VGI Partners: A guide to listed investment companies

VGI Partners

As with most things, the listed investment company structure has both benefits and drawbacks. But LICs can be appropriate investment vehicles for shareholders of all sizes, particularly those with a long-term outlook. Some of these pros and cons are explained in a recent report prepared by VGI Partners, which can be accessed in full by clicking the link at the end of this article.

History in Australia

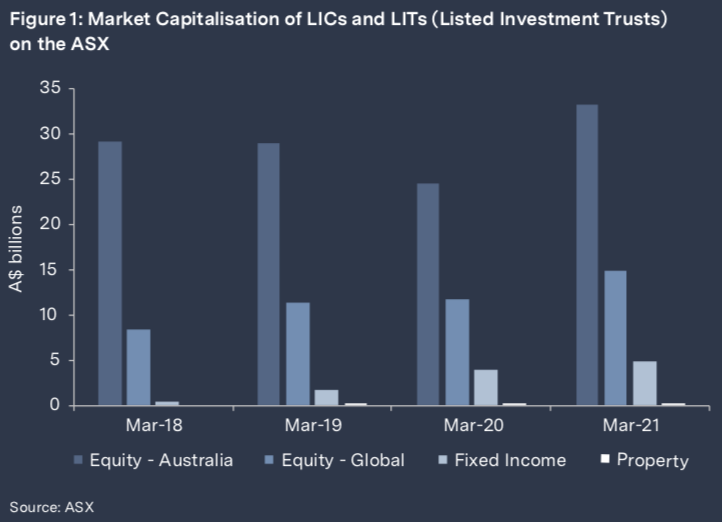

The Australian LIC market has been around for many decades, with the first LIC launched in 1928. Financial practitioners may be aware that LICs predate ETFs, but they may not appreciate they also predate unit trusts (unlisted managed funds). Historically, the Australian LIC market comprised mainly equity funds. However, in recent years, LICs have 20 expanded into other asset classes, such as fixed income and alternatives.

Key benefits of LICs

Being closed‐ended, LICs are not subject to unexpected inflows or redemptions. This means they have a fixed amount of capital to invest. Unexpected cash flows can force fund managers to buy and sell investments at sub‐optimal times.

For example, many open‐ended managed funds experience outflows when stock markets are falling and volatility is high, leading to forced selling when prices are low.

The certainty of capital that the closed‐end structure provides means the LIC manager will not be faced with this situation and is therefore able to take a long‐term approach to investing. For example, in times of extreme volatility, equity‐focused LICs can take advantage of share price falls to make investments in attractive companies with temporarily depressed share prices.

LICs can also choose to be more fully invested when market conditions are appropriate, as there is less need to hold cash in case of redemptions.

Given the reduced need to manage portfolio inflows and outflows, LICs often benefit from lower portfolio turnover which should reduce trading costs and taxes, including potentially lower overall brokerage costs and crystallisation of capital gains along the way.

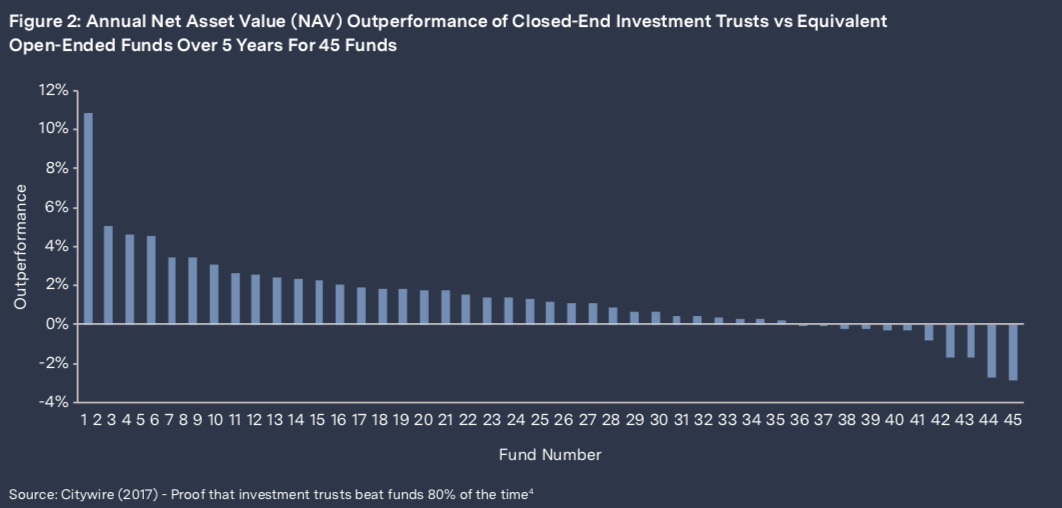

All of these factors can contribute to closed‐end funds or LICs outperforming open‐ended funds, such as ETFs and traditional managed funds. In fact, a number of overseas studies have shown that investment vehicles with a fixed capital base tend to outperform their open‐ended equivalents over time, as the chart below illustrates:

Premiums and discounts

The issue of premiums and discounts between a LIC’s share price and the NTA backing is currently a hotly debated topic.

Given that LICs have a fixed capital base, supply and demand for the LIC are reflected in the share price. This can lead to situations where the LIC share price and value of the underlying portfolio diverge. As a result, LICs can sometimes trade at either a premium or discount to NTA. Rationales for a discount can include:

- Fund size – Small LICs may suffer from low trading volumes, while very large LICs may struggle to maintain demand

- NTA or fund performance – Including the size and volatility of returns, and the length of track record of the manager

- Dividend yield – With many investors looking to LICs to provide stable and growing income over time

- Cyclical favourability of a strategy - Value vs growth companies, or asset class such as bonds vs stocks

- Accessibility – If the fund manager is closed to new investment in other channels, then new demand for the investment strategy should funnel into the LIC, and thus help support the LIC’s share price.

Premiums and discounts through the investment cycle

Individual LICs can oscillate between trading at a premium and discount over time, especially during different parts of an investment cycle. Reasons for a discount may include:

During the initial stages of COVID‐19 in March 2020, when stock market volatility increased dramatically, a number of well‐known LICs saw their discounts to NTA expand to more than 25%, before recovering strongly in the following months. For investors with capital available at the time, this proved to be an opportunity. History now shows that investors who took advantage of the COVID‐19 related sell‐off were rewarded with a significant rebound in the value of assets held within their LIC investments. Furthermore, these investors also benefited from share price gains due to the tightening of discounts between the share price and NTA.

For equity‐focused LICs, history has also shown that LIC share prices can underperform in the late stages of bull markets as investors seek individual stocks with strong momentum. It is often not until there is sustained share market weakness that investors ‘rediscover’ one of the main benefits that LICs provide ‐ access to a professionally managed active fund with the ability to put its fixed capital base to work.

How can LIC managers minimise the impact of premiums and discounts?

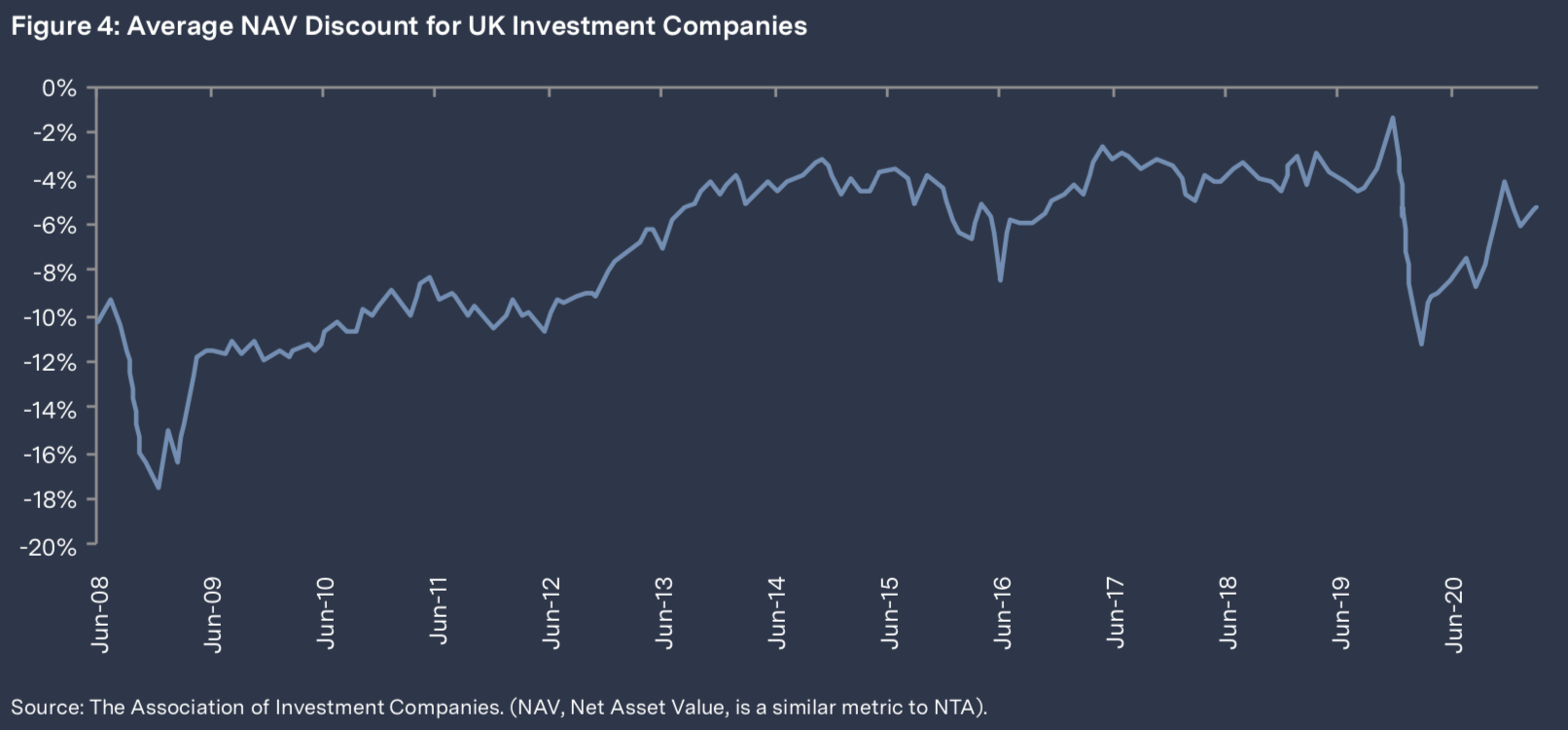

While some of these techniques may not always be as effective or as fast as investors may like, many UK funds have utilised a variety of ‘discount control policies’ and the UK industry has broadly managed to close its discount over time, as shown in the below chart. Many of these techniques are equally applicable to Australian LICs.

Firstly, it is clearly important that the underlying portfolio of a LIC is performing well and this should always be the core focus of any investment team.

Secondly, good investor relations and marketing can have a positive impact and a number of Australian LICs have closed their discounts through increased transparency and communication. Keeping clients informed, increasing brand awareness and constantly cultivating new investor demand all play key roles in supporting a LIC’s share price.

Thirdly, a tool that is commonly used to respond to discounts is a ‘share buyback’, through which the LIC purchases its own shares on‐market. A number of Australian LICs have announced on‐market buybacks. Some of these buybacks are relatively active, while others are ‘on hold’ and will only be utilised selectively. Buybacks provide support to LIC share prices on the days of purchase and this may help improve investor sentiment over the longer term.

Buybacks can also be accretive to the LIC’s returns, especially if undertaken at deep NTA discounts.

However, buybacks are not a long‐term solution, and the continued buyback of securities also leads to a reduction in fund size which may create additional challenges for LICs that are already subscale.

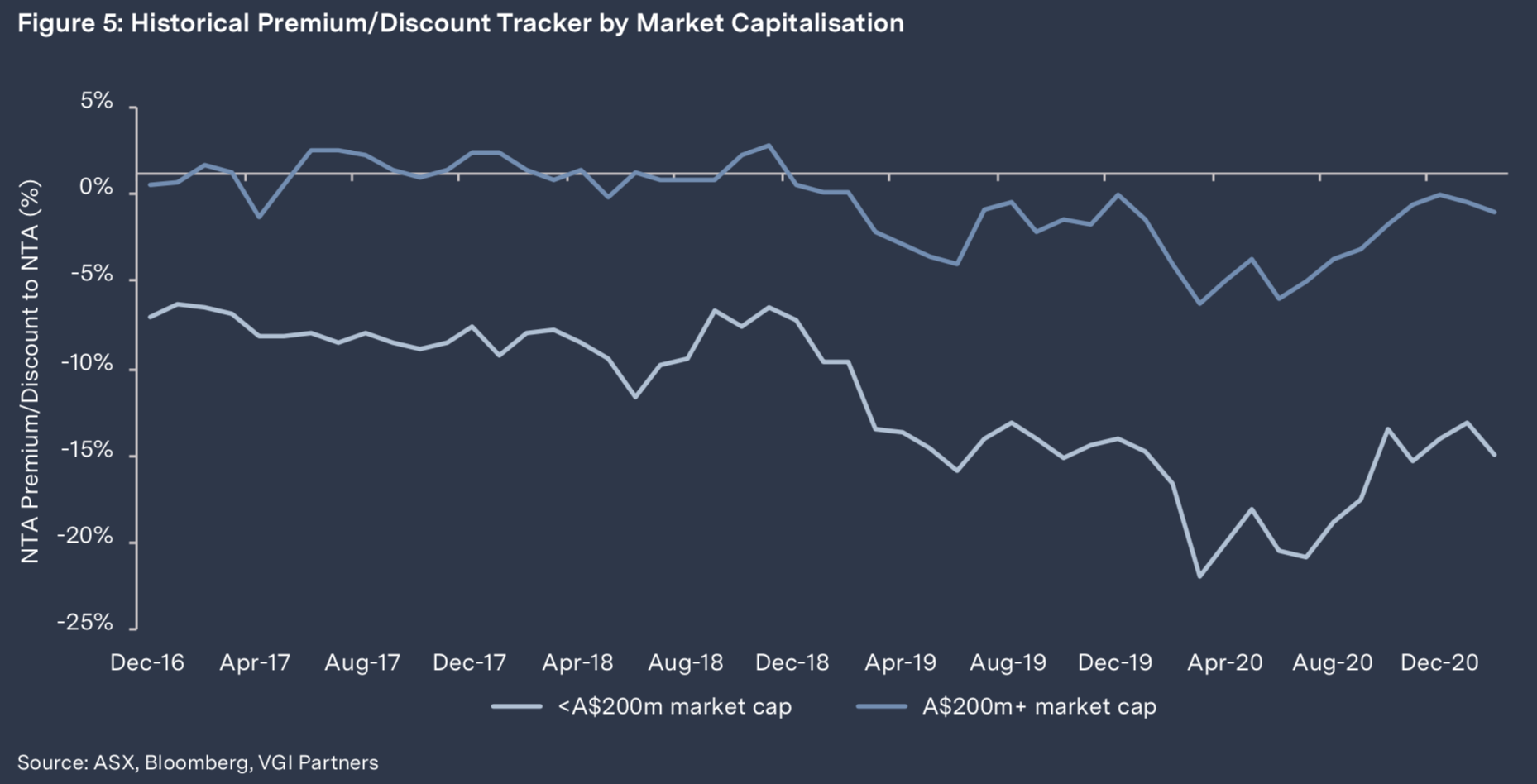

In particular, smaller LICs can have low trading volumes, which often exacerbates the discount. The chart below shows that ASX‐listed LICs with less than $200m of FUM have much larger discounts on average than larger LICs.

Which investment strategies make sense in a LIC structure?

For funds that are equities focused, the closed‐end nature of LICs is beneficial to high‐conviction, long‐term strategies. As flagged earlier, the structure reduces the likelihood of the fund manager being a forced seller or buyer at inopportune times.

In a similar vein, the LIC structure is also helpful for funds that are invested in illiquid assets, such as property. There have been many examples globally of open‐ended funds forced to freeze redemptions when they have been unable to liquidate positions fast enough, or at values that seem reasonable

Taking advantage of LIC opportunities

As this paper has discussed, while investors should be aware of the risk that a LIC may trade at a discount, the flipside is that discounts can represent a compelling opportunity for new investors, as discounts can allow cheaper entry into a diversified portfolio of underlying companies than if those securities were bought directly.

There are many successful international investment firms that look for well‐managed LICs and purchase shares in them when discounts appear.

Their thesis is based on discounts being temporary dislocations, so buying LIC shares can provide upside from the discounts narrowing as well as portfolio returns. Retail investors in LICs can utilise exactly the same strategy.

For those investors who are not confident in ‘picking the bottom’ in terms of discount, it may be best to take a long‐term view when investing in LICs, say five years or more. This means being aware and comfortable that the share price may oscillate between premium and discount throughout an investment cycle.

To view the full report, see below.

Diversification preserves wealth. Concentration builds wealth

VGI Partners is a high conviction global equity manager, focussing on businesses with secular growth, attractive industry structures and where they believe they possess insights not appreciated by the wider investment industry. For further information, please use the contact form below.

5 topics

VGI Partners is a high conviction global equity manager, focussing on businesses with secular growth, attractive industry structures and where they believe they possess insights not appreciated by the wider investment industry.

Expertise

VGI Partners is a high conviction global equity manager, focussing on businesses with secular growth, attractive industry structures and where they believe they possess insights not appreciated by the wider investment industry.