What you need to know about investing defensively for the times

In a world of short attention spans and instant gratification, few people have been shocked by the speed of the recovery since the March 2020 dislocations.

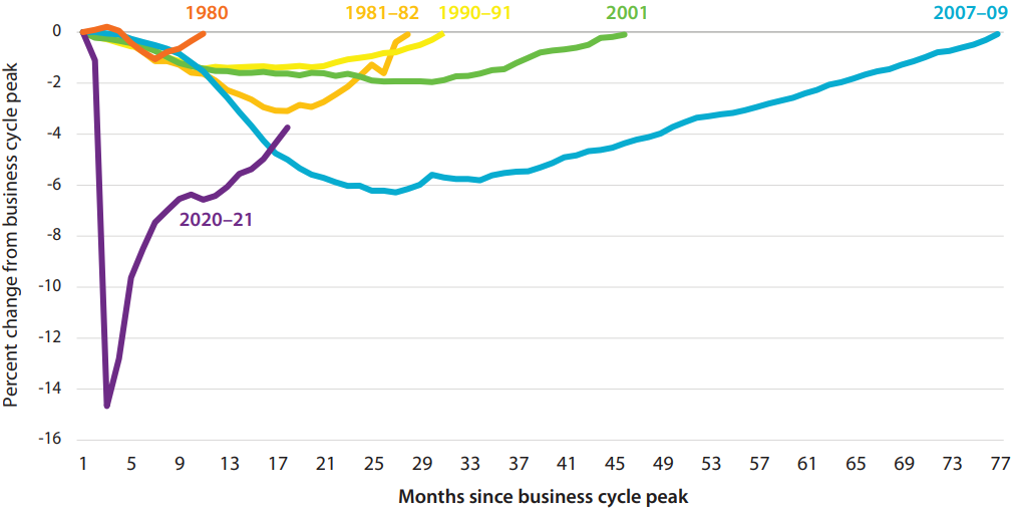

The pandemic collapse has almost been eclipsed by the spectacular business cycle turnaround – being the fastest one recorded in history, as this chart shows.

Change in employment from business cycle peaks, 1980–2021

Source: Brookings Institution: Bureau of Labor Statistics 2021; National Bureau of Economic Research

Note: The chart shows the percentage change in total non-farm employment from the peak of a business cycle until employment returns to the level of the previous business cycle peak.

The problem, however, is that positive headlines often gloss over the underlying economic woes bubbling under the surface. Individuals and businesses, whilst aided by government stimulus in reducing debt and keeping entities viable during troubled times, such as the experience of the recent pandemic, still have large debt loads in a tightening monetary policy environment.

They are stretched already, and monetary tightening will exert even more pressure across the system — something will have to give.

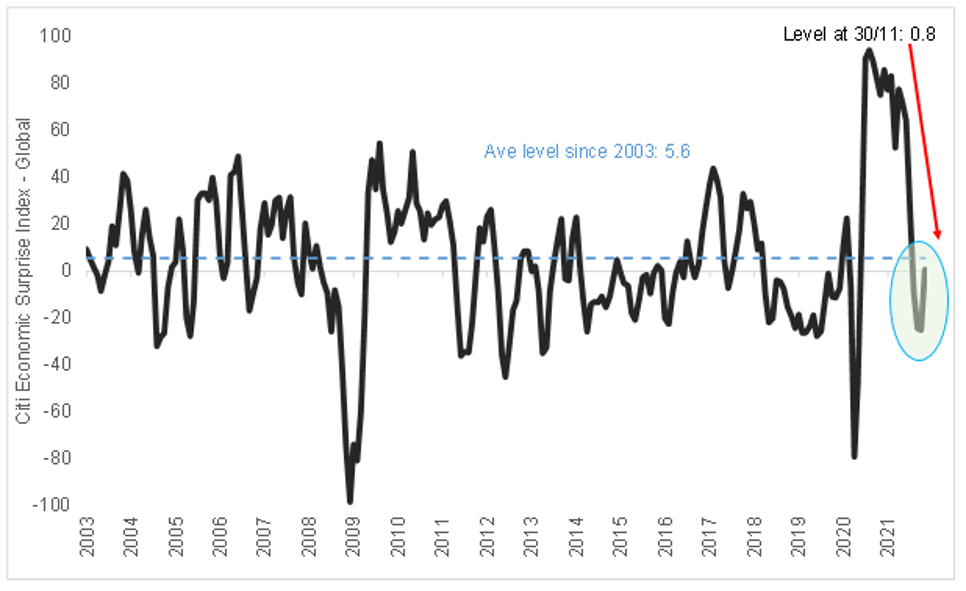

Meanwhile, the Citigroup Economic Surprise Index, as the chart below shows, suggests that subsequent data releases since the re-opening ‘pop’ have underwhelmed by printing below analysts’ expectations.

Put another way, economies have been underperforming as activity normalises, pent-up demand in part is satisfied and stimulus effects still are in play.

Global activity is normalising rapidly

Source: JCB team analysis, based on data from Bloomberg

Thus far, highly accommodative monetary policy from central banks have made for extremely easy financial conditions. The flow-on effects lead to problems to deal with later; extremely stretched asset prices especially for shares and property (where key ratios such as P/Es, dividend yields and equity risk premiums have been anchored in the 95th to 100th percentiles against history), and speculative behaviour from investors in the form of unbalanced portfolios, conditioned risky investor tendencies such as buying in dips and leverage from historically low yields.

From a bond manager’s perspective, we have been observing the financial market plumbing to be fragile and oversensitive to news alongside varying liquidity levels, which reinforces the view that there are undercurrents of issues that will likely materialise moving forward.

The inflationary concerns as re-openings have occurred have definitely been attention-grabbing in 2021, but these ideas can overshadow pandemic inspired impacts. Economic shutdowns have created imbalances and misconfigurations around supply chains and logistics, leading to problems for key sectors such as energy, electronic chips and metals.

While media images of backed-up shipping ports provide eye-catching vistas, such narratives give a narrow view of the disruptions which are truly global in nature and affect entire end-to-end supply chains.

Labour shortages for truck drivers and warehouse workers, as examples, are widespread in manufacturing, while sourcing staff for services, especially tourism, travel and leisure, have been equally difficult. For this reason, it may take some time for these imbalances to wash through, but there should not be confused for this being a permanent regime shift in inflation.

The reality is that the range of slower-moving secular themes which have conspired to keep a lid on longer-term inflation trends have not altered. Debt loads remain large (and growing); globalisation, whilst challenged by COVID-19 supply breakdowns, also remains well entrenched; technology continues as a deflationary force; demographics and ageing populations represent a burden on the working population, and labour forces are largely weakening. This underlines the point that supply and logistical imbalances are temporary phenomena that may take some time to revert.

The global secular themes suppressing inflation remain

Source: JCB

Against this backdrop, central banks have evolved their approaches, and are likely to become more reactive rather than proactive to economic conditions.

Policy makers will recall the emergence from the 2007-09 global financial crisis, which saw the European Central Bank prematurely hike rates in 2010 due to shorter-term commodity and supply bottlenecks, only to retrace steps and cut rates by the end of the same year.

The risk of policy misstep is high — the October 2021 experience has already underlined how sensitive the financial system is to central bank unheralded about-faces.

Many central banks, including the US Federal Reserve, and the RBA have openly committed to not hike rates until inflation is well within their target ranges. Having missed these targets for so long, the body of evidence will need to be high before they move faster on removing emergency policy settings, and normalising rates.

Leading into 2022, we observe an economy that is arguably somewhere between late upswing (still with a boom mentality — especially in technology, healthcare and property, restrictive central bank policies emerging and short rates rising) and economy slowing (confidence wavering, inflation continuing to rise, commodities starting to soften).

Throwing the cat amongst the pigeons are COVID-19 mutations: the relative newness of the omicron variant means assessments are still being made on the transmissibility and virulence.

While it is encouraging that global vaccination rates are strong, especially in the developed world, the jury is still out on whether existing vaccines can competently protect against these mutations. Herein lies the challenge to central bankers: maintain the healing, correctly responding to inflationary impulses while not derailing the recovery in a world of intense uncertainty.

Portfolio implications

Our engagement with investors – retail and institutional alike – suggests that many portfolios are over-tilted to risk. Bank of America in October 2021 observed that investors remained bullishly positioned for growth, transitory inflation and a peaceful US Fed taper.(1)

Notably, fixed income holdings sat at a record low which aligns with worries over prospective inflation and rising yields. Our reading implies that, like a proverbial party, you do not want to be the last person to leave the risk-on party. Too late to leave can mean investors, like party-goers, become exposed to the rapid gyrations in a time when risk is definitely building.

So, as financial markets prepare for the inevitable central bank tightening, we also see a major misconception with regard to bond duration. High grade sovereign bonds have strategic roles to play in the form of offering potential principal and income stability, diversification against risky assets, and protection against cyclical downturns.

But, in a dynamic (or with a nearer-term lens), many investors consider that higher expected future inflation represents a clear sell signal for exposures to bond duration. They rationalise this since yields will likely rise (prices will fall) across the yield curve to compensate investors for the inflation risk, leading to softer bond returns in the short term. We know that yield curves capture the aggregate view of all the participants − a future of rising rates and monetary tightening has already been priced in.

What really matters from hereon is the pace of any yield rises. If yields rise faster than what is currently priced by bond markets, an investor would be better off having an underweight position in duration. However, if yields rise slower than priced, then being overweight duration beforehand would have provided the superior outcome.

Practitioner experience and research tells us that ex ante, the chances of faster or slower yield levels relative to the aggregate expectations are about even. This underlines the value of holding a neutral holding through business cycles, unless an investor has special insight relative to aggregate yield curve information.

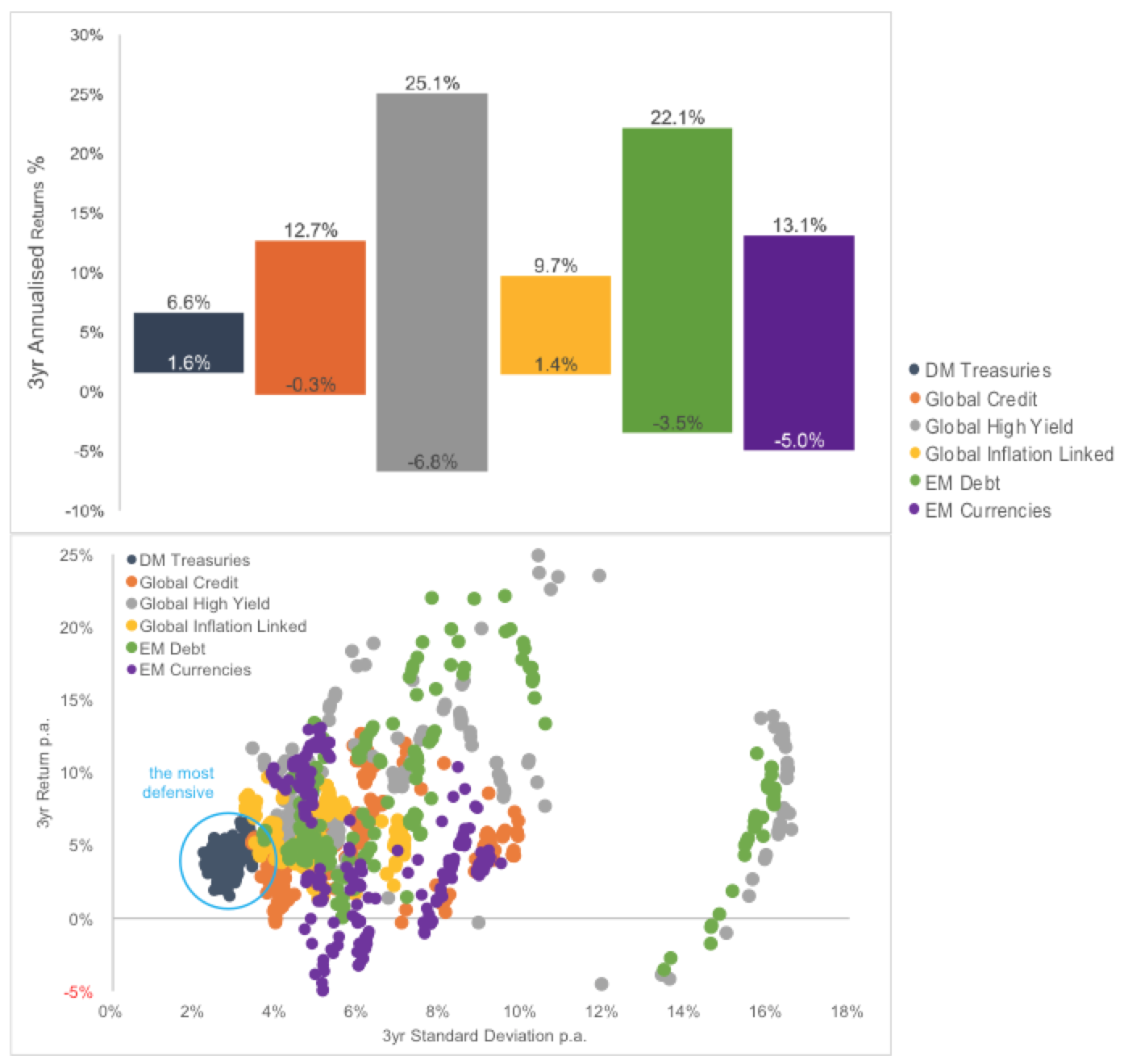

We are also seeing greater interest for offerings across the bond spectrum, especially the non-traditional forms such as global high yield, emerging market debt, or strategies with high degrees of freedom. (The chart below shows the range of outcomes over three years from underlying assets).

The thinking is to secure a return stream that behaves independent of share or bond index movements and offers lower levels of risk from seemingly lower correlated underlying bonds. The approach is noble and aspirational, especially as we move deeper into uncertain conditions, most likely characterised by bouts of volatility and dislocation.

Our sense is that investors, especially in these conditions, are best served by the highest quality assets, and not assets that can over-reach for yield. Many of these underlying exposures like high yield and emerging market debt oftentimes have lowered or mixed levels of liquidity and are subject to credit risk, meaning they tend to behave more like equities in times of stress.

The lower part of the chart shows the patterns of risk and return for these same fixed income sub-asset classes over time demonstrate that high grade sovereign bonds represent the least volatile underlying asset available given their explicit backing by governments, having withstood the test of time and conditions, and also having stable and proven political and financial systems.

Range of returns and patterns of risk for common fixed income sub-asset classes

Source: JCB team analysis using data from Bloomberg, from September 2000 to November 2021, in US dollars

Closing thoughts

Building resilient portfolios for the uncertainty ahead requires a healthy dose of humility especially when it comes to positioning for future inflationary and growth regimes.

In this environment of increased uncertainty, shortened business and investment cycles, and ‘twitterisation’ of news, we anticipate episodic bouts of volatility and increased sensitivity characterised by over-reactions.

Looking ahead into 2022, we believe investors will need a greater appreciation for manager skill in the areas of risk management, management against tail events and overall capital preservation — in addition to the usual demands for attractive portfolio returns.

Strengthen your portfolio with global high-grade bonds

In times of uncertainty, adding high grade bonds to your portfolio can provide much needed stability, liquidity and diversification. Find out more here

As prominent examples, the RBA (+73bps in yield), RBNZ (+84bps) and Bank of Canada (+54bps) allowed short-end rates to spike, despite recent commitments to anchoring these levels to facilitate the recovery. Without these (and other) central bank efforts, views on future inflation, and the pace of future hikes allowed the entire curve to shift upwards with market expectation of monetary tightening sooner rather than later.

For example, UBS’s current year-end 2021 projection is that the emerging market vaccination share will reach 71%, developed markets will be at 80% and the population-weighted global total will be at 72%.

(1) Bank of America Fund Manager Survey, October 2021.

4 topics

1 fund mentioned