Where JPMorgan finds value as the economy hits a crossroads

Financial markets, especially the US stock market, traditionally struggle in September, but not this time. The S&P 500 increased by 4% last month, largely thanks to the Federal Reserve's 50 basis point rate cut and a flurry of stimulus announcements from the Chinese government. But, as Dubravko Lakos-Bujas, JPMorgan's chief US equity strategist, reminds us, the backdrop that preceded all of this policy easing is just as important.

"The economy is now at a crossroads, with the next few months crucial," Lakos-Bujas wrote in a recent research note.

This view appears to be backed up by his colleague, JPMorgan Chief US Economist Bruce Kasman, who says there is a 35% chance of a US recession by the end of 2024 (and 45% by the end of 2025.)

"The Fed must be worried about moving too gingerly, especially since pre-easing yield curve inversion has often foreshadowed recessions."

The good news for investors is that despite this precarious situation, the JPMorgan team still thinks there is value in parts of the stock market. In this wire, we'll discover where exactly that is.

The Fed must be "urgent" - but not corner itself

The first interest rate cut is often the deepest, but it is always the most telling. It is, as Lakos-Bujas explains, "a good gauge of the Fed’s concern, and future hawkishness in bringing down rates quickly to avoid a recession." Since the mid-1980s, there have been two major recessions of note - 2001 and 2007.

"The two recessions in our sample involved serious damage to the balance sheets of one or two sectors: non-financial corporates (2001), financial companies (2007) and households (2007)," notes Lakos-Bujas.

So far, so good this cycle. But the Fed must be careful about being too anxious to move.

"These sector balance sheets have held up fairly well compared to prior episodes and have withstood stress tests in 2022 and 2023. Nonetheless, the Fed must be worried about moving too gingerly, especially since pre-easing yield curve inversion has often foreshadowed recessions," Lakos-Bujas adds.

But macro weakness cannot be ignored

While the business cycle is likely recovering and the labour market is unquestionably tight, some cracks are appearing.

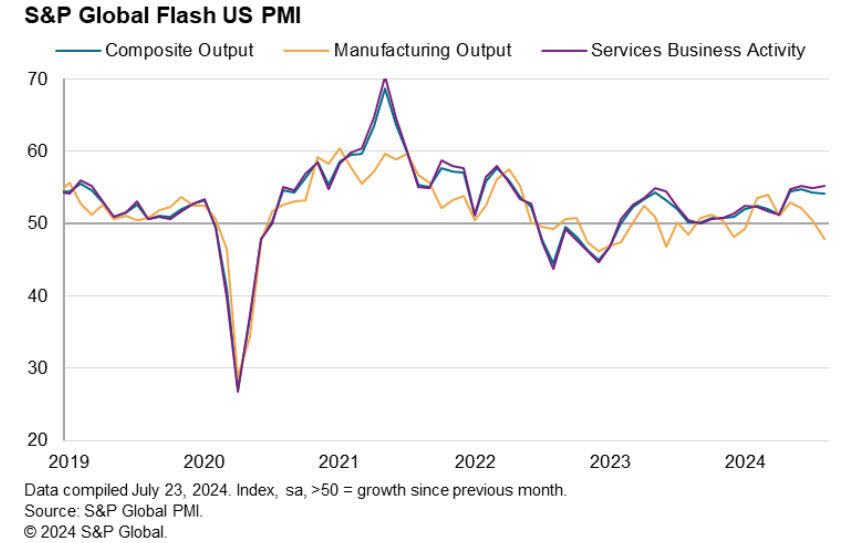

You can see this divergence on the far right area of the following chart:

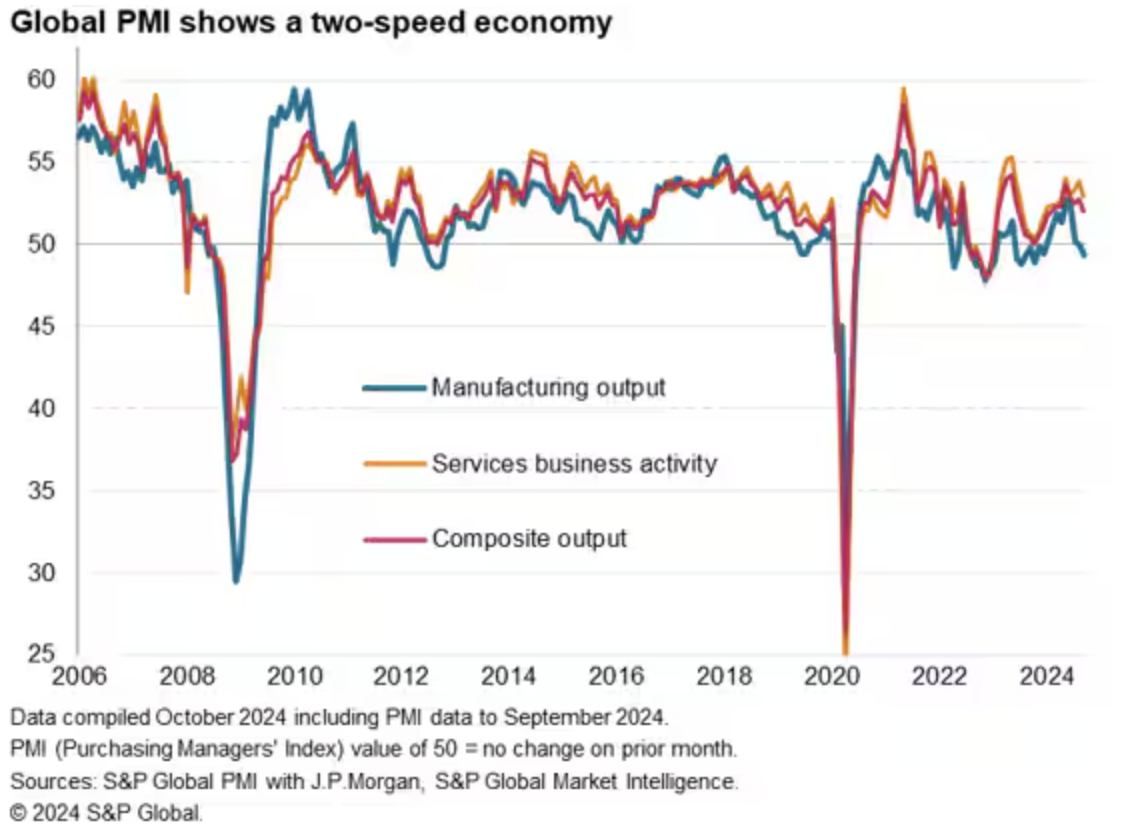

This divergence also turns up in the global read of this same data point:

For the record, Lakos-Bujas and his team think that the Fed could return to a traditional 25 basis point rate cut size as soon as its next meeting, given the strength of the labour market. This is in line with market pricing.

When will cash finally come off the sidelines?

Contrary to what a lot of the fund managers on Livewire say, cash may still have a place in portfolios even for a little while after the first Fed cut.

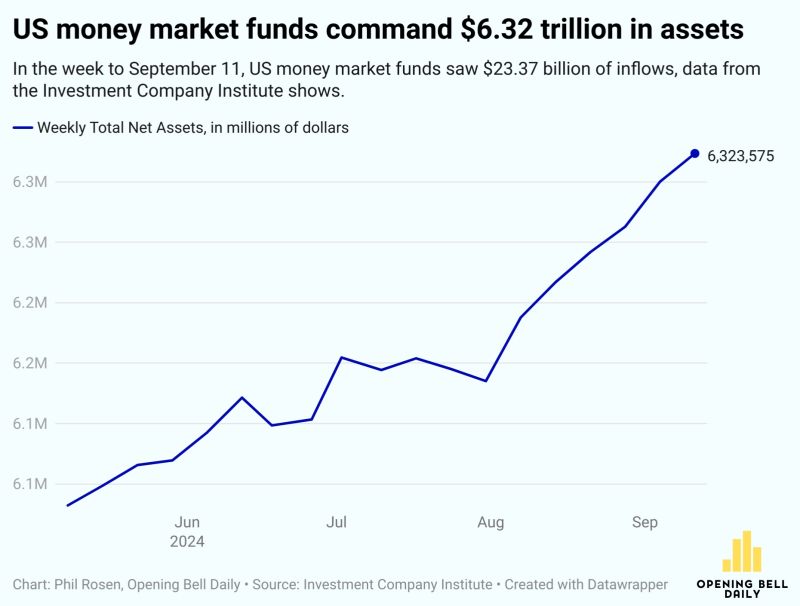

For reference, more than US$6.3 trillion is sitting in money market funds stateside at the moment (their equivalent to our term deposits). The monstrous growth of this asset class can be seen in the chart below:

Where it might have an effect is on companies and investors - but only a year from now.

"Every 100bp reduction in yield would translate into a decline of $250 billion per year in interest income. For S&P 500 companies, we estimate the corporate cash yield of around 3.5% on cash and cash equivalents was at a decade high in the latest quarter. We estimate the incremental cash interest income benefit [since the Fed started cutting rates] was around $5 for S&P 500 EPS over this period, which should begin to reverse over the next year," Lakos-Bujas adds.

When cash comes off the sidelines, where should it go?

This depends on your view of the markets.

If you believe JPMorgan's base case, as noted above, "the sluggish business cycle could more decisively shift back into recovery, as could animal spirits and inflation with upside to the pro-cyclical trade."

In fact, the team are already adjusting their view with this in mind, neutralising an existing long-defensive stocks/short-cyclical stocks trade.

On the cyclical side, they are backing energy stocks, consumer stocks whose share prices have lagged and possess brand value, and China-exposed stocks.

If the market's expectations for deep and significant rate cuts continue to be wound back, as it has been for the last few weeks, "the higher-for-longer areas of the market (e.g., mega-caps, tech, long-short momentum* stocks, Quality Growth), which have been dormant for several months, are likely to regain interest at the expense of both Defensives and Cyclicals. In particular, we highlight AI, Data Centres, and Electrification themes as a relative out-performer in this scenario."

And where in doubt, above all:

*Momentum = the practice of buying and selling assets according to the recent strength of price trends. It is based on the idea that if there is enough force behind a price move, it will continue to move in the same direction.

3 topics