What do rising rates mean for homeowners?

Livewire Markets

For the first time in more than 12 months, the world recently paused to consider what a higher interest rate might look like.

Just over the ditch from us, the Reserve Bank of New Zealand in late May became one of just a few central banks to forecast rising rates when it flagged the second half of 2022 as the likely turning point - and US Fed Chair Jerome Powell hinted at a similar outcome.

Fund managers in every asset class are telling Livewire that the potential for rising rates is their biggest concern over the mid to long term. Even James Gerrish of Market Matters said as much during a recent Livewire webinar, citing interest rate movements as the number #1 market driver for this new financial year.

As I explained in part one of this series, the Australian residential property market is booming, thanks to the RBA's "lower for longer" policy

So, what happens when interest rates eventually rise? Is this even a material concern given Reserve Bank Governor Philip Lowe has insisted that rates will only begin to rise in 2024? These are questions that I (as a millennial hoping to own a house one day) had.

In the second part of this three-part residential housing collection, our trio of contributors provide their predictions for when rates will rise and explain what this means for the residential property market.

Responses come from:

- Pete Wargent, Buyers Buyers

- Chris Rands, Yarra Capital Management

- Shane Oliver, AMP Capital

Investors need to keep a watchful eye

Pete Wargent, Buyers Buyers

As the Reserve Bank of Australia has noted, the economic rebound has been faster and stronger than previously expected, if somewhat uneven.

It’s clearly a fool’s errand trying to predict what will happen, and when, regarding Australia’s international borders. But progress on the vaccine rollout has been slow and little looks likely to change meaningfully this side of the Federal Election.

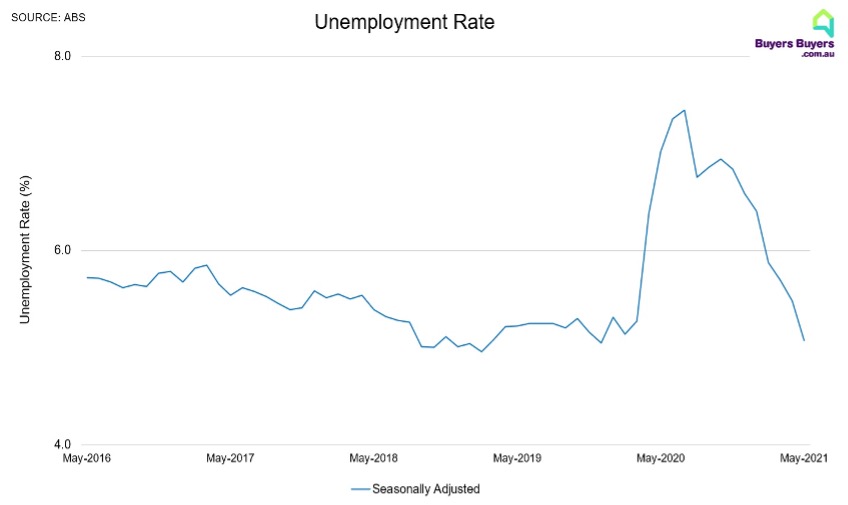

With fiscal and monetary stimulus working in powerful tandem, the official unemployment rate reported for May was just 5.07%, which is a remarkable improvement from about 7.5% only 10 months earlier.

But with the potential for re-opening international borders and an increasing labour supply, there remains uncertainty around when a healthy and sustained rate of wages growth will be achieved.

So, there is also likely a way to go before inflation is sustainably back within the target band, and it’s hard to imagine there will be any change to the cash rate soon.

It's more likely we will see some lenders adjusting their floor assessment rates a little higher, but context is important. Only a couple of years ago, borrowers were being assessed at about 7.5%, while the figure today might be about 200 basis points lower.

While "lenders tightening" will grab plenty of headlines, the investor cohort still has ample untapped capacity. This will likely continue to outweigh modest tightening of lending criteria as we heard towards 2022.

Hold your horses - it's not happening just yet

Chris Rands, Yarra Capital Management

While the RBNZ recently got hawkish, it is still questionable whether the RBA will follow the same path. The RBA’s messaging over the past 12 months has been incredibly consistent, stating that:

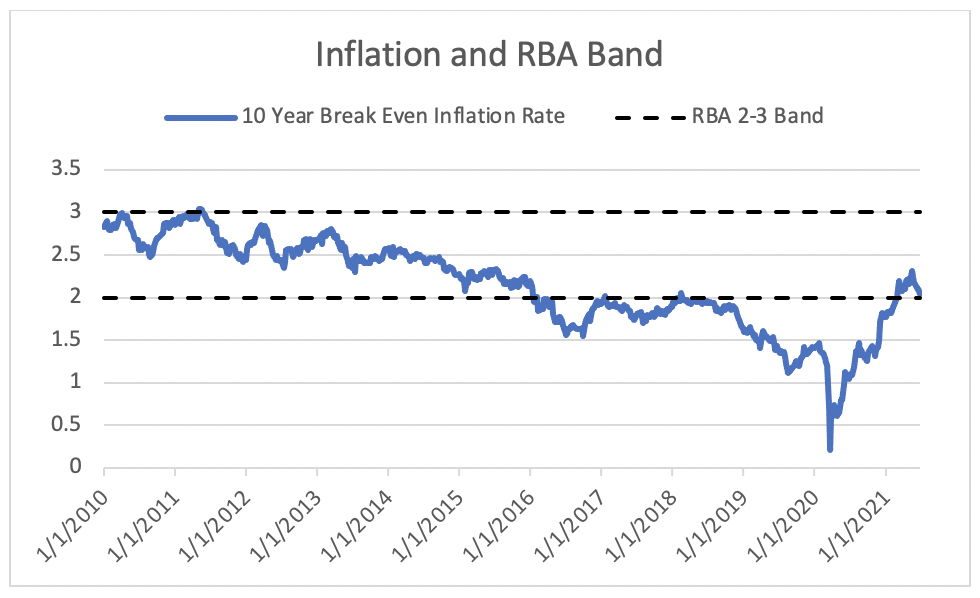

“It will not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range. For this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently. This is unlikely to be until 2024 at the earliest.”

While the market originally read this as a 2024 lift-off, it is actual inflation being sustainably in the 2-3% range that is the goal. And while there are promising signs that inflation may pick up (such as the unemployment rate falling to 5.1%), it is still debatable whether they will be able to achieve that goal consistently.

For example, the 10-year break even inflation rate (the expected inflation rate the bond market is pricing for the next 10 years) is currently still sitting around 2%. This is not quite as bullish as the market’s inflation expectations. And since the RBA’s inflation target is slightly higher than most other central banks – for example, New Zealand’s is between 1% and 3% – this implies it will take longer to get back to its goal.

Source: Bloomberg

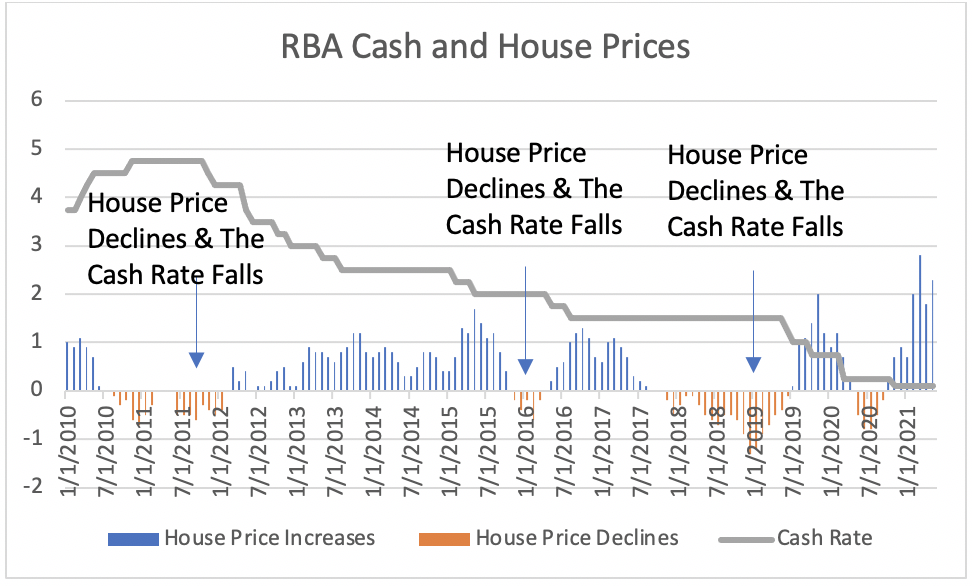

An interest rate hike should be a clear negative for house price growth, but if the RBA only talks about the potential for tightening, rather than actually tightening policy, we expect only a limited impact on the housing market. Australian housing loans are predominantly floating rate (although far less in recent months). This means that it's a moving cash rate that will tighten conditions, rather than the RBA talking about it (which tends to impact longer yields but has little impact on cash rates).

The final point worth noting is the RBA’s timing problem. If we take our mid-2022 timeline for a slowing in housing as correct, then the RBA is going to be talking about hiking rates just as prices begin to slow or decline. This raises the obvious question of whether a Hawkish RBA would actually pull the trigger, or just give us more of the same?

Source: Bloomberg, Yarra Capital Management

Make the most of low rates while they last

Shane Oliver, AMP Capital

The RBA, like many other central banks, is heading towards the exit from ultra-easy monetary policy. It's likely to lag the RBNZ though, which tends to be somewhat erratic at times. It's also likely to lag the Fed – with the US seeing more fiscal stimulus and benefitting from a faster coronavirus vaccine rollout. And after years of undershooting on inflation, the RBA is now more determined to get inflation back to target. This means a slower tightening than in the past.

That said, we see the RBA raising rates in 2023 or maybe even late 2022. The recovery has been far stronger than expected and it's now likely to meet the conditions for a rate hike. That is, wages growth in excess of 3% and inflation sustainably in the 2-3% target range - by late 2022 or early 2023.

The start of a rate hiking cycle is likely to result in modest home price falls in 2023.

But before we get to that, the RBA is likely to ease back on some of its other stimulus measures. This will see the end of cheap funding for banks, a shortening in the period that its bond yield target of 0.1% applies to, and a tapering (or slowing) in its bond-buying from September. The effect of this will be a modest rise in bank funding costs, which have already shown up with the scrapping of four-year fixed mortgage deals at rates of 2% or less. With 40% of new housing lending at fixed rates lately, this will have a dampening impact on new buyers coming into the property market.

Homeowners with debt should make the most of still-low rates to pay down their debt as fast as possible ahead of eventual rate hikes and to take advantage of still-low fixed rate deals.

Of course, a failure to get on top of coronavirus will delay RBA tightening. But with vaccination likely to ramp up in the months ahead (fingers crossed!) this is not our base case.

Stay tuned for more

If you enjoyed the second of this three-part series, make sure to give this wire a "LIKE". And if you've not yet read the first part, click here to see how our contributors weigh up the current state of play for Australia's housing market. Hit the yellow "FOLLOW" button to the left if you'd like to be notified when part three is published.

2 topics

3 contributors mentioned

Bella is a Content Editor at Livewire Markets.

Expertise

Bella is a Content Editor at Livewire Markets.