Where, how (and in what) Australians are investing now

One of the big economic indicators for market watchers flashed red yesterday, with the ABS labour force figures showing more than 55,000 Australians found work during October – well ahead of expectations. Despite this, unemployment ticked up to 3.7%.

Pundits are speculating what this means for the RBA’s next interest rate decision, which (of course) holds strong implications for the local financial market.

Then there's the RBA interest rate decisions themselves, which occur on the first Tuesday of every month. On the latest occasion, the ASX 200 “only” moved 0.3% between the announcement of a hike (just moments before the Melbourne Cup horses left the gate) and the market close. As many explain it, that’s because the market had already adjusted in line with the overwhelming expectation of another rate rise.

That’s investor sentiment laid bare. Investor sentiment can be thought of as the bigger-picture manifestation of behavioural psychology. It gauges what news, insights or other events are stirring “buy” or “sell” responses from the market horde.

At the individual investor level, one of the biggest studies of sentiment is the Schroders Global Investor Study. With a sample size of just under 24,000, including 1,000 respondents from Australia, Schroders surveyed individuals in 33 global locations between 26 May and 31 July 2023.

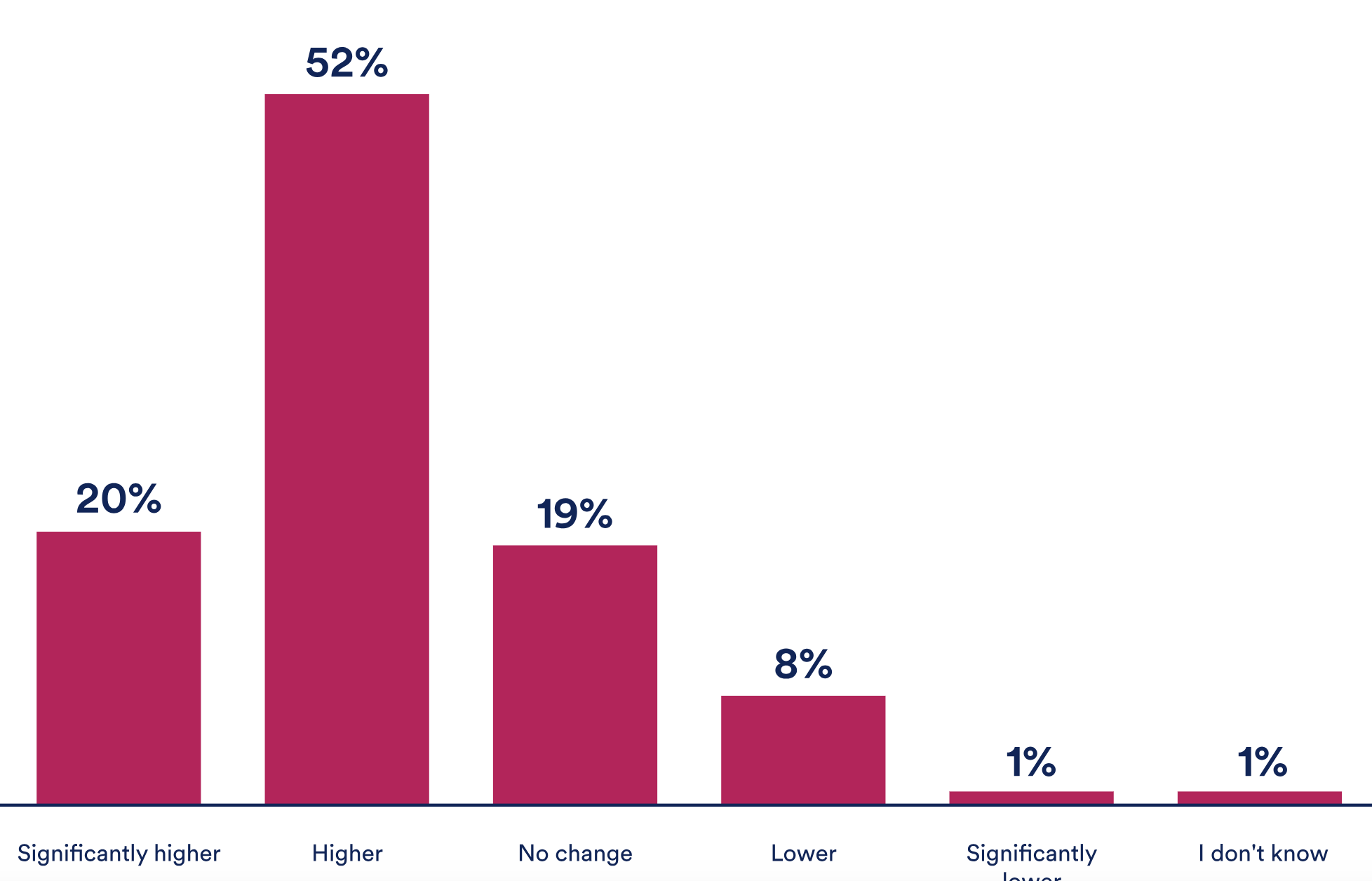

We'll start with one of the most positive findings: more than half of the Australian respondents indicated greater optimism about their investment return prospects now versus a year ago.

How will investment returns in the year ahead compare to the prior year?

Plenty has happened since the study period closed – including the outbreak of war between Israel-Palestine and the US Fed’s pause on rate hikes, to name just a couple of things. But the snapshot of how the tougher global economic outlook is colouring investor decisions remains relevant, given the survey began more than 12 months after central banks began lifting rates.

More than half of the respondents (54%) said they had adapted their investment strategy for a new economic era. And 34% indicated an intention to change course. Among this latter group, their inaction was linked to a lack of investment knowledge. As the report noted:

“Among those who rated their knowledge as expert, 16% said they still needed to adapt their strategy. For those who rated their investment knowledge as beginner level, the proportion was more than twice as high at 37%.”

Investors are less certain

This ties closely with another major finding of the study, that the greater complexity of the economic environment means fewer investors back their own judgement.

Just 47% of respondents, in a global basis, considered themselves as having “expert” or “advanced” knowledge. This was down from 56% in the study’s 2022 iteration.

Interestingly, a higher proportion of Australian investors (60%) rate their own knowledge as expert or advanced. But this was also lower year-on-year, from 70% in 2022.

Where are people investing?

Digging into investment decisions, the study found the following were the most popular themes:

- Internet and technology – 57% global (51% Australia)

- Real estate – 48% (Australia and global)

- Gold, silver, and other precious metals – 43% global (39% Australia)

- Cryptocurrency – 40% global (33% Australia).

The Alternatives asset class – spanning unlisted assets such as private equity, infrastructure (including renewables), and real estate – also featured strongly in the study. (For a raft of views on the area, including those of Schroders, check out Livewire’s Alternatives In Focus editorial series).

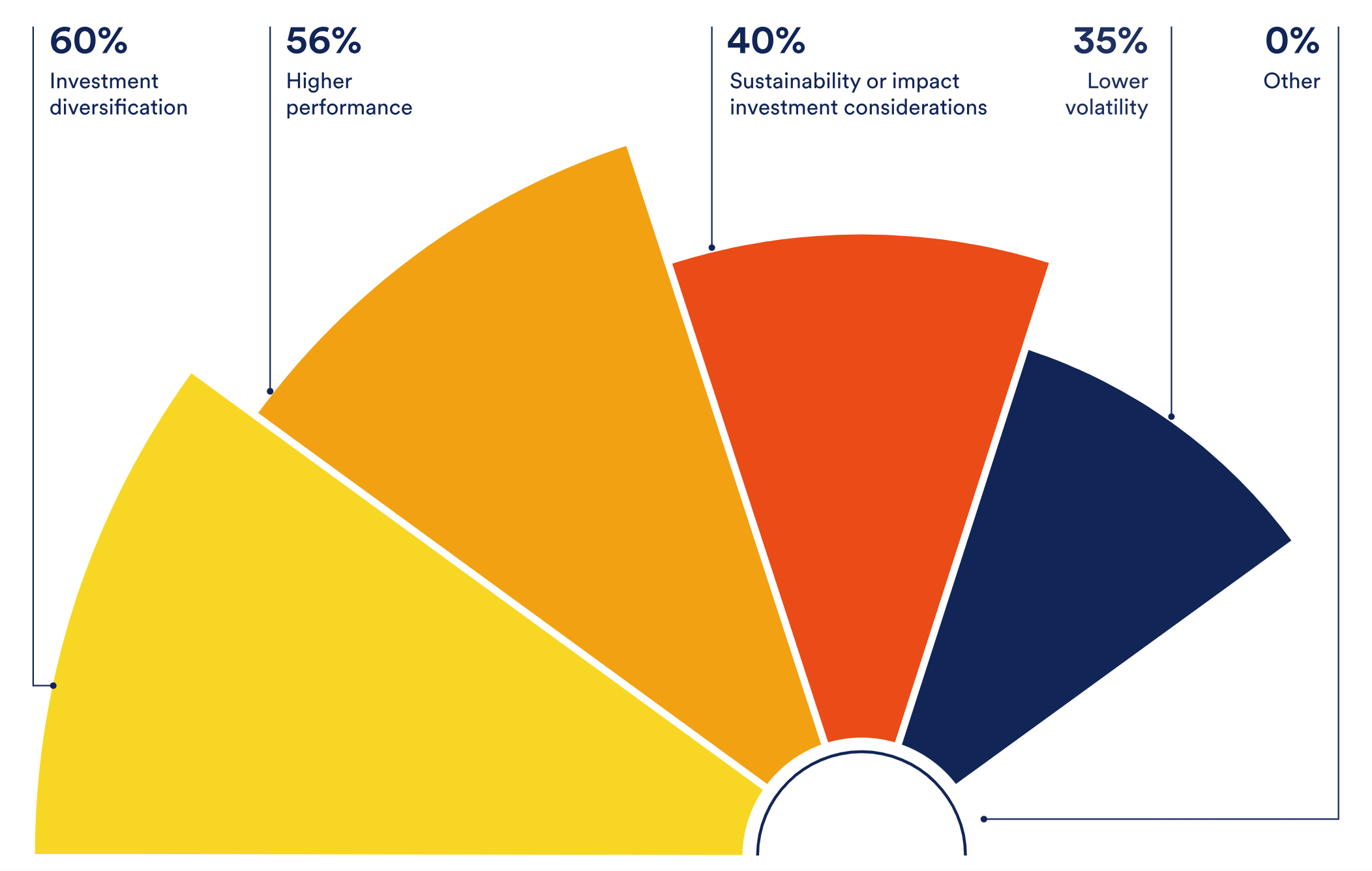

Why would you invest in private assets?

The study indicated 41% of global investors (39% in Australia) are interested in private assets as an investment vehicle.

But it also highlighted barriers, with respondents indicating illiquidity, transparency issues, and inexperience were holding them back from the asset class.

The findings here matched up with a targeted survey conducted by Livewire Markets ahead of the editorial series. The Livewire poll found 59% of respondents were already investing in alternatives. 72% indicated the lack of awareness of products was stopping them from investing in the first place, while 44% blamed it on the difficulty of accessing these investments.

Sustainable investing still polarises

Just over half of respondents (55%) indicated they are attracted to sustainable investment funds because of the wider environmental impact, up from 52% a year earlier.

Only 34% said a likelihood of higher returns was a drawcard for sustainable investing – down from 36% last year.

And 11% of respondents indicated “No, because [sustainable funds] won’t offer higher returns” – up from 6% a year earlier.

But some encouraging findings also unfurled within this:

- The greater the level of expertise (as rated by the respondents themselves), the more highly they rank the importance of sustainable stewardship among corporates

- More than half (54%) indicated greater knowledge would encourage more sustainable investing.

How do you feel about markets currently?

Whether you're a bull, a bear - or somewhere in between - let us know in the comments how you're feeling as we careen toward Christmas. Are you a net buyer or seller of shares currently?

2 topics