What's More Risky: Shares or Residential Property?

AtlasTrend

In Australia, many cities have enjoyed a prolonged period of house price increases. As a result, it's safe to say a large number of Australians have fallen in love with residential investment property as an asset class.

The housing price increases that so many investors have enjoyed has also led to a popular perception that residential property is a relatively low-risk way to invest.

However, is investing in residential property really that low risk – particularly if house prices start declining?

Let’s compare the risks involved when investing in residential property versus another popular asset class, listed shares. Since the analysis to follow will be focused on risks, it will be looking at what could happen when things go wrong – particularly when prices decline.

It's not meant to be a pessimistic, one-sided analysis of investment property versus shares. But rather about presenting some facts about downside risks, which are often left out of glossy marketing brochures.

Borrowing Risks

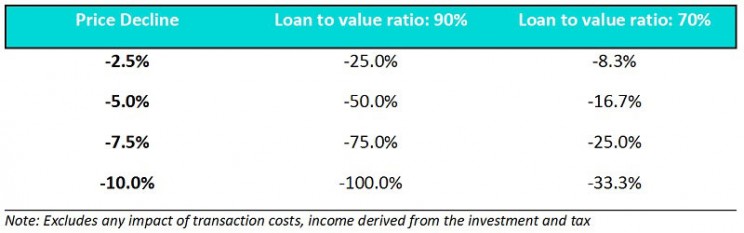

Borrowing money to buy an investment property has become somewhat of a national pastime. While debt on an investment property can significantly increase investment returns when property prices are rising, the opposite is also true. The table below shows how much an investor would lose in principal capital value for a given level of decline in prices, and loan-to-value ratio.

Investment Principal Capital Loss Table

At a 90% loan to value ratio, a house price decline of a mere 5% would result in an investor losing 50% of the equity they have in that investment. Is it possible Australian residential property prices could decline by 5%?

The short answer is: yes. In fact, in cities such as Perth and Darwin, the average house prices have already seen such declines.

Although it is also possible to borrow money for investing in listed shares, the maximum a bank will normally lend against listed shares is much lower than what they will lend against an investment property.

For example, many banks will lend up to 90% or more of the value of an investment property – but will only lend up to 70% against large blue-chip shares.

As a result, investors are not able to gear their share investments as much as property investments, which leads to a measurably lower risk of suffering substantial losses on principal capital value if prices decline.

Liquidity Risks

During a housing price downturn, it usually takes a longer to sell a house. Again, let’s take Perth as an example where publicly available statistics show the average number of days for a house to sell has increased from under 50 days (when house prices were rising rapidly) to over 70 days when house prices started to fall.

If you have an unexpected life event which requires access to cash at short notice, having the majority of your investments in residential property can be an issue. This is an even greater risk if the property has a high loan-to-value ratio in a declining house price environment, as the banks are unlikely to lend any more money against that property.

In comparison, most listed shares (particularly blue-chip shares) are highly liquid and can be sold for cash within a few days. Whether it is due to an unplanned need for cash, or you simply want to rapidly de-risk your investment portfolio during a market downturn – listed shares tend to have substantially less liquidity risk than a direct investment in residential investment properties.

Investment Concentration Risk

Do you know someone who owns a residential investment property in the same city or even suburb that they live in?

If that person’s only substantial investment is in one or two residential investment properties, they are likely to have significant investment concentration risk. For example, someone who works in Sydney, lives in Sydney, and invests only in residential property in Sydney is completely exposed to how the Sydney economy performs.

Let’s look at Detroit in the US as an example. The city suffered greatly during the depths of the global financial crisis – the unemployment rate more than doubled and house prices fell by approximately 50%. Undoubtedly, there would have been a lot of people in Detroit who lost their regular employment income and also lost tremendous amounts of money on their Detroit investment properties.

Yes, Detroit is an extreme example. In no way are there any suggestions this could happen in Australia on the same scale, but it does show the real danger of potential investment concentration risk.

Even if you decide only to invest in a handful of blue-chip listed shares, you are likely to be much more diversified than buying one or two investment properties near where you live.

Many large listed companies usually have operations across Australia (or even globally) with multiple revenue streams. They provide a far more diversified investment compared to a concentrated investment property portfolio.

For all the reasons above, investing in a diversified portfolio of shares can be less risky than buying 1 or 2 investment properties – particularly during periods of price declines.

For more investing insights, visit our blog.

5 topics

Kent Kwan is a co-founder of AtlasTrend. He was formerly a Chief Investment Officer of an ASX listed company and prior to that was an international equities fund manager with JPMorgan.

Expertise

Kent Kwan is a co-founder of AtlasTrend. He was formerly a Chief Investment Officer of an ASX listed company and prior to that was an international equities fund manager with JPMorgan.