Where is risk in a polarised market?

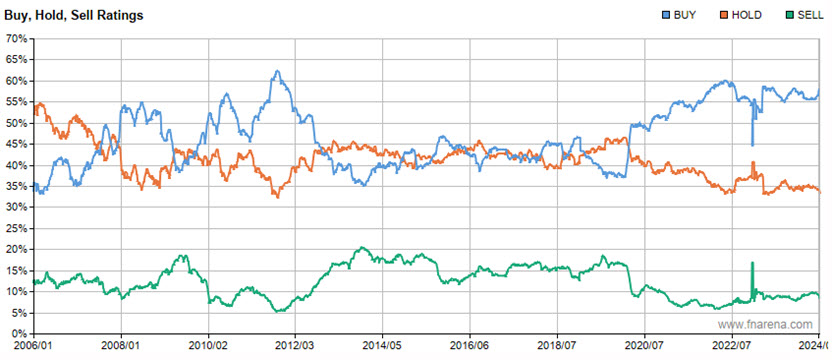

One of the proprietary data insights from FNArena is the balance between Buy-Hold-Sell (and equivalent) ratings for those stockbrokers we monitor daily.

As one would expect, apart from collating the data, it's just as important to pick the correct background and context when interpreting these data. Financial markets change on a daily basis, but their indicators are not per definition a static insight either.

According to our data, the local share market changed in character during the global covid pandemic, and it's never been its old self since.

Traditionally, the brokers we monitor carry around 9-10% in negative ratings for individual stocks, think Sell, Underweight, Avoid, and all other possible variations.

This leaves Buy and Hold/Neutral ratings vying for the bulk of ratings. As these ratings are usually strongly correlated to share prices, and thus to intrinsic valuations, the definition of a bull or bear market phase is usually rather straightforward:

- if the highest percentage consists of Neutral/Hold ratings the share market is having a jolly great time, otherwise known as a bull market

- when the highest percentage shifts to positive ratings (Buy, etc) the market is trading sideways at best for a prolonged period of time, but probably losing altitude

Do note these data shifts don't provide any sense of timing or predictions; they are merely the result of what is happening in the share market already and might, at best, confirm the conclusion that is already apparent from share prices and more timely, technical indicators.

As said, any correlation from pre-covid is no longer relevant today. From early 2020 onwards, the percentage of Buy ratings jumped from below 40% to over half of the total, and has since stubbornly remained above 50%.

There's one important element that needs to be taken into account: FNArena changed the composition of the basket of brokers we monitor daily. As every broker has its own methodology and in-house approach, this will always impact on the numbers. For example: Shaw and Partners, as a relatively smaller broker that researches less stocks and serves predominantly retail investors, traditionally holds a large skew towards Buy ratings.

Shaw's skew towards Buy ratings is by far the largest among the eight brokers FNArena monitors. But the discrepancy post-pandemic is so large, it cannot be simply ascribed to the inclusion of Shaw or the change in underlying mix.

As things currently are, more than 58% of all ratings for the eight brokers monitored is a Buy-equivalent, while Sell ratings are below 9% and Hold/Neutrals represent the remaining 33%.

As per the graphic overview below, the gap between Buys and Holds has never been this large for such a long period of time. Equally noteworthy: the share market is not in a prolonged bear market a la GFC or the March 2000 Nasdaq meltdown.

So what is happening exactly?

A Polarised Landscape

Were we to stick with our traditional, pre-covid interpretation, we'd say the share market is in a prolonged bear market that has been masked by a small number of companies that have performed exceptionally well and kept major indices on a positive up-trend.

This is not dissimilar from observations and analyses made about equity markets in the US, for example, where the large majority of index constituents has failed to make a positive contribution despite indices rallying to new all-time record highs.

Most investors don't like to talk about bear markets, so let's switch this conversation to a more positive starting point: equity markets are enjoying a new bull market -see also those fresh new records- but large swathes of stocks are not participating. The post-covid bull market is characterised by a narrow base of Big Winners and a larger group of share market laggards.

It is this polarisation, I believe, that is reflected in the large overweight in positive ratings because, well, many more companies look 'cheaply' priced, while indices are seen trading on elevated multiples.

The same underlying polarisation becomes obvious when we compare the performance of various indices for US equities at mid-year 2024.

Year-to-date, the S&P500 has gained 15.29% over the first six months, but the S&P SmallCap 600 index is down -0.72% for the period, while the S&P MidCap 400 index is up 6.17%. The Dow Jones Industrial Average only beat the small caps over the period, advancing only 3.79%.

The Nasdaq100 outperformed all with a total return of 16.98%. The equalweighted S&P500 has returned 5.08%.

In Australia, the dynamics have not been fundamentally different.

The ASX200 Accumulation Index year-to-date has returned 4.22%, of which half from dividends. The Small Ordinaries only returned 2.75% and the MidCap50, traditionally the best performing segment locally, sits in between with a return of 3.42%.

The Top50 companies on the New Zealand stock exchange have lost -0.45%. NZX Small Caps are down -16.74%.

Is 'Value' Ready To Catch Up?

I am sure we can debate for hours whether 'bull market' is the appropriate label for those numbers, but it's not difficult to see why investors would be more inclined to seek 'value' among the laggards, given the large gaps in share price moves and also amidst widespread concern about too much exuberance in popular stocks.

The problem with such a simplistic, value-based approach is that economies are slowing, and cracks are appearing in household spending and small business segments, while central banks are not yet ready to provide stimulus and relief through lower interest rates.

What this means is share market laggards might look 'cheap' and 'attractive' for good reason, and that reason might be a deteriorating outlook, implying share prices are heading lower first, before they can start trending higher.

Last week, share prices in discretionary retailers Cettire (CTT) and Mozaic Brands (MOZ) faced downward pressure as management teams had to 'confess' things were not going according to plan. Concerns about sales momentum in the months ahead equally overshadowed the FY24 releases from Collins Foods (CKF) and from Metcash (MTS).

Companies including KMD Brands (KMD), Fletcher Building (FBU), Healius (HLS), Sims (SGM), Sonic Healthcare (SHL), and Star Entertainment (SGR) have proved the bad news doesn't necessarily stop with one profit warning.

The Materials sector is down -11.69 year-to-date of which -6.49% happened in June.

I'd say, investors are all too aware that risks are rising. In the same vein, recent investor briefings and market updates from companies including Aristocrat Leisure (ALL), Insurance Australia Group (IAG), and Steadfast Group (SDF) certainly re-confirm not all companies are operating under a cloud of uncertainties.

A recent report by JP Morgan suggests local fund managers have been sharply reducing their exposure to the materials sector with JP Morgan analysis suggesting the third largest outflow on record occurred in May (most recent sector data available).

Local fundies remain heavily underweighted Australian banks, but they also have started yet again to embrace defensive supermarket operators Coles Group (COL) and Woolworths Group (WOW).

Earnings Risk Is Tangible, And Rising

In a market characterised by extreme polarisation, as are shares markets currently, the risk profiles for Winners and Laggards appear diametrically opposed. What should investors worry about most? Is it that certain share prices might have become too bloated or is it about the next profit warning waiting to be revealed?

Within this context, it's good to know the technology sector traditionally enjoys solid support from investors in July (not exactly clear as to why) with Pepperstone Head of Research, Chris Weston reporting the Nasdaq100 has posted gains in July 15 times out of the past 15 years.

It is also not difficult to make the argument that many of today's share market Winners are in excellent shape, and performing well operationally, maybe with the notable exception of Australian banks.

Witness, for example, the recent share market updates by the likes of Aristocrat Leisure, Xero (XRO), Gentrack Group (GTK), Webjet (WEB), Tuas (TUA), and TechnologyOne (TNE), to name but a few positive stand-outs.

Given many of today's Winners are carried by investor optimism on GenAi, with US markets in pole position, maybe the time to start worrying about share prices in Goodman Group (GMG), NextDC (NXT) and WiseTech Global (WTC) is when Nvidia et al experience a serious correction?

Meanwhile, owning shares in companies that are unable to meet expectations, either this month or in August, can be quite a deflating experience. Within this context, I note shares in Fletcher Building (FBU) have now lost -46% over the past twelve months, of which -29% occurred in the past three.

Shares in Orora (ORA) are down respectively -36% and -27%, while for Eagers Automotive (APE) the corresponding numbers are -22% and -26%. Shares in Cettire last week more than halved in the immediate response to management's downgrade. They have since rallied off the low point, but are still substantially below the share price pre-profit warning.

Macquarie's Warnings

Confession season in May and June suggests two sectors at higher risk are housing construction and discretionary spending related companies. Even though some analysts believe tax cuts and budget relief should benefit retailers.

Strategists at Macquarie recently advised their clientele it's probably best to remain more circumspect about cyclical housing related companies, in particular if they have significant exposure to New Zealand, as well as to those companies that need an above average pick-up in the second half to achieve their forecast for FY24.

Macquarie also suggested a third group of companies that is probably best avoided: stocks enjoying positive momentum without support from earnings growth. The strategists specifically mentioned Australian banks and Wesfarmers (WES).

Another category involves those companies suffering serious negative revisions to earnings forecasts. FNArena's Australian Broker Call Report offers daily updated insights, as does our weekly update on the matter.

This week's update reveals significant downgrades for Healius, City Chic Collective (CCX), KMD Brands, Baby Bunting (BBN), and Mirvac Group (MGR). I don't think any of these inclusions will come as a big surprise.

Macquarie points towards Sonic Healthcare, IDP Education (IEL), Domino's Pizza (DMP), Nufarm (NUF), Eagers Automotive, and Star Entertainment; all companies having suffered from analysts downgrades in recent weeks.

Regarding exposure to housing construction in New Zealand, Macquarie's research has identified Harvey Norman (HVN), oOh!media (OML), GWA Group (GWA) and ARB Corp (ARB) derive at least 10% of sales from across the Tasman sea, and there is a correlation with the housing market.

Companies that need a strong pick-up in H2 include Downer EDI (DOW), Ramsay Health Care (RHC), and Reliance Worldwide (RWC). Healius would have been Macquarie's number one company most at risk, but management duly delivered yet another profit warning last week.

Goodman Group, Macquarie strategists point out, continues to screen as a potential candidate to upgrade guidance. Bell Potter analysts would add the same upgrade risk remains alive for TechnologyOne.

Macquarie research also suggests FY25 prospects have been improving for a select number of companies, without share prices responding accordingly. Companies that fit in this category, according to Macquarie research, include ResMed (RMD), BlueScope Steel (BSL), and Block (SQ2) alongside small caps Coronado Global Resources (CRN), IPH Ltd (IPH), De Grey Mining (DEG), and Auckland International Airport (AIA).

Another category still at risk of suffering negative news remains the local REITs sector, specifically for Office assets. Analysts remain convinced the outlook for Office rents is not great. While growth might remain positive, its pace looks set for a much lower trend than has historically been enjoyed.

As the sector analysts from Morgan Stanley stated recently: "Given the lower income growth outlook, there are reasons to think that the cap rate spread should be higher than long-term average in the foreseeable future." This is why Morgan Stanley is still not a fan of Dexus (DXS), Centuria Office REIT (COF), or Mirvac Group.

This is also the reason as to why some analysts are still hesitant to get too enthusiastic about a "cheaply priced" Charter Hall (CHC) in the short term.

As also pointed out by sector analysts at Barrenjoey recently, the tremendous drop in cap rates is still unwinding and Australia has been slower to reprice than the US and Europe.

As a result of this, independent valuations could take another 6-12 months to fully adjust, which means more negative adjustments to valuations need to be made.

Bottom line: cheaply priced assets might require a lot longer before narrowing the gap with the top performers in today's share market, this in particular will prove the case if economies slump more deeply than expected and/or central bank rate cuts will be pushed out further into the future.

FNArena offers impartial, ahead-of-the-curve analysis and share market commentary, on top of proprietary tools and data for self-researching and self-managing investors. The service can be trialled for free at fnarena.com

3 topics

5 stocks mentioned