What's driving the stellar run in small caps?

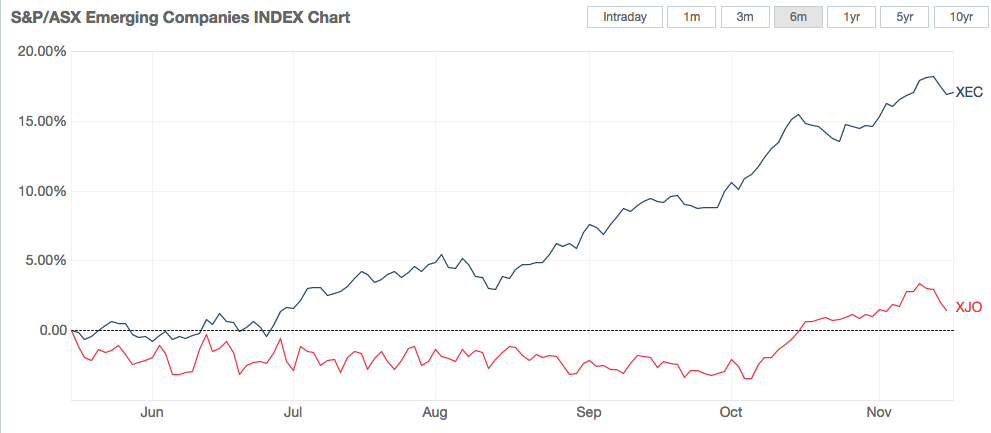

Small caps have surged in recent months. The Emerging Companies index (XEC), which includes stocks such as HUB24, Appen, Imdex, and Updater in its top ten constituents, has gained 17% over the last six months. There are scores of stories from the small end of transformative wins, not least in junior resources where, for example, numerous cobalt hopefuls are up ten-fold in a few months. It seems the casino is open for business once again. In stark contrast, however, the ASX200 has barely made it into the black in the same six-month time frame. Just what is going on? We reached out to several small cap experts to get a handle on things. This is what they told us.

Someone flicked the ‘Get-long-Australia’ switch

Chris Prunty, QVG

The whole market – including small caps – has been on fire since early October. It’s like someone flicked the Get-long-Australia switch in the first week of October, and since then it has been ‘game on’.

If there are big global money flows in to a market purely for the reason ‘Australia has lagged and it’s time they caught up’, then small caps will likely outperform for the simple reason that our banks make up such a large part of the market and their outlook is relatively less attractive than their global peers.

It’s also worth noting the role small resources have played in the rally. They are up 27.2% this calendar year, while small industrials and the top 100 stocks (Large Caps) are up 12.7% and 10% respectively.

Will this continue? At QVG we ascribe to the “It’s tough to make predictions, especially about the future” school of thought. Regardless, our modeling shows that small caps are slightly – but not alarmingly – expensive relative to both large caps and their own post-GFC averages.

The case for small caps is stronger than ever

David Allingham, Eley Griffiths

Whilst there will always be periods where smalls underperform, over the long-term, we believe the case for small caps to structurally outperform is stronger than ever. Reasons for this include:

- The high level of inside ownership & alignment with investors

- The leverage smalls have to M&A

- Smalls are typically less researched than large caps which give investors an ‘information bias’ if they do the work

- Leveraging technology

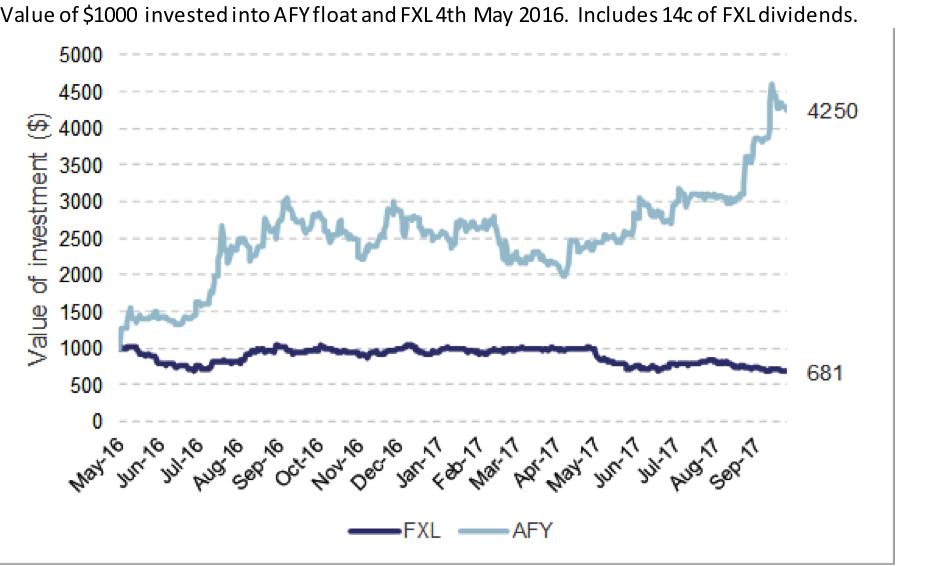

In recent years, technology has become a huge enabler of small company growth, leaving large companies more exposed to new competition. A quick comparison of AfterPay and FlexiGroup in the consumer finance space highlights how technology is enabling small caps to more effectively compete with incumbents.

Source: Wilsons

Whilst constituents within the small ordinaries will change over time, we believe a select portfolio of small-cap companies that exhibits the above characteristics will continue to outperform large caps over the long-term.

Investors coming down to small caps for growth

Dean Fergie, Cyan IM

I believe the run in the small caps has been driven by investors looking down the size curve to generate better investment outcomes.

Quite simply, the big caps have just not been performing:

- The big banks have been going sideways for the past 4 years

- Yield stalwart Telstra has cut its dividend and is back to where it was in 2009

- The resources sector as a whole has not made any gains in over 10 years

These companies alone comprise around 50% of the All Ords, so I think the investment community is starting to seriously look outside the top-end of town for their next leg of capital growth.

The risk is to the upside

Andrew Mitchell, Ophir Asset Management

One key risk factor facing portfolio management teams in the current market is ‘upside risk’, remembering that risk works both ways.

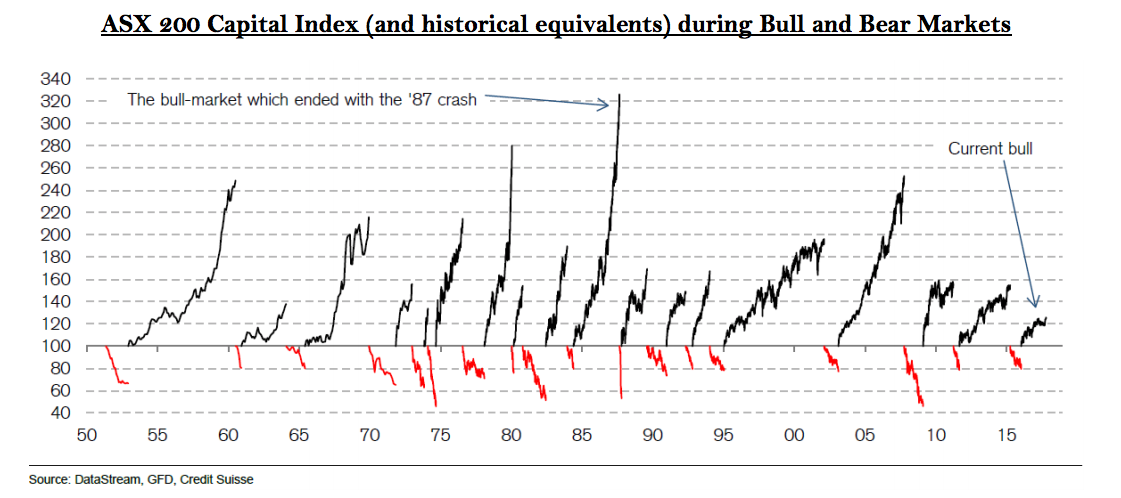

Positioning a portfolio too conservatively can ultimately result in a missed opportunity of participating in further upside, particularly in the latter stage bull markets where the bulk of returns tend to be generated toward the end of the cycle.

While the current bull market run in Australian equities has some tenure in terms of time (i.e. months passed since the last -20% pullback), the overall share price appreciation over the period has been relatively muted versus historical market moves. A recent analysis from Credit Suisse highlights that the current bull market in the ASX 200 is the 18th since 1950 and, if it were to end today, would be the smallest in terms of total share price return (with the median bull market run over the last 70 years delivering a total capital return of 70%).

While we recognise that risk levels are more elevated at this stage of the cycle, we tend to view the current environment as continuing to remain broadly supportive for equities - particularly for those businesses that are continuing to deliver sustainable and ongoing earnings growth. While equity market valuations do sit at a premium to longer-term averages, we are yet to see any meaningful warning signs of irrational exuberance emerge (e.g. increasing levels of M&A, significant increases in corporate leverage, unbridled optimism, ‘new’ valuation metrics etc).

We will continue to remain cognisant of the various risks that Australian businesses could potentially face under either a reflation or financial crisis scenario, however, at present we continue to feel these risks remain largely contained.

Growth remains difficult to find for larger capitalised, older-world businesses and, as a result, the opportunities available for higher quality, emerging growth businesses in Australia continues to remain compelling.

Risk appetite is on the rise

Andrew Smith, Perennial Value Management

After several years of underperformance, investors were initially attracted to the better valuations available in Small Caps.

However more recently there has been a noticeable improvement in risk appetite. This has added fuel to the rally with investors taking comfort from the almost synchronised growth that is occurring around the world.

Finally, investors have responded to slower growth in traditional large cap sectors (eg. Banks, Telco’s), and begun searching the small cap market to access higher growth sectors such as the Chinese consumer exposed names and small resources.

Mean reversion after a soft patch

Mark Tobin, IIR

While FY18 is barely underway the microcap and small caps indexes have got off to a flyer, significantly outperforming large caps indexes. Although most microcap managers have made a good start, they have lagged the index performance a bit but as the old adage goes “A good start is half the battle” so hopefully they can catch up a bit of performance later in the year.

There has been a noticeable rebound in the performance of microcaps and small caps versus large caps. The ASX All Ordinaries Accumulation Index returned a minuscule 1.0% for the quarter. In stark contrast, the ASX Emerging Companies Index posted a robust 8.9% return for the quarter. A bit of mean reversion appears to be happening as the large caps handily outperformed the smaller end of the market in FY17, so we will see if FY18 continues to be a year for the little guys.

Not a single LIC’s was able to outperform the ASX Emerging Companies Accumulation Index in the quarter however a minority managed funds did manage to outperform the index. Now it must be noted we are only 3 months into the year so there is a long way to go in FY18 and no investor should judge a manager on a single quarter performance.

4 topics

2 stocks mentioned

5 contributors mentioned