What does an ALP government mean for individual investors?

Australia heads to the polls this year for a federal election, most likely on 11 or 18 May. While voting intentions tend to narrow and tilt toward the incumbent as polling day draws closer, current voting intentions suggest there will be a change in government this year from the Liberal National Coalition (LNP) to the Australian Labor Party (ALP).

The ALP’s proposals are expected to result in considerable superannuation and tax changes which would have a wide-ranging impact on some clients. Due to the complex nature of these proposals and the considerable level of changes, coupled with the timing of the election, it is unlikely they would come into effect before mid-2020.

While there is no single or obvious strategy that would deal with the changes being proposed by the ALP, investors are advised to use this as an opportunity to review their current strategy with their investment adviser.

In this wire we look at the implications of the following proposed policy changes:

- Franking credit refunds

- Capital gains tax discount

- Minimum 30% tax on trusts

- Negative gearing

- Personal income tax

- Superannuation changes

Franking credit refunds

What is the ALP proposing?

Under current rules, if an individual receives franked dividends from shares held in a company, he or she is able to use the attached imputation credits (representing tax already paid by the company) to offset any tax payable by them. This is to ensure the original income on which the dividend is paid is not taxed twice. Where the imputation credits received are greater than the amount of tax payable, the recipient is entitled to a cash refund for the ‘excess’ amount. From 1 July 2019, the ALP is proposing that excess imputation credits would no longer be refundable.

Who would it impact?

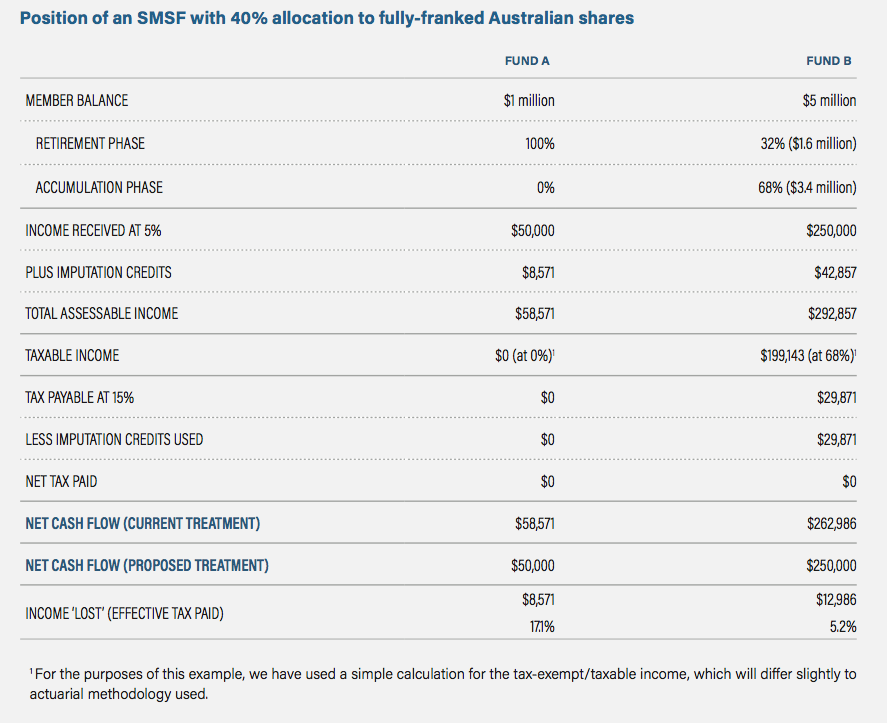

The change would impact all individuals and superannuation funds, with the exception of charities and not-for-profit institutions, an individual that is a ‘pension or allowance recipient,’ and self-managed super funds (SMSFs) with at least one member who is a pension or allowance recipient as at 27 March 2018. While the proposed rules would technically apply to all superannuation funds, some SMSFs would feel the impact more than other types of funds.

SMSF 100% in retirement phase—would have nil tax payable and, as such, would not be entitled to a refund of any of the imputation credits received. Due to the $1.6 million cap on retirement phase accounts, higher value SMSFs now have both retirement and accumulation phase accounts—and, as such, would be able to use some of their imputation credits. Lower value SMSFs would not be able to use any of their imputation credits.

SMSF with members in accumulation (tax-paying) phase and retirement (tax-free) phase—would be entitled to use imputation credits received to o set the amount of overall tax payable by the fund. However, it would not be entitled to a refund of any excess imputation credits.

For SMSFs with at least one member in retirement phase, investment portfolios should be reviewed taking into account the level of imputation credits being received. Options can be considered to increase the fund’s taxable income by:

- adding new members in accumulation phase (e.g. adult children);

- making assessable contributions (concessional tax-deductible contributions); or

- where members are drawing out more pension income than needed, transferring benefits from retirement (tax-free) phase back into accumulation (tax-paying) phase. While this would reduce withdrawals from the superannuation environment, it would also increase the fund’s tax costs.

Some industry commentators have suggested some or all of the balance within an SMSF may be rolled over into a large pooled superannuation fund—although in doing this, the investor would lose some control, flexibility and investment choice, and is not guaranteed to receive a full refund of excess imptuation credits. Also, caution would need to be exercised with the common strategy of withdrawing an amount from super to reinvest personally or within a trust structure. The aim of this is typically to take advantage of the individual’s $18,200 tax-free threshold where they have no other taxable income. However, with the proposed changes, they would likely lose their excess imptuation credits, and also pay higher CGT on the eventual sale of assets.

Large pooled superannuation funds (e.g. APRA-regulated funds including retail super and Industry funds)—funds that are in an overall net tax-payable position are unlikely to be impacted by these changes, as they would be able to fully offset their imputation credits. These funds are likely to have a higher value of member accumulation benefits relative to retirement benefits. However, should this ratio alter over time to a higher value of retirement over accumulation benefits, this may lead to the overall tax position changing to a net refund, which could result in the loss of excess imputation credits.

Companies, charities and not-for-profits—not impacted.

Trusts—not impacted directly, as all income flows through and is taxed in the hands of the beneficiaries (see section ‘Minimum 30% tax rate on trusts’).

Individuals that are a ‘pension or allowance recipient’—not impacted. The impact on individual taxpayers will depend on factors such as the level of franked dividends received, their total taxable income position and effective tax rate. Individuals who generally pay no tax would be worse off.

Individuals may wish to review their investment portfolio, taking into account the level of imputation credits received and whether restructuring is appropriate, considering the proposed increase to CGT on the future sale of assets. Given the changes, individuals may also review their eligibility to become a pension or allowance recipient.

Capital gains discount

What is the ALP proposing?

It proposes to halve the CGT discount for all assets purchased after a yet-to-be determined date. This would reduce the discount for assets held for more than 12 months from 50% to 25%. Investments made by superannuation funds including SMSFs are excluded from the proposed reduction, as are small business assets. All investments made before this date would not be affected and are expected to be fully grandfathered with the full 50% discount.

Who would it impact?

Given the impact on after-tax returns on CGT assets, investors may need to consider the appropriateness of holding assets such as domestic and international equities, as well as investment properties in alternative tax structures.

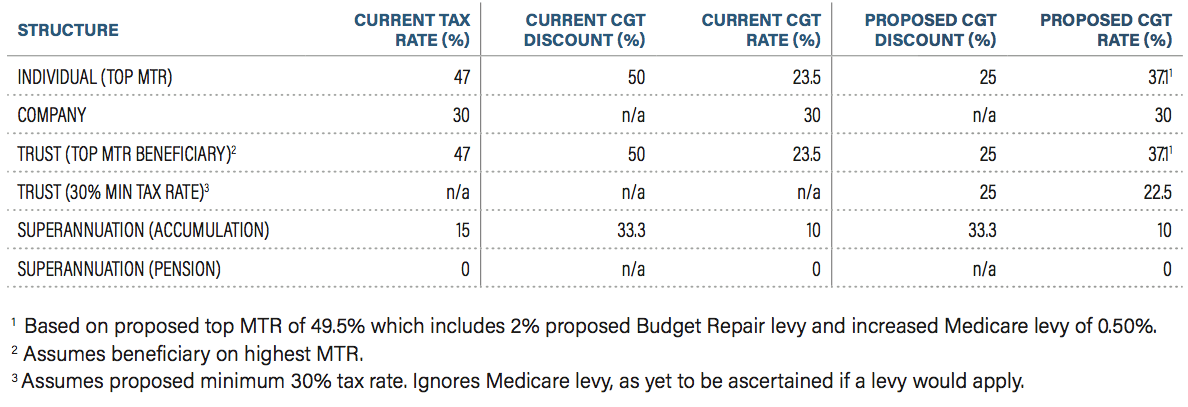

The estimated impact of these proposed measures on various tax structures are outlined in the following table. Individuals on the highest marginal tax rate and discretionary trust structures would be most impacted, given both currently access the 50% CGT discount.

The proposed changes emphasise the benefits of holding capital appreciating assets in a superannuation environment. However, this remains limited due to the $1.6 million total superannuation balance cap per person and the ALP’s proposed reduction of the non-concessional cap. Previously, a company (i.e. passive investment company, corporate beneficiary) was disadvantaged when holding capital appreciating assets due to the inability to access the 50% CGT discount. The proposed halving of the discount may potentially result in a different mix of asset classes being held in different tax structures to ensure the overall return is maximised.

Minimum 30% tax rate on trusts

What is the ALP proposing?

Although it is not proposing to tax trusts like companies, it is proposing a minimum 30% tax rate for discretionary trust distributions that occur from 1 July 2019 for beneficiaries over the age of 18. Although it acknowledges that trusts provide legitimate asset protection benefits and are used as an appropriate business structure, the use of such trusts also allows for tax minimisation, which is achieved through income splitting to family beneficiaries on lower tax brackets.

The ALP’s proposals aim to bring the system more in line with taxpayers who don’t have the ability to artificially split income and reduce their overall tax liability. While finer details are yet to be released, it is understood that where the 30% minimum tax rate on discretionary trust distributions is below what would be paid under the normal marginal tax scales, the higher tax rate would apply. The proposed measures would exclude special disability trusts, testamentary trusts (deceased estates), fixed trusts and fixed unit trusts, cash management unit trusts, public unit trusts (listed and unlisted), charitable and philanthropic trusts and farm trusts.

Who would it impact?

Private family businesses who typically operate through a discretionary trust structure and investors who hold a significant level of passive family investments via this structure. The general tax benefits of distributing taxable income to a non-working/low-income spouse and low-income adult children who have yet to earn sufficient income would essentially reduce under the proposal. Subject to the overall effective tax rate across a family group, potentially more distributions may flow to a corporate beneficiary to lock in the current corporate 30% tax rate—although distributing to a corporate beneficiary does have further implications and requires consideration.

Importantly, while the current tax benefits would be impacted under a Labor government, a discretionary trust structure continues to provide other associated benefits, such as asset protection, succession and estate planning, access to the CGT discount (although there is a proposal to halve this discount). Accordingly, we expect this type of structure would continue to be widely used as a long-term investment vehicle.

Negative gearing

What is the ALP proposing?

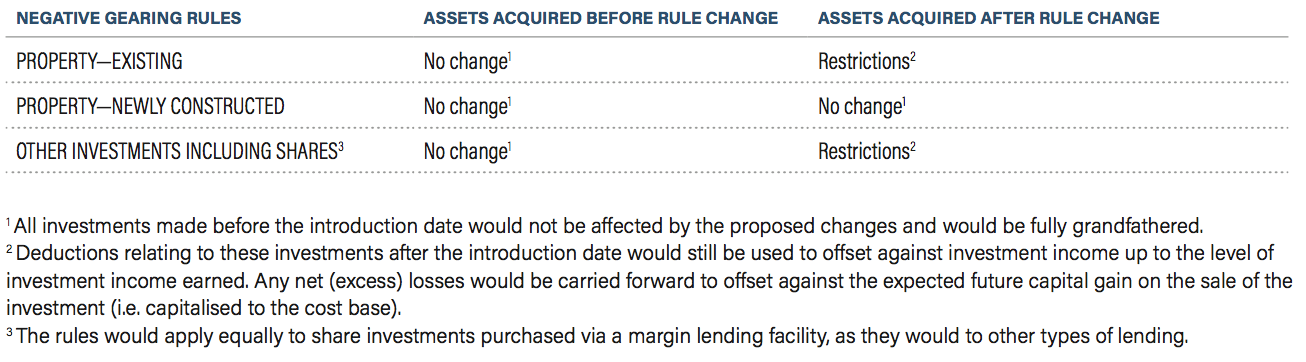

The position currently is that an investor can deduct the aggregate of all his or her investment-related net losses against all other income (e.g. salary, wages and any other income).

The ALP intends to limit the ability to negative-gear an investment to new housing only. This means a taxpayer investing in newly-constructed housing would continue to be allowed to deduct net rental losses against total assessable income. The date this would become effective is yet to be determined.

Who would it impact?

Investors using margin lending may be less impacted than those using other types of lending (e.g. mortgage lending), as margin lending cannot be used to fund 100% of the purchase cost of an investment due to the general loan-to-value ratio restrictions. Margin lending arrangements with low levels of gearing (e.g. 50% loan-to-value ratio) are more likely to be in a neutral or positive gearing position.

With a neutral or positive gearing level (for any type of investment), there is generally no net investment loss, as the interest costs would not exceed the income earned. As such, we expect that the taxpayer’s position would not be impacted by the rule changes. Taxpayers may seek to bring forward negatively-geared investment arrangements in light of the proposed ALP restrictions.

Personal income tax

What is the ALP proposing?

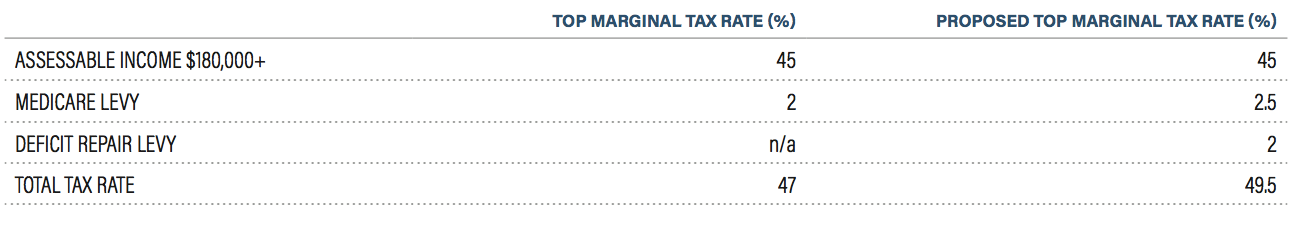

While the ALP supports the government’s efforts to reduce personal income tax burdens, it is further proposing to reintroduce a 2% deficit repair levy for high-income earners and the permanent return of the 0.5% Medicare levy increase for middle to high-income earners.

Who would it impact?

This would see the marginal tax rate for high-income earners (i.e. $180,000+ bracket) increase again as summarised in the table below. High-income earners would be further impacted by the proposal to halve the CGT discount (see summary table under ‘Capital gains discount’).

Superannuation changes

Non-concessional contribution cap

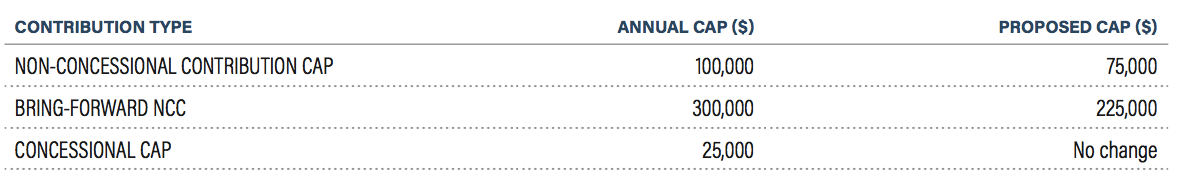

The ALP is proposing to lower the annual non-concessional contribution cap to $75,000 per annum, a reduction from the current annual cap of $100,000. The proposed change would impact the level of contributions allowed under the ‘bring forward provisions’ (i.e. three years’ worth) from $300,000 (or $600,000 combined per couple) to $225,000 (or $450,000 combined per couple). It is expected that the ‘total superannuation balance cap’ which applies to non-concessional contributions would remain—this cap is currently $1.6 million.

Cutting the thresholds would limit investors’ ability to make large one-off contributions, which are typically driven by liquidity events such as a sale of business, sale of property or an inheritance. Limiting the ability to make immediate large one-off contributions would ultimately result in excess funds being invested in a less concessionally-taxed environment.

In addition, those planning for retirement may need to start contributing to super earlier than anticipated due to the longer time period required to build up appropriate superannuation retirement balances.

Pension exemption limit

The ALP previously announced that it would limit the tax exemption for earnings on superannuation assets in a pension account. While it is unclear if it intends to reintroduce this proposal, it is broadly understood that earnings on assets supporting an income stream in retirement phase would be tax free up to $75,000 per member. This is based on a 5% yield on pension assets that equates to $1.5 million. Earnings above $75,000 would be taxed at 15%. At time of writing, it is unclear if the ALP would implement this policy, particularly since the LNP recently introduced a $1.6 million ‘transfer balance cap’ which limits the level of benefits that can be held in a tax-exempt pension account.

Catch-up concessional contributions

Currently, individuals with low superannuation balances can carry forward the unused portion of their $25,000 concessional contribution cap for a period of up to five years. Eligibility is limited to individuals with total superannuation balances less than $500,000 as at 30 June of the previous year. The ALP is proposing to abolish this provision, with no clear indication of any alternative measures being introduced or whether eligible unused concessional caps accrued under existing legislation would be retained. Subject to an alternative policy, abolishing this provision would impact individuals with low superannuation balances or those who have been out of the workforce for a significant period of time and have been unable to top up their concessional contributions.

Personal concessional contributions

The ALP proposes to reverse the recent change introduced by the current government, which allows any individual who is eligible to contribute to super to claim a tax deduction for personal concessional contributions where the individual has available cap space after taking into account compulsory super guarantee and salary sacrifice contributions.

It is unclear if the ALP would reinstate the 10% ‘substantially’ self-employed person test, which was abolished by the LNP. This allowed those who satisfied the test to make personal deductible concessional contributions which primarily excluded employees. The proposed changes would lead to employees reconsidering undertaking salary sacrifice arrangements if available and generally cannot be entered into retrospectively.

Division 293 tax income threshold

Currently, individuals who earn $250,000 or more pay a tax surcharge of 15% on concessional contributions (employer and personal deductible contributions) bringing the total tax levied on their super contribution to 30%. The ALP proposes to reduce the income threshold to $200,000, which would result in more income earners being subjected to the extra tax. However, high-income earners who are subject to division 293 tax would still receive a tax benefit. This is because contributions are taxed at a maximum rate of 30% compared to the highest marginal rate of 47%, which may also increase to 49.5% under proposed income tax changes.

Employer compulsory super guarantee payments

In order to help grow superannuation savings, the ALP would look to end the current government’s freeze on the superannuation guarantee rate of 9.5% and fast-track the rate increase to 12% as soon as practicable. This is in contrast to the current government’s more gradual increase. This would benefit those who currently have low superannuation balances and who need the increases to improve their retirement needs.

SMSF borrowing rules

Whilst the government did not adopt the Financial System Inquiry recommendation to prohibit an SMSF from borrowing for investment purposes under the limited recourse borrowing arrangements, the ALP has proposed restoring this prohibition on direct borrowing by superannuation funds for property investment purposes.

It is still unclear if the proposal is limited to just residential property or would also include commercial property, which is a commonly held investment and a key benefit of uilising an SMSF structure.

This wire is an extract of Crestone's Federal Election 2019 - Preparing for Change/ March 2019. To read the full article please click here.

Never miss an update

Stay up to date with the latest news from Crestone by hitting the 'follow' button below and you'll be notified every time we post a wire.

Want to learn more about Crestone Wealth Management? Hit the 'contact' button below to get in touch with us or head to our website

2 topics