What we learned from our recent trip to America (Part 1)

With ongoing political and macroeconomic uncertainty in the US, exacerbated by the federal election being held later in November, 4D visited the US to understand what fundamental impact these had on infrastructure earnings and how management teams were navigating the uncertain waters.

Despite some challenges, infrastructure investment is needed across the US. This investment should support consistent, predictable earnings growth for investors over the long term. The defensive qualities of infrastructure should also be increasingly favoured by investors, should the US experience financial difficulty and weak (or negative) growth.

In this first piece of a two-part series, we highlight some interesting political and economic observations from our trip. This piece will feed into part two where we discuss how specific sectors and companies are set to benefit from the bigger need to vastly improve the state of American infrastructure.

Politics

The upcoming presidential election dominated media headlines while visiting the US, with the November contest expected to be very tight. Anecdotal conversations indicated that domestic concerns mirrored international concerns, including:

- the ability of President Biden to complete another four-year term given his perceived deteriorating mental capacity, and

- concerns from moderates as to the intentions of Donald Trump if he were to win a second, and final, term in office, given his refusal to accept the official results of the previous election, and support of and for autocratic leaders.

Policy differences

The leadership of Biden vs Trump couldn’t be more polarising in their approaches to diplomacy, as well as their policy prerogatives. While Biden and the Democrats are focused on implementing the energy transition, increasing regulation of the technology and finance industries, and supporting conditions of lower income and working-class people (including continued support of the Affordable Care Act), Trump is focused on supporting the exploration and production of traditional fossil fuels, reducing regulation and red tape, and extending the 2017 tax cuts he implemented in his first term. Their competing policies are summarised below.

Of the above issues, some are particularly relevant to the infrastructure investment proposition:

Taxes – Trump’s Tax Cuts & Jobs Act (TCJA) of 2018 reduced the corporate tax rate to 21%, reduced tax rates of all individual income tax brackets (significantly supporting highest income earners), and cut the lifetime estate/gift tax exemption in half. The reductions are scheduled to expire in 2025, but it’s widely believed both candidates would look to extend them to some degree, putting upward pressure on budget deficits and inflation. Biden is expected to extend some form of tax cuts, but probably not the current state of affairs. It’s expected that Trump will be particularly supportive of extending the full suite of tax reductions.

Tariffs – Biden is likely to maintain tariffs on select Chinese goods and support the onshoring of manufacturing back to the US. Trump has communicated the potential for a universal tariff of 10% on all imports, and 60% on Chinese goods. The economic impacts of this could cause stagflation in the US economy.

Energy – Trump has communicated that he intends to repeal Biden’s Inflation Reduction Act (IRA) which supports renewables, cleaner/green energy sources, and Electric Vehicles (EVs) through tax credits. Commentators suggest he may only repeal the support for EVs from the bill. He has also communicated the intention to support drilling for traditional fossil fuels in oil/gas, potentially through Federally streamlining the permitting process for drilling and pipeline development. This move could be detrimental to operators investing in the energy transition (utility sector).

Economics

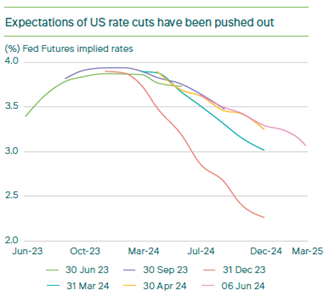

2024 dawned with the market pricing in significant rate cuts throughout the year. In our 2024 outlook article published in January, we highlighted that “the market had once again got ahead of itself in pricing in such aggressive rate cuts so soon, and there is was a high chance of rate cuts being pushed into the second half of 2024, as central bankers wait for a more sustained period of lower inflation, which should structurally settle higher than pre-pandemic periods.”

In the first half of 2024. inflation, whilst on a downward trajectory, plateaued above the communicated target of the Federal Reserve of 2%. And, as expected, interest rate cut predictions were pushed out from the first half of the year to August/September 2024.

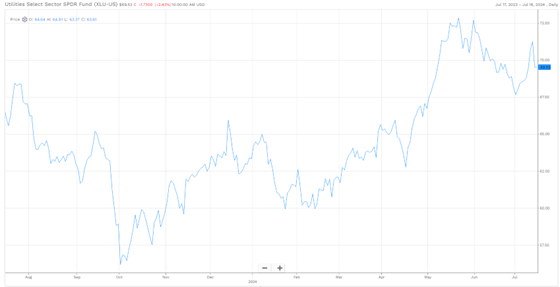

This initially didn’t impact utility company share valuations, but more recently have contributed to poor performance of the utility price index, Utilities Select Sector SPDR Fund (NYSE: XLU).

XLU performance for the past 12 months to 16 July 2024 – shows improving performance to late May 2024, and a pullback more recently. (Source: FactSet)

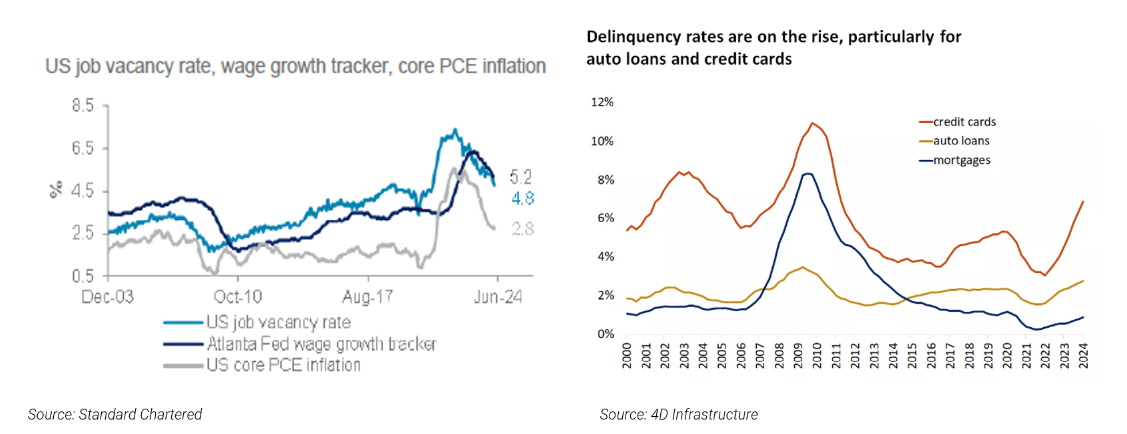

Despite stickier inflation than was anticipated at the start of the year, and interest cuts being pushed out, recently there have been indicators of a softening job market and increasing credit delinquencies. GDP growth has been hovering at a healthy 3%, but these indicators could be pointing to harder economic times in the US and potentially a recession (markets currently assuming a 50% probability). A cut in interest rates by the Fed could ease financial conditions but could get ahead of itself, leading to inflation either not reaching the communicated Fed target or increasing again – putting more pressure on consumption.

Fundamentally, in the event of a recession, the defensive qualities of infrastructure companies should result in a rotation from the investor-loved growth stocks (such as the technologically-focused ‘Magnificent Seven’), to more defensive sectors, such as utilities and communication towers. However, should the US experience stagflation rather than a recession, the increase in inflation and interest rates could negatively impact the valuations of infrastructure names (through increased discount rates) resulting in a different market reaction.

As outlined above, political policy between Biden and Trump seems to vary widely, although neither candidate’s policy is likely to reduce budget deficits, and both are likely to be inflationary.

A BlackRock report recently stated, “We track potential changes on US trade, immigration and energy policy – and see a potential inflation boost no matter who wins." This represents a macro risk to investments and something we are monitoring closely.

The feel for economic conditions while visiting the US was of cautionary optimism. As a traveller from Australia, everything felt very expensive, more so than previous trips, although US wages have increased significantly, which has compensated (at least partially) for the increase in domestic prices. People were out spending, but it’s unclear if this was to be maintained.

In Part 2, we'll discuss how this macro environment is influencing the operations of portfolio holdings and prospective portfolio holdings. Follow my profile to be notified when Part 2 is released.

This piece was written by Peter Aquilina, Portfolio Manager - Sustainability.

3 topics

1 stock mentioned

2 funds mentioned