Where is the upside for Nufarm?

Australia’s drought may be the worst in 800 years and is also likely to affect many agriculture companies. Reviewing the FY2018 result by agricultural chemical company, Nufarm (ASX:NUF), makes interesting reading. While Nufarm’s results were in line with the guidance provided by the company in July, the result includes two areas of concern for investors. One being the decision to pay a 6 cent unfranked dividend at the same time as announcing a A$300 million entitlement equity raising.

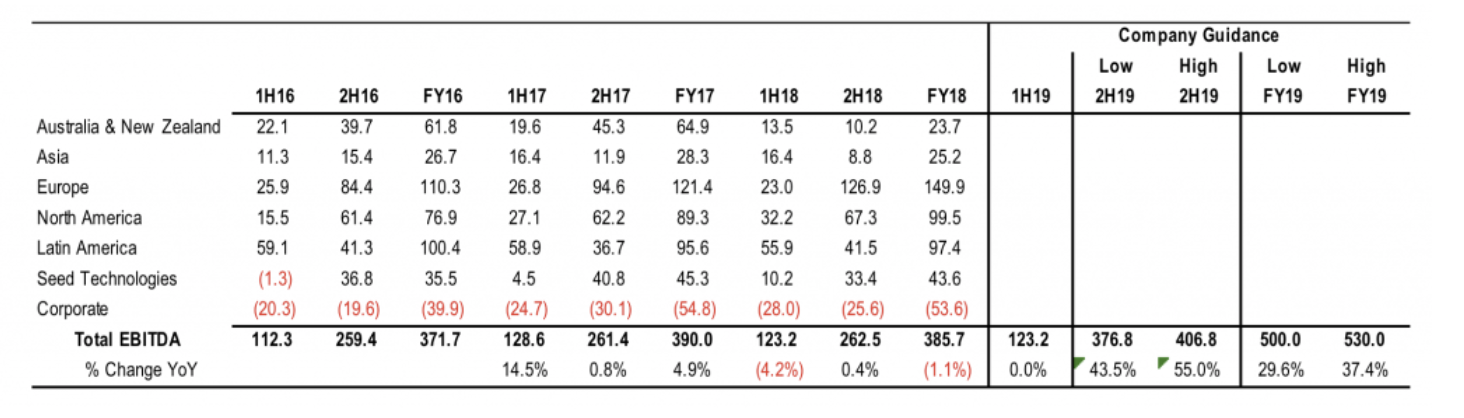

The first was its guidance. Management expects earnings before interest, tax, depreciation and amortisation (EBITDA) to increase significantly in FY2019 to between A$500 million and A$530 million. On the surface, this appears logical as the company’s performance rebounds following the drought impacts in FY2018, and it benefits from a full year contribution from its acquisition of businesses in Europe from FNC and Syngenta.

However, the company also stated that EBITDA would be roughly flat on its prior year level in the first half as a result of continuing impacts from the drought and a temporary plant shutdown in Europe for maintenance.

This implies EBITDA in the six months of January 2019 of around A$123 million, with the second six months of FY2019 needing to deliver between A$377 million and A$407 million of EBITDA to achieve the FY2019 guidance provided by management. This level of EBITDA in 2H19 implies growth of between 44 per cent and 55 per cent on 2H18 EBITDA of A$262.5 million.

NUF – EBITDA Results and Management Guidance

Source: Company, MIM Estimates

Source: Company, MIM Estimates

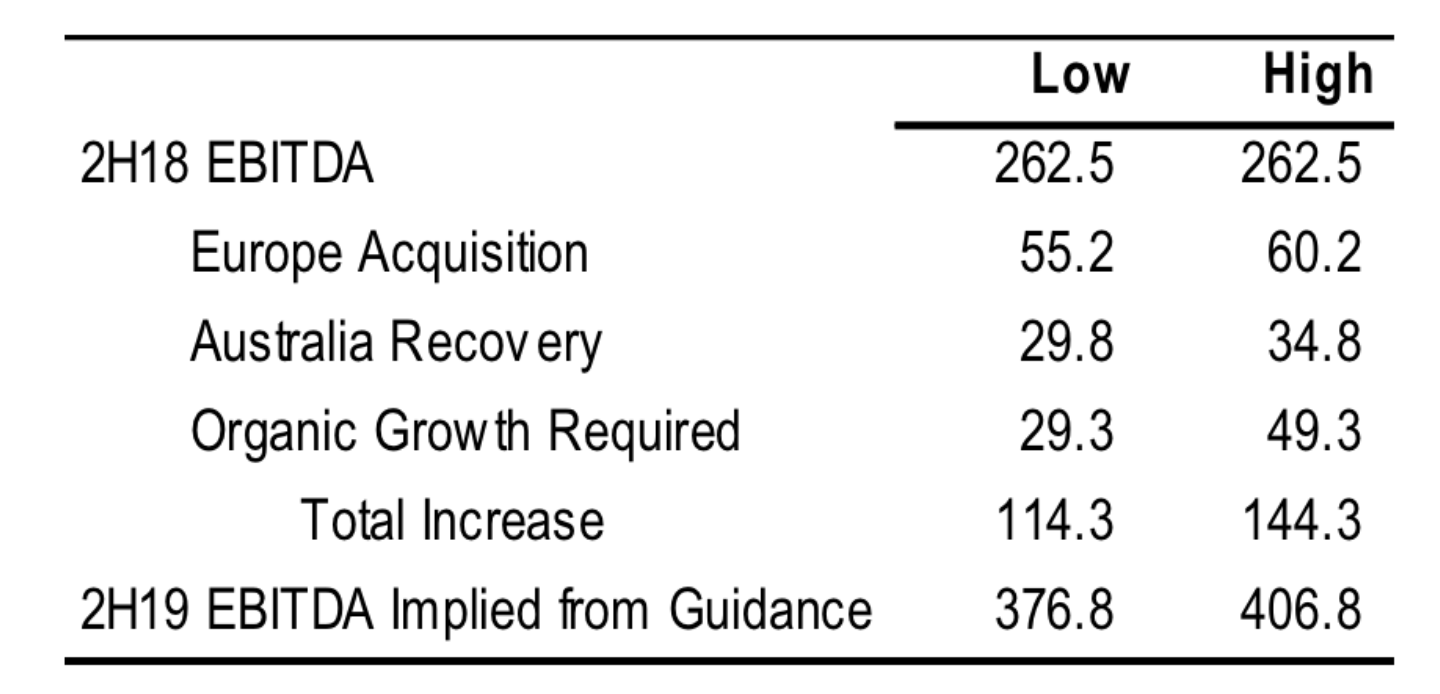

So where will the incremental A$115-A$145 million of EBITDA come from in 2H19 relative to the prior year result?

The first area will be some recovery in Australia assuming a reversion to more normal cropping conditions. However, the impact of an inventory overhang in the crop chemicals industry, due to lower than expected demand this year, is unlikely to be fully cleared before the start of 2H19. As such, margins are still likely to be lower than the longer-term average as excess stock is cleared.

Being optimistic, let’s assume earnings in 2H19 can recover to the same level in 2H17 (i.e. before the drought). This would add A$35 million to 2H19 EBITDA. Management’s FY2018 result presentation indicates that the drought reduced group EBITDA by around A$33 million, so a full recovery would likely result in a A$30-35 million improvement in 2H19 EBITDA relative to the same period in FY18.

Then there is the impact of the European acquisitions. Management stated that these acquisitions contributed A$32 million of EBITDA in FY2018, all of which flowed through in the second half given the acquisition from FNC was completed on 1 February 2018 and the acquisition from Syngenta on 16 March. In FY2019, these businesses are expected to contribute between A$110 million and A$115 million to EBITDA.

European earnings are heavily skewed toward the second half of the year. Over the last three years, just under 80 per cent of Nufarm’s European EBITDA has been generated in the second half of the financial year. Using this as a guide to the seasonality of the forecast EBITDA contribution from the acquired businesses implies 2H19 EBITDA of A$87-92 million, an increase of A$55-60 million on the A$32 million generated in the prior year (2H18).

So, combining the impact of a normalisation of conditions in Australia and the increase in the contribution from the European acquisitions would add between A$85 million and A$95 million to EBITDA in the second half of FY2019 relative to the results reported for the same period in FY2018 (i.e. A$30-35 million for Australia plus A$55-60 million for Europe).

This leaves a further A$30-50 million of EBITDA growth that would need to come from organic sources. This implies 9-14 per cent organic growth on the prior year (adjusted for the higher base including the European acquisitions), which appears to be a bit optimistic given the historical performance of the business.

Drivers of 2H19 EBITDA Growth to Achieve Management Guidance

Source: Company, MIM estimates

For example, management’s FY2018 result presentation indicates that organic growth contributed around A$21 million of EBITDA uplift in FY2018. This equates to 5.4 per cent, but pretty much excludes anything that was a negative for the company’s earnings during the year. But even this is well below even the bottom end of the 2H19 organic growth range implied by company guidance.

Additionally, given that the European acquisition occurred in the second half of FY2018, the 1H19 results will be boosted by the first time inclusion of any of these earnings (unlike 2H18 which included A$32 million of EBITDA). Despite this, EBITDA is expected to be flat on the prior year. This implies that underlying EBITDA will decline materially. While this is partially due to the decision to shut down a European plant for maintenance, organic growth appears to be negative in 1H19. Forecasting 9-14 per cent organic growth in 2H19 represents a dramatic turnaround in the underlying performance of the business from the first half to the second half of FY2019.

Remember that this organic growth forecast is in addition to the benefit the company will get from a recovery in earnings from an assumed end to the drought in eastern Australia.

As such, there is likely to be fairly material downside risk to even the bottom end of management’s updated guidance range, which is not reflected in current sell side analyst earnings forecasts.

The other curiosity from the result was the decision to pay a 6 cent unfranked dividend at the same time as announcing a A$300 million entitlement equity raising. While on one hand, the board is handing shareholders A$20 million of capital, it is taking A$300 million back from them with the other. If the dividend was fully franked, then it could be argued that the dividend is being paid to provide shareholders with a tax credit that could otherwise go unutilised and wasted (particularly if Labor wins the next Federal election). However, this is not the case.

Raising equity costs a company money and the more you raise, the more it costs. Paying a dividend means the company has to raise more in the entitlement issue resulting in higher transaction costs. While the incremental cost might not be material, it sets a very poor example from a cultural perspective, particularly for a business that operates at the commodity end of the product spectrum, where maintaining a high degree of cost efficiency is critical to its competitive positioning.

2 topics

1 stock mentioned