Wesfarmers delivers a profit beat but concerns linger

The name behind the hardware behemoth Bunnings and retailers Kmart and Target reported a more than 14% net profit gain in the first half of FY2023.

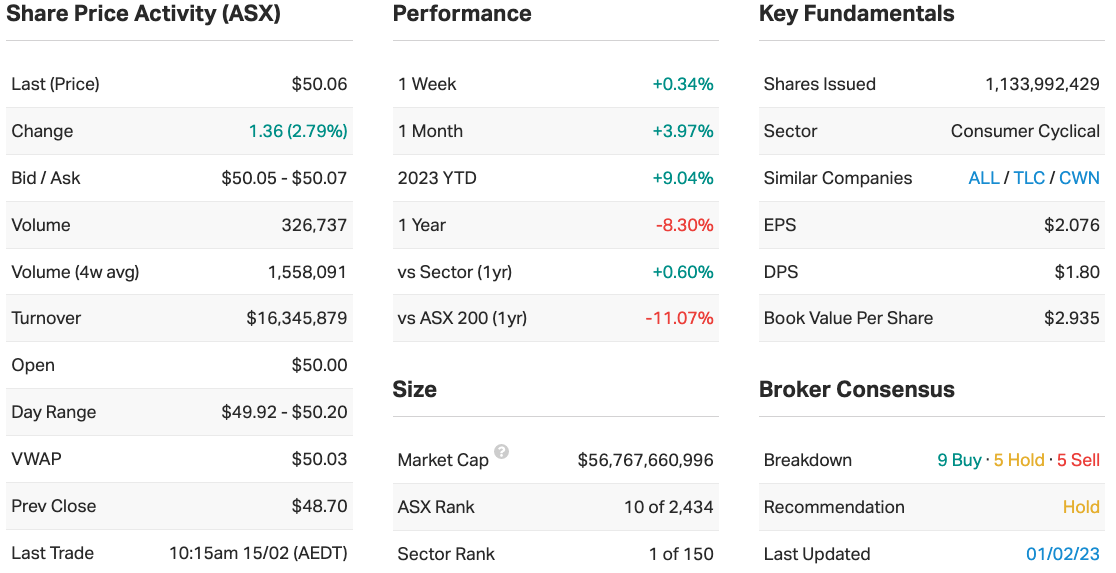

Wesfarmers (ASX: WES) is one of Australia’s 10 largest companies overall (in terms of market cap). It’s also the largest locally-listed consumer discretionary company – and by a long way, with its $56 billion market cap more than double the second-largest in the category, Aristocrat Leisure (ASX: ALL).

The conglomerate’s biggest business is Bunnings alongside other retailers Kmart, Target, Officeworks and online marketplace Catch Group. A diversified company, Wesfarmers’ industrial division, WesCEF (Chemicals, Energy and Fertilisers), includes miner Covalent Lithium, which is tipped to produce its first lithium hydroxide in 2024.

Ahead of the latest result, management in late October last year reported “pleasing” sales growth in the prior 10 months and said Kmart and Target revenues had proven particularly strong – even after adjusting for the impact of lockdowns and other COVID measures.

But in late November, the group’s CFO, Anthony Gianotti, cited the increasing difficulties in the face of rising inflation, surging interest rates, and rising living costs. These are issues that were addressed again by the group’s managing director, Rob Scott, in the earnings call on Wednesday.

Pengana Capital Group investment analyst Mark Christensen discusses some of these in the interview below, along with his view on the overall resilience of Wesfarmers.

Wesfarmers 1H2023 key results

- NPAT of $1.38 billion, a gain of 14.1% from $1.21 in the prior half

- EBIT of $2.16 billion, up from $1.9 billion previously

- Revenue of $22.55 billion, up 27% from $17.75 bilion

- Free cash flow of $1.36 billion, up from $949 million

- Interim dividend of 88 cents a share

Key company data for Wesfarmers

Wesfarmers recently placed in the top 10 for supply chain risk management (9) , operational management (8), and sustainable competitive advantage (7), according to MarketMeter. For more information on MarketMeter, please click here.

Note: This interview took place on Wednesday 15 February 2023.

What were the key takeaways from this result? What surprised you the most?

Revenue earnings beat expectations quite substantially at a headline level, so your first inclination is that it’s a great set of results. But compositionally, there are a few areas of concern, particularly on the retail side of the business, as we enter a period where WES and its peers face significant pressure. This could see significant pressure on the top line through a consumer slowdown.

A few questions have arisen from these results, even though we’ve had an earnings beat in this period, particularly around Bunnings. Expectations were set reasonably low, on the back of the widely reported adverse effects of wet weather on the top line – but the company beat these.

That said, Bunnings' profit growth was much lower than its revenue growth. So, it's either seen gross margin contraction in the period – and management referred to the fact that they’ve invested in price to stay competitive – and/or they have seen operating costs grow at a faster rate than sales.

We often think about Bunnings being dominant in its category…but competition is fierce, and they too have to invest in price to maintain volumes. Everyone thinks of Bunnings as a price-setter, not having to compete on price, but that’s not the case. That was one element that surprised me.

There is sensitivity among investors as to what evolution of operating costs we’ll see for all businesses out there. We know that inflation is running rife, and retailers' two biggest costs - rent and wages – are both facing upward pressures. So, if a company comes out with higher operating costs than the market’s expecting, people start to ask, “Hang on, are they a victim of inflationary forces?”

It's clear that, overall, costs grew faster than revenue did. And as a result of that, profit growth is lower than revenue growth. Sales grew by 6.3% and EBITDA grew by 2.6%. So, costs grew by more than 7%. That leaves a lot of questions about what’s happening to their gross margin and their costs.

The other thing worth noting is that last year there was about $40 million worth of COVID costs in the profit figure, but virtually none this year. So, they should have had a tailwind from costs – but they still grew faster.

I’d also note that Kmart’s performance was very strong. My one-liner here is that its value proposition is really coming to fruition in this environment of belt-tightening for consumers.

And I’d also point out that Catch’s performance was highly disappointing. It has been for a number of periods now, and it got worse. Management essentially owned up to this, saying, "We made mistakes, we've replaced the people in charge, and are continuing to invest to try to get it right.” But they've invested a lot of money in that, and so far, things are getting worse before they get better. That's a concern for investors.

What was the market’s reaction to this result? Was this an overreaction, an under-reaction or appropriate?

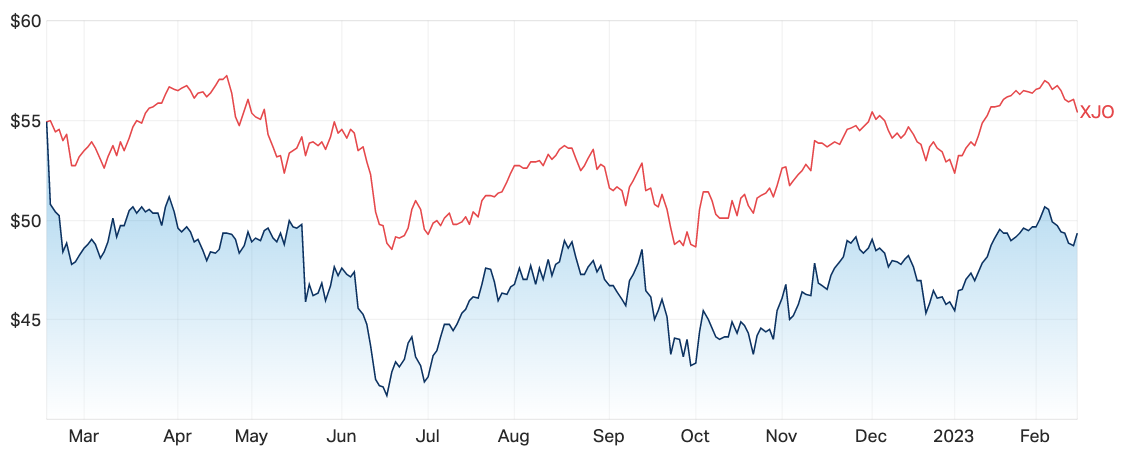

With the share price up 1.5% on the day of the result, the response seems fairly muted given it was an earnings beat.

People are hesitant to relay the full earnings beat into the share price. I think it deserved to trade up a bit today because ultimately, the Wesfarmers portfolio is proving its resilience. But it is a reasonably expensive stock and there are a few things that I think would prevent it from re-rating further from here.

Would you buy, hold or sell Wesfarmers on the back of these results?

Rating: Hold

I’d like to be more excited, because it is offering resilient earnings, particularly from Kmart, which I think is very well-positioned to take on this difficult trading period ahead. And I think Bunnings will also offer a degree of resilience. You’ve also got its Mount Holland mine which should start generating cash in the next 18 months. But it is priced in.

Some stocks on the ASX have near-term concerns priced in, but WES is not necessarily an example. You’ve got to pay about 24 to 25 times Bunnings' earnings based on the current share price, so I wouldn’t say it’s a screaming buy.

What’s your outlook on Wesfarmers and its sector for FY23?

For the sector as a whole, it’s quite a cautious outlook. The retail sector is facing a double-whammy correction. There are still elements of over-earning from COVID in their base, so revenue is still elevated.

And on top of that, you’ve got rising rents and inflationary pressure on household spending – which means you’ve got to normalise from COVID and then face a more restrictive consumer environment too. For the entire sector, we’re looking at a scenario where revenue gets rebased. It’s a question of whose portfolios (of businesses) can be most resilient in the process and who can adjust their cost base accordingly.

Wesfarmers probably stands out as better positioned because of its large exposure to department stores. Kmart tends to do well in a weak consumer environment. So does Bunnings, given people spend less money on travel and other experiences and more on DIY and home maintenance during such times. So, WES stands out as well positioned in a difficult sector over the next 12 months.

Are there any risks for Wesfarmers and its sector that investors should be aware of given the current market environment?

As I’ve mentioned, the elevated cost base for Bunnings and whether it can manage that in the face of a weaker top-line environment.

There are also the investments management is making in Catch, which so far has proven to be destroying shareholder value. It certainly hasn’t worked out so far. To the extent they can’t turn that around in the meantime, we just seem to be seeing good money thrown after a cause that’s not generating value.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you bullish or bearish about the market in general?

Rating: 4.

And I’m mainly talking about parts of the market that I think you want to be exposed to in this environment. A number of tech stocks or “growthy” stocks have derated quite substantially, so the temptation would be to view them as cheap. But that’s just taking into account a more appropriate long-term interest rate, which was unsustainable previously at almost zero.

Even though they’ve sold off, they’re not as cheap as people might think. There’s still a lot of noise from COVID in existing earnings. Overlay that with this impending consumer cliff and I think there’s a high degree of forecast risk across a lot of these companies. That makes even those that look a bit cheap, they might not be as cheap as they appear.

There are a few names in the discretionary retail sector that I think have been oversold, but on the market as a whole, we’re still waiting for a better opportunity before we get more bullish.

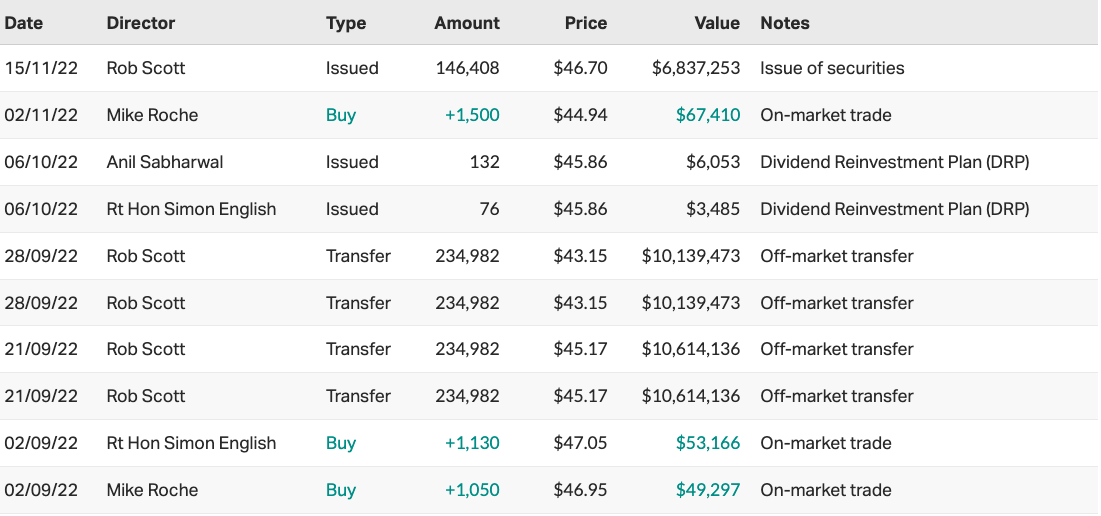

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

2 topics

2 stocks mentioned