WebCentral - simplified and on the growth path

Back in March, I wrote about WebCentral (ASX:WCG), the third-largest domain and hosting business in Australia.

WCG had just been the subject of a complex bidding war, with 5G Networks (ASX:5GN) emerging with 45% ownership and board control, kicking off a turnaround phase for the business.

It’s been a very busy six months for the company, so an update is warranted.

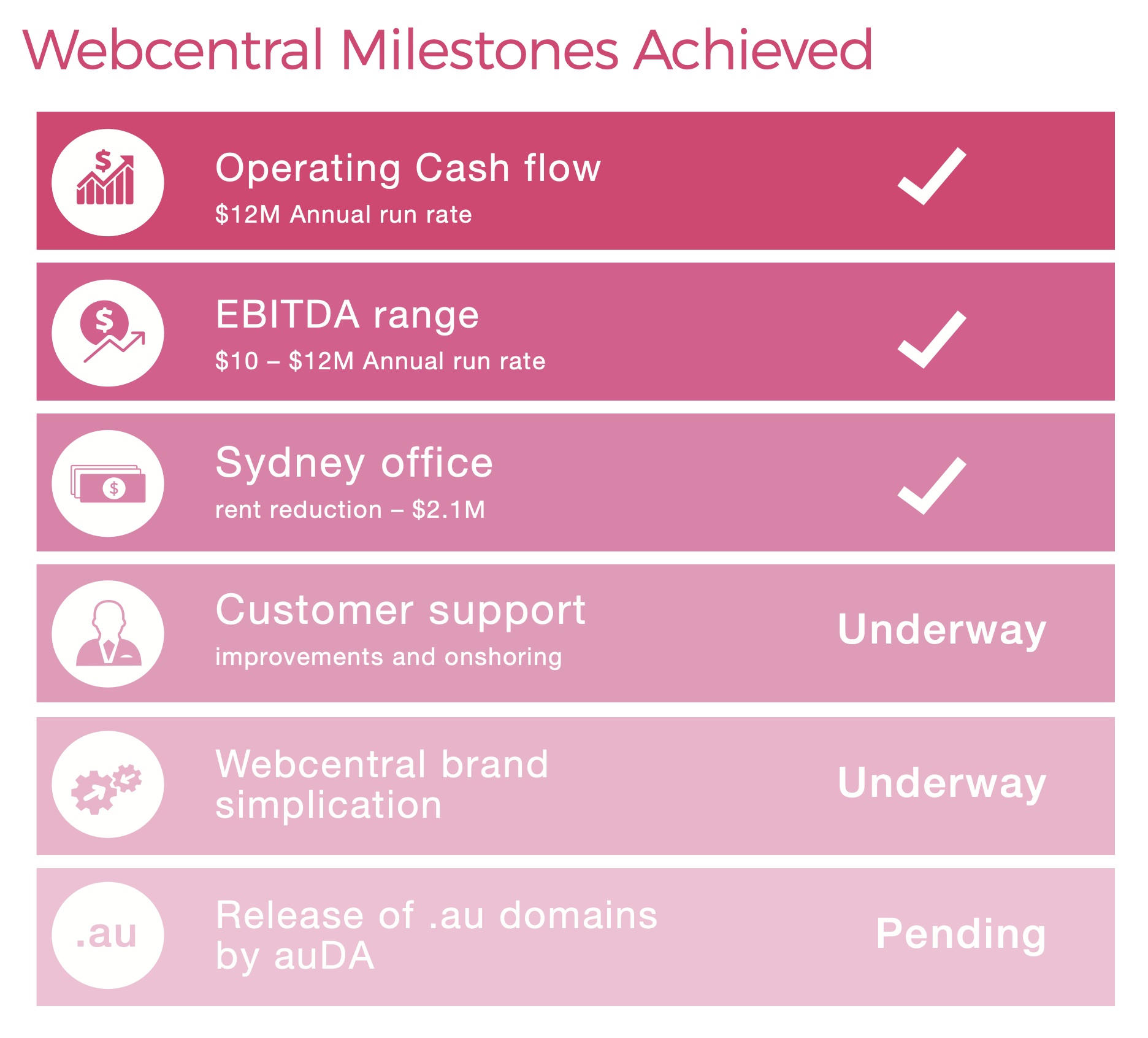

Since the original wire, the new management team have undergone a cost-out strategy that has successfully lifted EBITDA from $2-$3 million a year to a run-rate of $12m today, based on the recent trading update.

Current EBITDA margins of c.20% are broadly in line with industry norms. Cutting costs was the first phase to our thesis, and that is now largely complete.

The second part of the thesis was resolving the complexity that resulted from the bidding process.

At its core, WCG is a largely recurring revenue, capital-light, predictable and cashflow generative business. The type of business that should trade on a relatively high earnings multiple.

And indeed, the stock did initially perform well as management right-sized the cost base and functionally integrated with 5GN to reduce overheads.

But as a result of the bid, WCG had a controlling shareholder to which it owed $40m of debt. We had outlined in the previous wire a number of reasons why there were protections in place for minority shareholders, but at the end of the day the market likes simplicity, and the stock wasn’t going to reach full value until this was resolved.

There were several potential solutions we thought might be available to WCG, one of which was a merger.

In the end, we were only half right.

Merger creates mid-cap integrated telco, hosting and domain provider

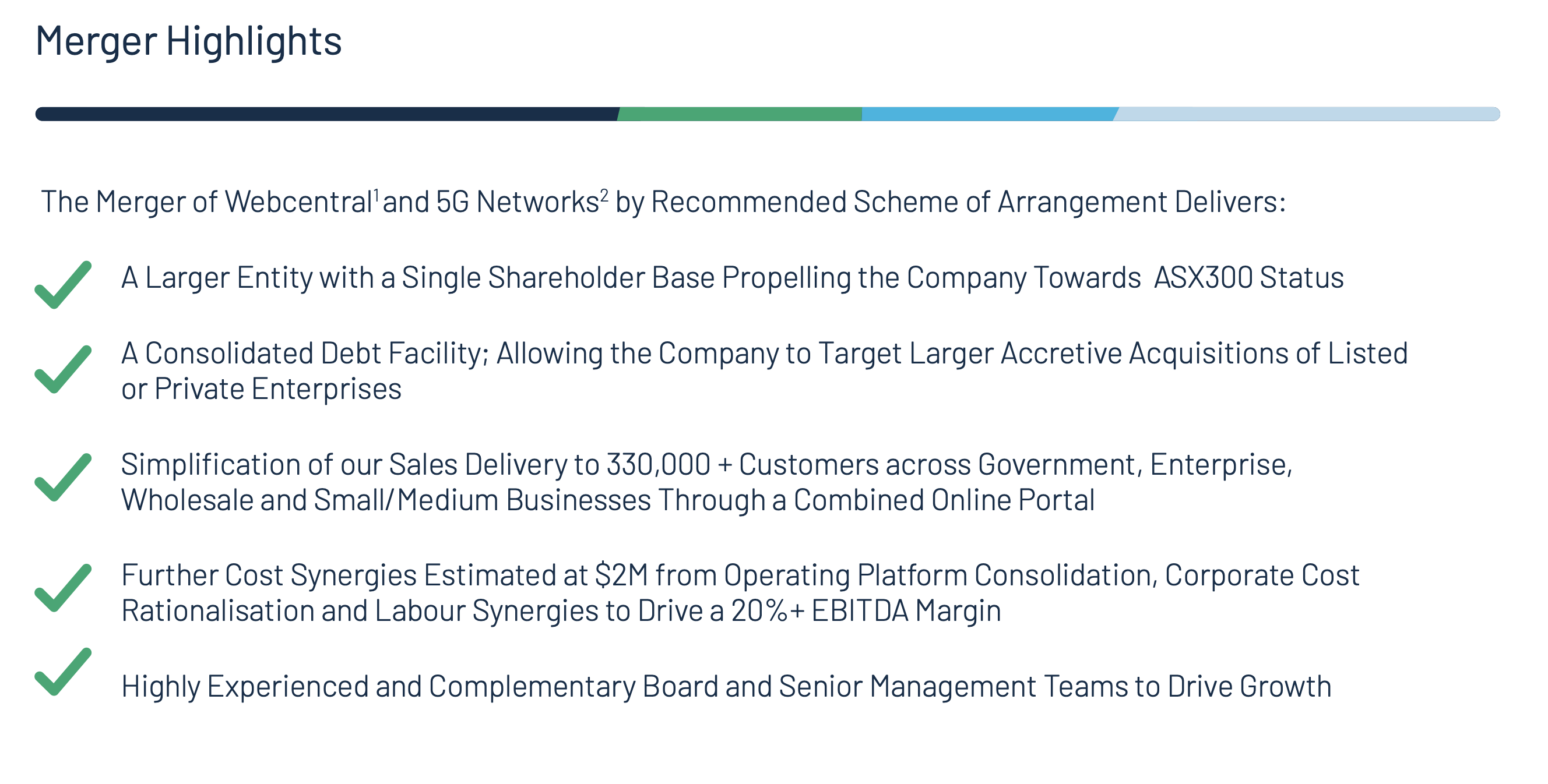

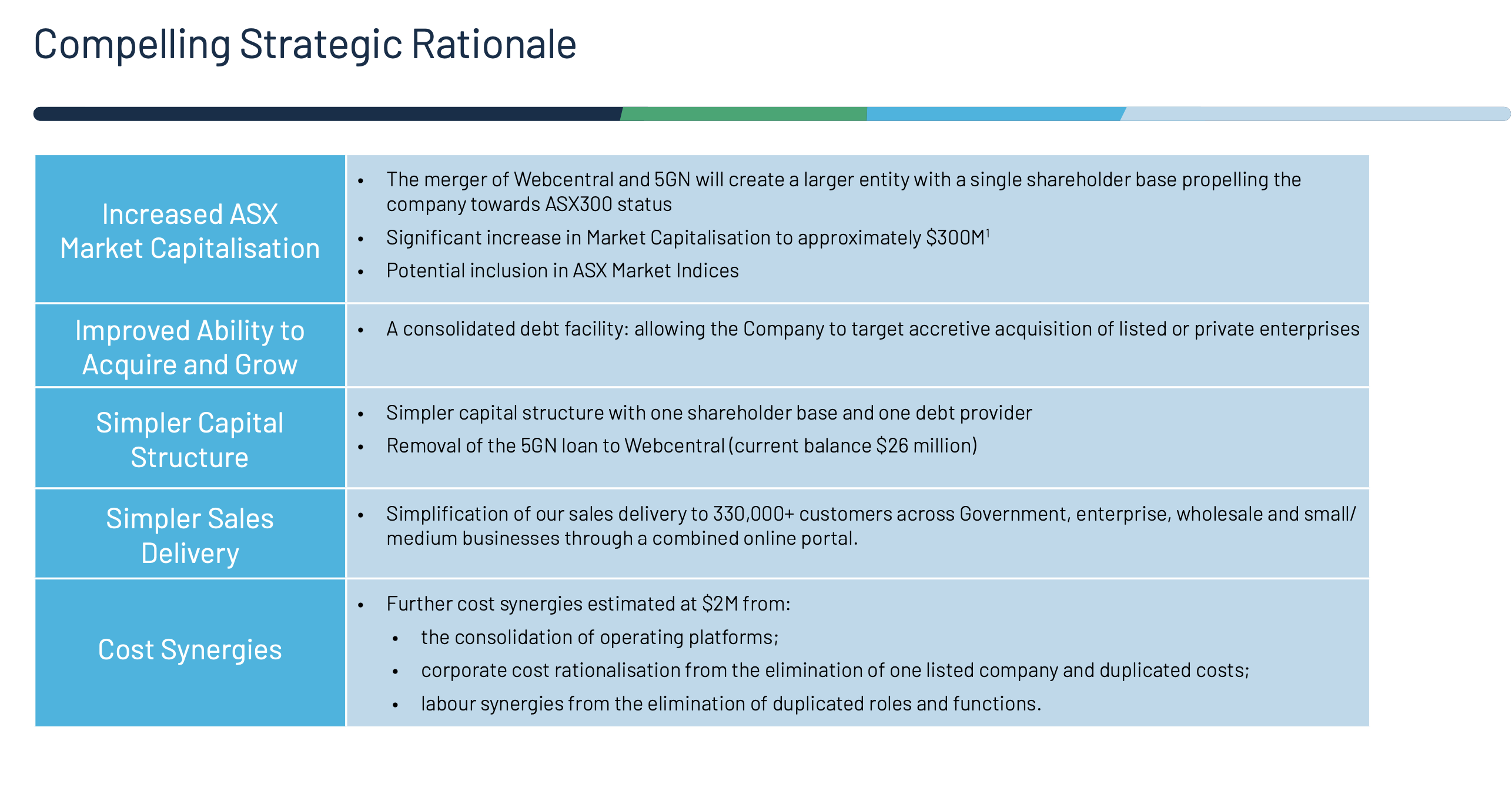

In July, WCG announced it would be merging with 5GN, creating a simplified corporate entity and investment thesis with a larger market cap, a strengthened balance sheet and improved liquidity, making it an eventual candidate for indices like the ASX300.

We did note that a merger was a possible solution and likely to unlock a lot of value, hence we would be supportive. While we got this part right, we were (pleasantly) surprised to see the hunter become the hunted, and WCG make a scrip bid for 5GN.

Why the pleasant surprise?

Because this structure is far more accretive for shareholders of the combined entity, post deal completion.

Firstly, if the merger proceeds, the debt owing to 5GN (now c.$26m) will be offset. The consolidated balance sheet will sit at c.$8.4m net debt.

That will leave plenty of room for further acquisitions (including the CNW deal that we’ll talk about in a moment).

Secondly, the c.70m shares (45%) that 5GN owns in WCG will be cancelled, meaning far less dilution and a simpler capital structure.

On merger completion, WCG will have approximately 320m shares on issue, which at the current price is $160m market cap. Net debt will be approximately $8.4m on a pro forma basis, giving an EV of $168m.

Guidance for the combined group is $23m+ pro forma EBITDA in FY22, which incorporates c.$2m of merger synergies, and is prior to any further growth.

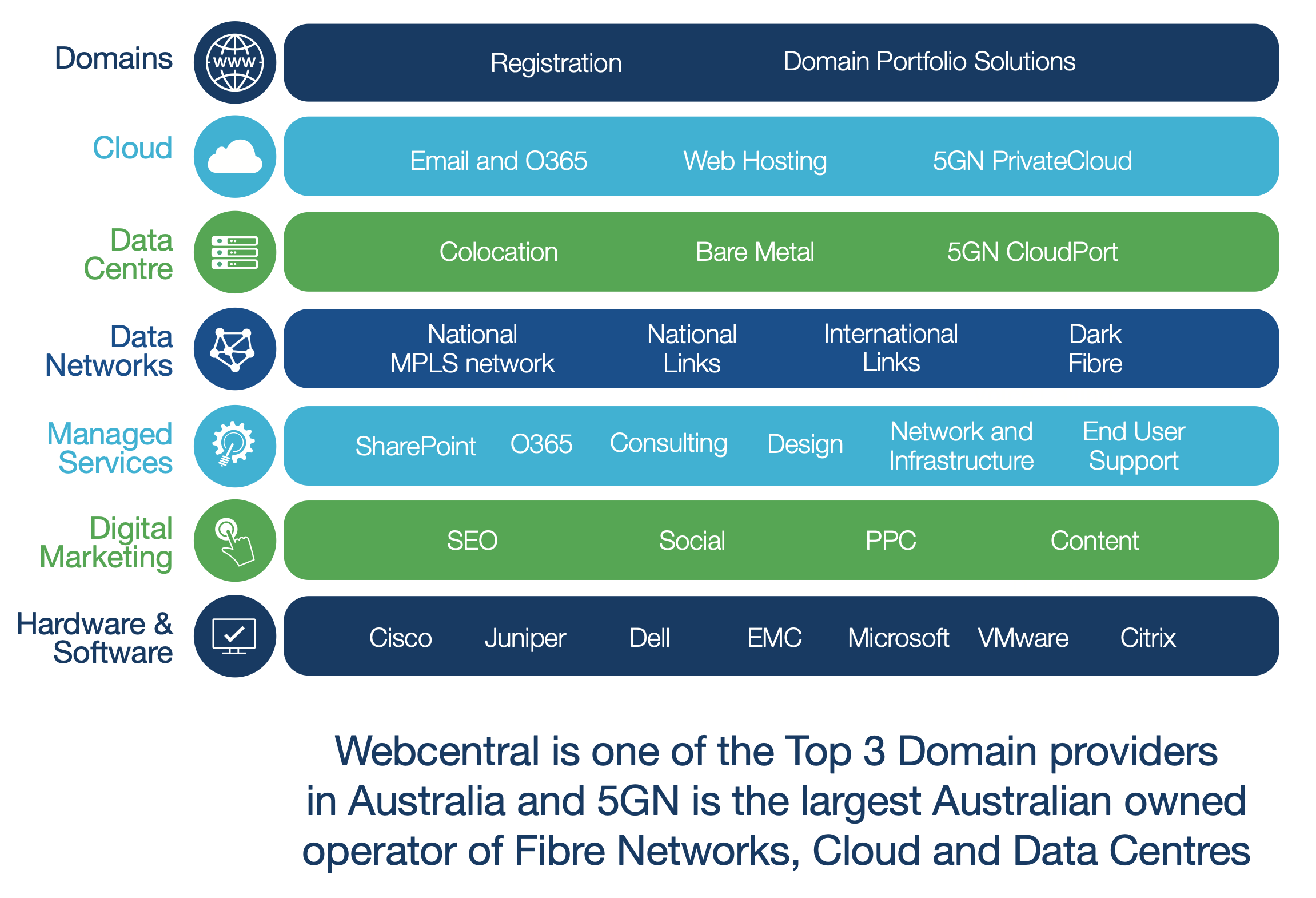

It will create an integrated telco, data centre, domain and hosting business servicing over 300,000 SMB’s in Australia and NZ trading on just 7x EV/EBITDA.

The telco sector generally trades on 12-16x, while the market darlings like Uniti Wireless (ASX:UWL) and Aussie Broadband (ASX:ABB) trade closer to 25 times.

So, before we factor in any growth, and assuming merger completion, WCG looks to be 75-100% undervalued based on lower growth peers and far more substantially so versus the faster growing players in the space.

It will also become a candidate for the ASX300 and other indices, owing to the greater scale, larger market cap and improved liquidity that it creates. Entry into an index can be a powerful driver of capital flows and share price performance.

But most importantly from our perspective, it simplifies the corporate structure into one entity with one shareholder base and a single mandate for growth, both organic and acquisitions.

Growth From Here – Organic

For this section, we’ll assume the WCG/5GN merger has completed and speak from the perspective of the combined group.

In our last wire we highlighted the upcoming release of .au domains from industry governing body auDA and how that was going to drive an uplift in revenue.

What we got wrong was the timing. We thought the .au domain release was going to occur at the start of FY22, but it was delayed.

Since then, auDA have announced the formal release date for March 2022 and provided the industry with a framework of rules for how it will work.

Source: auDA

What does the .au domain release mean?

As an example, I currently own CapitalHManagement.com.au.

I’ll be given a window of time (six months from when applications open in March 2022) where only I can purchase CapitalHManagement.au and can only do so from my existing domain provider.

I will do it simply because it’s a nominal expense for the protection it grants me. I’ll then keep both domain names and have them redirect visitors to the same website.

In theory, if I didn’t purchase the .au domain and the exclusive window expired, someone else could (by chance or with malice) purchase CapitalHManagement.au. Depending on what they decided to put on the website, we’d likely have several very confused current and prospective investors.

It's not worth the risk for the minimal outlay. Unsurprisingly, when they did something similar in the UK (.uk) the industry experienced a 30% increase in sales.

However, there is one important difference between the UK rules and those for the .au release.

In the UK, they gave the owner of the relevant domain name five years to register the .uk extension on priority allocation.

But for the .au release by auDA, that priority allocation period is just 6 months.

This intuitively means that there is more likely to be a rush of .au purchases and that the revenue uplift will be brought forward, starting from March 2022 when applications open.

Of the more than 500,000 domain names across the WCG customer base, 430,000 are Australian domains. Of those, 380,000 are eligible to purchase the .au extension exclusively from WCG.

The next question becomes, what portion of those 380,000 eligible domains take it up?

Our working assumption is currently that a third of those domains will purchase the .au extension. At $30/domain for 125k domains it is c.$4m revenue at 45% GM = $1.7m additional EBITDA (+14% uplift on current run-rate, largely recurring each year).

Important details to be aware of:

1) this sales opportunity is entirely incremental. There is little to no variable marketing cost as the sales are to the existing customer base, and those customers can only purchase the .au extension from WCG. An email blast is likely the main source of customer acquisition;

2) It is not just the $ received from the domain sale that is important, but the pull-through on other services. This is a chance to have those customers add other items to the cart and if WCG are smart, they will leverage it to cross-sell their expanding product base;

3) While the revenue can’t be recognised until March 2022 at the earliest, WCG can begin pre-selling the domains later this year. Domains are sold with the cash received upfront for a minimum of 12 months of registration, and then the revenue is recognised monthly. The cash impact will therefore occur before revenue, and because customers typically buy domains for more than one year at a time, it could be quite a meaningful inflow of cash upfront.

The WCG/5GN merger should complete later this calendar year, assuming shareholders approve the deal. That will unlock c.$2m of synergies.

Then shortly after that, the auDA release of .au will start to benefit the bottom line. While the full year's impact won’t occur until FY23, from March 2022 it will create a catalyst for news flow and, hopefully, upgrades to earnings expectations.

Then in fiscal 2023, we'll see the full impact of the .au release, a full year of synergies and uplift from what has always been the most attractive asset in WCG - cross-selling to the large SMB customer base.

Leveraging WCG’s Enormous Customer Base

The next piece to the organic growth story is the release of new products into WCG’s 300,000 strong customer base that spans Australia and New Zealand.

That 300,000 strong customer base is a big number. But let’s put it into context.

In total, there are approximately 2 million small businesses in Australia.

One of the telco market darlings mentioned earlier, Aussie Broadband (ABB), currently has 24,000 business customers.

While the bulk of the ABB business today is consumers, they recently raised $100m of capital to focus on expanding their B2B segment noting they want to transition to a one-stop-shop business solution offering. ABB’s market cap is $1 billion.

The other market darling mentioned above, Uniti Wireless (UWL), has secured approximately 550,000 premises. UWL’s market cap exceeds $2b. Not a perfect comparison by any means, but some context as to the size of the respective customer bases.

WCG’s market cap, pre-merger, is just $80m.

ABB’s strategy in essence is no different to WCG’s. For ABB, the initial anchor sale is a connection to the NBN and they’ll then develop that customer relationship to sell additional products and services like security, cloud hosting and hardware.

One of the planned new products into WCG's customer base, by chance, is NBN.

WCG is doing the same thing with domains as the anchor sale but is kicking off with a head start of 300,000 SMB customers. ABB is trading at $1b, and WCG at $80m.

I would note ABB is an excellent business and their customer service is second to none.

Put simply, those 300,000 SMB customers are a highly valuable asset if you can successfully develop the customer relationship. Most of the ability to do that comes from the level of customer service and satisfaction, which was historically a big problem at the old MelbourneIT.

But things seem to be going in the right direction. We asked management for some of these stats, as we think it’s a decent lead indicator for sales growth.

Over the last six months, case volumes have reduced by 66%. Days to resolution has dropped from 10 days to 4 days. And there was a 59.7% increase in NPS.

Post-merger completion, WCG can start offering those 300,000 customers a broad range of additional products and services, made available to add to the ‘shopping cart’ through the sales process. The .au release is a catalyst for this and a potential sales opportunity that should be leveraged.

And we think that if some of those larger telco players want access to a 300,000 strong SMB customer base that the current market cap of WCG relative to their own size certainly makes it look interesting.

Growth From Here – Acquisitions

One of the main upsides to the WCG/5GN merger is that the combined group has a single entity with a strengthened balance sheet to continue its aggressive M&A strategy.

In this part of the market, M&A is critical. Smart deal-making is essentially what built the current market darling in UWL.

The market loves to see aggressive M&A activity for businesses like this, and WCG post-merger will have the potential to do something similar to what UWL have done so well.

While the merger is yet to be completed, management hasn’t been standing still. They recently launched an on-market bid for Cirrus Networks (ASX:CNW).

CNW is a hardware and managed service provider generating c.$100m of annual revenues with a national presence.

They had previously given guidance of $4.2-$4.6m of EBITDA in FY21, before downgrading to $2m. We suspect a lot of this is due to delays in hardware (lower margin) sales, supply issues and Victorian lockdowns. But at the same time, there has been a history of missing guidance, meaning the market seems to have lost some faith.

What they do have going for them is a strong Canberra business (government clients) that generated $55m of revenue in FY21. 5GN does not have a strong presence in Canberra and this can be a hard market to break into organically. Further, to CNW’s credit, their recurring managed service business is apparently running at record levels.

The market cap is $30m, with $8m of net cash, leaving an EV of $22m. If we assume that EBITDA in a normal year is c.$3m, then CNW is trading on 7x EV/EBITDA at WCG’s bid price.

The Independent Expert’s Report assumed approx. $2m of corporate synergies that WCG could extract (CNW couldn’t extract this themselves). We suspect that figure is probably underdone and is more like $3m. That would take EBITDA under WCG’s ownership to approx. $6m and reduces the multiple to 3.7x.

This is, in our view, a perfect acquisition target for the combined WCG group.

WCG has acquired a 16% shareholding through their on-market bid and called a shareholder meeting. While the market was anticipating that they would lift their bid from 3.2c, as they are now the largest shareholder it looks possible that they will be able to get some form of control, or access to synergies, without needing to acquire the whole group.

Importantly, if they don’t acquire CNW in its entirety, that will leave them with plenty of capacity for other acquisitions.

Bringing it all together

If and when the merger goes ahead, it will create an integrated telco, data centre, domain and hosting provider with 300,000 SMB customers & 2,500 government and enterprise clients. The group will have over 300 staff, 5 data centres nationally with its own interconnected fibre network and over 500,000 domains under management.

The group will be generating more than $100 million of annual revenue and run-rating at $23 million of EBITDA.

Growth will come from auDA’s .au release, the new product pipeline and a strengthened balance sheet capable of restarting the company’s aggressive M&A plans.

At the moment, WCG is trading on just 7x EBITDA. Even the mature telcos are trading closer to 12-16x while the market darlings are well north of this.

To me, that’s far too cheap. We continue to think that WCG is worth north of $1/share and expect that on merger approval the share price will move towards that target.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

4 stocks mentioned