What Australia's hottest inflation print since 1990 means for rates (and stocks)

For anyone who thought Australia's inflation story would be different from our global counterparts, today may have provided quite the alarm. A day after the Federal Budget warned that hard times are on the horizon, Q3 inflation has printed at a hotter than expected rate on both the headline and trimmed mean figure.

The numbers make for sobering reading.

- Headline inflation: +1.8% q/q (consensus: +1.6%), 7.3% y/y (consensus: 7%)

- Trimmed mean inflation: +1.8% q/q (consensus: 1.5%), 6.1% y/y (consensus: 5.6%)

Whichever way you slice it, the numbers are hot and the Reserve Bank's policy path will now be under even greater scrutiny. The 6.1% trimmed mean figure is also now above the Reserve Bank's own year-end forecast, proving once again that central banks are just as flawed as the rest of us when it comes to keeping up with inflation. Both the RBA and Treasury also sing from similar song sheets when it comes to the peak for inflation - this Christmas and it could be as high as 7.8%.

So what does today's print mean for the future of the Reserve Bank and for investors? In this wire, I'll share some of the highlights from underneath the hood and speak to two experts in this field - HSBC Chief Economist Paul Bloxham and Mathan Somasundaram of Deep Data Analytics.

It's all lowlights unfortunately

Let's not mince words - there isn't much to love about this report. To explain just how challenging the Reserve Bank's problem is, we need to look at the different sub-sectors of inflation. This is where it's helpful to differentiate between headline inflation and the trimmed mean variant.

- Headline: All of the elements in one number

- Trimmed mean: All the same elements minus food and energy

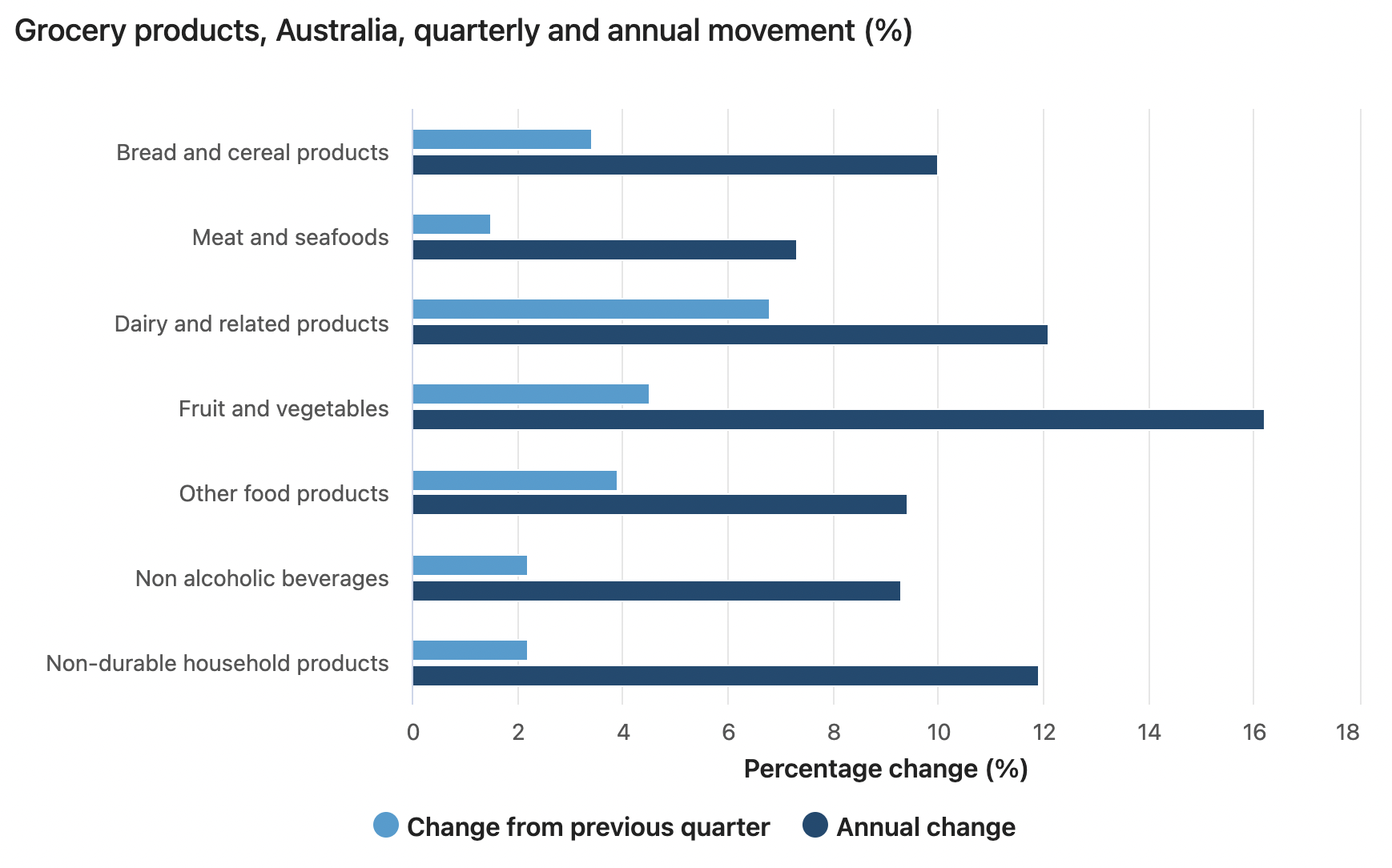

In the headline figure, it's all about food prices which rose 3.2% in the quarter. Fruit and vegetable prices were up 4.5% across the country, and dairy prices were even more so. Increased supply chain costs and the floods on the East Coast will be mostly to blame.

Up, up, prices are up

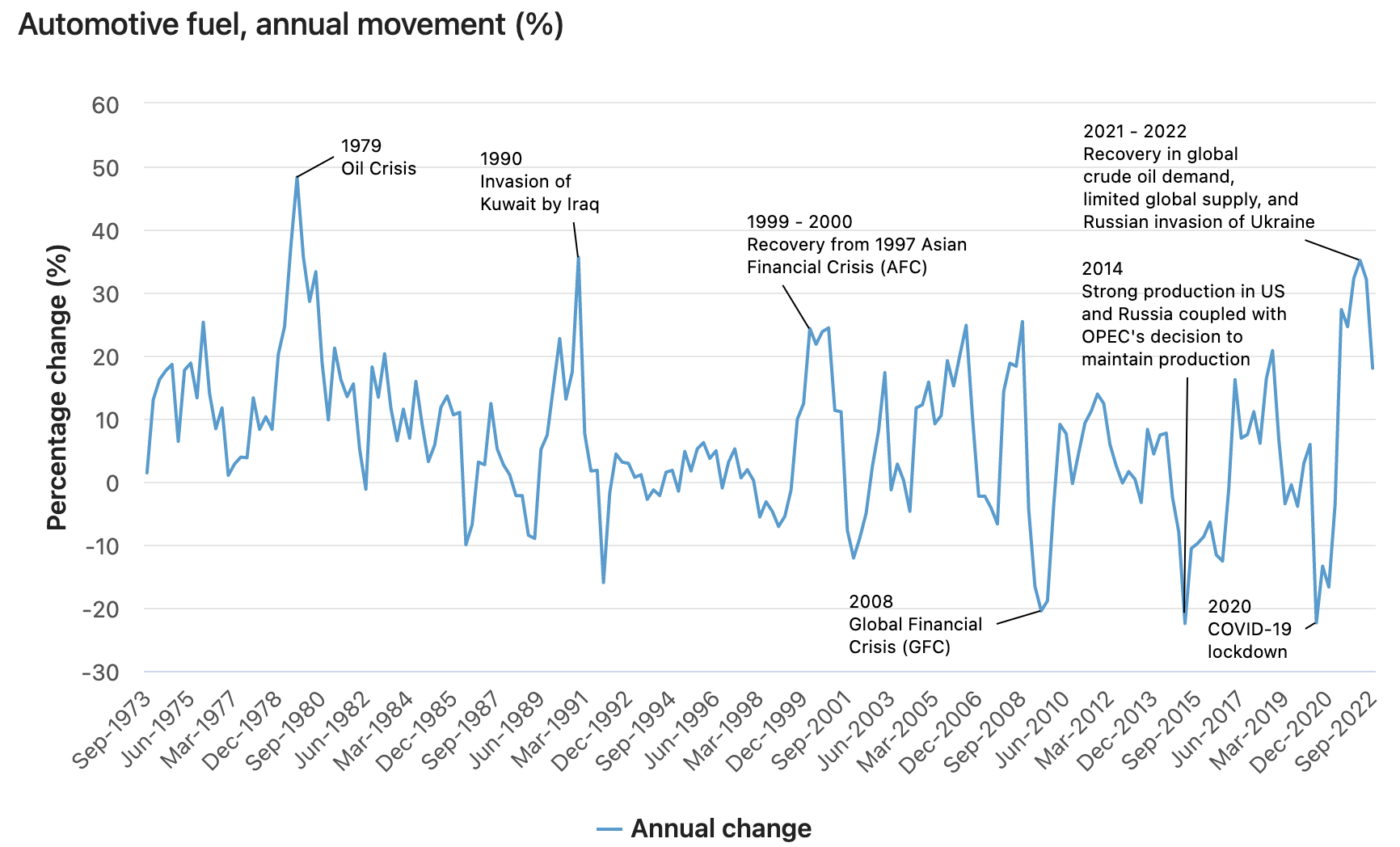

On the energy front, we know the story about crude oil imports globally. But here in Australia, automotive fuel actually in the September quarter by just over 4%. But don't expect this relief to last long, because the fuel excise's restoration will reflect in next quarter's numbers.

Fill up before you head out

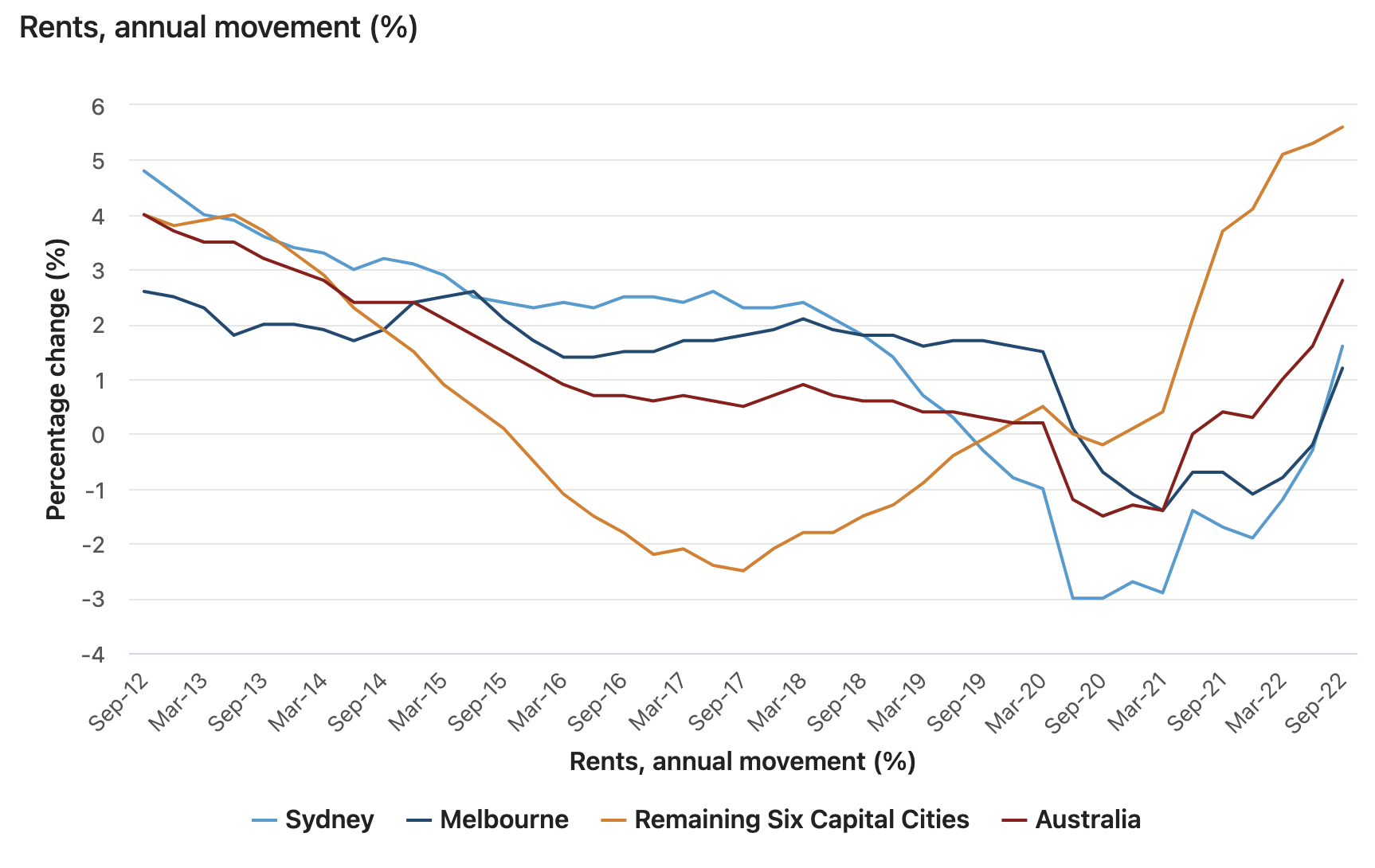

And then there's housing. While rental inflation is only up 1.3% year-on-year, that's not representative of the huge increase in rents in the major cities of Sydney and Melbourne. High levels of activity and ongoing shortages are also continuing to drive prices for new dwelling construction higher. So there's one area of inflation that's guaranteed to go up which hasn't been reflected yet.

House Rules

So will the Reserve Bank flinch...?

If there is anyone who might be shaking over this number, it's Reserve Bank Governor Philip Lowe. Earlier this month, the Bank hiked rates by 25 basis points in a counter-consensus move heard all around the world. Previous to that decision, RBA Deputy Governor Michele Bullock hinted that the decision had already been made before the release of the first monthly partial-inflation report. Both of these topics were covered in recent pieces on this very website:

.png)

So it all begs the question - will the RBA be forced into a "reverse pivot"? That is, will it have to undo its 25 basis point hike plans and add an extra 25 come Melbourne Cup day? HSBC's Paul Bloxham says no.

"I still think the RBA's pivot means the hurdle for them shifting back will be very high," he said. "To reverse this move would be a difficult message to sell."

While inflation is the top priority (and rightly so), Bloxham goes on to add that it should not be the be-all and end-all of its thinking.

Mathan Somasundaram disagreed, arguing its choice to step down the magnitude of its rate hikes is a sign of its "alternative reality".

"They have decided to take their alternative reality path and that means they are likely to stick to a 25bps hike. The RBA was hoping to not hike in December but that is looking almost delusional given the beat," Somasundaram told me.

...and does that bring us one step closer to a recession?

Bloxham has been one of the many voices arguing Australia will not end up in a recession. In his position, he also heads up HSBC's global coverage of commodities. With this expertise in mind, he argues Australia should never shy away from its competitive advantage. He has also long held the view Australia won't enter a recession because of this very fact - and it didn't change even in the face of today's data.

"Our central case is the Reserve Bank traverses the narrow pathway and delivers a soft landing rather than a recession," Bloxham says. "Although inflation is high, it hasn't embedded itself in the wage-setting process as it has in the US or New Zealand. The other reason is we are a large energy exporter. We have what the world wants," he adds.

Somasundaram agrees, arguing Australia won't have a recession. Having said that, other countries will not have the same easy ride - especially emerging markets and the Eurozone.

So what does it all mean for investors?

Stay defensive, says Somasundaram.

"We are positioned for elevated inflation for longer and central bank failures and that is exactly what we are getting," he argues. He's backing the gold, energy, and food/agriculture trades which have done so well for clients this year.

Among his top picks:

- Gold: Northern Star (ASX: NST), Silver Lake Resources (ASX: SLR), Gold Road (ASX: GOR)

- Food/Agri: Elders (ASX: ELD), Incitec Pivot (ASX: IPL), Nufarm (ASX: NUF)

- Energy: Karoon Energy (ASX: KAR), Soul Pattinson (ASX: SOL), Boss Energy (ASX: BOE)

At the macro level, Bloxham argues you should lean into assets that benefit from a falling Australian dollar. His message to investors is not to focus on an endgame, but rather on how the whole of the cycle plays out.

"The risk is that there is more downside yet," Bloxham says. "That rate differentials story will probably continue."

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

4 topics

9 stocks mentioned

1 contributor mentioned