We (didn't) work (and what that means for co-working real estate in 2024)

In another blow to the office sector, WeWork, the global flexible workspace provider, has declared bankruptcy and initiated a re-organisation to strengthen its capital structure. The company aims to further rationalise its commercial office lease portfolio, rejecting 69 office leases in North America (predominantly in New York and San Francisco) while continuing to operate most of its locations outside of the U.S.

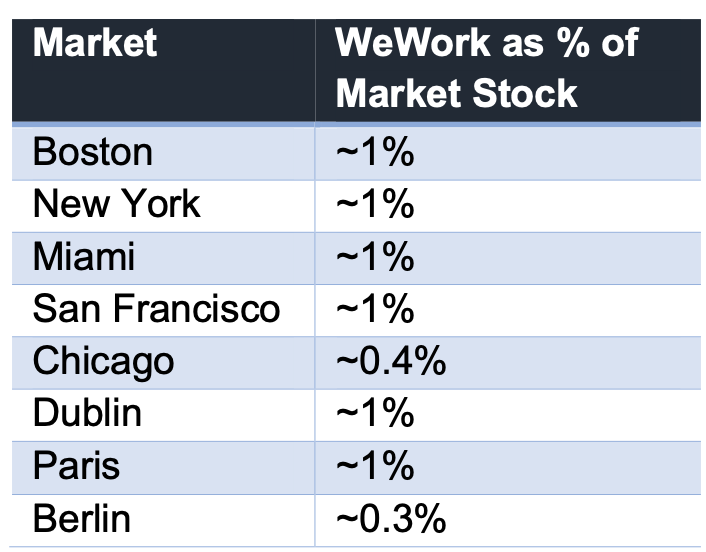

As of 30 June 2023, WeWork had a network of 777 locations in 39 countries around the world, leasing approximately 43.9 million sqft. Estimates put WeWork as a percentage of total office inventory at around 1% in key global office markets.

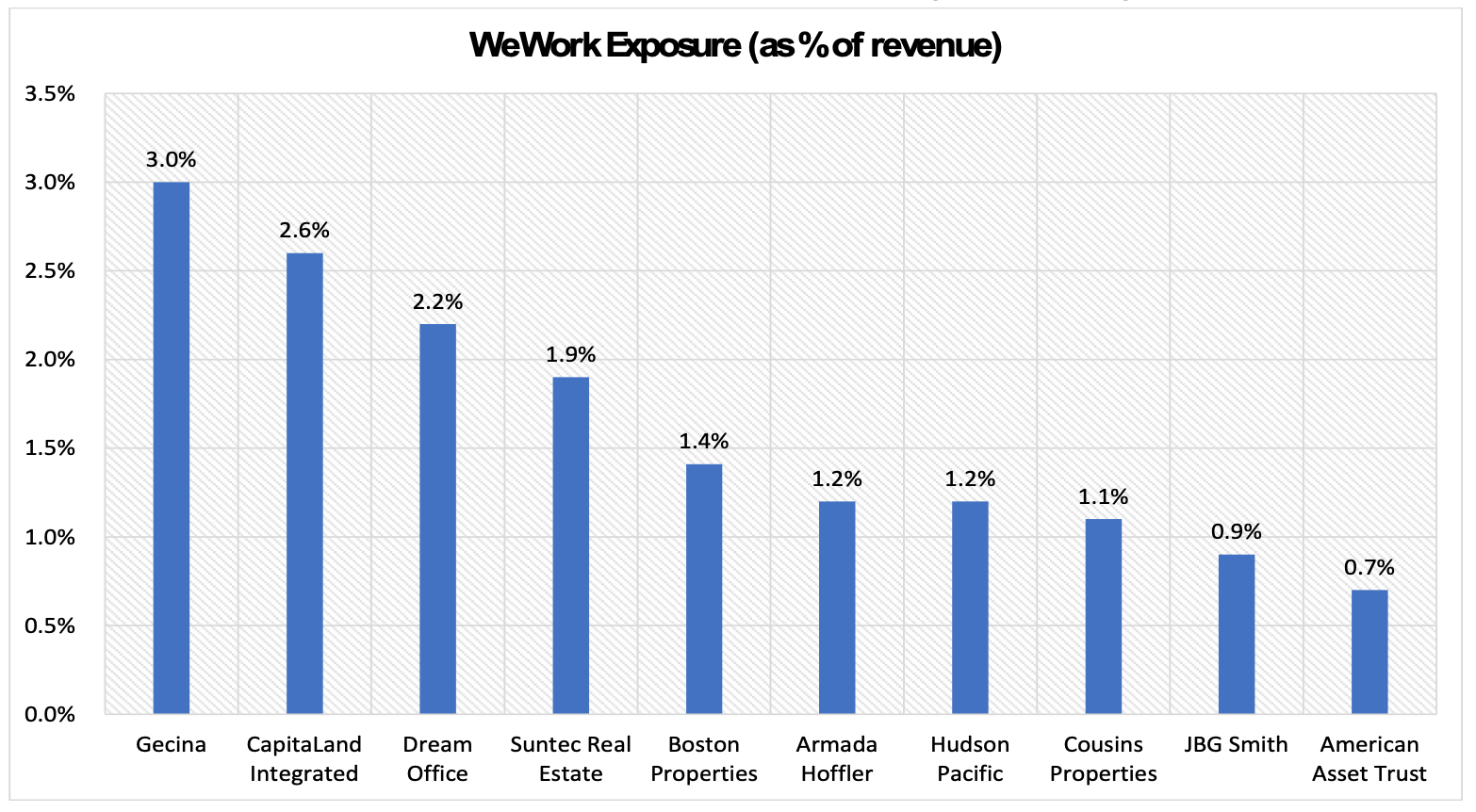

WeWork has already been in decline for some time, and as such we do not view the consequences for office REITs as overly concerning. Only a few listed REITs have more than 2% direct exposure to WeWork as a tenant. In the case of Gecina (EPA: GFC), which has the largest exposure at 3%, its WeWork exposure is located in central Paris where the market vacancy rate is 2.0% and in Singapore where Capitaland Integrated (SGX: C38U) has exposure, the market vacancy rate is 4.3%.

WeWork is not listed in the top 10-15 tenants of any holdings in Resolution Capital’s Global REIT portfolio.

Listed Office REIT’s Disclosed Exposure to WeWork (% revenue)

Source: Resolution Capital, November 2023

Nevertheless, the bankruptcy is another blow to the already struggling office sector, and a stark contrast to the heady days when WeWork was expanding exponentially, fuelled by private equity venture capitalists pouring easy money into startups that were fundamentally poorly structured companies.

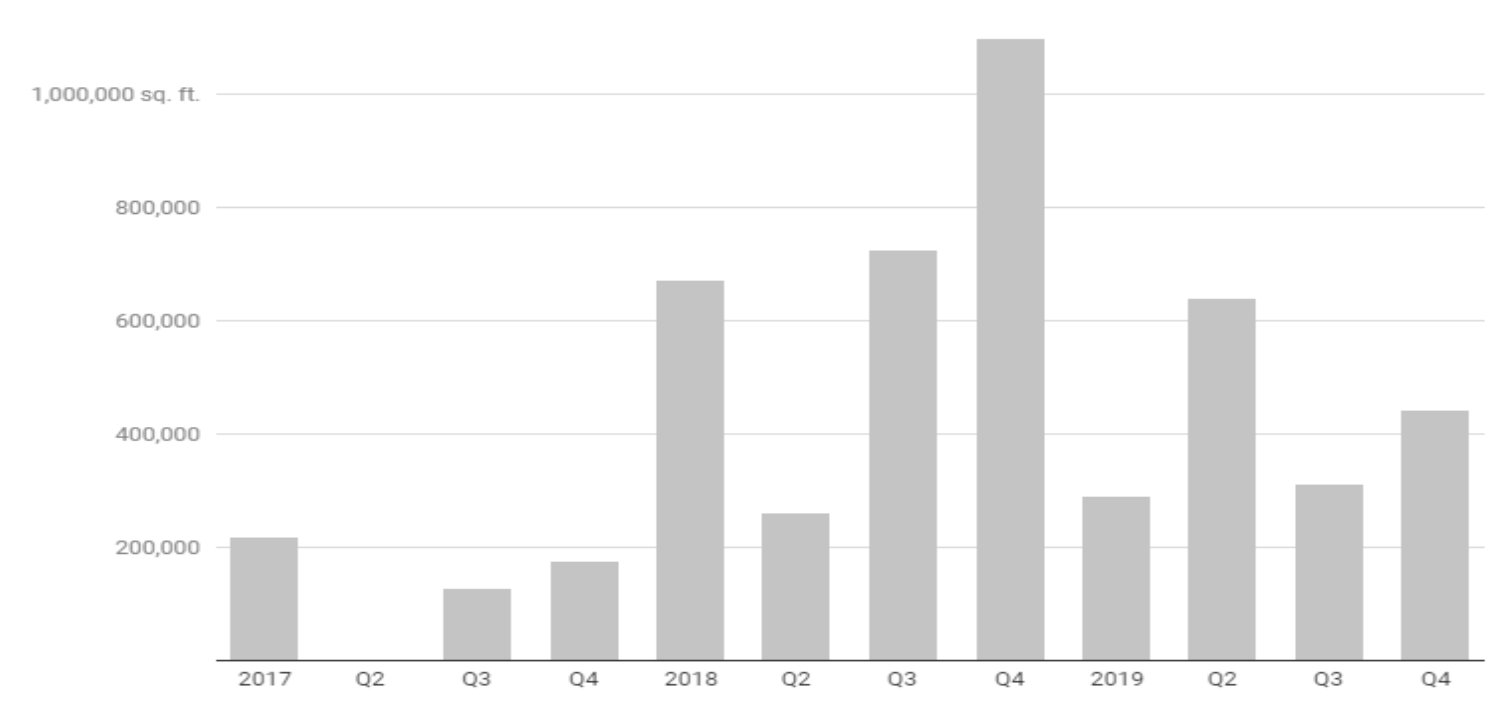

At its peak in 2019, WeWork was the largest single driver of office leasing demand in multiple cities across the globe and even surpassed JP Morgan as the largest occupier of space in New York city.

Space leased by WeWork in Manhattan each quarter

Source: Cushman & Wakefield, 4Q 2019

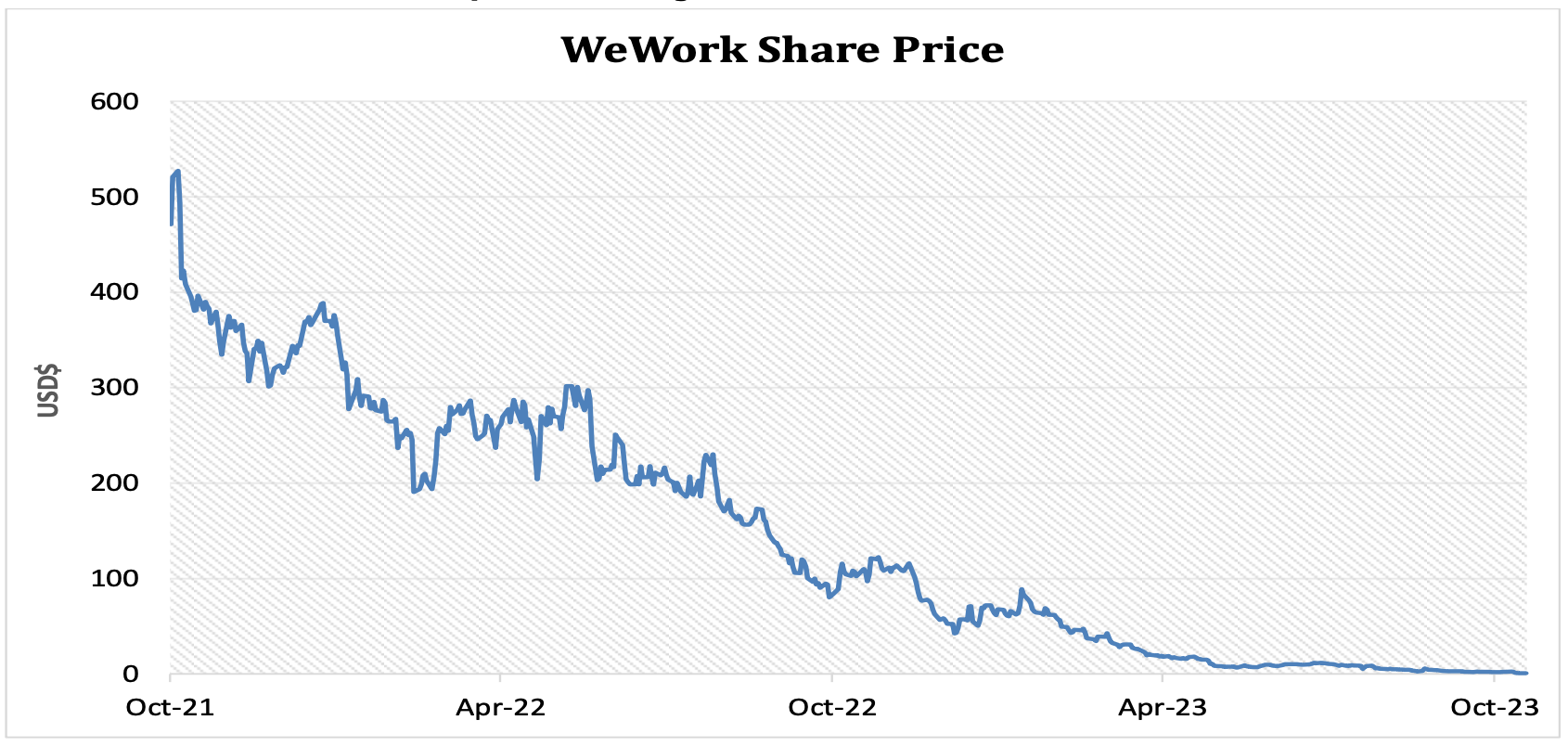

In our June 2018 quarterly report, we wrote (excerpt below) about the rapid rise of co-working office operators, including WeWork, expressing our concern about the credit quality of such fast-growing and profitless companies with operationally leveraged business models that have a fundamental duration mismatch. At its peak, WeWork was valued at US$47 billion by its private equity backers, but an attempted initial public offering (IPO) in 2019 brought the scrutiny of public investors who disagreed with the value and were concerned about the company’s rapid expansion, its business model and apparent disregard for corporate discipline. This setback prompted the company to commence cutting costs and rationalising its space commitments. Adam Neumann, the founder of the company, also departed as chief executive, although not empty-handed after an exit package reported to be c.$500 million.

The company eventually went public in late 2021 via a SPAC1 with a market capitalisation of $8.5 billion which has since fallen to under $50 million at the time of its bankruptcy filing in November 2023.

While the COVID pandemic, the shift to hybrid work and increased competition in the flexible office space industry all contributed to its de-rating, the Company’s demise was fundamentally rooted in its legacy long-duration leases which quickly became unsustainable as office vacancies surged and market rents declined.

As we wrote in 2018, industry incumbents have had a chequered past. Recognising the duration mismatch, industry stalwart IWG had long ago mitigated that risk by predominantly signing leases on a non-recourse basis to the parent company (the founder often referred to the additional cost of running separate corporate entities for each location as an ‘insurance premium’ it was willing to pay to enable IWG to cancel leases when office market conditions deteriorated).

At the time of its rapid expansion (and peak hubris), many office landlords (to their credit) demanded parent company guarantees when signing leases with WeWork. Ultimately, however, WeWork’s bankruptcy leaves them in a similar position to those who are at the wrong end of IWG’s ‘insurance policy’.

Notably, IWG has since transitioned its business to an ‘asset light’ model akin to a ‘fee for service’ where it acts simply as the operator of serviced offices rather than committing to long term leases. In our opinion, neither model is ideal from an office landlord perspective, and investors need to price the risk of credit events appropriately where serviced office operators are a material exposure.

WeWork Share Price since public listing October 2021

WeWork reported a global occupancy rate of 72% as of 30 June 2023, a 300bps decrease from December 2022.

North America is weaker at 68% compared to locations such as Paris at 83% and India at 78%. It is therefore not surprising that WeWork has so far rejected 69 leases in North America, as part of its bankruptcy filing, many of which were already not operational.

The majority of the discarded sites are concentrated in New York City and San Francisco, cities that previously constituted a significant portion of the Company’s portfolio. It is anticipated that WeWork will continue to seek to reduce tenancy costs and renegotiate leases in more desirable locations that were signed at pre-pandemic higher rental rates, aiming for the more favourable market rates currently available.

WeWork’s downfall comes at a time when the office sector is already struggling with elevated vacancy rates and weak tenant demand, even before the impact of weaker macro-economic conditions begins to be felt more broadly across office-using industries outside of the technology sector.

Add to that the imminent debt maturities expected to unfold in 2024-25 for highly-levered private office landlords, and the prognosis for the office sector looks particularly dire.

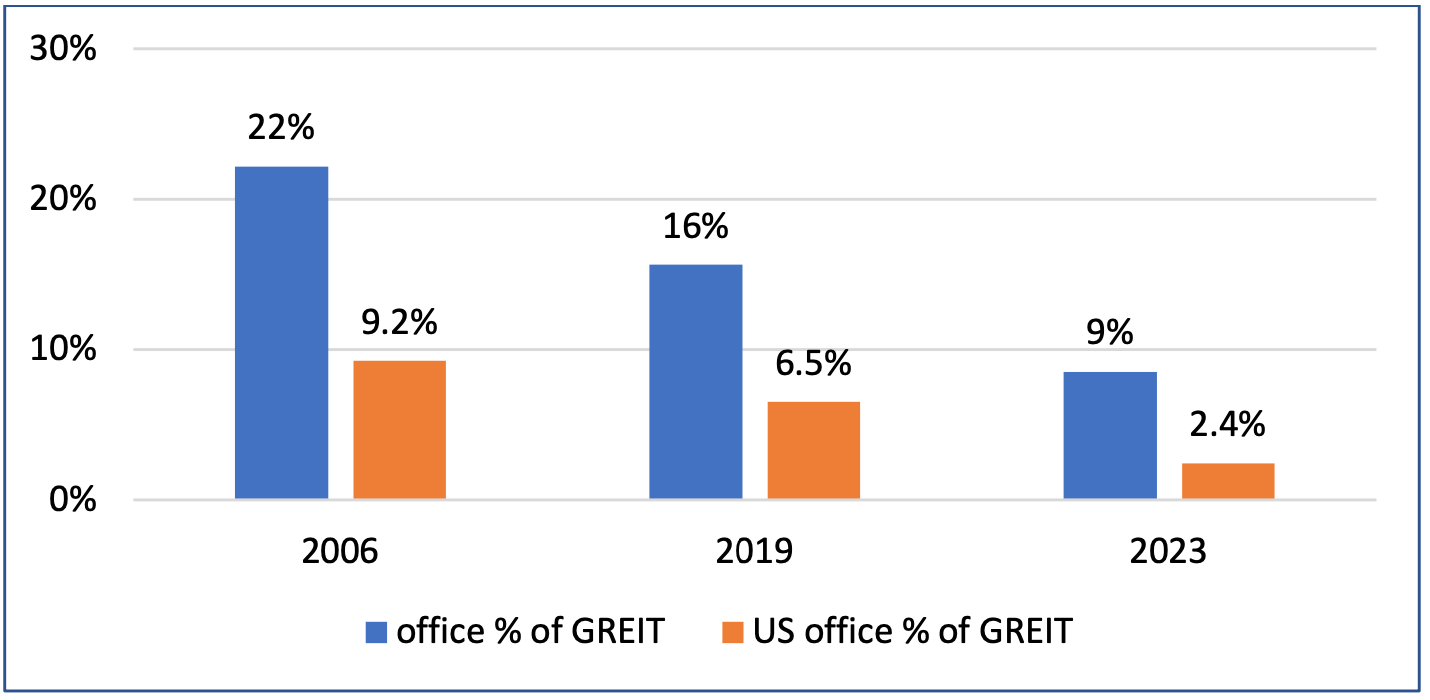

With this backdrop, it would be easy to discard the entire office sector as un-investable. Indeed the listed GREIT market largely has, with the office sector representing only 10% of the FTSE EPRA Global Developed index, down from ~16% in 2019. Many US office REITs have declined by more than 50% from their 2019 levels and are trading at or below GFC multiples.

Public Office REITs as % of Global REIT Index

We also remain wary, with the Resolution Capital Global REIT portfolio maintaining an underweight exposure to the office sector.

Nevertheless, we continue to monitor office REITs for select value opportunities, recognising the listed market has already factored in a lot of the negatives. Our select office exposures, representing approximately 6% of the portfolio, have sound balance sheets and are focussed in markets with relatively low vacancy rates such as London’s West End, and central Tokyo.

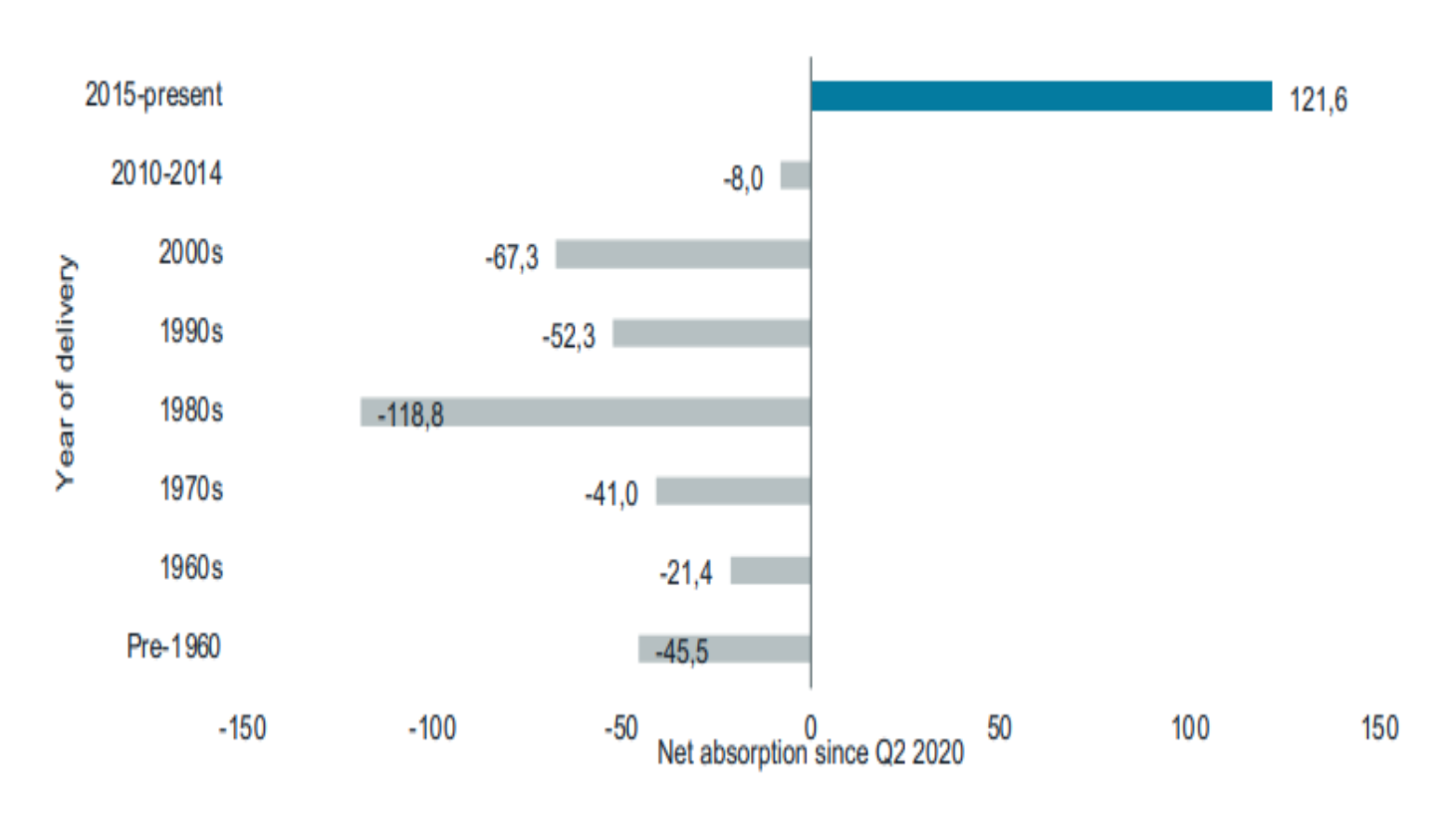

We note that even in a tough environment for the industry, select office landlords can win market share. The "flight to quality" has been a prominent theme gaining momentum since the pandemic as newer, amenity-rich buildings closer to public transportation have been capturing a greater share of the leasing market.

It is expected that WeWork's prime locations will remain operational, whether managed by WeWork or by other operators in the future. WeWork's customers are unlikely to vanish, instead, many are expected to transition to other coworking operators or to take direct leases with landlords, who are likely to retain the extensive office fit-outs.

Net absorption by building vintage

Note: Our previously published thoughts on the rapid growth of the co-working sector, from June 2018, are available in the full version of this article, as attached here.

Learn more

We believe that listed real assets is an excellent means of gaining exposure to the underlying returns of some of the world’s highest quality real estate and infrastructure assets in a simple, transparent, liquid and tax efficient form.

1 topic

1 stock mentioned

2 funds mentioned