What a Trump presidency could mean for copper, gold, oil, and battery metals markets

The events of July 13 might appear to many Aussie investors as a “USA thing”, but there could be important knock-on effects for commodity markets as a result of last Saturday’s attempted assassination of former President Donald Trump.

Major broker Citi released a research report on Thursday investigating some of the possible outcomes for commodity markets should former President Trump win a second term in office. In the report, the broker cites betting markets which are now overwhelmingly backing him to win November’s presidential election.

Citi believes the most important potential impact on commodity markets stems from Trump’s stance of tariffs. Last week, Trump announced a plan proposing a 60% tariff on US imports from China, and a universal baseline 10% tariff on imports from all other countries.

If implemented, these tariffs would have a “variety of implications for commodities, direct and indirect” notes Citi. However, the broker also notes, given usual US regulatory processes, it would likely take around a year from now for these impacts to be felt in commodity markets.

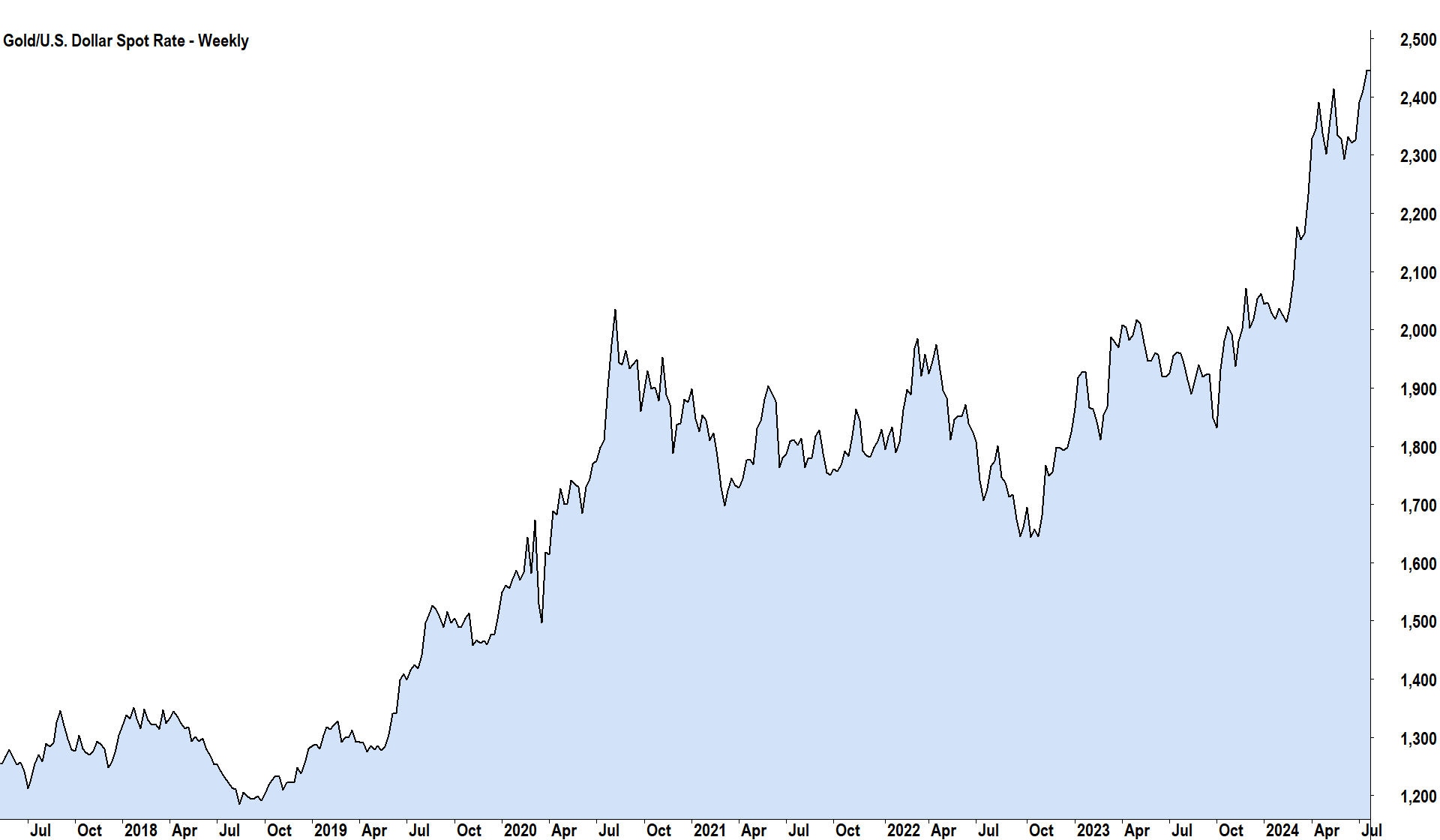

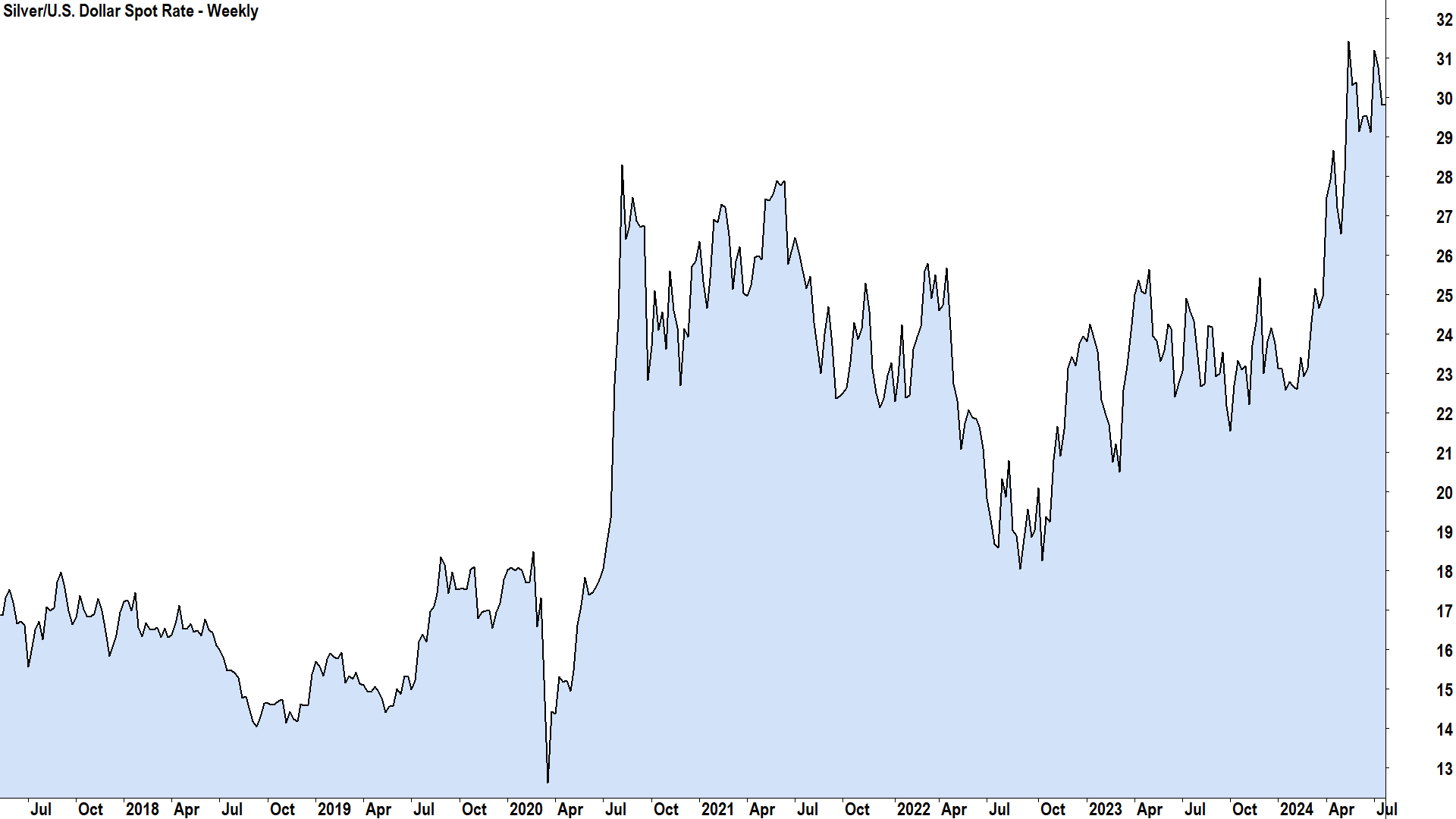

Gold & Silver

Citi considers that within the window between now and Trump’s tariffs having a tangible impact on markets, central banks like the US Federal Reserve and the European Central Bank will be well into their rate cutting cycles.

This means there’s still scope for the broker’s previous bullish calls on commodities like gold and silver. Citi reaffirmed its target for gold of US$2,700-US$3,000/oz over the “next 6-12 months”, and US$38/oz for silver. The current price of gold is US$2,445/oz implying around 17% upside (mid-point), and silver is presently trading at US$29.80/oz implying around 28% upside.

“Ahead of a likely trade war escalation between the US and China, and more broadly, globally, investors may want to hedge their equity and currency exposures”, says Citi, and this is likely to support the prices of precious metals.

There could be a headwind, however, the broker also notes. Tariffs and the chaos they might cause to global markets could trigger a strengthening of the US dollar – typically seen by global investors as a safe haven. Gold and silver are priced in US dollars, so its strength could undermine their performance.

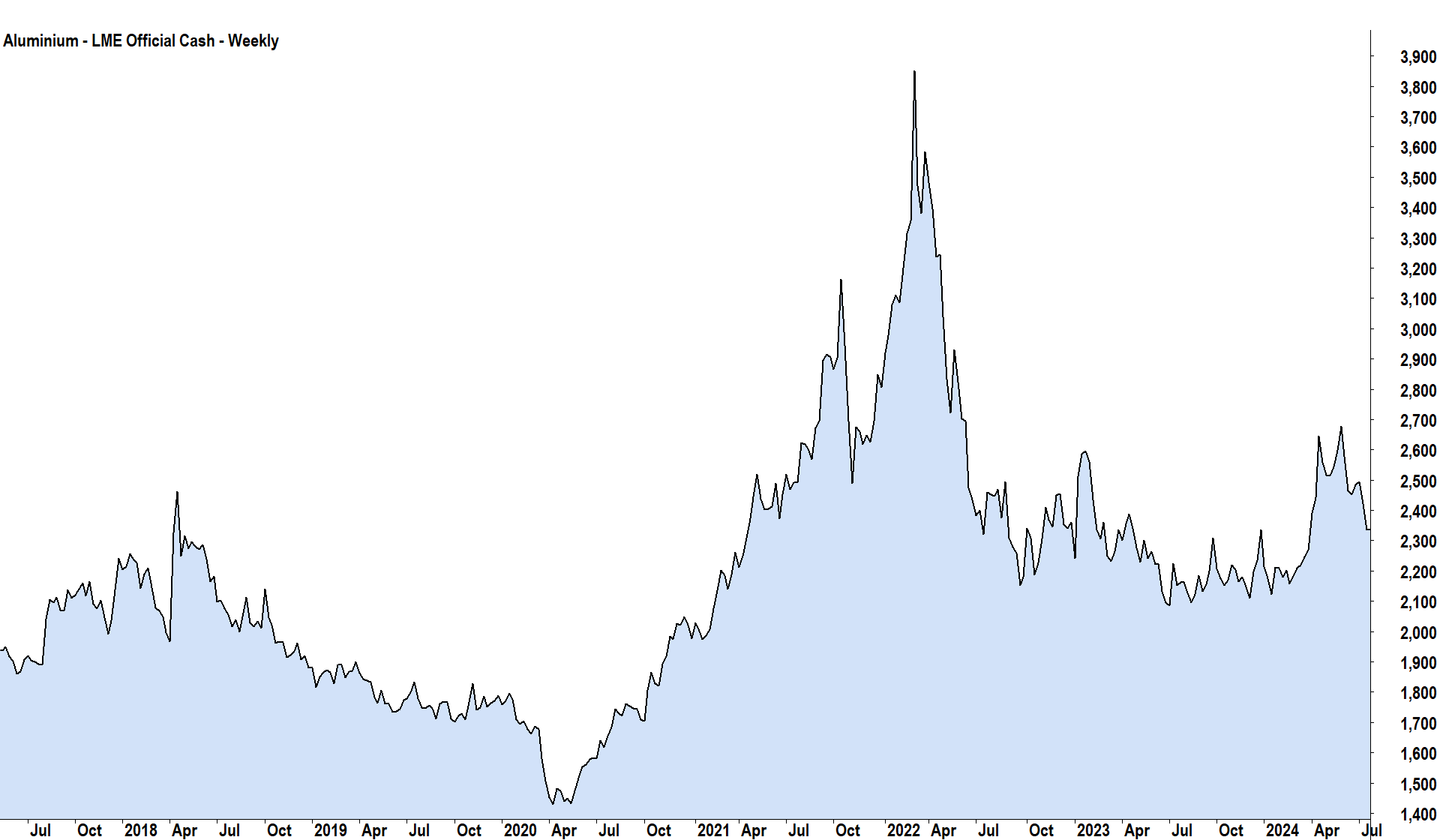

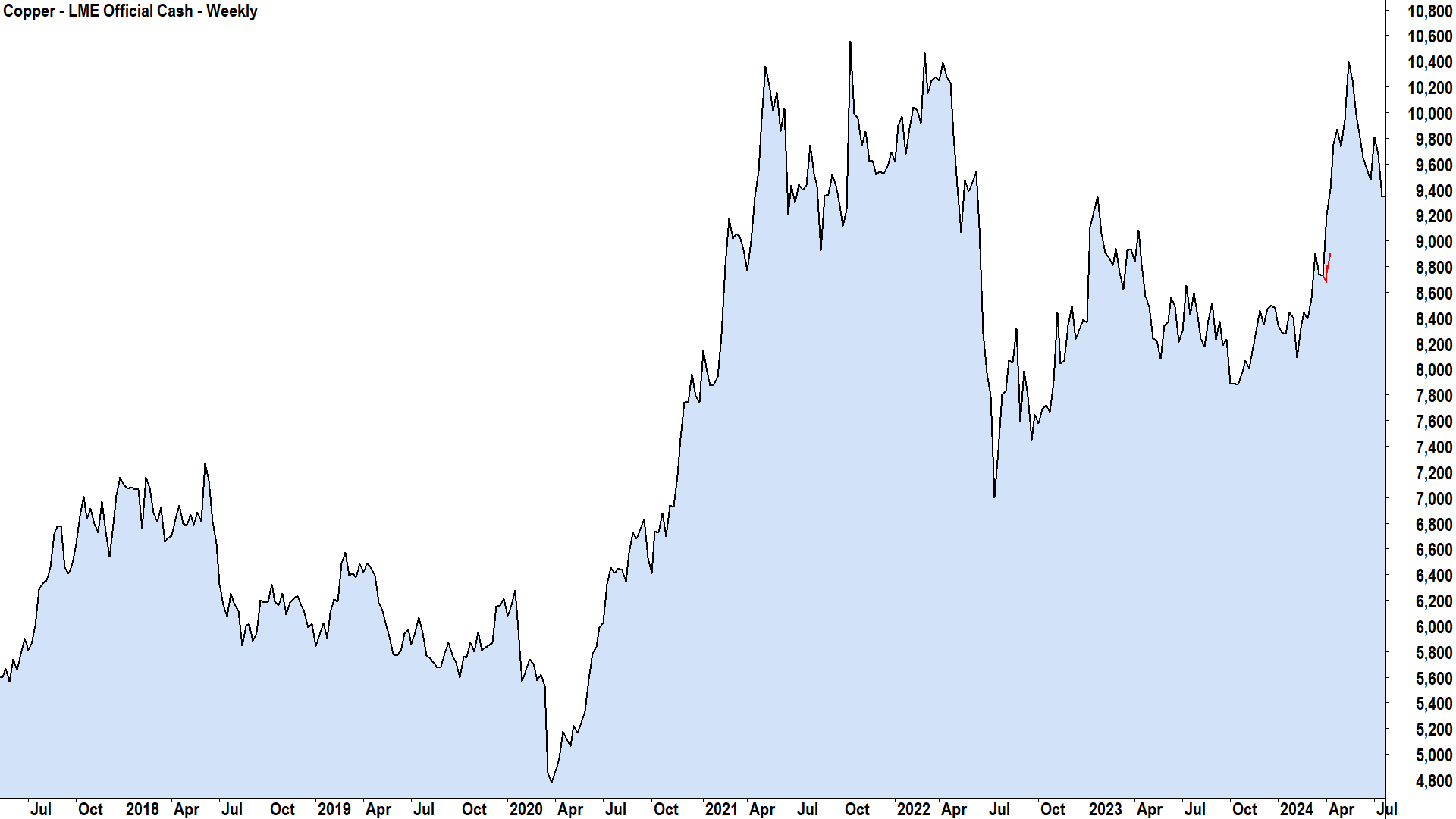

Aluminium & Copper

During the last Trump presidency, China responded to newly imposed tariffs with a range of stimulatory economic measures. It could happen again, thinks Citi. The broker believes that this time around, Beijing would likely favour infrastructure spending, particularly focussed on the ongoing upgrading of the country’s energy grid.

This would likely be a positive for aluminium and copper – both essential to China’s grid upgrade, but there’s likely to be some push and pull here given higher tariffs would ultimately present a “substantial headwind” to global trade more generally. The broker notes such headwinds could jeopardise their current target of US$12,000/t for copper and US$2,800-$US$3,000/t for aluminium by the second half of 2025.

Citi’s copper and aluminium targets remain in place for now but are likely to be scrutinised closely as events progress. Note, the current price of copper is US$12,000/t, implying around 28% upside, and aluminium is presently trading at US$2,335/t implying around 24% upside (mid-point).

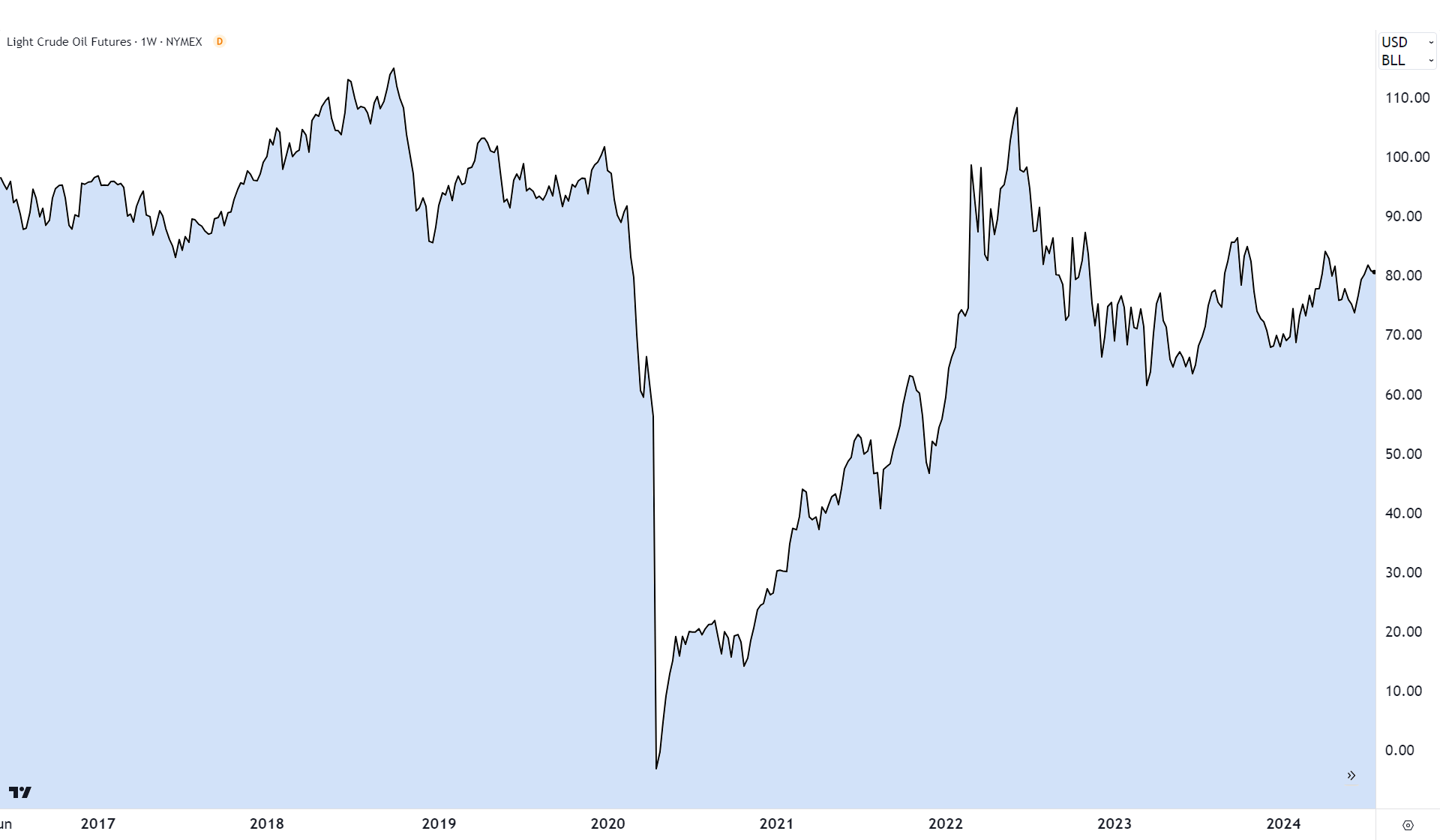

Crude Oil

Citi’s house view is bearish crude oil. The broker doesn’t expect another Trump presidency to move the dial too much for their bear case, reaffirming their sub-US$60/bbl by the second half of 2025. The current price of West Texas Intermediate (WTI) crude oil is US$80.60, so this implies at least 25% downside.

A Trump win could perpetuate risk to the upside, notes Citi, citing the possibility of the reintroduction of sanctions on Iran. This would likely have a smaller relative impact given the market is far better supplied this time around, though.

More likely, suggests Citi, a Trump presidency would be a positive for energy supply. He might push for a ceasefire in the Russia-Ukraine conflict, therefore potentially unlocking oil and gas supply there; and Trump is very much pro-US energy production, so we can expect US production to increase markedly as well.

Lithium & Battery Metals

Details in Citi’s research report are scant on this item, but I include this section here for completeness. “We aren’t expecting that a Trump Presidency would negatively impact the path of EV development in the US”, the broker notes.

A dynamic situation

Clearly the situation with respect to who will be in the White House come January inauguration remains dynamic, and as the events of the last week prove – anything can happen.

There’s plenty of water to pass under the bridge between now and when a winner in the 2024 US presidential race is declared. But at least you now have a very useful playbook on how things might play out in commodities markets should we indeed see a second Trump term.

This article first appeared on Market Index on Friday 19 July 2024.

5 topics

8 stocks mentioned