What to learn from the last year’s IPO winners and losers

IPOs can give you wonderful returns if you get them right, but burn your money if you don’t. And that’s clearly shown in the trajectories of the companies that have listed since the COVID-induced market lows in March 2020. Because, while there were some big winners – like Cettire (ASX:CTT), Aussie Broadband (ASX:ABB) and Universal Stores (ASX:UNI), there were also some clear losers.

Our process at the Montgomery Small Companies Fund is designed to seek out companies with an under-appreciated or undiscovered competitive advantage with capable management teams that are early in their value creation journey. The IPO market can be a good place to look. So what’s been happening in this area of the market since the market’s COVID lows and what did we do?

The IPO market since COVID

The first IPO out of the blocks in the COVID market depths was a $30 million raise for Atomo Diagnostics (ASX:AT1) at 20c a share. AT1 listed with an agreement already in place to provide COVID diagnostic kits to needy European Government type customers. It seems that whatever solace the market is looking for at any given moment in time, there is an IPO for that! Day 1 turned out to be AT1’s best day (so far) – trading at over 50c, but it’s been downhill ever since, with the stock now trading 20 per cent below issue price at 16c or so today. Quite a journey. There is a message in the AT1 story.

The valuation regime of an IPO is an unknown, brokers do a good job to select IPOs that they can “get away” essentially giving the investor crowd what its craving, the flavour of the month. And brokers work hard to whip up demand, this can result in extreme pricing dislocation events. Our job is to be on the right side of that event. Picking those businesses that can go on to create that value for our investors in the Fund. The ones that go up and stay up.

There are many IPO events – we go through the stats below – so our process involves an initial screen, to see if the IPO candidate likely has the characteristics that we are looking for in the portfolio, before selecting which ones to spend the time and effort doing proper due diligence on. Doing the work at IPO helps get an understanding of a company that can pay dividends down the track, even if we don’t decide to invest on IPO, we try to do the work on as many as we can.

The stats: By our count there have been 110 IPOs since the market COVID lows in March 2020. 39 of these have been resource exploration plays, all but 2 have been sub $50 million market cap. Microcap resource exploration plays is not an area of the market the Fund goes hunting in. Too speculative. We don’t look at those.

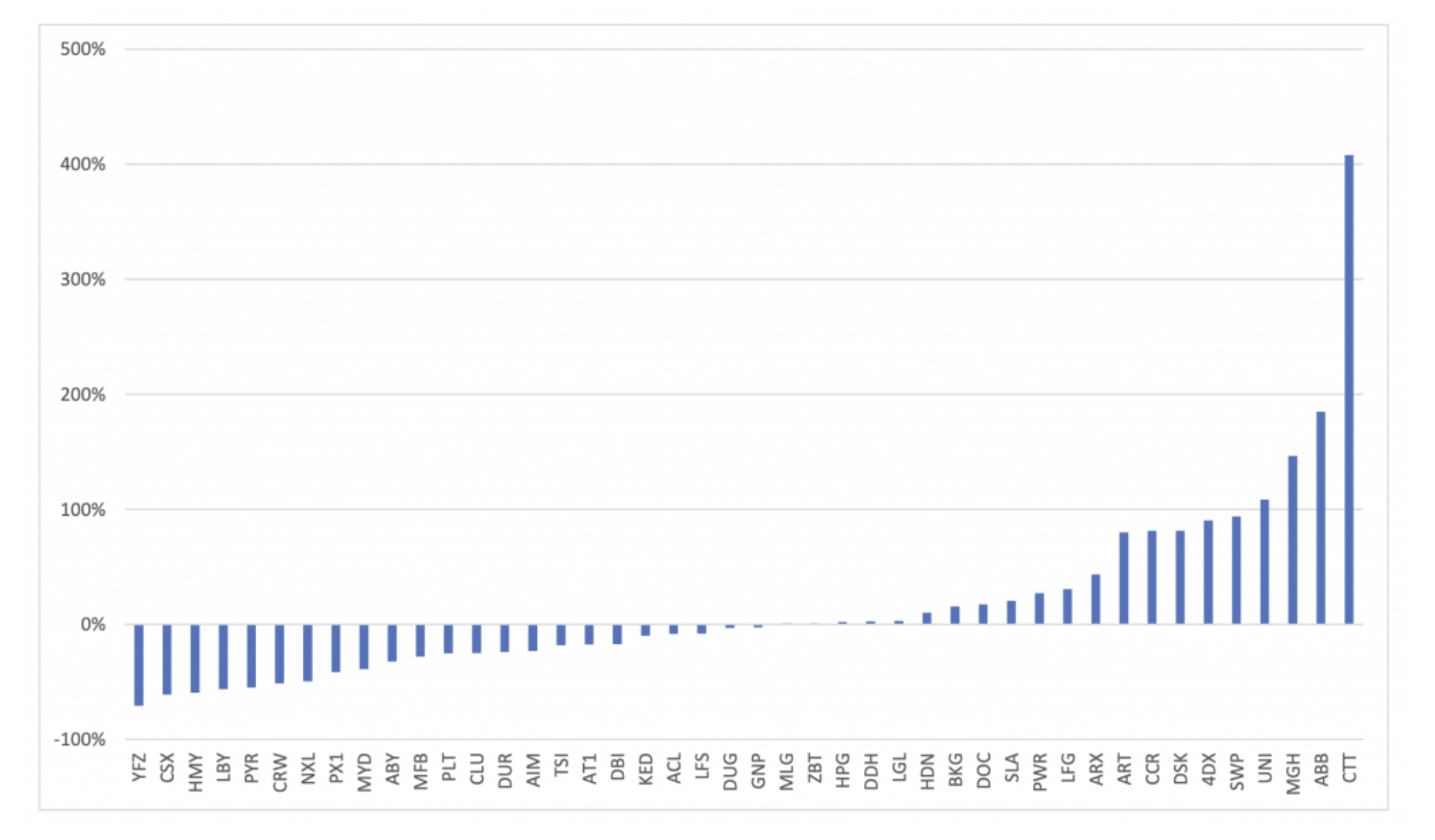

There have been 71 non-resource exploration IPOs that have listed since the COVID lows, 44 of these have had a market cap on IPO of greater than $50 million. That’s our investible universe. Of these 44 listings, the median return since IPO is -3 per cent. 21 are above IPO price, 23 are under. The data says IPOs are not a one way bet, but the chart below also shows that if you get them right there are good returns available.

Distribution of IPO Returns post March 2020: IPO price to date

Source: Montgomery, Iress, Listings 1/4/21 onwards, ex Resource exploration with Market Cap > $50mn

Characteristics of IPO losers

One of the most common IPO errors observed in recent times is investors look to play “hot themes” of the moment. Remember if you want it, there is an IPO banking team that has got the deal for you and during COVID times this was meal kits, e-commerce and buy-now-pay-later, amongst other things. An IPO on a “hot theme” can look good in the short run, but can come with longer term pain, as the hot money that chases these “hot” deals does what it does best and moves on to the next shiny thing. Consequently, most if not all of these types of new issues don’t find a real investor base anywhere near their IPO price and end up firmly under water.

Youfoodz (ASX:YFZ), tried to capitalise on the market’s appetite for meal kit delivery that boomed during COVID. Its IPO was “priced” at $1.50, it never traded within cooee of that, best print was $1.32. One way traffic since then. It’s 71 per cent down, trading at 44c on my screen as I write, and takes the award for the worst post COVID IPO (to date anyway). My Food Bag (NXZ:MFB), New Zealand’s “Youfoodz” provides further illustration of hot theme/hot money loser and is trading 28 per cent below its issue price.

Another that looked to cash in on the “moment” was internet retailer Adore Beauty (ASX:ABY). The business was listed on a high valuation, after being acquired by private equity for a much, much lower price only a short time before. At best you could say this was opportunistic. Nevertheless “investors” fluttered like moths around the e-commerce flame when it IPOd at $6.75 in October 2020. That did slightly better than YFZ, however like many moths the “upside” there didn’t last long, ABY closed above issue on its first day, but never since and is now down 32 per cent on that IPO price. ABY is arguably now an illiquid micro-cap with a lot to do to re-build its reputation with investors after its warning that it’s not growing at the rate investors expected. A downgrade in expectations before it even delivered its first set of full year financials as a listed company is a sin not easily forgiven by institutional investors.

A blog on IPOs wouldn’t be complete without reference to Nuix (AX:NXL), but given the AFR has done such a good job of disclosure there (better than the prospectus it appears…), we don’t feel the need to explain. Caveat Emptor.

We didn’t do the work on any of the above. Screened out early.

The Winners

IPOs can be lucrative too, as just as the price discovery process can be difficult for investors, that’s the case for the IPO brokers and advisers too, and the business can be sold too cheaply at IPO. IPOs that have performed well include Cettire (ASX:CTT), Aussie Broadband (ASX:ABB), Maas Group (ASX:MGH) and Universal Stores (ASX:UNI). We didn’t look at CTT (we thought the e-commerce model was just a child of the times and would quickly slow, time will tell) or ABB (sometimes we miss things). We looked at MGH but thought it was expensive, it’s up 150 per cent so I suppose you’d classify that as getting it wrong! We invested in UNI.

Of the bottom 10 IPO stocks, 9 of those were “hot theme” stocks, only Harmoney probably doesn’t manage to fit that description, although arguably it may have been pitched as such. On the flip side of the top 10 performing IPOs only 2 of them could be considered to be “hot themes” and 1 is a bio-tech (tough to value), the rest have proven business models, some with competitive advantage, many are well run by talented management teams. That’s what you need to look for.

Montgomery Small Companies Fund IPO report card

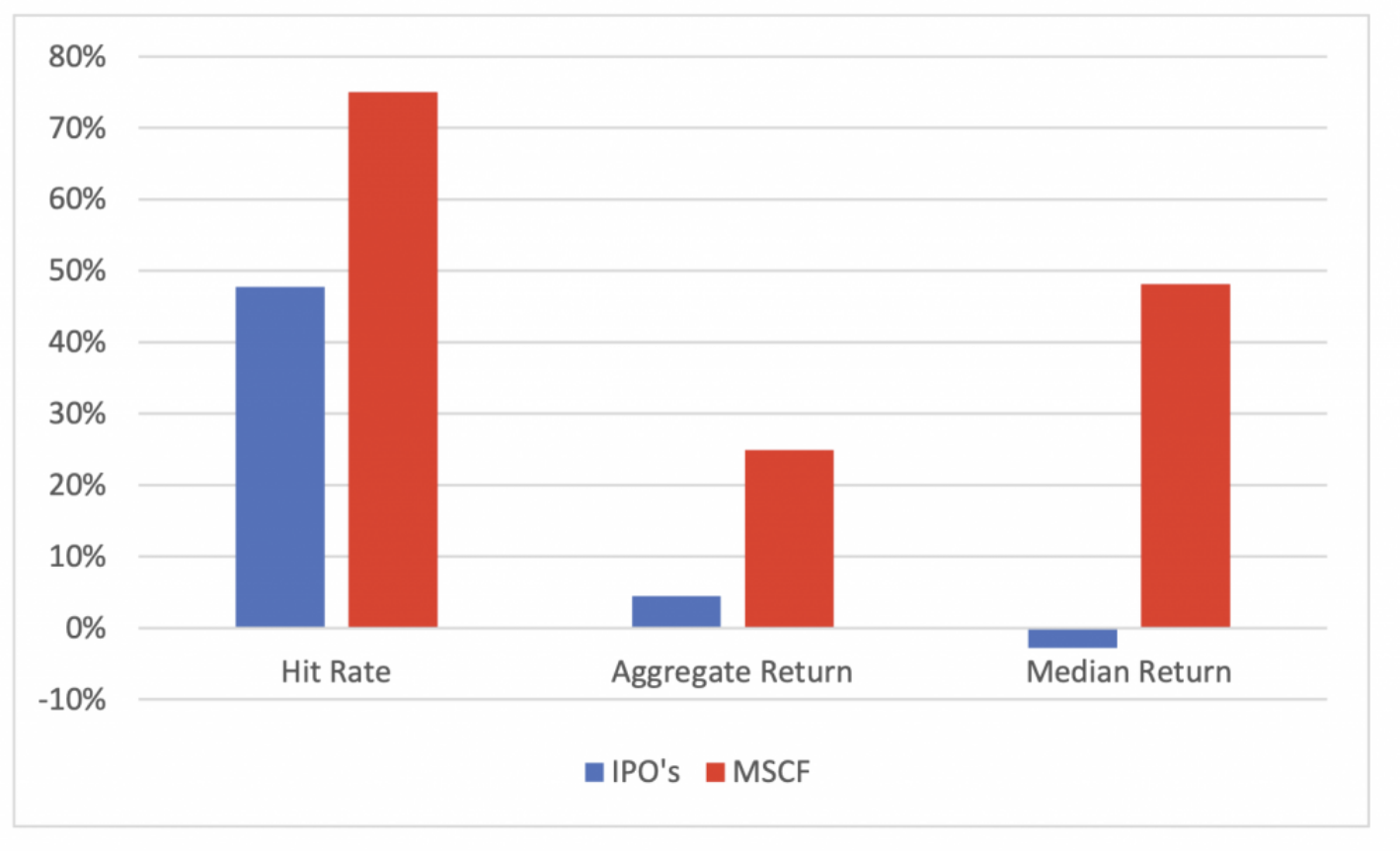

Of the 44 non-resource exploration IPOs since COVID with a market cap of greater than $50 million, we have looked at 23 of them, the rest we screened out, for one reason or another. We also looked at one sub that market cap level as we thought it could be interesting – a total of 24 active IPO investment decisions were made. We decided to invest in 8, of the 24 we reviewed.

Of the 8 we invested in, we made money in 6 of them, sometimes with very good returns. As an aggregate across those 8 we have made 25 per cent return on total capital deployed, with the median return being 48 per cent. It’s worth pointing out that only a small fraction of the Fund at any one time is committed to IPOs, for instance of the 8 IPOs we invested in, 5 have been sold, and we hold 3 which are collectively circa 2 per cent of the portfolio. Risk management is always important, especially with IPOs. Early stage companies have higher risk, so we size these in the portfolio so that if they go right we make good returns (see chart below), but if they don’t work you won’t see us telling you we have underperformed because an IPO didn’t go the way we planned. We acknowledge the work done by the advisors and brokers who partner with us, in bringing these companies to market, for the good ones that is, you can keep the bad ones!

What about our losers? Of the two IPOs we invested in that didn’t work, we made minor losses on one, the other is Cashrewards (ASX:CRW), which hasn’t worked (so far) but we continue to hold. We certainly don’t get them all right.

Montgomery Small Companies Fund IPO report card: 75 per cent hit rate

Source: Montgomery, Iress, Listings 1/4/21 onwards, ex Resource exploration with Market Cap > $50mn

Of the other 16 decisions where we looked but decided not to invest, 10 of those are under water, 6 made money, although 3 only just. We did miss 3 good opportunities that we did the due diligence on but for various reasons we didn’t get over the line. Next time.

And we think that there will be a next time for quite some time. IPO banking teams at the banks and brokers report many IPOs in their pipeline, all looking for the right time to come to market. Whilst it’s clear to us that investor appetite has moderated, particularly for loss making businesses, we see that as some “heat” coming out of the market. That’s healthy and we expect a steady flow of IPOs for us to scrutinise over the coming months.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

7 stocks mentioned