Weekly S&P500 ChartStorm - 19 June 2022

The Weekly S&P500 ChartStorm is a selection of 10 charts that I handpicked from around the web and from Twitter posts. The purpose of this wire is to add extra colour and commentary around the charts.

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective...

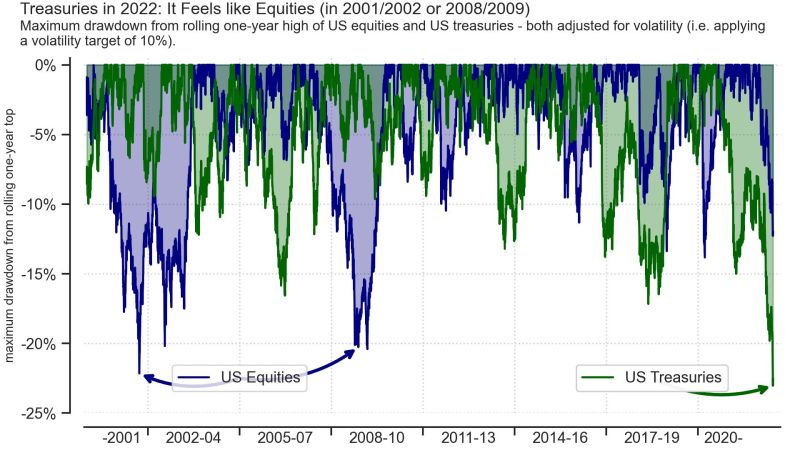

1. The worst of times: In hindsight, it was never going to end well when both stocks AND bonds were trading at crazy expensive levels. It is the worst-case scenario for traditional passive buy-and-hold portfolios.

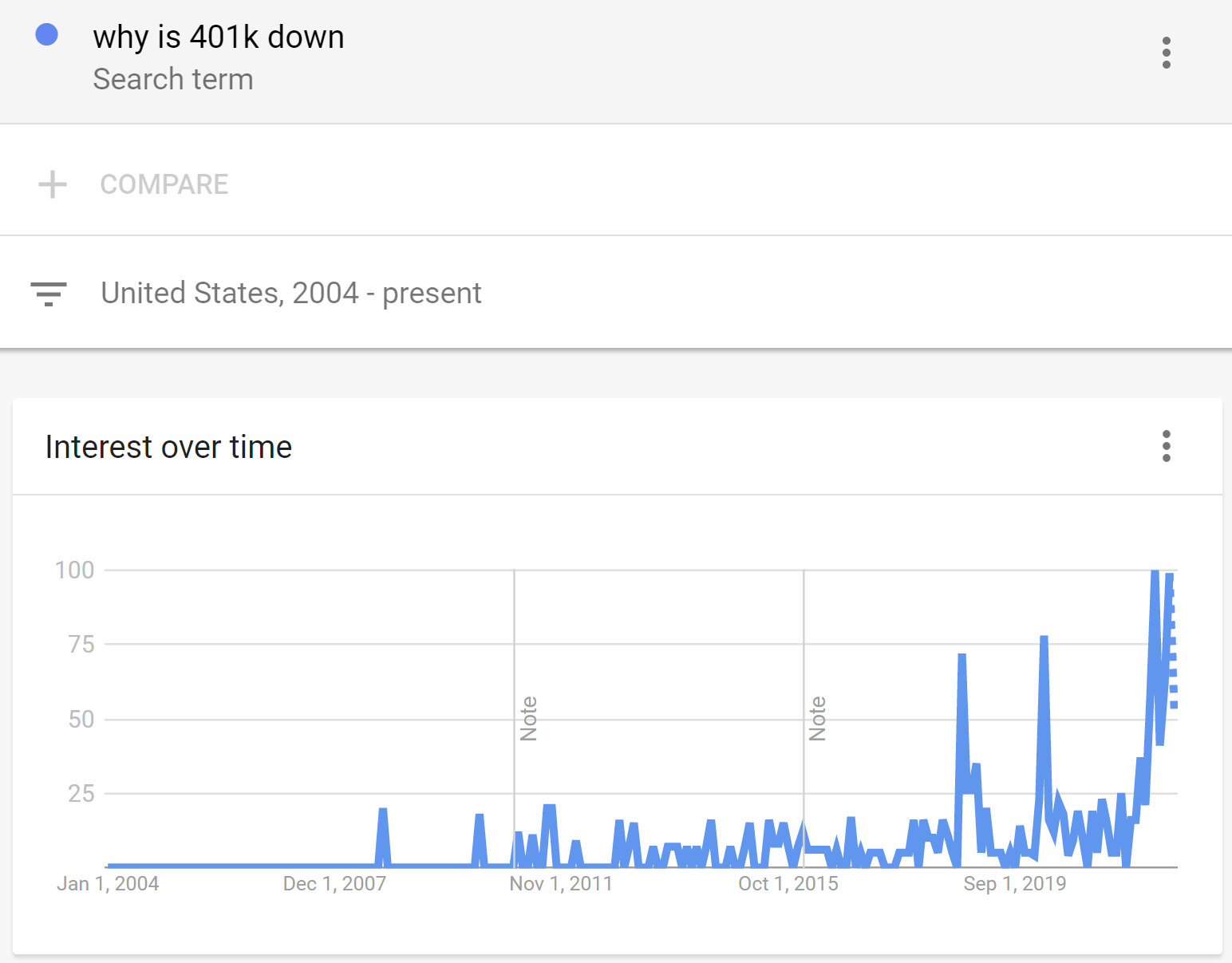

2. Max pain: Passive buy and hold + stocks and bonds down = portfolio pain. And it is showing up clearly in Google Trends data on searches for "why is 401k down".

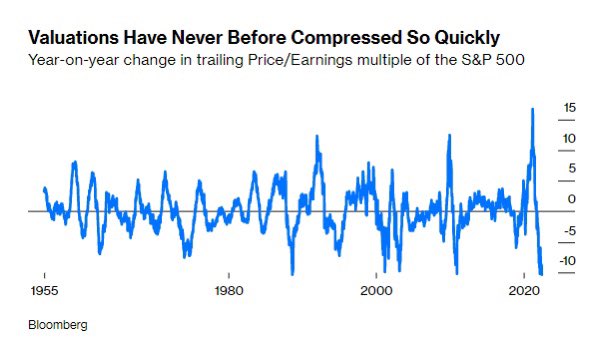

3. Extreme valuation swinging: We’ve just witnessed an extremely rapid and substantial contraction in P/E multiples (which follows a previous extremely rapid and substantial expansion!). The question many will ask: "is it cheap yet?"

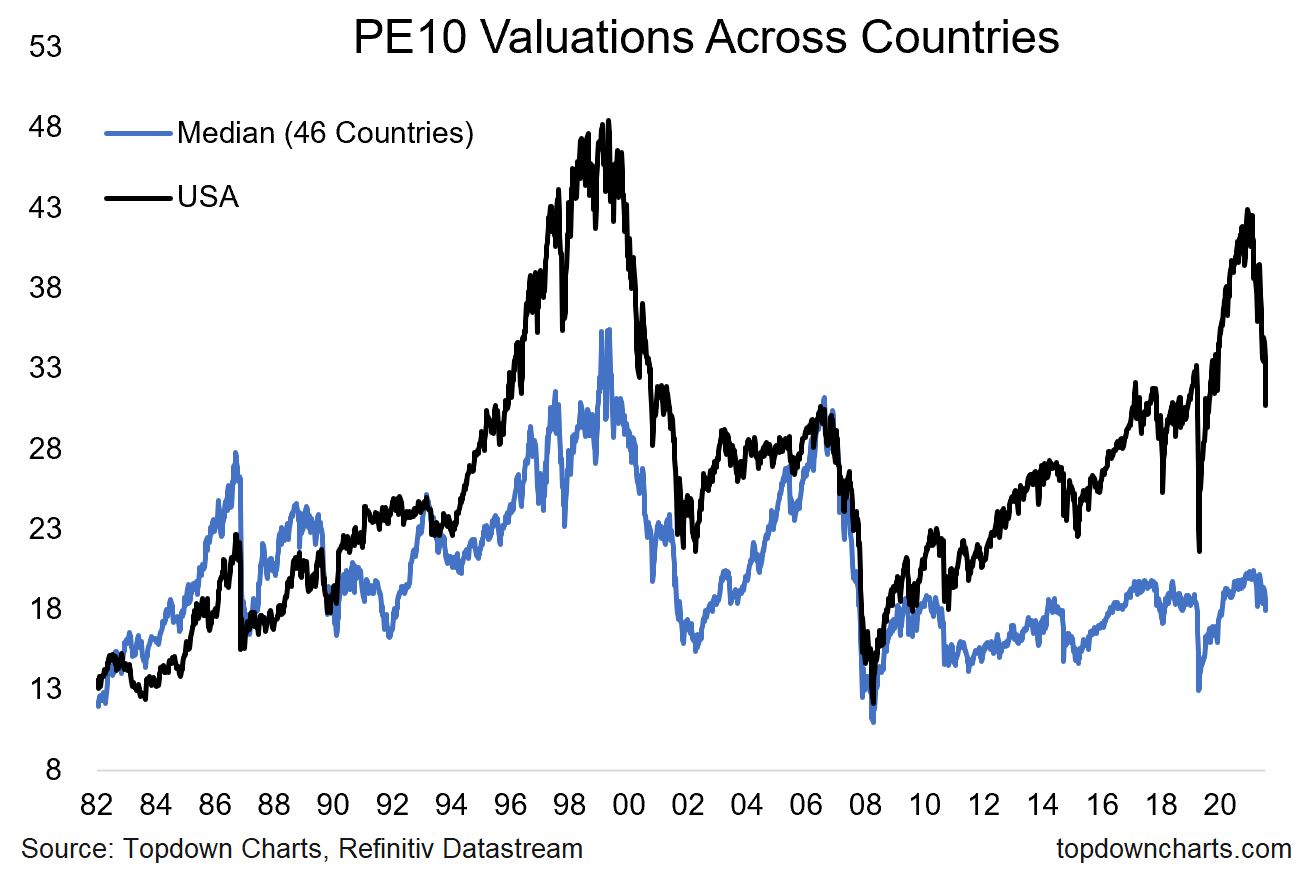

4. Is it cheap yet? In terms of levels, even though the US PE10 ratio has come down sharply, it is still some way off the bottoms seen in 2016/18/20. So I would say no, it is not cheap yet: not expensive anymore, but not cheap.

Even the rest of the world is still not far off the top of the range of recent history (albeit cheaper than US and cheap by longer-term historical standards).

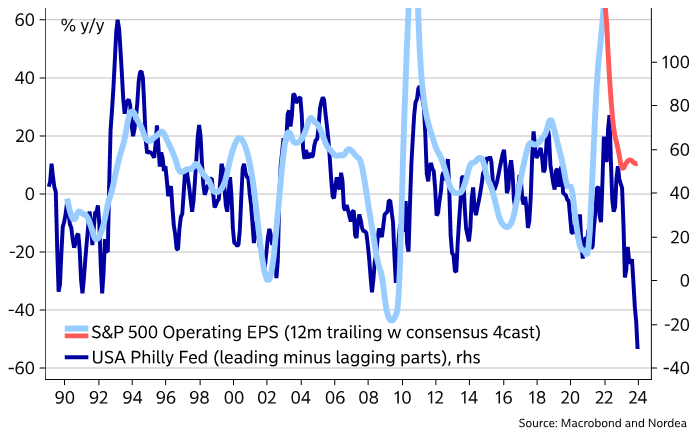

5. Earnings @ Risk: The problem with lower P/E ratios is that while the P has moved, the E is on thin ice -- and the cracks are starting to show...

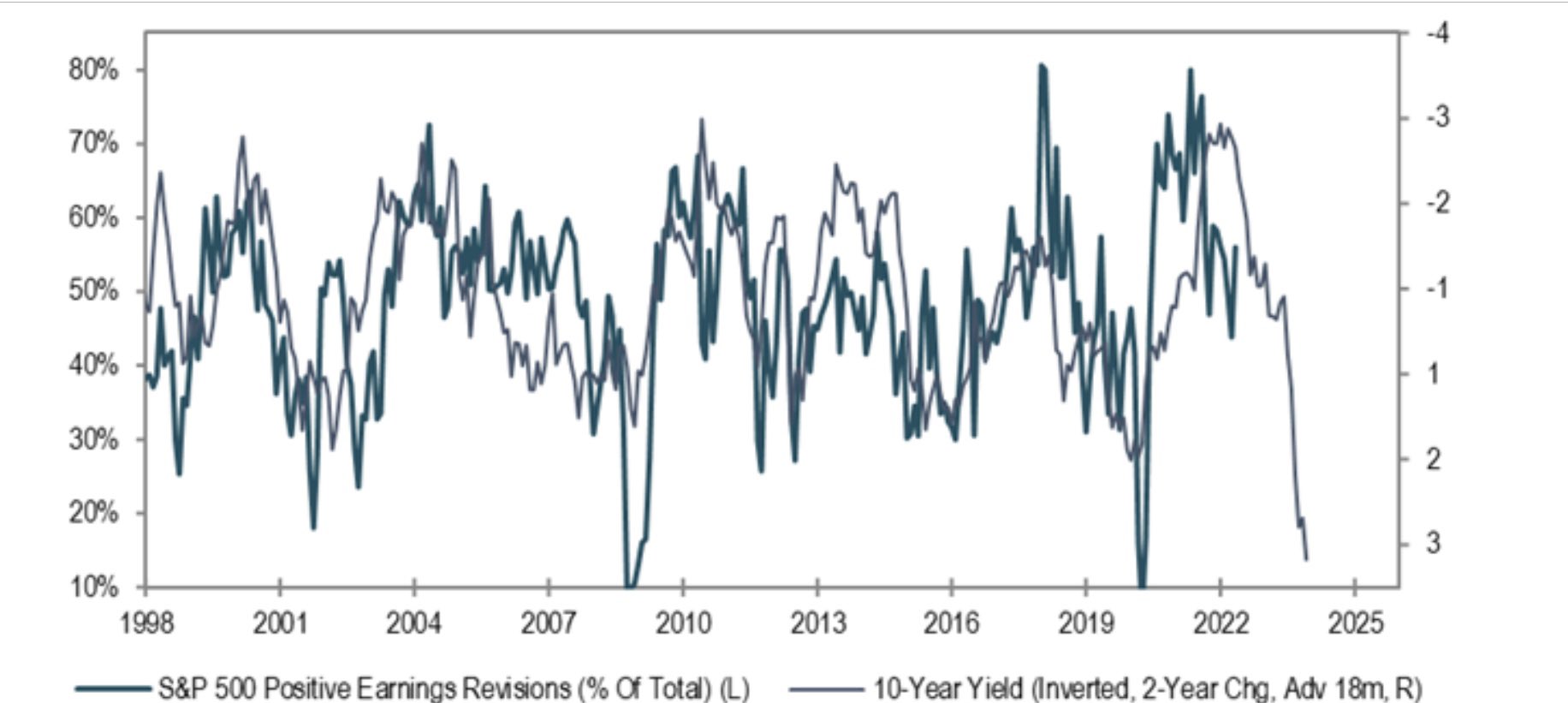

6. Downgrade doom due: Once analysts cotton on to the steadily deteriorating macro outlook, we should expect to see waves of earnings downgrades.

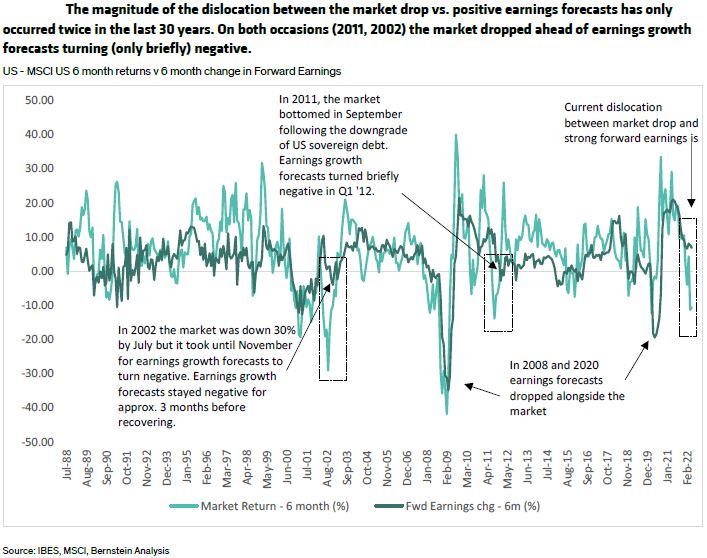

7. Price vs earnings: Interestingly, for now at least the market appears to be front-running the destined downgrade doom...

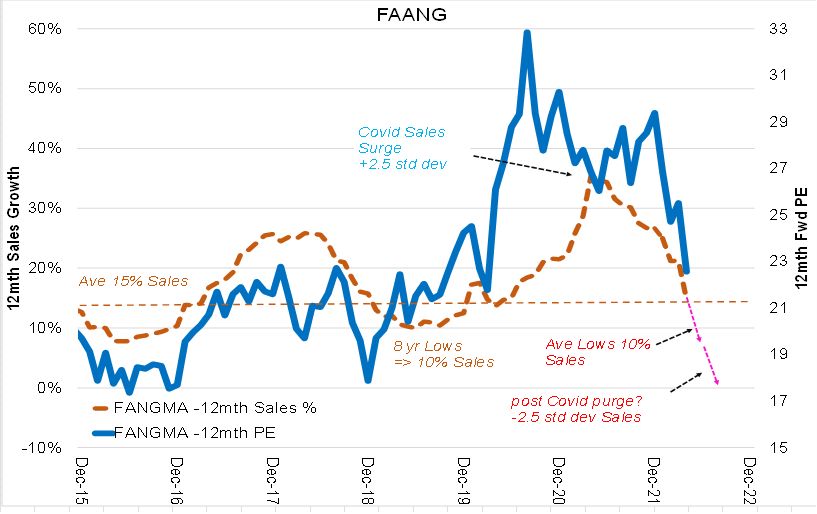

8. Tech ex-growth: Sales stagnation suggests more multiple contractions coming.

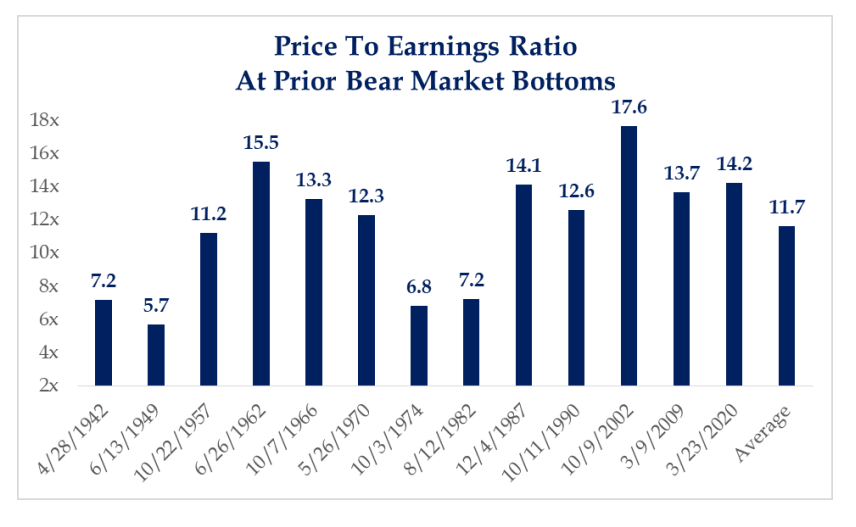

9. Bear bottoms: And another thing... on average, the trailing P/E ratio trades at 11.7x when a bear market bottoms (with a historical max/min of 5.7x-17.6x). The current trailing P/E for the S&P is about 18.5x — so could be some ways to go yet.

Although again, n.b. the "E" is a moving target!

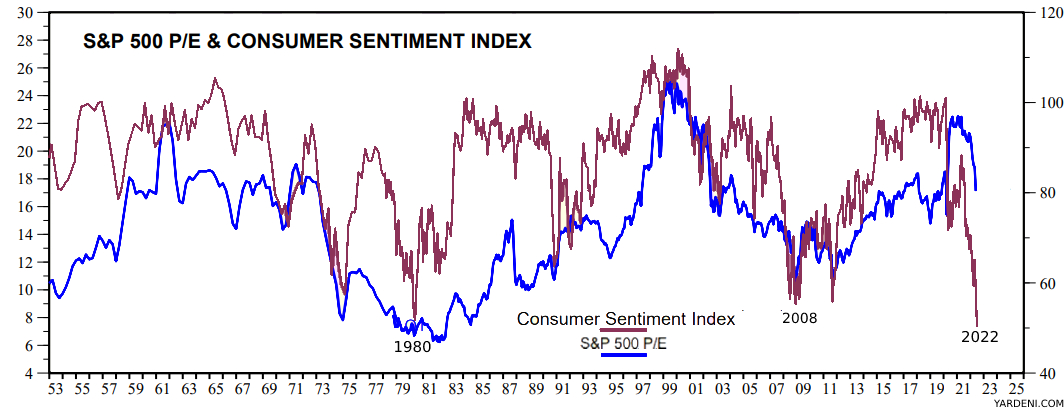

10. Consumer sentience: Lastly, while the correlation is not perfect, here’s yet another chart pointing to P/E pressure.

Thanks for reading!

Callum Thomas, founder and head of research at Topdown Charts.

Any feedback, questions and views are welcome in the comment section below.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

4 topics