Where Airlie is bullish in a market full of bears

For every bull, there is a bear - and where the dominant narrative is bearish, Emma Fisher of Airlie Funds Management likes to be the bull in the room. Headlines in the financial markets tend to swing towards one extreme or the other. If you want any proof of that, just think of all the "recession" and "superbubble" headlines we've seen in the last twelve months. But Emma has a far more constructive view, arguing that a concentrated portfolio of strong stock ideas from across the ASX gives you an advantage in this trigger-happy environment.

In fact, being the bull in a bearish room was the big theme of the Airlie national roadshow.

The roadshow wrapped up in Sydney to an engaged audience on Thursday evening. In this wire, I'll take you through Airlie's thesis and the famous investor who inspired it. Then, combined with a healthy dose of macro and financial history, we'll take a look at some of Airlie's top holdings in the flagship Australian Shares Fund (ASX: AASF). Finally, we'll delve into why the fund does not have any interest in energy stocks - another case of going against the grain in a world where many fund managers continue to argue there is more to run.

The oak doesn't fall far from the tree

In explaining their current market thinking, Fisher turned to the philosophies of one Howard Marks of Oaktree Capital. Marks famously wrote a note in August 2021, arguing that investors should ignore the predictions of economists. After a year where macro and data have driven the price action across all assets, Marks (and in turn, Fisher) both believe the valuations on quality assets have depressed dramatically.

Although Marks is contrarian by nature, Fisher and her team don't describe themselves as permanently contrarian.

"It's not about being contrarian for contrarian's sake - there's no point stepping out in front of a speeding truck just because nobody else is. That doesn't make it a good idea," Fisher says.

While the market is good at understanding the macro, it's not always the best at pricing assets. That's where Fisher and her team come in - picking up assets while the herd (the majority) are selling off assets. Indeed, the consensus view still suggests that the E in EPS isn't being trusted by the market and that it's still too high in many companies.

While Fisher doesn't dispute the market's general feeling about risk assets, she does think you need to be careful about just taking all the data in your stride. Indeed, context is everything especially when the headline falls and rises are convenient.

"We try to move away from the dogma and we just look at all the available evidence but not positioning ourselves in any extreme way," Fisher says.

Safety does not equal panic

When you think of "safe" equities, what names do you think of? The major supermarkets - Woolworths and Coles? How about industrial heavyweights Amcor and Brambles? Healthcare giant Resmed? If you're invested in any of these, you'd be playing alongside the market's thinking. But Fisher has an alternative take on what "safety" looks like.

"When we're worried about a downturn, we want to hide in businesses with good balance sheets," Fisher says. For any proof of that, just look back to the two most recent market crashes - the 2008 Global Financial Crisis and the 2020 COVID-19 market shock. Ironically, the only outlier to this theory is the time we are in right now.

The other key metric for the Airlie team is looking at businesses that fly under the radar. These may be the businesses with the strongest pricing power, but they may not be the businesses who hold another key criterion - and it's this that Fisher is far more interested in.

"The other element to it is the capital intensity of the business model. If you're a CAPEX-heavy business, you're just spending more money to stand still. That will really impact your returns," Fisher argues. In short - own companies that have the cash to make it through the rough seas.

An example of that is Medibank Private (ASX: MPL). Management's cost base isn't hit as hard by inflation, and with interest income on its balance sheet, it also benefits as a yield play. An example that doesn't fulfil the criteria is Healius (ASX: HLS), because its cash is tied up in the leasing of its asset base. As revenue declines from less COVID-19 PCR testing, rents go up as landlords demand more for their space.

Sometimes, the best opportunities are in your mistakes

One of Airlie's top and long-standing conviction calls has been Reece Holdings (ASX: REH). In fact, the bathroom supplies company was the largest single holding in the Australian Shares fund when it was launched in June 2018. Fisher recounts a story where she successfully campaigned to bring Reece's position down from 6% to just 2%. Her co-portfolio manager Matt Williams eventually relented but reminded her of the dangers of short-termism.

Williams was eventually proven correct, with Reece topping out at $27/share. To this day, Reece is one of the fund's top "bottom drawer" stocks. In 20 years, the company has increased its earnings profile 22 times and smashed all the competition in its field. That's a statistic that not even Bunnings can attest to.

But Reece now has bigger fish to fry - it wants to carve its own slice in the US housing market. Given the US market is 13 times the size of the Australian housing market, it believes it has the brand and the runway to make it work. No wonder Fisher has a lot of upside in her valuation case!

The other opportunities in the home

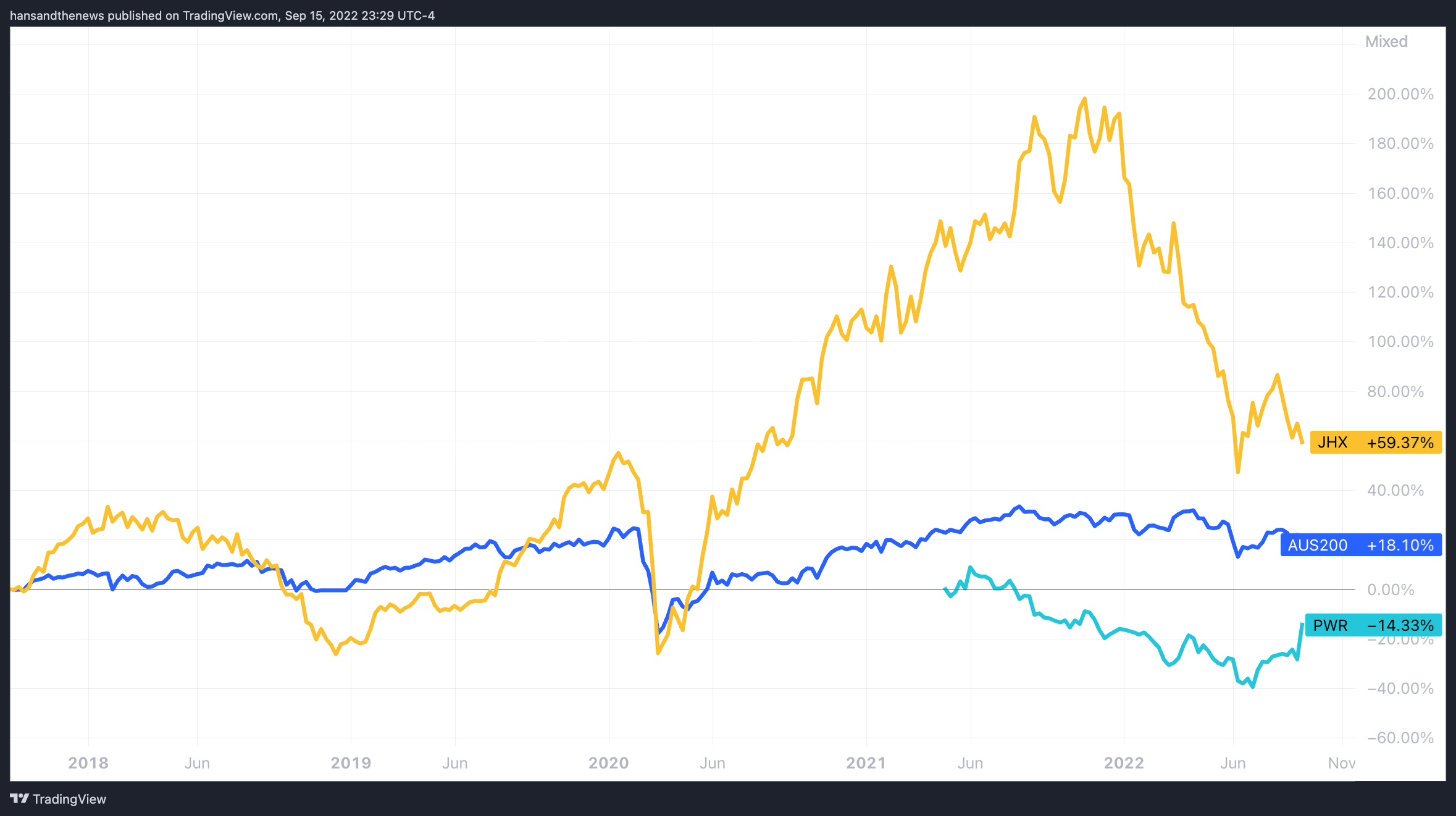

Her other favourite opportunities are James Hardie (ASX: JHX) and PWR Holdings (ASX: PWR). After surviving the Global Financial Crisis, which started in the US housing market, Fisher argues Hardies presents a unique opportunity to buy a company on a less-than-average earnings multiple while engineering an outstanding return on capital.

For those who think 2022 will be a repeat of 2008, Fisher reminds those investors that not all recessions "are housing armageddon". She doesn't rule out things won't slow down, but any falls in housing starts will probably not reach the level that was seen nearly 15 years ago. That means earnings will probably remain relatively resilient, given the US is still building 1.5 million houses a month on the annualised rate.

PWR Holdings stands in some contrast to James Hardie. Although it's a small cap, it actually is one of the top 10 holdings in the fund. Fisher has been bullish on the company for some time, and not least because it has an enviable trait any business would love no matter the industry - a literal monopoly.

"They actually supply the cooling systems to every single Formula One team. It's a global success story run out of their factory on the Gold Coast," Fisher says. And now that the company has had around 10 years of supplying the world's fastest drivers, it now wants to take over the aerospace game. One other thing Fisher says it has going for them is strong company culture - a perfect asset in a world where skilled labour is getting harder to find.

Then, there's Chris Ellison

Chris Ellison is the long-time MD of Mineral Resources (ASX: MIN), as well as being one of the original three company-wide shareholders. He also happens to be one of Western Australian mining's most colourful characters - he has his lovers and haters. Fisher and the Australian Airlie Shares Fund team definitely belong in the "lovers" camp.

Not only is MinRes a top 10 holding in the fund, but it's also continuing to attract staff to its mines in spite of crippling labour shortages. So what is its secret? Gyms, pools, and areas for your spouse to stay for starters. I'll let Emma explain.

"Their way around this labour shortage is investing in the mining camp. The way he [Ellison] describes these camps - if this funds management thing doesn't work out, I'll go drive a truck!"

Not all retailers deserve to be sold off

As Fisher alluded to in her presentation, markets are great at broad sell-offs but they are not always the best at individual company valuations. Enter Vinay Ranjan, who argues that this very problem applies to the consumer discretionary space. Ranjan is quick to point out that the fund is not overtly bullish on the consumer - far less than all-in actually. But he does note that a savage sell-off works for the right investors at the right time.

"Don't confuse volatility with risk. You may have felt safe investing in Brambles (ASX: BXB), but you're far better off investing in Nick Scali (ASX: NCK)," Ranjan notes. The furniture retailer is one of four consumer-centric companies owned in the fund. The others are Premier Investments ASX: PMV, ARB Group ASX: ARB, and Wesfarmers ASX: WES.

So how do you separate the heroes from the duds in this field? Return to your investing anchors - strong balance sheets and quality businesses run by good management. Don't look for companies, Ranjan says, that are at risk of raising capital - especially if they end up needing to do it during the good times.

In the case of Nick Scali, one store costs (on average) $700,000 to open. But quality management and disciplined store rollouts have allowed the company to make as much as $5 million in sales in each showroom. That's afforded Nick Scali a rare award - one of only three companies to return 20%+ on its capital every year for 10 years.

"They make the money back very quickly, leaving plenty for shareholders. You can see that in its dividend history," Ranjan notes. A similar kind of talent can be seen in Wesfarmers' greatest money maker - Bunnings. Both companies, however, are at risk of the big macro headwinds including rising interest rates and a consumer tightening its belt. Ranjan responds to this by going back to fundamentals.

One last word: Why Matt Williams doesn't like energy stocks

While we've talked a lot about the stocks that Airlie like, there is one sector that has been a bugbear for almost all of Williams' distinguished career - energy. While the fund does back plenty of resources stocks, Williams argues that energy stocks are in a different basket.

"I've always hated energy and in 30 years, it has worked out. But every three to five years, you get a period like this," Williams says. He argues that energy companies never deliver on their promises, and certainly don't make back the CAPEX they spend on projects a lot of the time.

Having said this, he does believe and respect the argument around underinvestment in oil drilling infrastructure. And he does admit that the fund owns Woodside Energy (ASX: WDS) and Santos (ASX: STO) after all.

Even the professionals relent - eventually.

2 topics

13 stocks mentioned

4 contributors mentioned