Weekly S&P500 ChartStorm - 27 February 2022

The Weekly S&P500 ChartStorm is a selection of 10 charts which I hand pick from around the web and post on Twitter. The purpose of this post is to add extra color and commentary around the charts.

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective.

Hope you enjoy!

1. S&P500 defending support for now…

Major drivers of weakness:

-RSX = Russian stocks (geopolitics)

-LQD = credit/duration (rising yields/Fed)

-ARKK = ... (tech bubble burst)

Somehow I don't think any of these resolve quickly, but this chart at least presents some barometers or indicators to track for signs of further strength/weakness.

Source: @Callum_Thomas

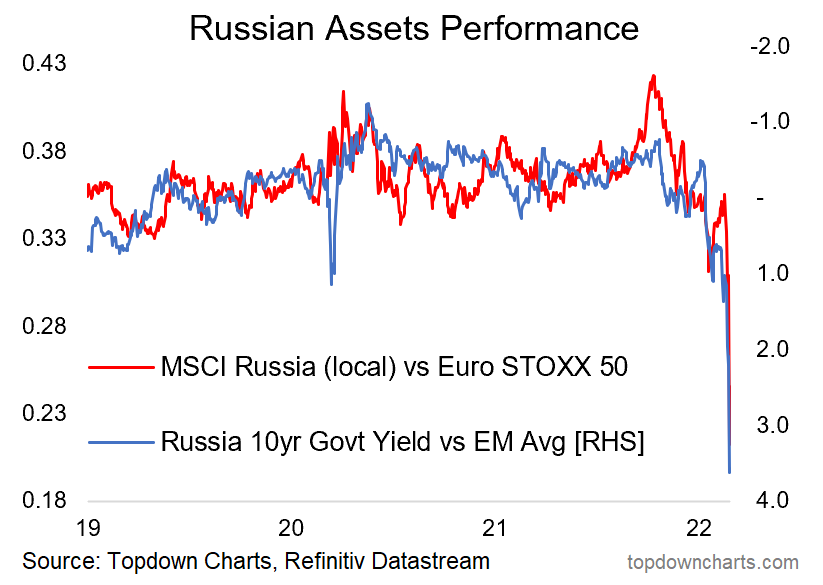

2. Strategic Mistake: Russian assets are imploding.

Source: @topdowncharts

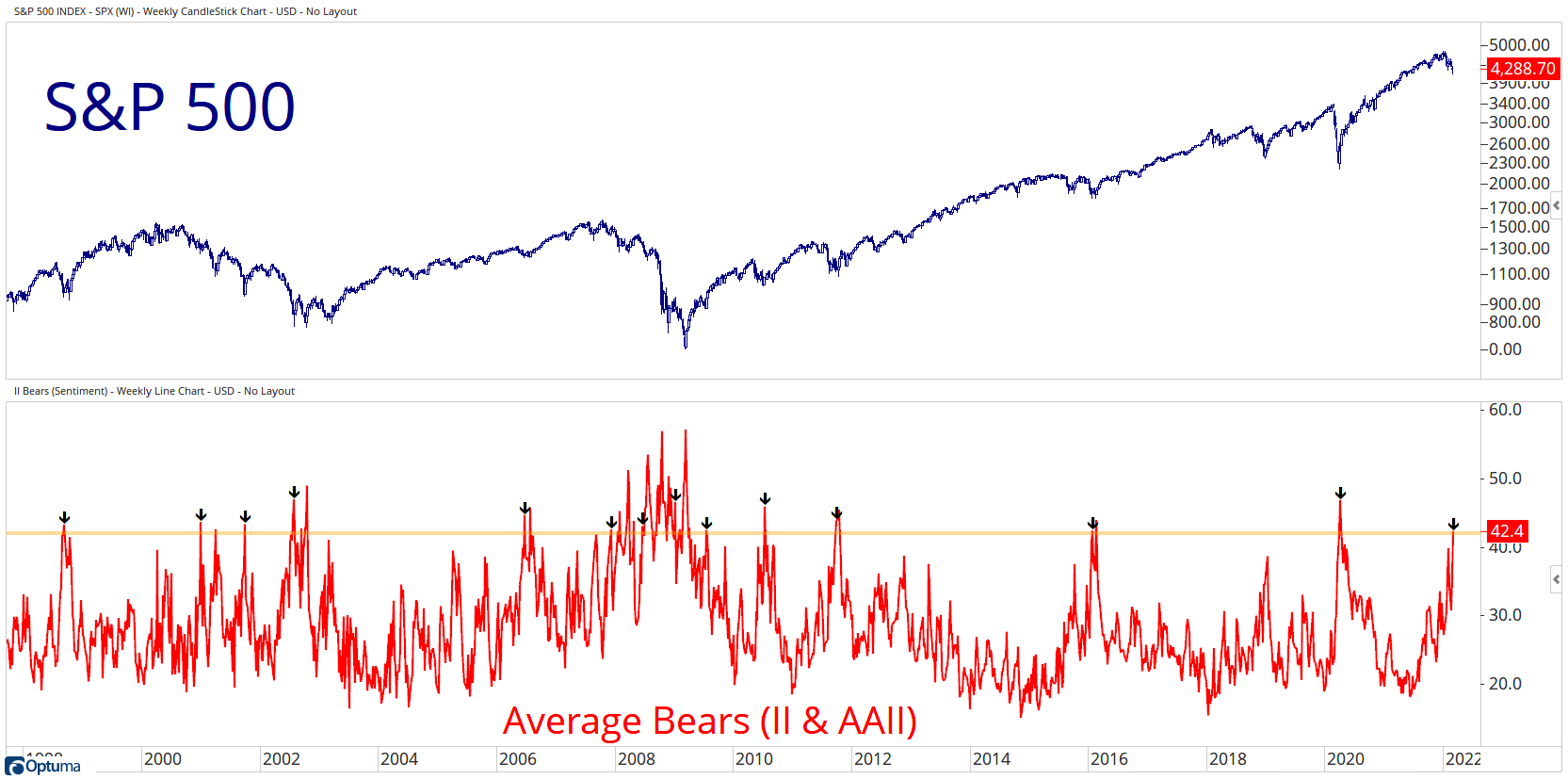

3. Boom in Bears: Since 1998, whenever investors got this bearish 1yr forward returns were positive 69% of the time, with a median gain of +21.6% (albeit for the 31% of cases where returns were negative, the average loss was -24%, and worst was -39%).

Source: @granthawkridge

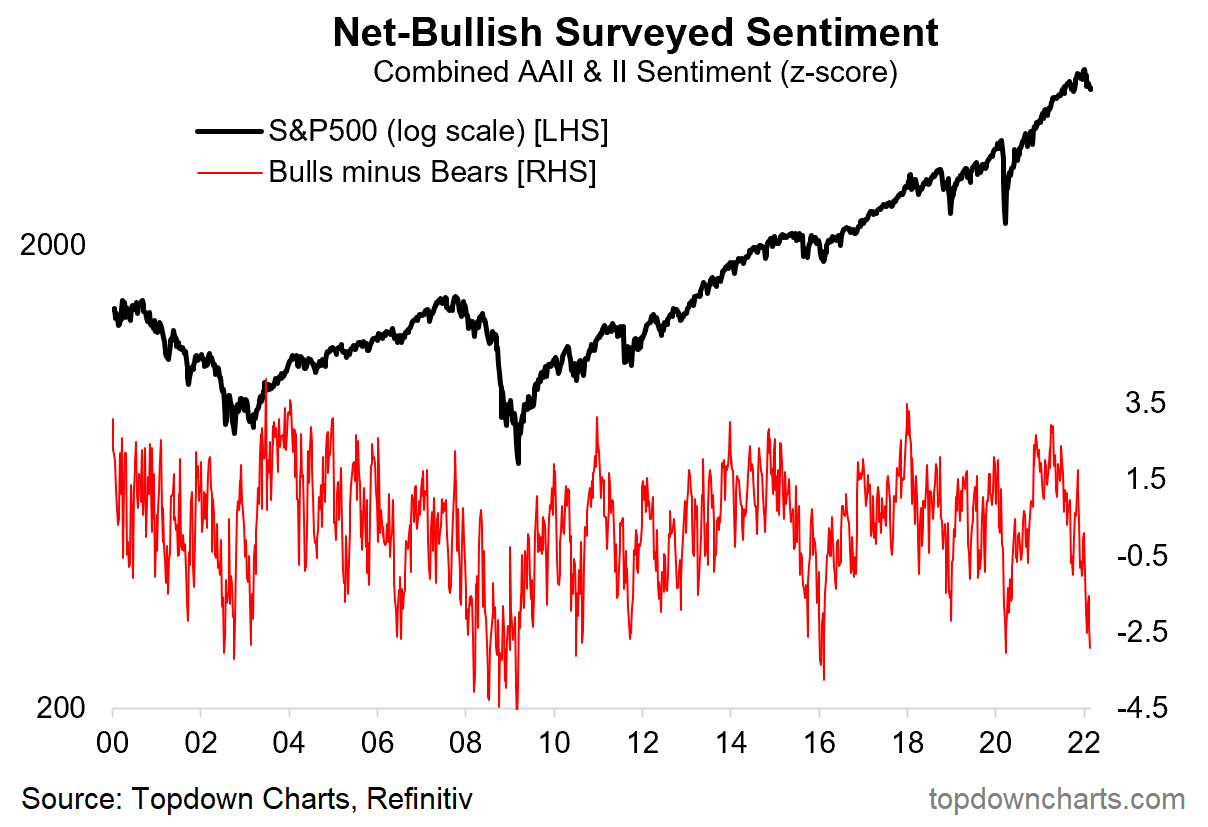

4. Sentiment basically as bad as the covid crash.

(but then again, you have to ask: is this 2020, or is it 2008? i.e. sentiment goes like this in a short/sharp dump, but also goes like this during transition to bear market)

Source: @topdowncharts

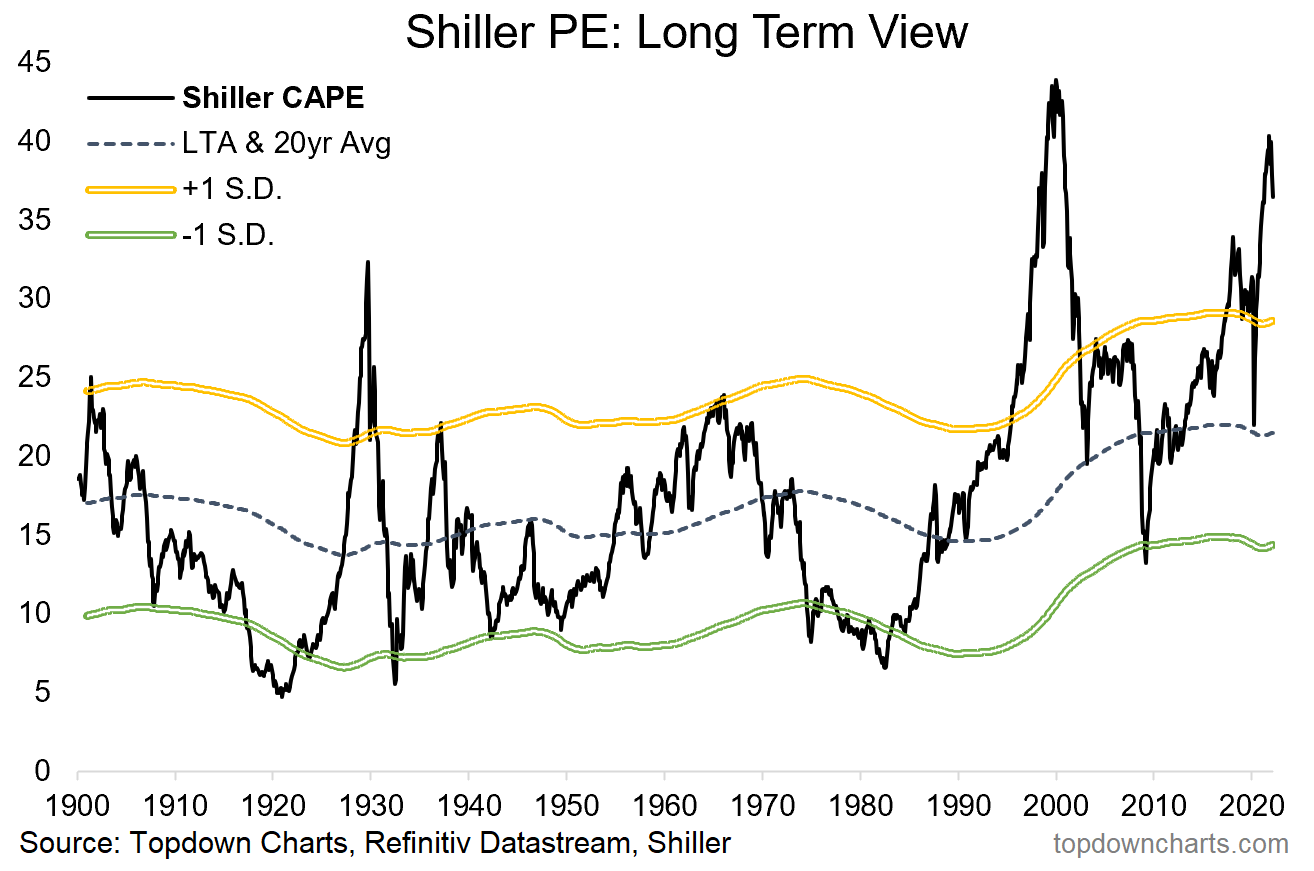

5. Bargain Hunting?? For some context, the US CAPE valuation ratio is down -9.5% from the peak in Oct, but is still 112% higher than its long-term average…

Source: @topdowncharts

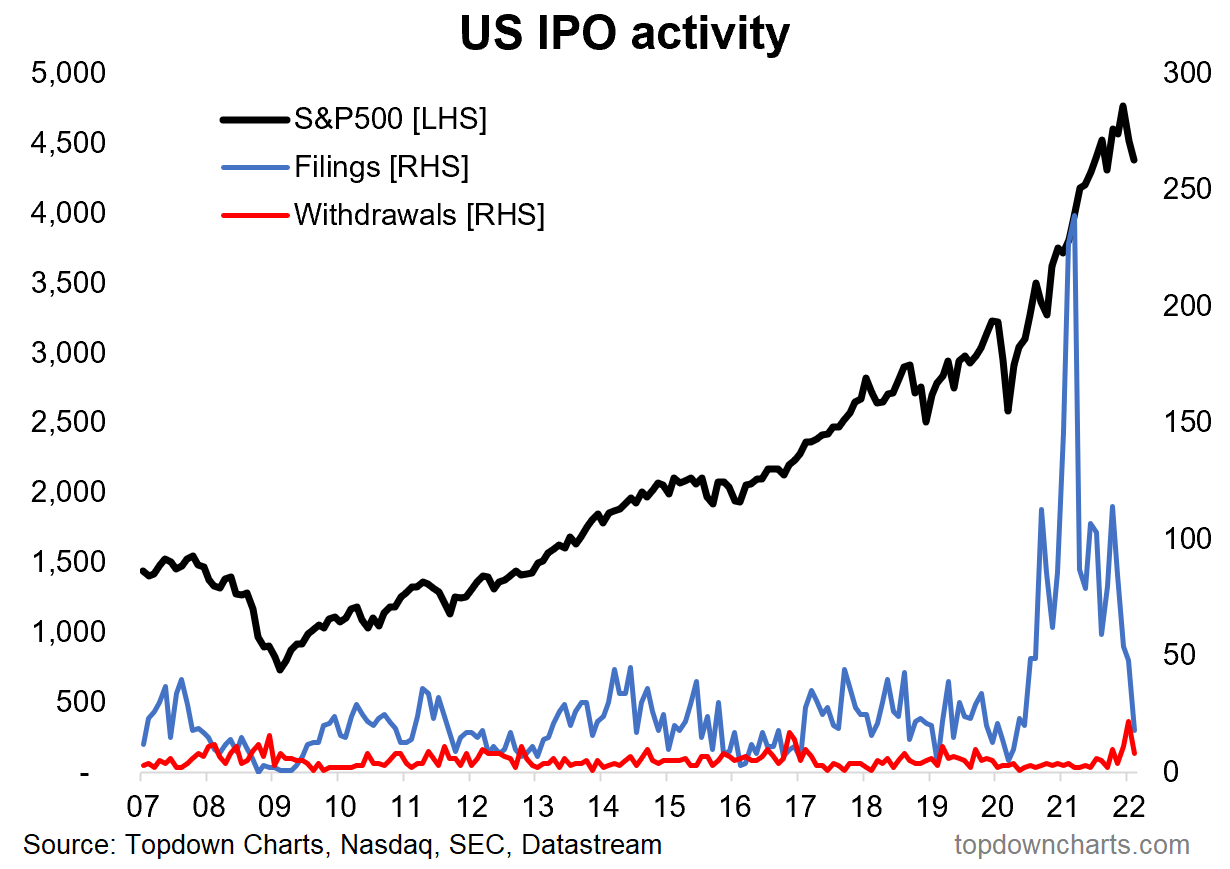

6. IPO Boom & Bust: This chart gives a sense for the magnitude and scale of the US IPO boom (and bust). Notably, IPO filings increased exponentially through the second half of 2020 into 2021. More recently though, IPO filings have plunged back to “normal“ levels.

Source: Chart of the Week - IPO Boom & Bust

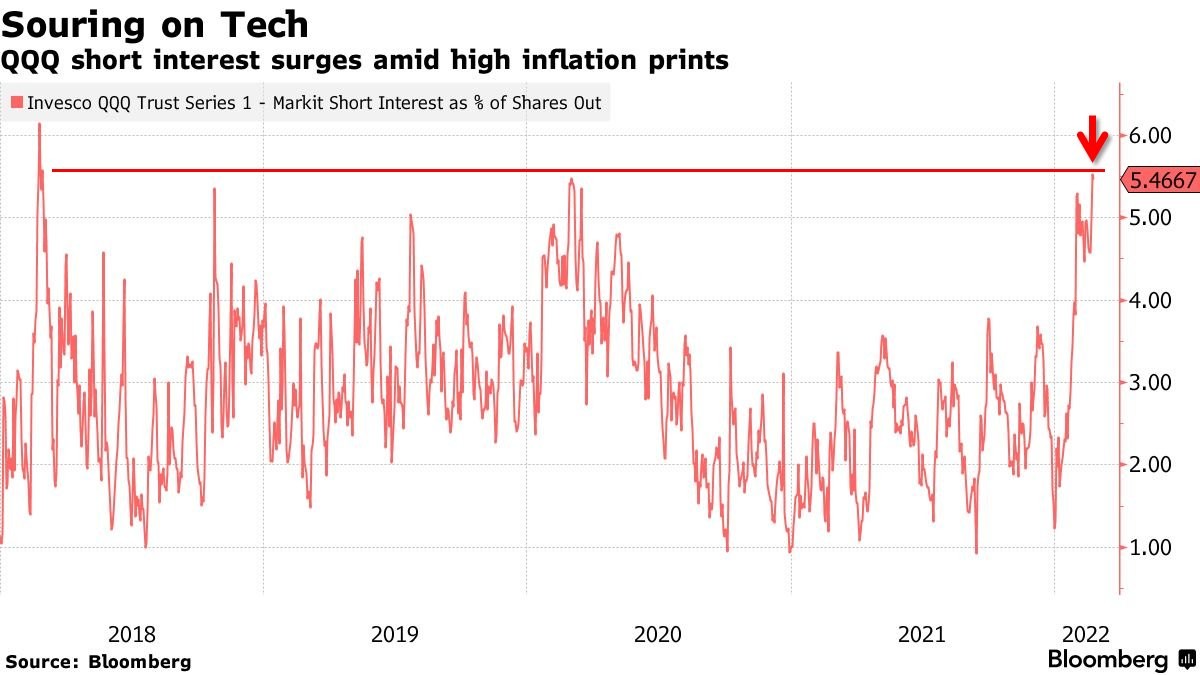

7. Get Shorty: Nasdaq (QQQ) short interest surging.

Bear markets are known for sometimes having a series of short, sharp, face-ripping rallies... and this is exactly the type of precondition that fuels them.

Source: @MacroCharts

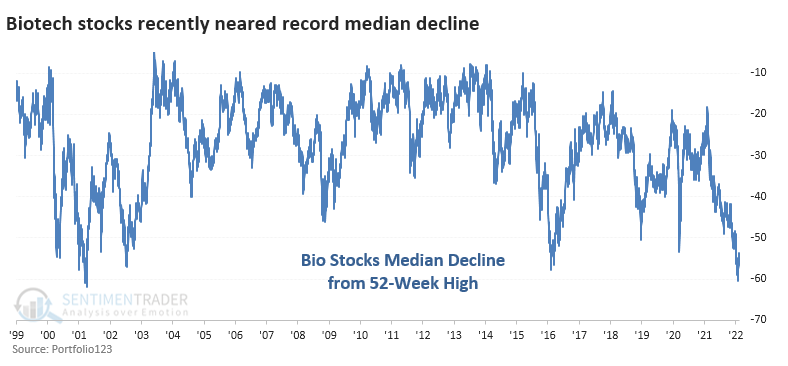

8. Biotech Stocks: Amid a major global health crisis, Biotech Stocks...

*checks notes*

...are performing the worst since 2001.

Source: @sentimentrader

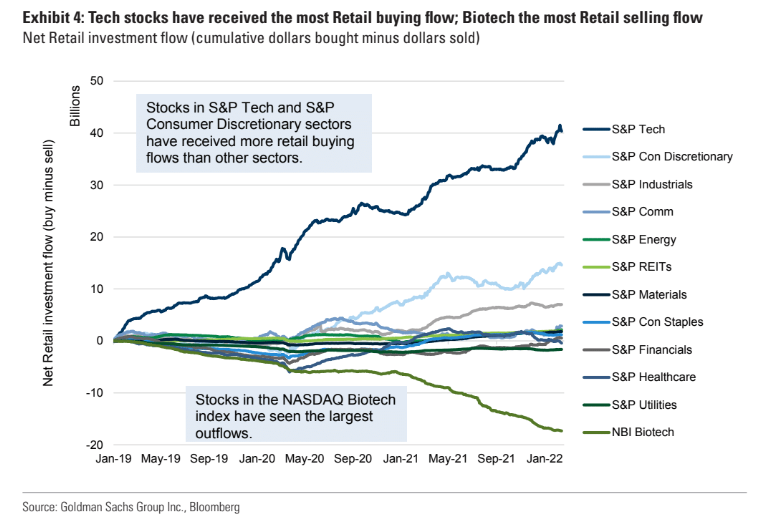

9. Fund Flows: As such, investors are dumping biotech and pumping ...abio-tech.

Source: @WallStJesus

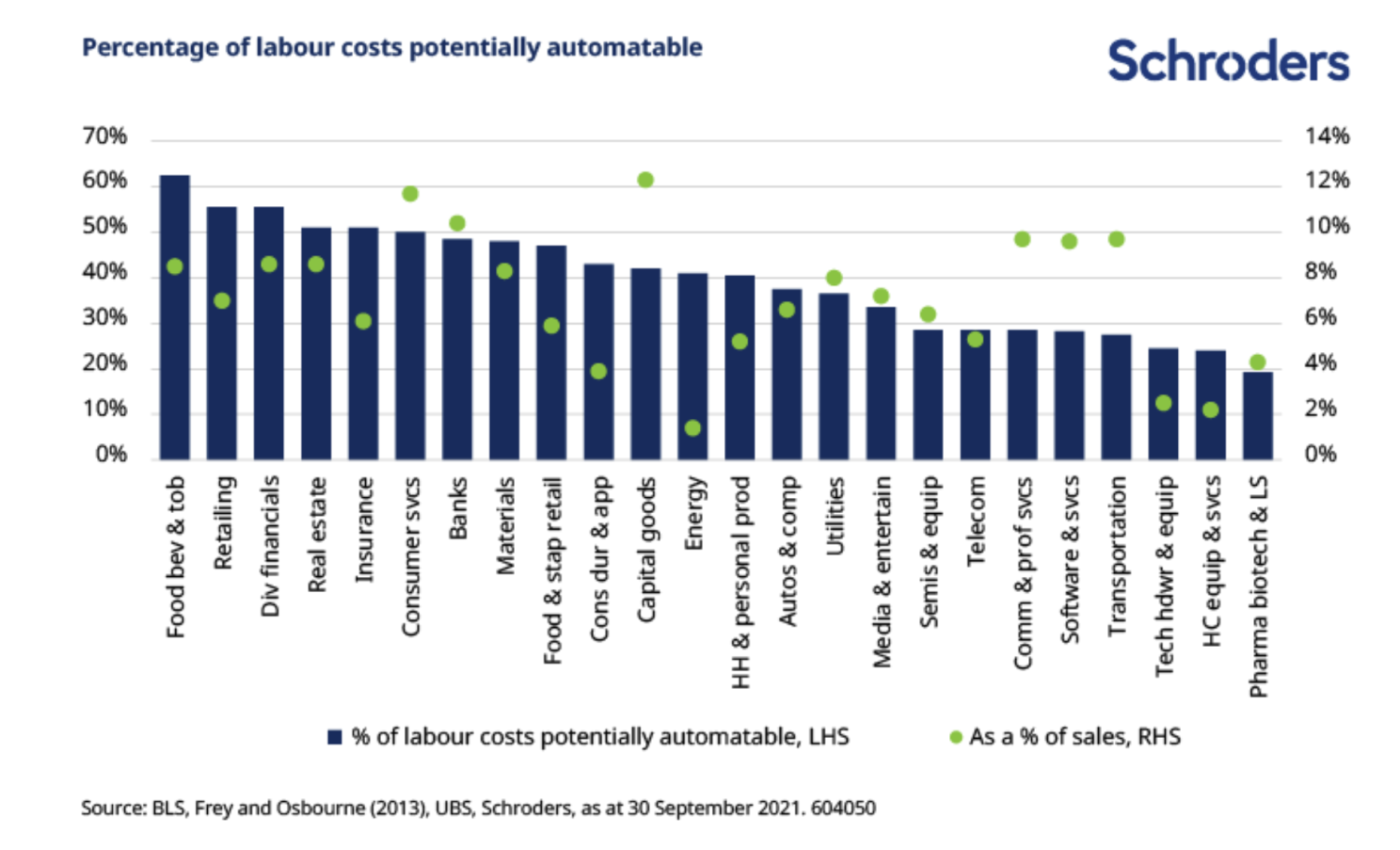

10. Automatability: the robots are coming...

Source: Automation and Reshoring

Thanks for reading!

Callum Thomas

Founder and Head of Research at Topdown Charts

Feedback/questions/views welcome in the comment section below:

5 topics