We’re “tactically bullish” on copper – Citi

Major broker Citi has provided an update on its views on the copper market in the wake of the recent COP28 conference on climate change and in the lead-up to the Chinese Lunar New Year in February. Overall, the broker is positive for the near-term prospects for copper, but is more cautious about what 2024 has in store.

Copper prices have been on a rollercoaster since Russia’s invasion of Ukraine which spiked the prices of most industrial metals. Copper has long been considered a key indicator of global economic growth due to its ubiquitous use across manufacturing and construction, and for this reason, it has gained the popular moniker “Dr. Copper”.

The theory is: A healthy copper price indicates a healthy global economy, and vice versa.

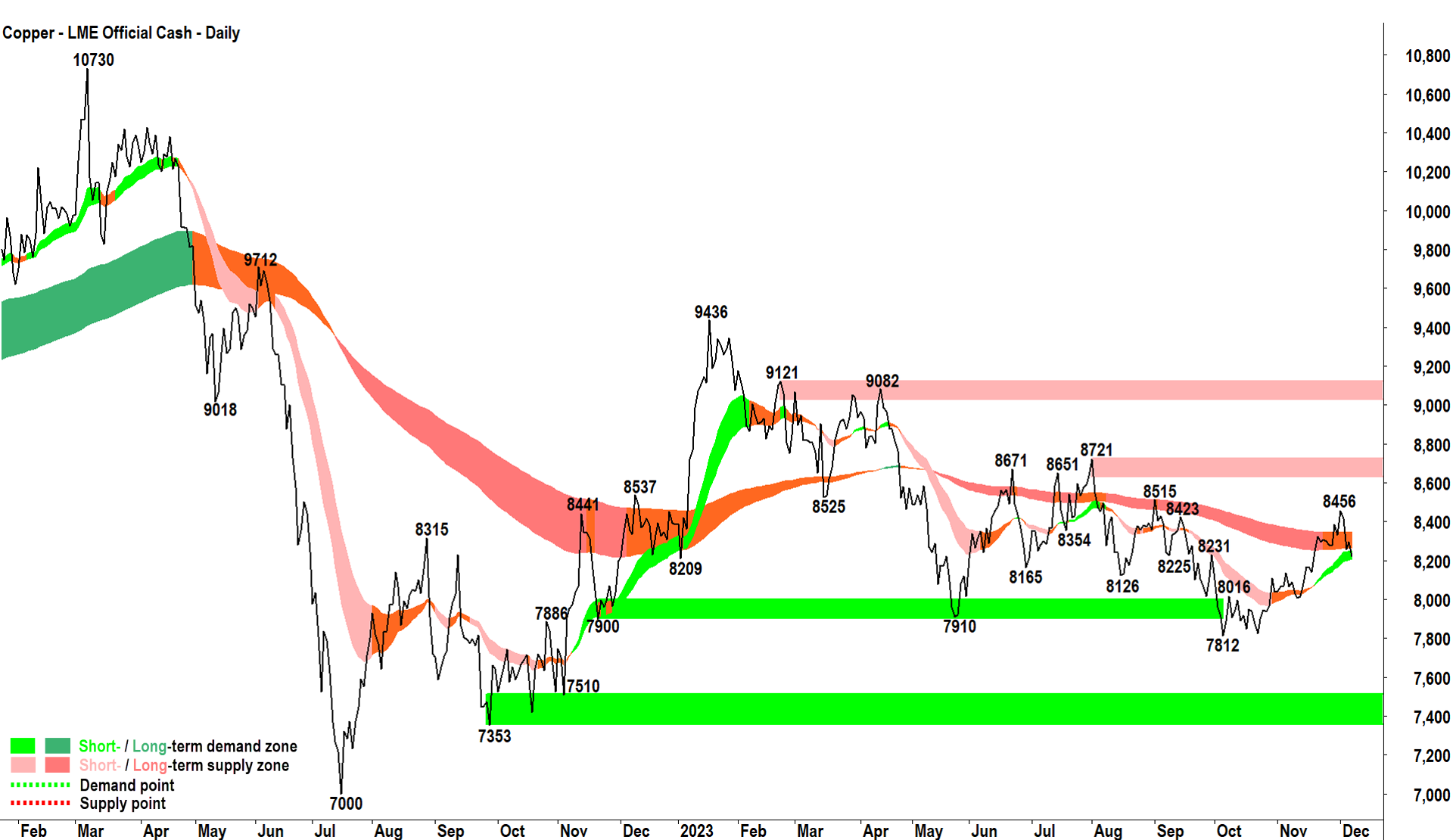

The chart above illustrates the wild ride for copper prices since 2022, and if you’re investing in Aussie copper stocks, you would no doubt have felt these swings in your portfolio as well. For most of the period since the Russia-Ukraine conflict, the negative impact of rising interest rates on global economic growth has dragged on sentiment for copper.

First, the good news from Citi

Copper bulls would also be aware of a recent resurgence in the price of the red metal. London Metals Exchange (“LME”) copper bottomed just below support at US$7,812/t in early October and peaked recently at US$8,456/t. According to Citi, LME copper largely achieved their near-term price target in this run. The good news for copper bulls, though, is that Citi expects the recent pullback to US$8,221/t will likely be short lived.

This is because Citi says its “base case” is for further economic easing in China which will help drive a “renewed rally in the coming weeks” for copper. Citi is optimistic initiatives by Chinese policymakers to boost urban village redevelopment and affordable housing will help boost overall demand from the property sector, and this will help change the prevailing bearish sentiment towards the sector.

Along with a weaker US dollar, Citi says, this should provide support for all metals prices, including copper.

Now for the bad news…

Unfortunately, copper bulls, Citi expects any renewed strength in copper prices may not extend much past the Chinese Lunar New Year in February. This is because the “full impact of Chinese policy is unlikely to completely offset the drag” from weaker growth in other developed markets in 2024.

Citi believes the worst is potentially still to come for the global economy as higher interest rates continue to bite into end demand. This is harming global manufacturing, and Citi feels we are yet to reach “peak weakness”. Citi’s economics team forecasts a recession in the USA from mid-2024, and that a tepid German economy would also help “lead a contraction in European GDP”.

The all-important ‘target’ call

Citi notes total copper consumption will remain resilient, likely rising around 2.3% in 2024 with much faster growth in demand from sectors focussed on decarbonisation (around 16%). It is the latter which Citi sees as helping likely offset the drag from slower growth in the rest of the global economy in 2024.

Indeed, in the longer term, Citi’s modelling of COP28 pledges suggests as much as 4.1Mt of additional copper demand by 2030. To put this into perspective, according to Citi’s numbers, producers could only add an extra 1.7Mt of mine supply over the past four years.

The problem in the short-to-medium term, however, is hedge funds are likely to continue to play the bear side on copper in 2024 “as selling as growth weakness materialises”.

In conclusion, after considering all the potential jigsaw pieces of global economic growth in 2024, Citi says they’re “neutral to bearish” overall on the prospects for copper and other industrial metals. Their 6-12-month price target for copper is US$8,000/t, approximately 2.7% below the current LME price.

This content originally appeared on Market Index.

5 topics

5 stocks mentioned