What’s happening with oil prices?

Whether you’ve noticed it at the bowser as petrol prices surge over the $2 mark, or have simply been watching it in the news, oil prices are on the rise… again. And this follows a period of weakness. This obviously comes as somewhat of a concern – there’s a strong link after all between inflation and oil prices. In fact, some commentators suggest that this is behind the jump in inflation print numbers for August.

Oil remains one of the essential commodities to keeping our world running smoothly and demand is high.

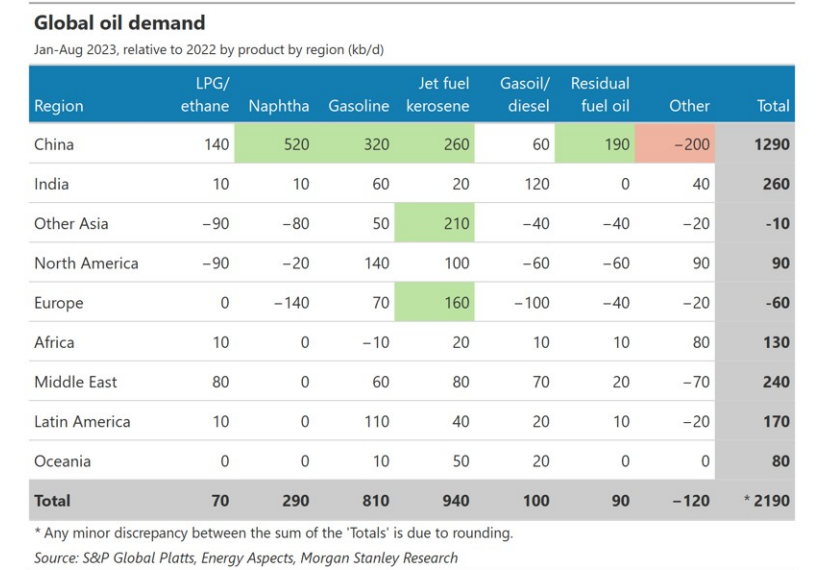

In fact, the International Energy Agency (IEA) estimates global demand will have grown by 2.2m barrels per day in 2023 – and expects a slowdown in demand in 2024. This is in line with data shown in the chart below for demand between January-August 2023 compared to the previous year.

By contrast, the Organisation of Petroleum Exporting Countries (OPEC) believes demand will remain high in 2024 and estimates demand of 2.25 million barrels per day.

So what is actually happening and how does this play back to investment markets? I’ll take a look in this wire.

The same old supply and demand story

The trigger for rising prices last year was a result of the Russian invasion of Ukraine. Russia is the third largest producer of oil and European sanctions forced many countries to look elsewhere for their imports – in addition to this Russia cut supplies. While things seemed to improve as US supplies increased, there’s been yet another spanner in the works. OPEC's 23 members are responsible for 40% of the world’s supply and sets production targets monthly. It dramatically scaled back production targets by one million barrels per day back in July, with Saudi Arabia and Russia continuing cuts for the remainder of 2023. The IEA is tipping a significant supply deficit as a result for the fourth quarter of 2023 – though if their 2024 forecasts are correct, we may end up oversupplied.

While other countries like the US and Brazil have filled some of the gaps across the year, US oil and gas companies are now hesitant to ramp up production, wary of any risks of excess supply.

Demand has been largely fuelled by China, with the IEA pointing to the country as being responsible for more than 70% of demand growth in 2023. This is despite the fact that the Chinese economy has not lived up to hype in general this year – travel and transportation demand is slowly creeping upwards but Chinese manufacturing has slumped and the property market is currently in crisis.

Oil prices have spiked further on concerns over geopolitical activity in the Middle-East, with some commentators monitoring Iran’s potential involvement in the Israel-Hamas War.

The outlook for oil prices

There are some suggestions that demand and supply constraints are likely to peak in the fourth quarter of 2023 – so don’t expect any relief filling up your car just yet.

- UBS last week raised its forecast for Brent oil to $US92/barrel up from its previous target of $US85/barrel.

- Goldman Sachs suggested we could be staring down $100/barrel by Christmas – you can read more in this wire from my colleague Hans Lee which discusses further the bull and bear cases for prices.

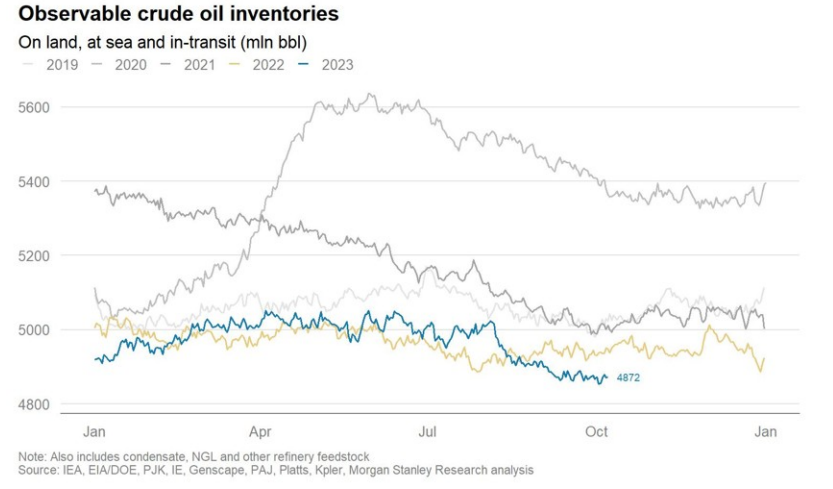

- In its Oil Manual, Morgan Stanley maintained its range forecasts of $85-95/barrel and pointed to forecasted deficits of 0.8-0.9m barrels/day in the fourth quarter. It also suggests that stocks have continued to draw which will continue into the first quarter of 2024.

In any case, it’s going to be a bumpy ride and investors should stay tuned for what higher oil prices mean for supermarket prices, after all, the transportation costs are going to hit the grocery basket sooner rather than later.

2 topics

1 contributor mentioned