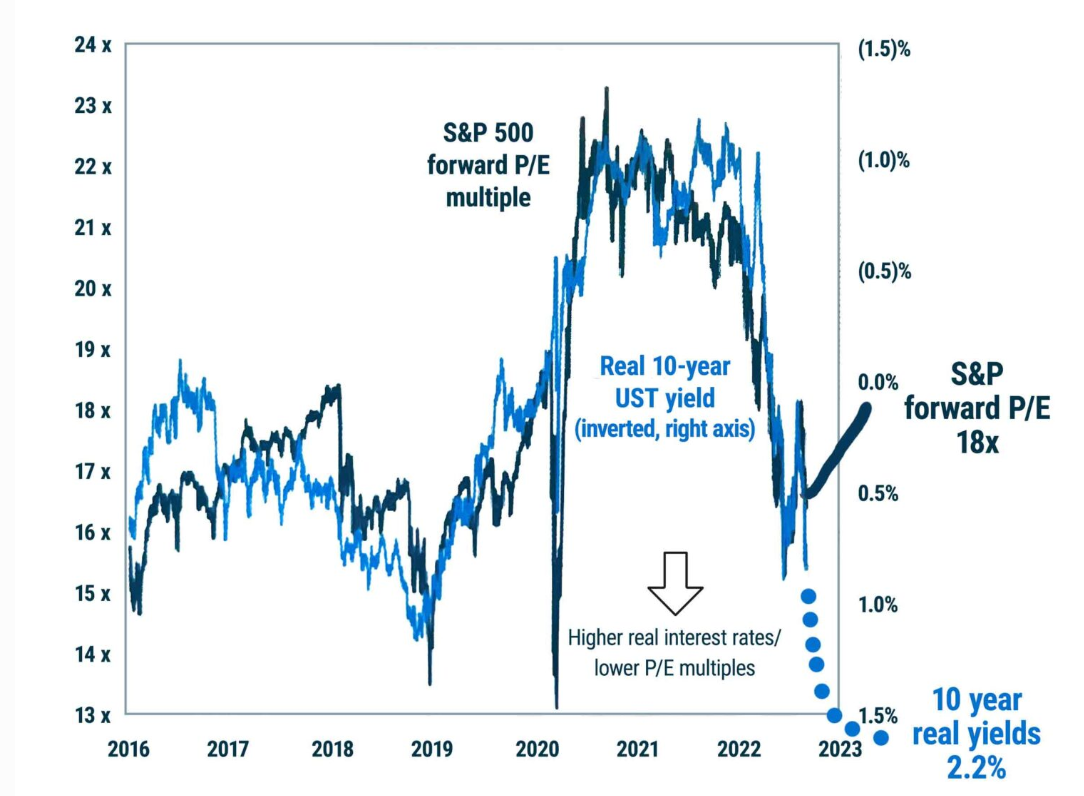

The first part of that explanation can be seen in the Goldman Sachs chart below. Note the darker line of the S&P500 forward price/earnings (P/E) multiples and the correlation with the 10-year US Treasuries yield (light blue line) since 2019. Note the change in the last 12 months on the right-hand side of the chart.

However, Gross believes there is a long-term logic for this.

"A P/E ratio turned upside down to E/P is really an earnings yield," he said.

"One might commonsensically assume that if bond yields go up by 350 basis points that (everything else being equal) earnings yields (E/P) should follow somewhat. They did until the Fall of 2022 as the chart will show but not since."

Gross notes the explanations for this are many; the strong economy, assumptions about the Fed's yield decisions in 2024 (they will lower yields quickly), and the influence of AI on productivity and earnings growth (it will be positive).

"[However], everything else has not been equal during the 350 basis point rise in real 10-year Treasuries. Once the Fed stops and then lowers short-term rates, we’ve got a bull market optimists claim. Well, not so fast," Gross explained.

That not-so-fast is about an assumption as to the exactness of that correlation and what it means for P/E ratios. It goes something like this:

If there is an exact correlation - the 350 basis points rise in real 10-year Treasuries is accompanied by a 350 basis points rise in E/P earnings - Gross notes that yields would lower the market’s P/E ratio to 12 times instead of the current 18 times.

"But still, a new bull market? Can AI and $2 trillion fiscal deficits going forward validate that 'it’s different this time?' I’m suspicious," he said.

Gross doesn't believe that Jerome Powell, chair of the US Federal Reserve Board will be either willing or able to lower rates on 10-year Treasuries, given a 3% inflation future.

Arbitrage situations via M&A

So what would he do? Focus on future total returns. Gross is focused on arbitrage situations at two US companies being acquired.

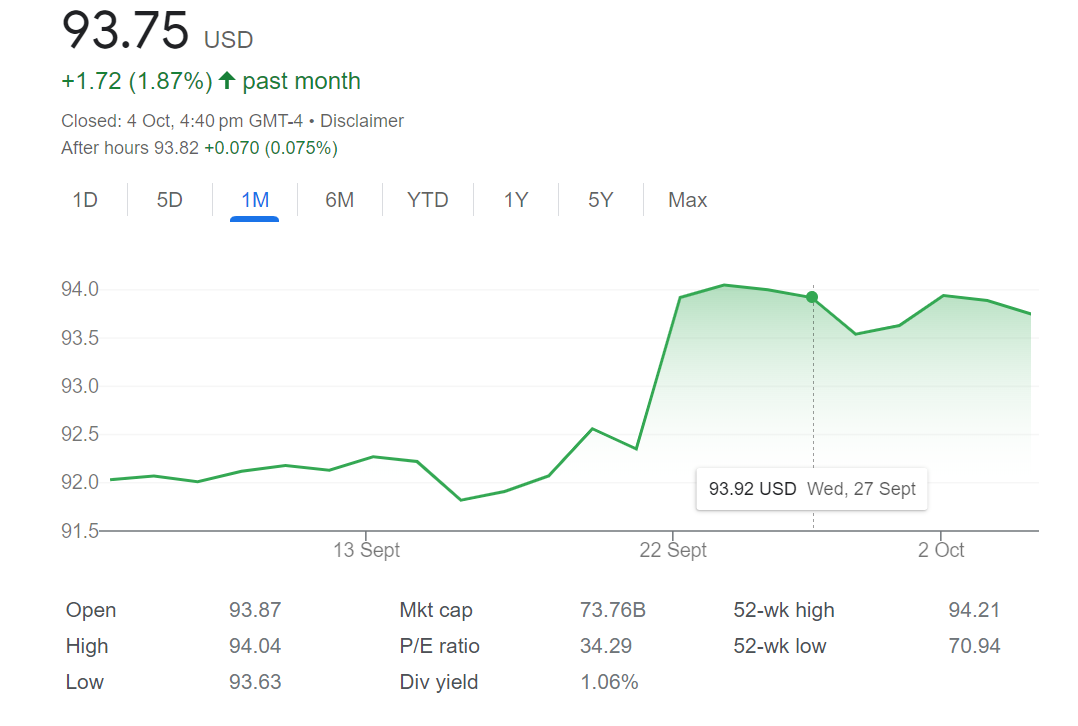

He first calls out the arbitrage situation at gaming company Activision (NASDAQ: ATVI). In January 2022, Microsoft (NYSE: MSFT) made an all-cash offer to acquire Activision for around US$69 billion or approximately US$95/share.

Microsoft successfully cleared several regulatory hurdles in the US and EU and cleared the last one on 22 September when the UK's Competition and Markets Authority approved the deal after Activision agreed to sell its streaming rights to Ubisoft (PA:UBIP). Gross notes that the deal should close in around two weeks or so.

He also likes the global fashion luxury group Capri (NASDAQ: CPRI) with brands such as Versace, Jimmy Choo and Michael Kors. Tapestry Inc (NYSE: TPR) with a stable of brands such as Coach, Kate Spade, and Stuart Weitzman, has entered into a definitive agreement to acquire Capri Holdings for a total enterprise value of around US$8.5 billion, with shareholders to receive cash of US$57 per share. That deal was announced on 10 August 2023 and is anticipated to close in the calendar year 2024. The price reaction can be seen in the chart below.

"Pipeline master limited partnerships (MLPs) are still a favourite of mine due to their favourable partnerships tax benefits, but price-wise are a little toppy due to oil prices that seem vulnerable to the downside," Gross said.

His final piece of advice?

"Keep your eye on real (and nominal) 10-year Treasury rates. They need to come down a lot to validate existing forward P/E ratios. They may not," he said.

4 topics

4 stocks mentioned

2 contributors mentioned