What's the next big play in the energy sector?

The global energy sector is in the midst of significant transformation, presenting diverse investment opportunities. Imagine standing at the edge of a vast river. On one side, we have traditional energy assets like coal and oil, which have historically been staples of the energy portfolio. On the other side, there's the emerging realm of clean energy, driven by evolving consumer preferences, technological advancements, and regulatory shifts. Navigating the transition between these two domains is crucial for informed investment decisions. Uranium, used in nuclear power, is one of the many options in this transition.

For investors, a comprehensive understanding of all available energy options, including uranium, is essential to strategise for a balanced and future-ready portfolio.

The promise of renewables

The transition to renewable energy is not just a hopeful vision: it's an unfolding reality. Sprawling solar panels tap into the sun's steady energy, wind turbines on hills and plains harness shifting winds, and hydro systems utilise the force of rivers and waterfalls for power. This vision of clean, abundant energy is not just captivating but also essential for our planet's future.

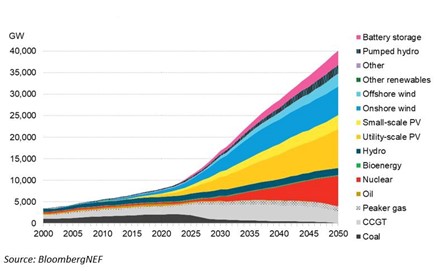

The momentum behind this transition is evident in the data. According to S&P Global Platts, renewable energy capacity is expected to grow by 13% in 2023, driven predominantly by wind and solar installations. This sector is projected to attract a staggering $322 billion in investments in the same year. Such growth is attributed to supportive government policies, technological advancements, and the decreasing costs of renewable technologies.

The gap in a power-hungry world

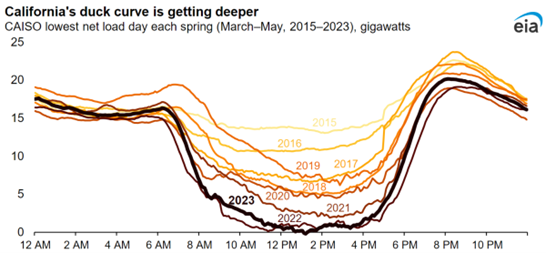

Renewable energy's ascent is undeniable, but challenges persist. In 2023, global renewable capacity is set to spike by 107 GW, with solar PV constituting two-thirds of this growth. However the unpredictability of solar and wind, coupled with geographical constraints of hydro energy, remains. The EU, responding to geopolitical crises, has accelerated its renewable deployment, forecasting a 40% increase in capacity additions for 2023-2024. Yet as global electricity demand rises, the gap between renewable supply and consumption widens, underscoring the need for reliable energy sources as economies and industries grow post-pandemic.

Paving the path to energy transformation

Uranium continues to hold a central position in the global energy landscape. A single uranium pellet can rival a tonne of coal in energy output. Beyond just power generation, uranium-fuelled reactors produce essential isotopes for various sectors. Its consistent energy addresses the intermittency challenges of renewables. With global electricity demand rising and the urgency to cut carbon emissions, uranium's role is becoming indispensable. Geopolitical tensions, like those in Kazakhstan and the Russia-Ukraine conflict, further highlight its strategic importance.

After years of stagnation, uranium prices are rebounding due to increased global support for nuclear energy. The unreliability of wind, solar, and hydro has governments eyeing nuclear for steady power. With significant reserves in stable areas like Canada's Athabasca Basin, nuclear energy promises reliability. As uranium demand rises, its supply struggles due to past under-investments. Experts predict a potential supply shortage, emphasising the need for higher uranium prices for incentivizing new supply.

Our three top ideas

ATOM - Uranium ETF (ASX: ATOM): Hailing from GlobalX ETFs, ATOM stands out as a premier investment avenue, offering a comprehensive portfolio of companies engaged in both uranium mining and the broader nuclear component production. Since its launch in December 2022, ATOM has demonstrated consistent growth, positioning itself as an enticing option for investors eager to capitalize on the burgeoning uranium market.

PDN – Paladin Energy (ASX: PDN): A prominent figure on the ASX 200 list, Paladin Energy boasts a commanding 75% interest in the globally recognized Langer Heinrich Mine situated in Namibia. With an impressive history, having produced over 43 million pounds of U3O8, Paladin is gearing up for a robust production return by Q1 CY2024. Beyond its flagship mine, Paladin's reach extends to high-quality uranium exploration and development ventures, primarily in the resource-rich regions of Canada and Australia.

BHP (ASX: BHP): As one of the world's leading commodities producers, BHP has carved a niche in the uranium sector. Its Olympic Dam mine in South Australia, renowned as the world's most significant known uranium deposit, is a testament to BHP's commitment to the industry. While copper extraction remains its primary focus at Olympic Dam, the mine's vast reserves of gold, silver, and uranium underscore BHP's diverse and robust commodities portfolio.

Founded by Investors for Investors

MPC Markets' mission is to empower every investor with the knowledge, tools, and guidance necessary to unlock their financial potential. Find out more.

4 topics

3 stocks mentioned