What inflation means for this defensive, high-yielding asset class

We believe inflation linkage is a key attribute of infrastructure as an asset class. And we’re often asked to prove it, especially now with fiscal and monetary stimulus pushing inflation expectations to near two-decade highs.

From our experience, it is extremely difficult for almost any asset class, including infrastructure, to offer clear statistical proof. The forward-looking nature of markets and multiple factors impacting prices combined with how inflation expectations interact with those factors make this a complex area.

There is also a wide divergence in the inflation protection delivered by different infrastructure assets. Some offer extremely strong protection – good examples are toll roads, UK, Australian and Latin American regulated utilities and telecommunication towers – and others offering less such as US regulated assets.

This is a topic that was front of mind when my partners and I started the Maple-Brown Abbott global listed infrastructure business in 2012, based on our prior experience in the sector which formed our views of it being a key differentiating factor of the asset class. The inflation linkage is core to our definition of ‘infrastructure’ and how we select investments, and indeed is a key factor in why we believe infrastructure deserves a strategic asset allocation within a diversified investment portfolio. So how do we reconcile these challenges, particularly around proof?

We consider the inflation linkage asset by asset. Our process specifically focuses on this. Our proprietary ‘Focus List’ for the Global Listed Infrastructure strategy comprises companies with the strongest combination of low cash flow volatility and inflation linkage.

Thanks to recent work by my colleague, Steven Kempler, co-founder and portfolio manager, Maple-Brown Abbott Global Listed Infrastructure, we believe we are able to demonstrate inflation linkage at the asset level.

In his paper, Taking Shelter from Inflation: Deconstructing the Implications of Inflation for Listed Infrastructure, Steve argues that “most core infrastructure assets have their earnings or revenues linked to contracts or concessions with built-in inflation escalators or have returns set by a regulated asset base with limited or no link to volumes or cyclical demand”.

As Steve points out, within the infrastructure sector, there are significant variations in the earnings and valuation sensitivity of companies to movements in inflation (and interest rates more broadly), particularly with regard to growth, inflation or regulatory offsets.

Regulated assets typically rely on multi-year mechanisms set by an independent regulator as to the price path of tariffs or rates. Concession assets usually see tolls or tariffs escalate in line with an agreed formula, while contracted assets rely on agreed price adjustments in their leases or contracts.

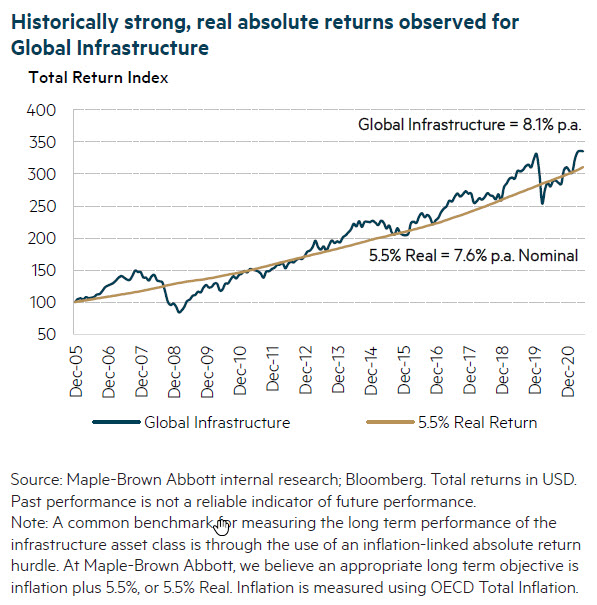

These commercial frameworks underpin the positive real returns observed from infrastructure. This has led to historically higher income than other asset classes as well as the perceived inflation-linked growth of that income.

In the paper, Steve gives four examples to show the linkage with inflation. As an illustration, I’ll focus on Infrastrutture Wireless Italiane (INWIT), an Italian mobile/cell tower owner and operator, which has around 22,000 towers across Italy with long-term contracts that are ~95% inflation-linked, with a 0% floor.

The rate of inflation is built into the lease payments made by mobile carriers and wireless operators for capacity on INWIT’s towers. Coupled with a high fixed cost base and high margins, this means more than the inflation increase is passed through to earnings and equity holders. For example, the company guides that for every 1% increase in inflation, there is a positive impact on EBITDA of around 1.2%.

In addition, we see that higher inflation-linked revenues may be partly offset by the company’s structure to the extent it has inflation-linked debt or floating rate debt that may see rates rise with inflation. In the case of INWIT, the majority of debt (80%) is set at a fixed rate, which eliminates any short-term exposure to inflation-linked interest rate rises.

Whether an investor chooses to invest in global infrastructure for its downside protection, for its reduced correlations with global equities, or for its inflation-linked income, a final thought should be given to return expectations.

A significant portion of the historical total returns for the asset class has come from dividends – averaging around 3.5% a year over the past 15 years and with real dividend growth of 2% a year. Further, we view the current valuation of the sector as fair to attractive, and clearly attractive relative to where comparable assets trade in the direct infrastructure market.

Read a copy of the full paper attached to this wire.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

Andrew Maple-Brown started Maple-Brown Abbott Global Listed Infrastructure with three partners in 2012, holding the belief that the best way to align with investors was through a boutique ownership structure. With more than 20 years’ experience in...

Expertise

Andrew Maple-Brown started Maple-Brown Abbott Global Listed Infrastructure with three partners in 2012, holding the belief that the best way to align with investors was through a boutique ownership structure. With more than 20 years’ experience in...

.jpg)

.jpg)