What you can learn from our worst-performing stock in 2022

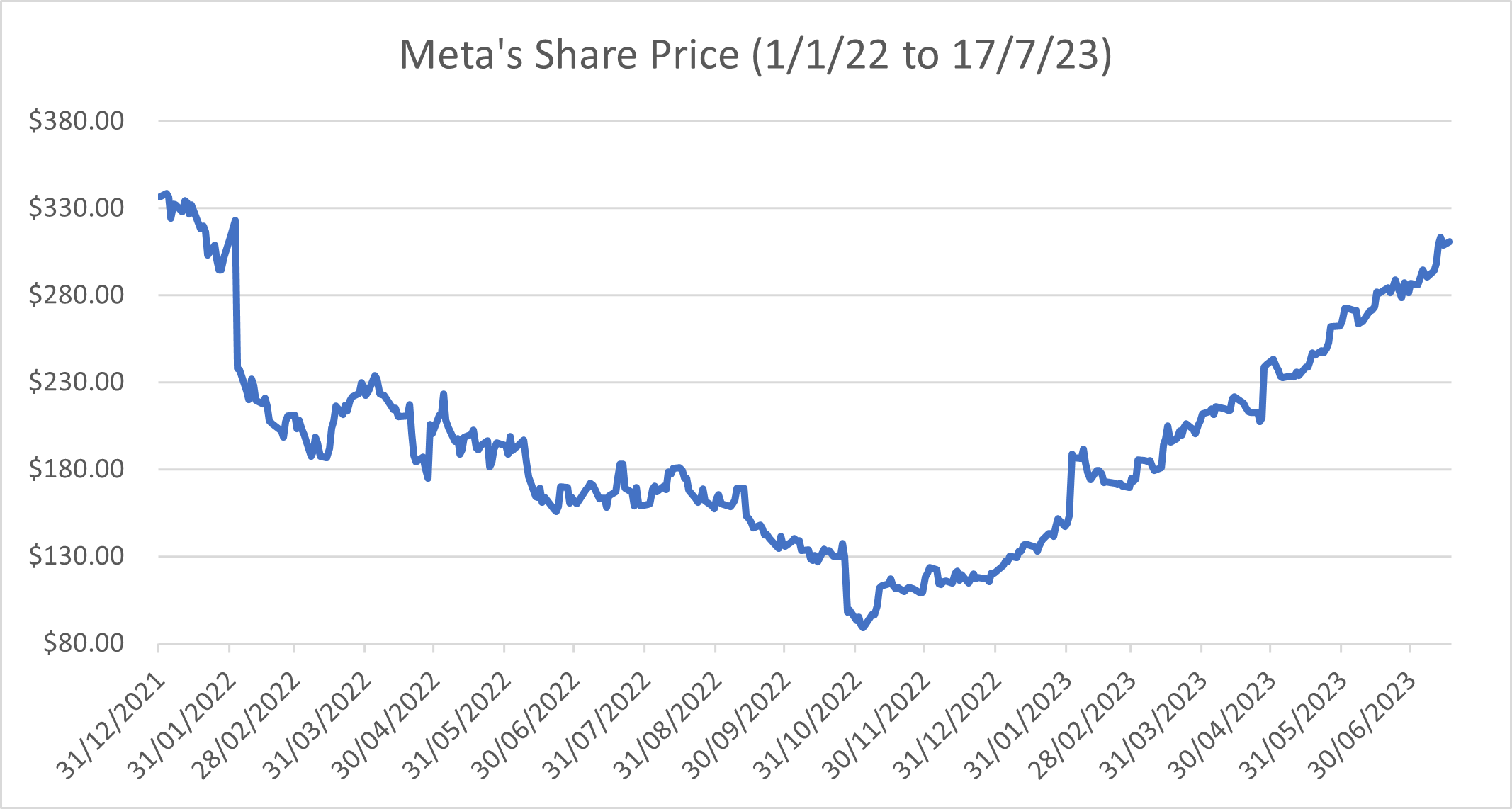

2022 was a tough year for Meta. Rewind to the start of the year and the stock was sitting at what would be its high point of $336. By November, it had fallen 73% to its low of $89. It was the worst-performing stock in the Swell Global Portfolio.

To the casual observer, this appeared to be nothing short of a catastrophe. However, we saw the situation through a different lens. Our investment thesis was intact, the valuation looked appealing, and rather than turning tail, we doubled down on our position. Eight months later, the stock is up more than 250% from its lows and has generated significant alpha for our portfolio.

To be clear, we didn't have a crystal ball to predict when the stock would rebound, nor do we believe our forecasting abilities to be better than anyone else's. But investing isn't about clairvoyance; it's about a firm belief in the quality of a company and recognising the potential in a depreciated valuation.

Our guiding philosophy? When a quality stock dips significantly below its intrinsic value, it's time to buy – not to wait around for it to potentially fall further.

High-quality investment opportunities are rare and often ephemeral. As an investor, it's vital to exercise patience yet be ready to act decisively when the moment strikes. Here are some timeless practical lessons learned from our experience with Meta in 2022, that you can implement in your own investment strategy.

Know your stocks better than the market.

The first lesson is to know your stocks better than the market. It’s what fund managers often refer to as their 'edge over the market'. Having an edge means you will be able to identify opportunities that arise when the market becomes overly optimistic or pessimistic. This can sound like a tall order, but there are two things you can do to help you achieve this.

- Invest in what you know, and

- Don’t over-diversify.

Invest in what you know.

Often this is an exercise in discipline; to pass on stocks that lie outside your knowledge realm. Consider Nvidia. Many know it designs top-tier GPUs crucial for training complex AI models. But do they understand its competitive edge over AMD or Intel, the risk of backward integration from the big tech or even the process of chip manufacturing? Most likely, the answer is no. And that's fine. The challenge lies in knowing when to pass and when to play.

That’s not to say one can’t work hard to understand a company and its industry over time. We had owned Meta for six years prior to its collapse in 2022. That’s six years of analysing every earnings call, annual report, investor day, developer conference, and press release, not to mention the mountain of content published in the news (both positive and negative). This enabled us to form a confident opinion on the risks from ATT, TikTok and the metaverse that was different from the market.

Don’t over-diversify

Over-diversification inhibits investors from knowing stocks better than the market, automatically removing their edge. Our belief is that once you exceed ten stocks in your portfolio, it becomes increasingly challenging to understand each company deeply. Once you cross the 20-stock threshold, you risk becoming a follower rather than a leader in your investment journey.

In the Swell Global Portfolio, we are capped at 10-20 stocks. This means we can (and must) invest a significant amount of time in understanding what we own. For individual investors who have less time on hand, this is even more critical.

Have an investment thesis from the start

An investment thesis should be the bedrock of any buy/sell decision. It outlines the reasons why you believe in a company's long-term prospects. If the company’s share price falls, you can review your thesis and, if it remains intact, have the conviction to increase your investment or, alternatively, to sell if the thesis is broken. As such, an investment thesis helps remove emotion from the decision.

Our thesis for Meta was, and still is, based on its powerful network effects. Since social media is free to use and has relatively low switching costs, competition is literally only a click (or a swipe) away. But with over 3 billion monthly active users, Meta’s apps are the best place to connect with anyone. Consequently, they are also the best place for advertisers to reach their audience. Being the first to scale, most of the users have ingrained habits that are very hard to break. Moreover, these network effects give Meta the ability to test, launch, and scale new products faster than any other business. See Stories, Reels, and more recently, Threads, which amassed 100 million users in just five days.

This thesis remained intact, even during Meta’s 2022 lows, which allowed us to capitalise when the majority were selling.

Key Takeaways

Our experience with Meta in 2022 serves as a powerful reminder of several timeless investment principles. The importance of investing in what you understand, having a robust investment thesis, and the fortitude to act decisively when an opportunity arises are critical to successful investing.

Importantly, investing is not a get-rich-quick scheme. It requires patience and discipline. It's not about knowing when the market will turn but about understanding the businesses in which you invest and having conviction in their long-term prospects. As the Meta story shows, the market can be unpredictable, but staying committed to solid, well-understood investments can pay off in a big way.

1 topic

1 stock mentioned