Where in the world to find winning small-caps

With the ASX 200 currently just 3.7% below its pre-pandemic level, many investors who didn’t buy the dip have a severe case of FOMO . Small caps are a possible solution, but the local cohort has already attracted plenty of attention, the Small Ords is already a few points ahead of where it was at the end of last February.

Which leaves global small caps, which are also looming larger on investors’ radars, according to Livewire audience surveys conducted throughout 2020.

In this Collection, we speak to some of the most-renowned global small-cap managers in the Australian market:

- Paul Mason, senior analyst, Paradice Investment Management

- Edward Rosenfeld, Lazard Asset Management

- Catriona Burns, lead portfolio manager, Wilson Asset Management

In the following wire, the first in this three-part series, they provide insights on spotting future success stories and explain where they’re looking – both in terms of geographies and sectors.

“There’s room to rally”

Paul Mason, Paradice Investment Management

The US Real Economy. Despite headline multiples for US SMID markets looking expensive, there is incredible dispersion among sectors. Our view is that the US “real” economy (industrials, materials, cyclicals) has room to rally. This is because of both the effect of the continued re-opening and the potential for fiscal stimulus.

The UK. It has been almost five years since Britons voted to leave the European Union, a lost half-decade for the UK economy, where companies were faced with the combination of very weak growth and extreme uncertainty.

With a Brexit Withdrawal Agreement in place, we believe our UK holdings are set to prosper as growth returns to the country, likely supported by the stimulus.

In fact, we have already seen takeover bids at two of our portfolio companies.

Medical devices. While many pockets of the US Healthcare market are quite expensive, we see opportunity in medical device companies that are dominant in their respective niches. These businesses were disrupted in 2020 due to COVID and reduced medical procedures.

We take the view that most procedures were deferred, not cancelled permanently. There is likely significant pent-up demand heading into the next few years, and we do not believe current valuations are pricing this in.

Underweight US, overweight EU

Edward Rosenfeld, Lazard Asset Management

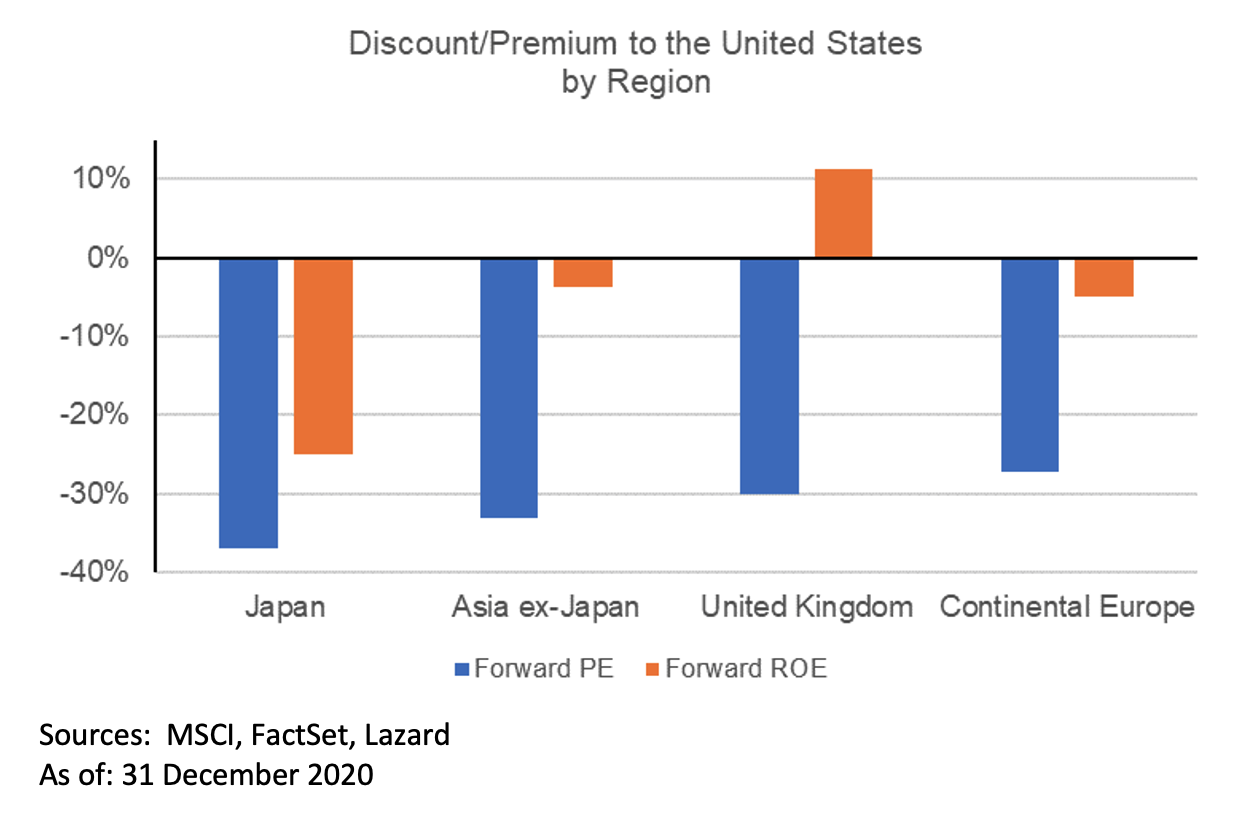

Markets outside the US continue to stand out, from a fundamental and valuation point of view. With the exception of Japan, which perennially trades at a lower return on equity and lower valuation than the rest of the world, most major developed regions offer a similar ROE as the US, and at a far cheaper valuation.

Our bottom-up stock selection drives our allocation to specific stocks far more than a top-down regional view. But it is perhaps not surprising we have a notable underweight position in the US, in light of the relative characteristics shown above. On the other hand, we have a notable overweight to Continental Europe.

In addition to these regional opportunities, we see potential in companies that may disproportionately benefit from an economic recovery, after suffering as a result of the demand impacts caused by COVID-19. These companies include holdings in the industrials, consumer discretionary, and materials sectors.

It is worth pointing out that many small caps (particularly non-speculative small caps) are more sensitive to economic growth than large caps, so the likely uplift in global growth is a big positive for these types of companies. A backdrop of economic growth and the prospect of a more fundamentally driven market is creating the opportunity in small caps today.

Where to find under-appreciated Growth

Catriona Burns CFA, Wilson Asset Management

We are seeing opportunities in multiple geographies. We hold a positive outlook for global equity markets in 2021 and have selectively transitioned the WAM Global investment portfolio from coronavirus beneficiaries towards companies that stand to gain from the re-opening of economies.

While ongoing waves of coronavirus and ensuing lockdowns around the world have dampened economic data in the near-term, we expect a return to normality through the second half of the calendar year as the roll-out of the coronavirus vaccine accelerates. We believe the market underestimates the future earnings power and the strong recovery that awaits certain businesses that have effectively reset their cost bases through the pandemic.

We are focused on undervalued growth companies, primarily within the small-cap segment of the market, and have identified a range of travel, media, automotive and industrial companies globally that will benefit as economies re-open.

We have recently increased our exposure to Europe. In our view, many European businesses have:

- a clear path of growth ahead;

- high-quality management teams;

- attractive valuations, especially when compared to their US counterparts.

Are US small-caps on the nose?

Only one of our trio, Paradice’s Mason, nominates the US among their preferred small-cap hunting grounds this year. And even then, his enthusiasm relates to a single area. Europe, including the UK, seems fertile territory for global SMIDs as an ex-US region that features some highly developed economies. And of course, the sectors that stand out are those the above managers expect to bounce back hardest as the recovery trade gathers pace.

Stay up to date with this series

Make sure you "FOLLOW" my profile to be notified of the upcoming entries in this series. In part two, the contributors will discuss how they weed out the winners from the also-rans among global small-caps. And in part three, our trio each reveal a stock that might only leave their portfolio with the aid of a crowbar.

5 topics

3 contributors mentioned